Enact Holdings (ACT)·Q4 2025 Earnings Summary

Enact Holdings Beats EPS by 10%, Announces $500M Buyback

February 4, 2026 · by Fintool AI Agent

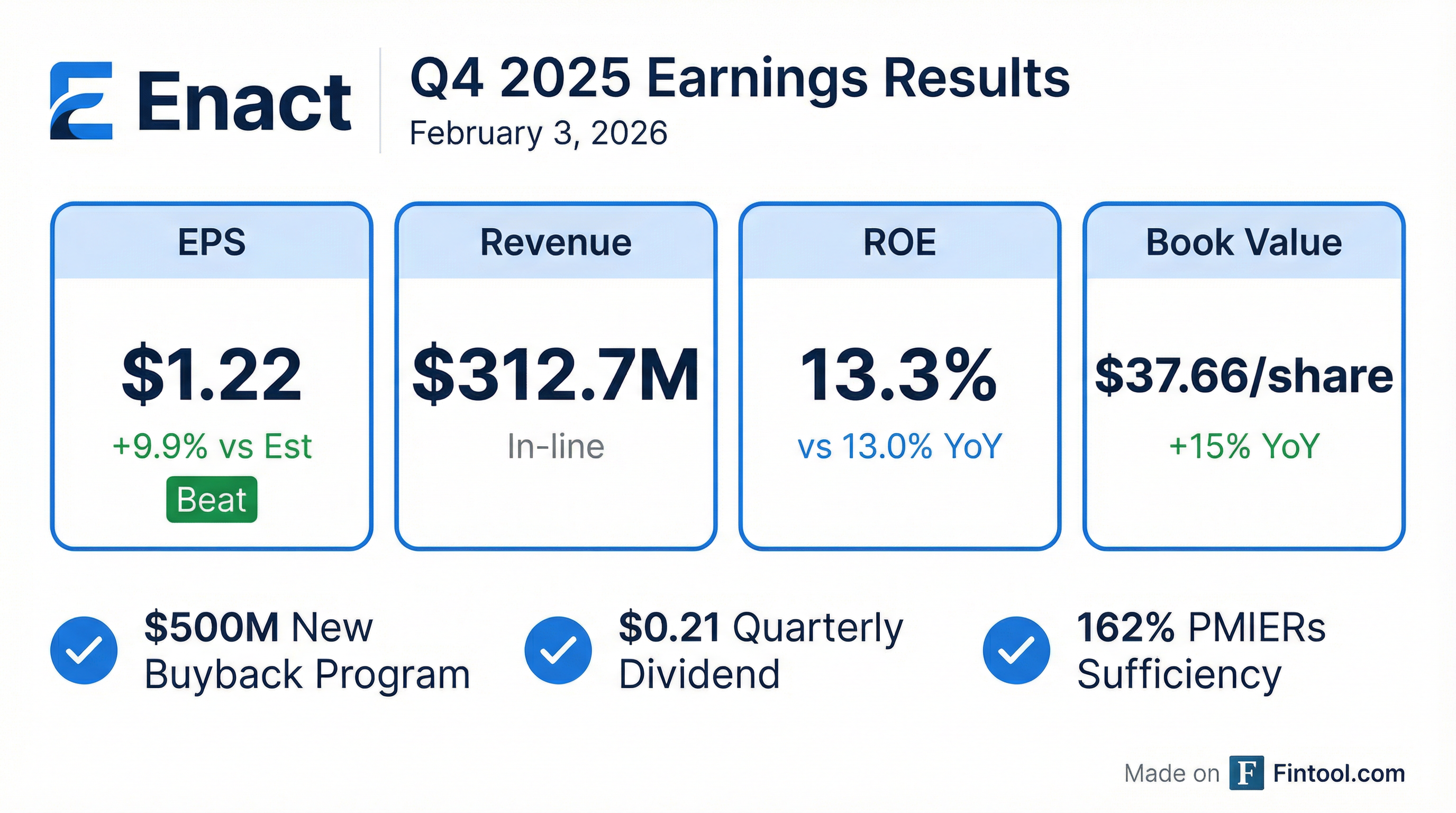

Enact Holdings (ACT) reported Q4 2025 results that beat earnings expectations while announcing aggressive capital returns. Diluted EPS of $1.22 topped the $1.11 consensus by 10%, driven by favorable loss development and a net reserve release. The mortgage insurer also unveiled a new $500 million share repurchase program, signaling confidence in its capital position.

Did Enact Beat Earnings?

EPS Beat, Revenue In-Line

The EPS beat was driven primarily by a $60 million net reserve release reflecting favorable cure performance on delinquencies. Management lowered claim rate expectations from 9% to 8% based on sustained positive trends.

8-Quarter EPS History:

What Changed From Last Quarter?

Key Sequential Changes (Q4 vs Q3 2025):

- Net income: +$14M (+8%) to $177M, driven by lower loss incurred

- Losses incurred: -50% to $18M from $36M, due to $60M reserve release

- Loss ratio: Improved to 7% from 15%

- ROE: Improved to 13.3% from 12.4%

- NIW: +2% to $14B, with 96% monthly premium policies

- Persistency: Declined to 80% from 83% as rates remain elevated

The standout change was the reserve release. Management noted that sustained favorable cure performance justified lowering claim rate assumptions, releasing reserves accumulated in prior quarters.

Capital Returns: New $500M Buyback

Enact announced significant capital return enhancements:

CEO Rohit Gupta emphasized the capital return strategy:

"The Board's authorization of a new $500 million share repurchase program reflects the strength of our balance sheet and our continued confidence in Enact's long-term performance. The authorization reinforces our disciplined approach to capital management and our commitment to returning excess capital to shareholders."

The company has also entered into an agreement with Genworth Holdings to repurchase its shares proportionally to maintain Genworth's ~81% ownership stake.

How Did the Stock React?

Stock Price: $40.33 (-0.3% on the day)

The muted reaction suggests the strong results were largely priced in. ACT is trading near its 52-week high of $41.35 and has rallied 29% from its 52-week low of $31.28.

Valuation Context:

- Book value per share: $37.66 (+15% YoY)

- Price-to-book: 1.07x (trading at slight premium to book)

- Market cap: ~$5.8B

Key Business Metrics

Insurance In-Force (IIF) by Book Year:

The 2020-2022 vintages now represent the core of the portfolio:

- 2025 book year: 18% of IIF ($48.5B)

- 2024 book year: 15% of IIF ($42.0B)

- 2023 book year: 14% of IIF ($38.3B)

- 2022 book year: 17% of IIF ($46.2B)

- 2021 book year: 17% of IIF ($45.9B)

PMIERs and Capital Position

Enact maintains a fortress balance sheet with significant excess capital:

S&P upgraded the financial strength rating outlook for EMICO, EHI, and Enact Re to positive subsequent to quarter end.

Credit Quality and Delinquencies

Delinquency trends remain manageable:

Geographic Concentration:

- Florida: 8% of RIF, 13% of reserves (3.35% delinquency rate)

- New York: 5% of RIF, 9% of reserves (3.38% delinquency rate)

- California: 12% of RIF, 13% of reserves (2.84% delinquency rate)

Management Commentary

CEO Rohit Gupta struck a confident tone on the earnings call:

"Enact delivered a very strong finish to 2025 that reflected the disciplined execution of our strategy, robust credit performance, and our commitment to shareholder value creation."

On the outlook, management highlighted that only 22% of mortgages in the portfolio have rates at least 50 basis points above December 2025's average mortgage rate of 6.2%, supporting elevated persistency. Meanwhile, 59% of loans in the book have rates below 6%.

2026 Outlook and MI Market Forecast

MI Market Growth Expected: Management expects the mortgage insurance market to grow approximately 10-15% from 2025 to 2026, based on external purchase origination forecasts ranging from 8% to 24% increases (Fannie Mae, MBA, Moody's).

2026 Guidance:

CFO Dean Mitchell on capital returns: "We're confident that right now, given those dynamics, we're confident in the ability to return $500 million to shareholders in 2026."

Geographic Risk and Housing Markets

Management flagged differentiated housing market dynamics across regions:

Areas of Concern (Sun Belt):

- Florida, Texas, California, Arizona — Housing supply has increased, home prices have moderated or declined

- Management is incorporating these regional risk views into granular, loan-level pricing through Rate360

Areas of Strength (Northeast):

- Low housing supply, home prices continue to appreciate meaningfully

CFO Dean Mitchell: "We're monitoring housing markets as an example of something that we're keeping our eye on for affordability, supply, demand dynamics, and we'll continue to consider that as we think about how to crystallize our philosophy of the right risk and the right price."

Regulatory Environment

Management is actively engaged with the new administration on housing policy:

Topics Under Discussion:

- Limited inventory and affordability challenges

- Credit score policy changes (pros/cons)

- GSEs buying mortgage-backed securities (recently announced)

- Ban on institutional investors buying single-family homes

CEO Rohit Gupta: "We remain actively engaged with the new administration, and that includes Treasury, FHFA, the GSEs, as well as policymakers... I couldn't call out any specific idea which is high up on the list from an execution perspective. I think it's just a list of ideas right now."

Q&A Highlights

On Capital Return Flexibility (Doug Harter, UBS): Management will evaluate dynamics throughout 2026, including business performance, loss performance, macroeconomic environment, and regulatory developments. The $500M target could be adjusted based on these factors.

On Front Book Credit Performance (Rick Shane, JPM): All recent book years (2022-2024) are performing in line with or better than pricing expectations. Despite higher-risk purchase market attributes (higher LTV, DTI), management has priced appropriately for these risks.

On Delinquency Trends (Mihir Bhatia, Bank of America):

- Portfolio weighted average age: 4.1 years (approaching plateau of loss development pattern)

- YoY new delinquency growth slowed from mid-teens (2023→2024) to mid-single digits (2024→2025)

- Expect further moderation in 2026 with only ~2,000 incremental new delinquencies YoY

On Reinsurance Pricing (Bose George, KBW):

- Strong demand in traditional reinsurance market for mortgage credit default risk

- Cost of capital now at lower end of low-to-mid single digit range (previously higher end)

- Attachment: ~3% of risk in force

- Detachment: Within PMIERs tier (~7%)

On Expense Efficiency (Bose George, KBW): Since IPO, operating expenses are down $30+ million on an annualized run rate basis. Technology investments continue to drive productivity and customer experience improvements.

Forward Catalysts

- MI Market Growth — Management expects 10-15% MI market expansion in 2026

- Interest rate trajectory — Lower rates could pressure persistency as refinancing accelerates; 59% of loans have rates below 6%

- Housing policy changes — Active engagement with administration on GSE MBS purchases, institutional investor bans, credit score changes

- Continued buybacks — New $500M authorization provides significant runway for share count reduction

- Credit performance — Favorable cure trends supporting reserve releases; claim rate reduced to 8%

- Reinsurance tailwinds — Cost of capital at lower end of range, strong demand for mortgage credit risk

Full Year 2025 Summary

Upcoming Investor Conferences

- UBS Financial Services Conference — February 9, 2026 (Florida)

- Bank of America Financial Conference — February 10, 2026 (Florida)

- RBC Capital Markets Global Financial Institutions Conference — March 11, 2026 (New York)