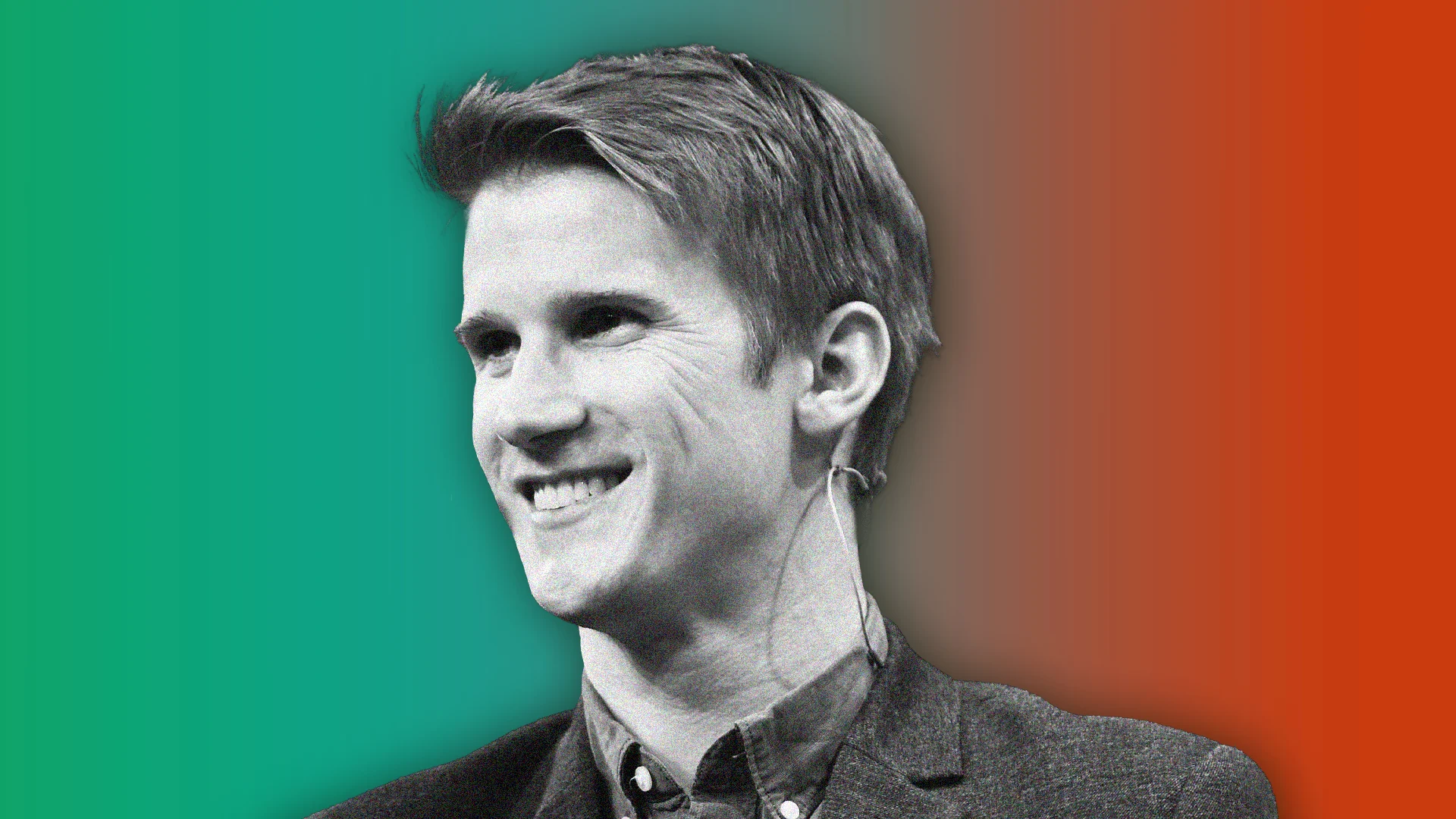

Don Burnette

About Don Burnette

Founder and CEO of Kodiak Robotics since April 2018; will serve as CEO and Class I director of Kodiak AI, Inc. upon the AACT–Kodiak business combination closing. Age 39 (as of Aug 5, 2025). Prior roles include Google/Waymo self-driving program, co-founding Ottomotto (acquired by Uber), and senior autonomy roles at Uber ATG. Education: BS in Physics, Mathematics, Electrical Engineering; MS in Physics (University of Florida), MS in Robotics (Carnegie Mellon). Company disclosures highlight commercial driverless operations, recurring revenue from Driver-as-a-Service, and government contracts; no TSR/EBITDA performance metrics are disclosed pre-listing .

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Google (Self-Driving Car Project, predecessor to Waymo) | Software Technical Lead | 2010–2016 | Early development leadership on autonomous driving stack . |

| Ottomotto LLC | Co-founder | 2016 | Built first self-driving truck startup; acquired by Uber in Aug 2016 . |

| Uber Technologies (ATG) | Software Technical Lead | 2016–2018 | Led autonomy engineering for Uber’s self-driving efforts . |

| Kodiak Robotics, Inc. | Founder & CEO | 2018–present | Scaled AI-powered autonomous trucking; commercial driverless deliveries, recurring revenue model, DoD contract (~$30M) . |

External Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Kodiak AI, Inc. (post-merger) | Director (Class I) | Upon Closing | Founder-operator governance; board majority expected independent . |

Fixed Compensation

| Metric | FY 2024 | FY 2025 (pre/post Closing – planned) |

|---|---|---|

| Base Salary ($) | 325,000 | 425,000 (confirmatory employment letter) . |

| Target Bonus (% of salary) | 20% | 80% . |

| Actual Bonus Paid ($) | 65,000 (paid under Incentive Bonus Plan) | Not disclosed. |

Notes:

- Employment is at-will via standard offer letter; confirmatory employment letter to take effect prior to Closing .

- Benefits provided on same basis as employees; no executive-specific perquisites disclosed .

Performance Compensation

| Instrument | Grant date | Shares/Options | Exercise Price | Vesting | Performance metrics | Notes |

|---|---|---|---|---|---|---|

| Legacy Kodiak Options | Jun 2025 | 1,535,563 options | FMV at grant | 12.5% at 6 months from vesting start; then 1/48 monthly, service-based | None disclosed; annual bonuses are discretionary | No option fair value disclosed for Burnette; others’ options use ASC 718 . |

Equity Ownership & Alignment

| Scenario | Shares owned | Ownership % | Breakdown |

|---|---|---|---|

| Post-Closing (No Redemption) | 28,169,428 | 12.5% | 26,739,581 direct + 1,429,847 via Burnette Family Irrevocable Trust (Citizens Trust Co.) . |

| Post-Closing (Maximum Redemption) | 28,169,428 | 16.0% | Same as above. |

Additional points:

- Burnette receives no additional compensation for director service; remuneration shown above reflects employee compensation .

- Options exercisable within 60 days of Aug 18, 2025 are not reported for Burnette (consistent with 6-month cliff); Wendel and Wiesinger have options exercisable in that window .

No pledging/hedging disclosures identified. Stock ownership guidelines are not disclosed at this time.

Employment Terms

- At-Will Employment: Standard offer letter and At-Will Employment, Confidential Information, Invention Assignment and Arbitration Agreement; confirmatory employment letter prior to Closing .

- Arbitration and successor clauses appear in Kodiak executive agreements; Don Burnette signs as CEO in exemplar; similar terms apply across executives .

- Severance and Change-of-Control Policy (to be adopted at Closing): For CIC window (3 months before to 12 months after change in control), Burnette eligible for 150% base salary; 100% vesting of unvested equity (performance deemed at target); pro-rated target bonus; up to 18 months COBRA reimbursement or cash in lieu . Outside CIC window, Burnette eligible for 100% base salary in lump sum; other benefits not detailed in filings excerpt .

| Trigger | Cash Severance | Equity | Bonus | COBRA |

|---|---|---|---|---|

| CIC (termination w/o cause or resignation for good reason within 3m pre- to 12m post-CIC) | 150% base (greater of pre-cut or at CIC) | 100% vest; performance at target | Pro-rated target bonus (based on actual achievement) | Up to 18 months |

| Non-CIC (termination w/o cause or good reason) | 100% base | Not disclosed | Not disclosed | Not disclosed |

Clawback policy: Compensation Committee tasked to adopt/oversee clawback policy post-Closing .

Board Governance

- Post-Closing Kodiak Board: 7 members; James Reed expected to serve as Chair. Majority independent; Burnette (CEO) and Reed expected to be non-independent. Sponsor (Ares Acquisition Holdings II LP) has right to designate one Class III director and appoint a non-voting observer through the third annual meeting .

- Committees (post-Closing): Audit Committee (Kenneth Goldman—Chair; Kristin Sverchek; Scott Tobin) with independence and financial expert qualifications; Compensation Committee (Mohamed Elshenawy; Allyson Satin; Scott Tobin—Chair) oversees executive pay, clawback; Nominating and Corporate Governance Committee (Kristin Sverchek—Chair; Mohamed Elshenawy; Kenneth Goldman) oversees board composition and governance .

- For AACT (pre-Closing): Audit/Nominating committees comprised of independent directors; chair and financial expert designated; good governance scaffolding pre-combination .

Dual-role implications: Burnette will be CEO and director (not Chair); board expects majority independence and formal committees, which mitigates, but does not eliminate, potential management influence over strategy and compensation .

Director Compensation

- Non-employee directors in 2025 received initial option grants (e.g., 276,414 Legacy Kodiak options to Mohamed Elshenawy, Kenneth Goldman, Kristin Sverchek; grant date fair values disclosed for some). Burnette receives no additional director compensation beyond his CEO pay .

- Ongoing director cash/equity retainers to be set post-Closing; change-in-control accelerations for director equity contemplated under 2025 plan; details to be finalized by the new Compensation Committee .

Equity Financing and Related Arrangements (context)

- Sponsor Affiliate Investor (Ares) provided financing via SAFEs ($10M) later exchanged into Second Lien Loans; and $20M second-lien convertible loans. Second Lien conversion priced at the lower of transaction price or 90% of lowest PIPE price; warrants issued to lenders; Burnette executed related agreements as CEO. Sponsor retains rights to nominate one director and appoint an observer .

Investment Implications

- Strong founder alignment: Burnette’s 12.5–16.0% post-Closing stake, including a trust allocation, indicates significant “skin-in-the-game” and lowers near-term voluntary departure risk .

- Retention and liquidity dynamics: 2025 option grant has a 6-month cliff then monthly vesting, creating a gradual accrual of exercisable options; combined with standard lock-ups (not detailed here), near-term insider selling pressure may be capped; bonus plan remains discretionary pre-Closing .

- Governance structure: With an independent-majority board, formal audit/compensation/governance committees, and a non-independent Chair (Reed), the CEO/director dual role is moderated; Sponsor board designation and observer rights embed investor influence in early public-company governance .

- Change-in-control economics: CIC severance policy grants full equity acceleration and 150% base salary for Burnette, signaling protection in strategic transactions; outside CIC, cash severance is moderate. These terms can support management continuity but elevate acquisition payout optics .

All facts above are sourced from SEC-filed AACT documents:

- S-4 (May 14, 2025) **[1853138_0001193125-25-119920_d948047ds4.htm:7]** **[1853138_0001193125-25-119920_d948047ds4.htm:420]** **[1853138_0001193125-25-119920_d948047ds4.htm:423]** **[1853138_0001193125-25-119920_d948047ds4.htm:428]**

- S-4/A (Jun 30, Jul 28, Aug 15, Aug 25, 2025) **[1853138_0001193125-25-152053_d948047ds4a.htm:431]** **[1853138_0001193125-25-152053_d948047ds4a.htm:437]** **[1853138_0001193125-25-152053_d948047ds4a.htm:439]** **[1853138_0001193125-25-152053_d948047ds4a.htm:444]** **[1853138_0001193125-25-152053_d948047ds4a.htm:448]** **[1853138_0001193125-25-152053_d948047ds4a.htm:389]** **[1853138_0001193125-25-165628_d948047ds4a.htm:356]** **[1853138_0001193125-25-165628_d948047ds4a.htm:425]** **[1853138_0001193125-25-165628_d948047ds4a.htm:431]** **[1853138_0001193125-25-165628_d948047ds4a.htm:432]** **[1853138_0001193125-25-165628_d948047ds4a.htm:433]** **[1853138_0001193125-25-165628_d948047ds4a.htm:440]** **[1853138_0001193125-25-165628_d948047ds4a.htm:442]** **[1853138_0001193125-25-165628_d948047ds4a.htm:383]** **[1853138_0001193125-25-165628_d948047dex108.htm:4]** **[1853138_0001193125-25-187391_d948047ds4a.htm:556]** **[1853138_0001193125-25-187391_d948047ds4a.htm:557]** **[1853138_0001193125-25-187391_d948047ds4a.htm:497]** **[1853138_0001193125-25-187391_d948047ds4a.htm:569]** **[1853138_0001193125-25-187391_d948047ds4a.htm:571]**

- AACT 8-Ks and press releases (Apr–Sep 2025) **[1853138_0001193125-25-093527_d896144d8k.htm:3]** **[1853138_20250507SF81512:0]** **[1853138_20250414SF63756:0]** **[1853138_0001193125-25-079657_d948522dex991.htm:0]** **[1853138_0001193125-25-212149_d946584dex991.htm:0]** **[1853138_0001193125-25-165806_d84279dex991.htm:7]**