AMRK (AMRK)·Q2 2026 Earnings Summary

Gold.com Lands $150M Tether Investment as Q2 Earnings Jump 70%

February 5, 2026 · by Fintool AI Agent

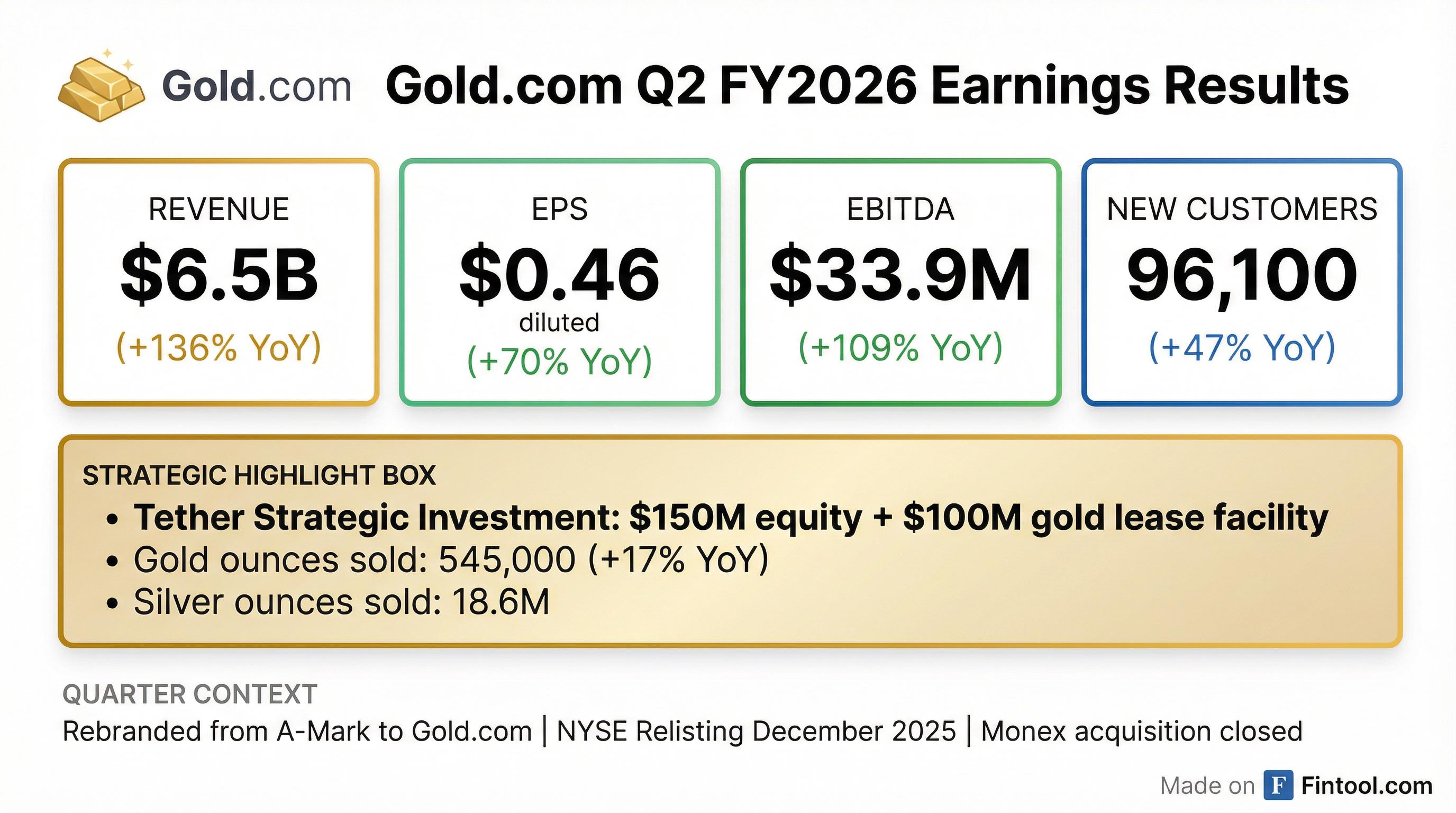

Gold.com (NYSE: AMRK), formerly A-Mark Precious Metals, delivered strong fiscal Q2 2026 results in its first earnings call under the new corporate identity. Revenue surged 136% year-over-year to $6.5 billion, while diluted EPS jumped 70% to $0.46. The quarter was overshadowed by a blockbuster announcement: stablecoin giant Tether is investing approximately $150 million in Gold.com with a $100M+ gold leasing facility.

Did Gold.com Beat Earnings?

Gold.com delivered robust year-over-year growth despite facing headwinds from silver market backwardation:

Revenue growth was driven by higher average selling prices for gold and silver, increased gold ounce volumes, and contributions from the SGI, Pinehurst, and AMS acquisitions completed in fiscal 2025.

Key Operating Metrics:

What Is the Tether Strategic Investment?

The headline announcement was Tether's strategic investment in Gold.com—a deal CEO Greg Roberts called "the most significant announcement in the history of the company."

Deal Structure:

- Equity Investment: ~$125M at $44.50/share, with ~$25M more pending regulatory clearance

- Gold Lease Facility: Minimum $100M gold leasing facility

- Board Seat: Tether entitled to nominate one board member

- Commercial Partnerships: Storage services, logistics, and stablecoin distribution through Gold.com's DTC channels

- XAUT Investment: Gold.com will invest $20M in Tether's gold-backed stablecoin

Tether is one of the largest private holders of gold globally and sponsors USDT (the largest dollar-backed stablecoin) and XAUT (the largest gold-backed stablecoin).

Why It Matters: CEO Roberts emphasized the immediate financial impact: "If you just throw everything else out and you just take the interest expense benefits we're gonna see from this transaction, it's a significant amount of money." The company currently pays 6-7% on dollar credit lines—gold leases carry much lower rates.

What Did Management Say About Q3 Outlook?

When asked about profitability outlook for Q3, CEO Roberts was unusually direct: "You should probably think about that we're gonna have a really good quarter this quarter."

Key Tailwinds Cited:

- Premium spreads widening: Silver product premiums "significantly higher" than three months ago

- Silver demand surging: Silver now ~50% of volume, up from lower levels in 2025

- Backwardation easing: Market moving back toward contango, which benefits trading income

- Operating leverage: AMGL facility shipped 120,000+ packages in January alone

What Were the Q2 Headwinds?

Despite strong headline results, the quarter faced notable challenges:

Silver Backwardation Impact: The prolonged backwardation in the silver market created a $10-12 million year-over-year swing in trading results. Roberts explained: "We probably swung from about a $6 million gain from contango in December of 2024 to a $5 or $6 million loss in Q2 of calendar 2025."

Higher Interest Expense: Interest expense increased 57% to $16.3M driven by:

- Product financing arrangements: +$3.7M

- Precious metal leases: +$1.9M

- Trading credit facility: +$0.1M

Sunshine Mint Drag: The Sunshine Mint equity investment contributed negatively due to facility consolidation timing and reduced U.S. Mint blank demand. Roberts called it an "anomaly" that should improve.

What Changed From Last Quarter?

The transformation was rapid. Roberts noted November was "a very slow month" before things "picked up in December" and became "craziness through the last three weeks of December and then into January."

How Is Gold.com's Minting Capacity Positioned?

Management highlighted the competitive advantage of vertical integration during the demand surge:

SilverTowne Mint Production:

- Mid-2025: ~200,000 oz/week (reduced during slow period)

- Current week: Targeting 800,000 oz/week

- Peak capacity: 1.3M oz/week achieved previously

"Having our balance sheet and having two mints available to us is going to allow us to sell more products than our competitors. And there's nobody really even close," Roberts said.

When Silver Eagles go on allocation (supply-constrained), customers shift to Gold.com's private mint products—a direct revenue capture opportunity.

What About International Expansion?

Key Developments:

- Atkinsons Bullion (UK): Increased stake from 25% to 49.5%

- LPM Hong Kong & Singapore: "Incredibly strong" performance, positive momentum in retail and wholesale

- AMGL Las Vegas: Operating at increased capacity, shipped 275,000 packages in December-January combined

On international logistics facilities, Roberts was cautious: standing up a Las Vegas-like facility abroad is "a very large capital commitment" and current international volumes don't justify it.

Stock Price & Earnings History

The stock has experienced significant volatility over the past year, reflecting the commodity-linked nature of the business. The Tether investment and strong Q3 outlook commentary could serve as catalysts.

Recent Earnings Trajectory:

Capital Allocation

Dividend: Board declared $0.20/share quarterly dividend, payable March 1, 2026 to shareholders of record February 20, 2026.

Balance Sheet at Quarter End:

- Cash: $152M (vs. $78M at FY25 end)

- Non-restricted Inventory: $1.03B (vs. $795M at FY25 end)

The Tether investment proceeds will further strengthen the balance sheet and reduce reliance on higher-cost dollar borrowings.

Q&A Highlights

On Taking Market Share: "I do believe we're taking market share right now, and I do believe... I've always believed we're better than everybody else."

On Future M&A: When asked if Tether changes M&A strategy, Roberts replied: "It doesn't change a thing. And I think it gives us the opportunity to grow the company with bigger transactions."

On Silver Volatility: "Silver at $100 and gold at $5,000... it causes us a significant increase in the amount of dollars we need to manage those positions. To this point, we have been successful... But it is a bit of a stress when the numbers are this big, which... this relationship with Tether... is gonna really give us a lot more liquidity."

Forward Catalysts

- Q3 FY2026 Results: Management has telegraphed strong expectations—watch for premium spread realization

- Tether Transaction Close: Regulatory clearance for additional $25M tranche

- Commercial Partnerships: Stablecoin integration, storage deals with Tether

- Minting Capacity: Ramp to 900K+ oz/week at SilverTowne

- Gold.com Credit Card: Development ongoing with potential Tether involvement

The Bottom Line

Gold.com delivered a strong quarter that was largely overshadowed by the transformative Tether announcement. The combination of improving market conditions (easing backwardation, widening premiums, surging silver demand) and strategic capital infusion positions the company well heading into Q3. CEO Roberts' unusually bullish forward commentary—rare for a management team—signals confidence in near-term performance.

View the full Q2 FY2026 earnings call transcript | Gold.com company page