ALLIANCEBERNSTEIN HOLDING (AB)·Q4 2025 Earnings Summary

AllianceBernstein Beats on EPS and Revenue as AUM Hits Record $867B

February 5, 2026 · by Fintool AI Agent

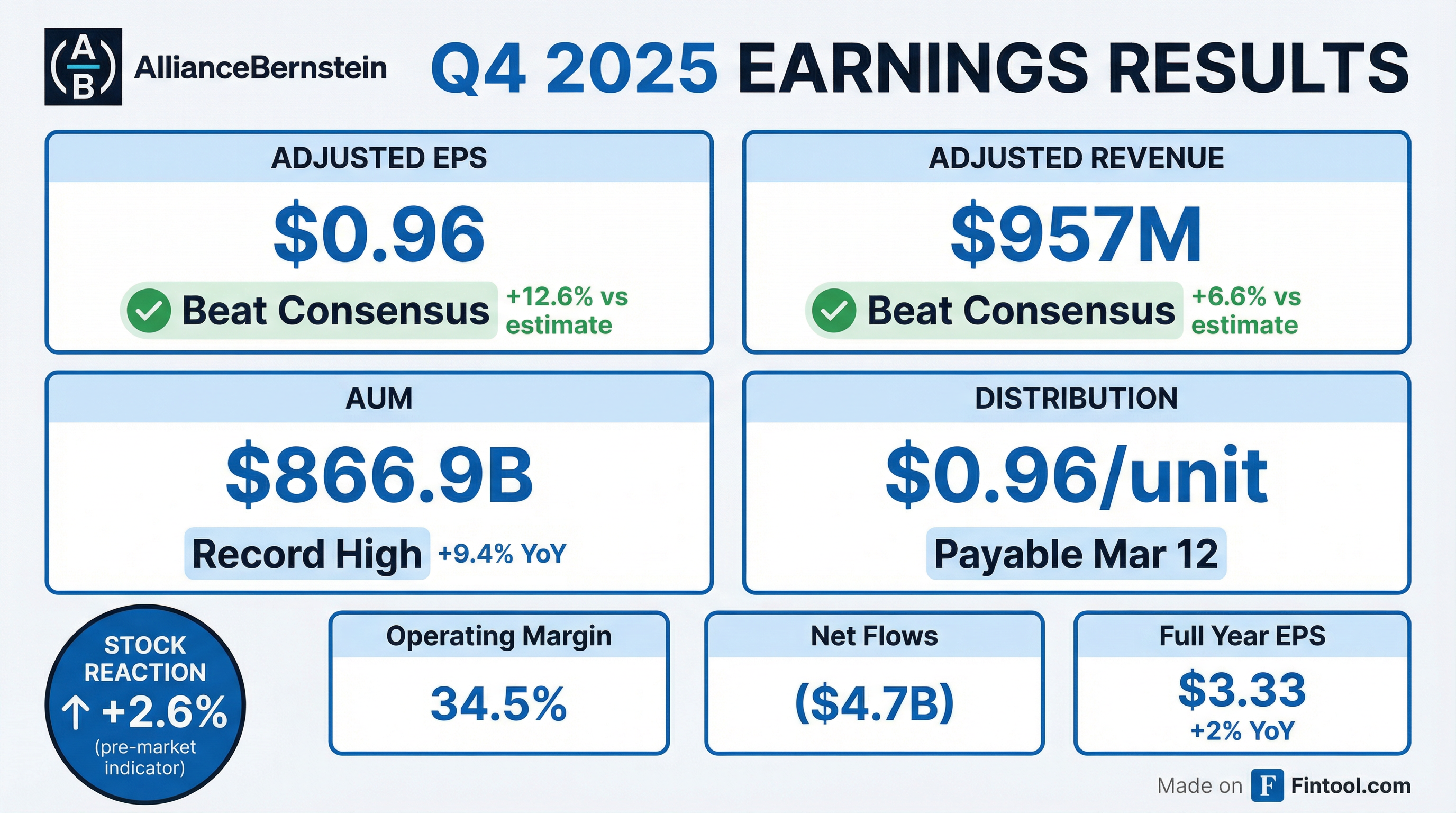

AllianceBernstein delivered a double beat in Q4 2025, with adjusted EPS of $0.96 exceeding consensus by 12.6% and adjusted revenue of $957M topping estimates by 6.6%. Assets under management reached a record $867 billion despite persistent net outflows, as market appreciation offset $3.8 billion in quarterly active outflows.

The investment manager's full-year adjusted EPS grew 2% to $3.33, while unitholder distributions increased 4% to $3.38 per unit.

Did AllianceBernstein Beat Earnings?

Yes — a double beat on both EPS and revenue.

*Values retrieved from S&P Global

Key drivers of the beat:

- Higher investment advisory base fees (+5% YoY) on record AUM

- Continued cost discipline with adjusted operating expenses up only 1%

- Favorable mix shift toward higher-margin alternatives and private markets

The EPS beat was notable given Q4 2024's $1.05 adjusted EPS benefited from stronger performance fees. Q4 2025 performance fees of $82M were below prior year's $133M, which included catch-up fees from CarVal and strong contributions from public strategies like ABSA and ARIA.

What Did Management Guide?

CFO Tom Simeone provided detailed 2026 expense guidance:

The non-comp increase reflects "normalization in promo and G&A expenses recovering from last year's depressed levels" plus ~$10M of discretionary investment in technology implementation and CML platform onboarding. Excluding discretionary spend, non-comp would increase in the low single digits.

Private Markets Trajectory: CEO Seth Bernstein confirmed the firm is "well-positioned to transform the business, unlock new opportunities for our clients, and exceed our $90 billion–$100 billion target for private markets AUM by 2027." An updated target will be provided with Q2 2026 earnings.

Insurance Partnerships: The institutional pipeline is "nearly $20 billion," with expectations to add "approximately $3 billion of new private asset mandates from strategic insurance partnerships in the first half of 2026." AB will onboard "more than $10 billion of new long-duration assets from Equitable by year-end 2026."

Investment Platform Upgrade: A new unified investment management platform will result in ~$40M cash flow impact over 4 years, generating $20M–$25M in annual net expense savings beginning in 2030.

How Did the Stock React?

AB shares are trading at $42.43 following the earnings release, essentially flat from the prior close of $42.45. The stock is near its 52-week high of $44.11 and up 5.6% from its 50-day moving average of $40.19.

Historical context: The Q4 2024 earnings day saw a sharp 12% decline despite a beat, as investors reacted to guidance concerns and flow pressures. The muted reaction to Q4 2025 suggests the beat and guidance were largely priced in, with shares already up 31% from the 52-week low.

What Changed From Last Quarter?

Key sequential changes:

-

Net outflows accelerated from $2.3B in Q3 to $4.7B in Q4, driven by retail channel weakness ($3.5B outflows vs. $1.7B in Q3).

-

Margin expansion continued modestly, with adjusted operating margin improving 30 bps to 34.5%.

-

Private Wealth inflows slowed from $1.2B in Q3 to $0.7B in Q4, though the channel remained the only one with positive flows.

Assets Under Management: Record High Despite Outflows

AUM reached a record $866.9 billion, up 9.4% YoY despite full-year net outflows of $11.3 billion. Market appreciation of $86.0 billion more than offset redemptions.

Source:

Flow commentary by asset class:

- Active Equities: $22.5B net outflows for the year, with $7.6B outflows in Q4. "Roughly half of these were driven by retail redemptions."

- Tax-Exempt Fixed Income: Extended record to 13 consecutive years of inflows, +$11.6B for the year and $3.9B in Q4. "The platform has generated organic growth for 13 consecutive years and long-term alpha for our clients."

- Alternatives/Multi-Asset: $10.6B active net inflows for the year, "supported by strong private markets deployments" of ~$9B.

Segment Performance

By Investment Service (Q4 2025 Net Flows)

Source:

Standout performers:

- Tax-exempt fixed income grew 23% organically in 2025

- Private markets AUM reached $82B, +18% YoY

Key Management Quotes

CEO Seth Bernstein on 2025:

"2025 was a year of disciplined execution and strategic progress for AllianceBernstein. I'm very proud of the strides we've made as a firm, and I'm deeply grateful to my colleagues for their dedication and impact."

On Private Wealth (Fifth Consecutive Year of Positive Flows):

"Bernstein Private Wealth delivered its second consecutive quarter of organic growth and fifth straight year of positive net flows, supported by record-level advisory productivity."

On Equitable Partnership:

"We view our strategic partnership with Equitable as a meaningful competitive advantage, reinforcing AB's capital-light, client-aligned model and enabling efficient and disciplined scaling of new offerings."

CFO Tom Simeone on Margin Expansion:

"We have demonstrated meaningful operating leverage from both markets and scale, with incremental margins well above our long-term 45%–50% target. We expect constructive markets to continue boosting the profitability of our existing services, reflecting improved flow-through to earnings."

President Onur Erzan on Private Markets Ambition:

"We are ambitious, and we see further opportunities to expand it... We will, with our second quarter earnings, revise that target for you."

Capital Returns

Source:

The Q4 distribution of $0.96 is payable March 12, 2026 to holders of record at close of business on February 20, 2026.

Operating Metrics

Source:

Full Year 2025:

- Adjusted operating margin expanded to 33.7%, "at the upper end of our 30%–35% investor day target range"

- Full year revenues of $3.5B were flat YoY, but up 3% like-for-like excluding Bernstein Research separation

- Adjusted base management fees grew 5% driven by higher markets

Q&A Highlights

On Asia High-Yield Demand (Onur Erzan, President):

"The Asia clients, the retail, particularly likes income, and still the U.S. dollar-denominated strategies and global strategies deliver attractive income, hence, the structural demand remains strong."

AB launched its second active ETF in Taiwan — a high-yield fund that had a "successful IPO, top in its category." Taiwan also raised regulatory limits from 70% to 90% for AB's vehicles, unlocking more opportunity.

On Private Wealth Seasonality:

"In terms of seasonality, you always have the tax impact in the second quarter, so that's always the biggest thing to consider."

M&A activity remains a key driver of ultra-high-net-worth client acquisition.

On AI/Software Exposure in Private Credit: The PCI (private credit) portfolio has ~25% exposure to technology/software companies, in line with the broader corporate direct lending market. Management noted "no material change in terms of our loss experience" and emphasized active monitoring of credit watches.

On Private Markets Target Beyond 2027:

"We are ambitious, and we see further opportunities to expand it... We will, with our second quarter earnings, revise that target for you."

2026 Financial Outlook

CFO Tom Simeone provided detailed 2026 guidance:

Investment Management Platform Upgrade: AB selected a new unified investment management platform expected to result in ~$40M total cash flow impact over 4 years, with $20M–$25M in annual net expense savings beginning in 2030 after legacy systems are retired.

Commercial Mortgage Expansion: The new CML platform will be fully operational in H2 2026, managing $10B+ of long-duration assets for Equitable. This brings insurance-tailored assets to over $20 billion.

Key Risks and Concerns

-

Persistent Active Equity Outflows: $22.5B net outflows in active equities for 2025 represents a structural headwind. Management acknowledged "firm-wide active net flows were negative for both the quarter and the full year."

-

Retail Channel Weakness: The retail channel swung from organic growth in prior years to $9.1B net outflows in 2025, "ending a two-year streak of organic gains."

-

Performance Fee Volatility: Q4 performance fees fell to $82M from $133M prior year, highlighting earnings sensitivity to market conditions.

-

Equity Performance Headwinds: Only 21% of equity AUM outperformed over 1 year, with "the most pronounced performance pressure in U.S. large cap growth-oriented strategies, where benchmark concentrations remain acute."

Investment Performance

Fixed Income (Strong Relative Results):

- 86% of AUM outperformed over 1- and 3-year periods

- 67% of AUM outperformed over 5-year periods

- Municipal strategies: Nearly all funds rated 4 or 5 stars by Morningstar

- U.S. retail taxable flows ranked among top 15 fund managers in 2025

Equities (Challenged Environment):

- 21% of AUM outperformed over 1 year

- 37% over 3 years, 51% over 5 years

- Underperformance concentrated in U.S. large cap growth strategies

- Value, core, and thematic strategies delivered strong results

- Emerging markets, China, and international value were "notable standouts"

Equity Outlook Improvement:

"As market breadth began to improve entering 2026, platform performance has started to rebound. A growing share of growth, value, core, and thematic strategies are now delivering stronger relative results."

Forward Catalysts

- Private Markets Pipeline: Nearly $20B institutional pipeline with $3B expected in H1 2026

- Equitable CML Platform: $10B+ long-duration assets expected by year-end 2026

- Tax-Exempt Momentum: 13-year inflow streak, $11.6B net inflows in 2025

- Active ETF Expansion: $14B AUM across 24 strategies, 65% organic growth in 2025

- Private Markets Target Update: Revised target to be announced with Q2 2026 earnings

For the full 8-K filing, see AB Q4 2025 8-K. Earnings call transcript available at AB Q4 2025 Transcript.