APPFOLIO (APPF)·Q4 2025 Earnings Summary

AppFolio Beats Q4, But Guidance Miss Sends Stock Down 5%

January 29, 2026 · by Fintool AI Agent

AppFolio delivered a solid Q4 with revenue up 22% and Non-GAAP EPS beating by 11%, but FY 2026 guidance came in roughly 2% below Street expectations, sending shares down 5% in after-hours trading. The company highlighted that 98% of its customers are actively using AI capabilities, and management expressed confidence about reaching the $1 billion revenue milestone in 2026.

Did AppFolio Beat Earnings?

Revenue: Beat by 0.7% — Q4 revenue of $248.2M came in above the $246.6M consensus, growing 22% year-over-year. Full year 2025 revenue reached $951M, up 20% YoY.

EPS: Beat by 11% — Non-GAAP diluted EPS of $1.39 comfortably exceeded the $1.25 Street estimate. GAAP EPS was $1.10.

*Q4 2024 GAAP EPS of $2.79 included a large tax benefit

What Did Management Guide?

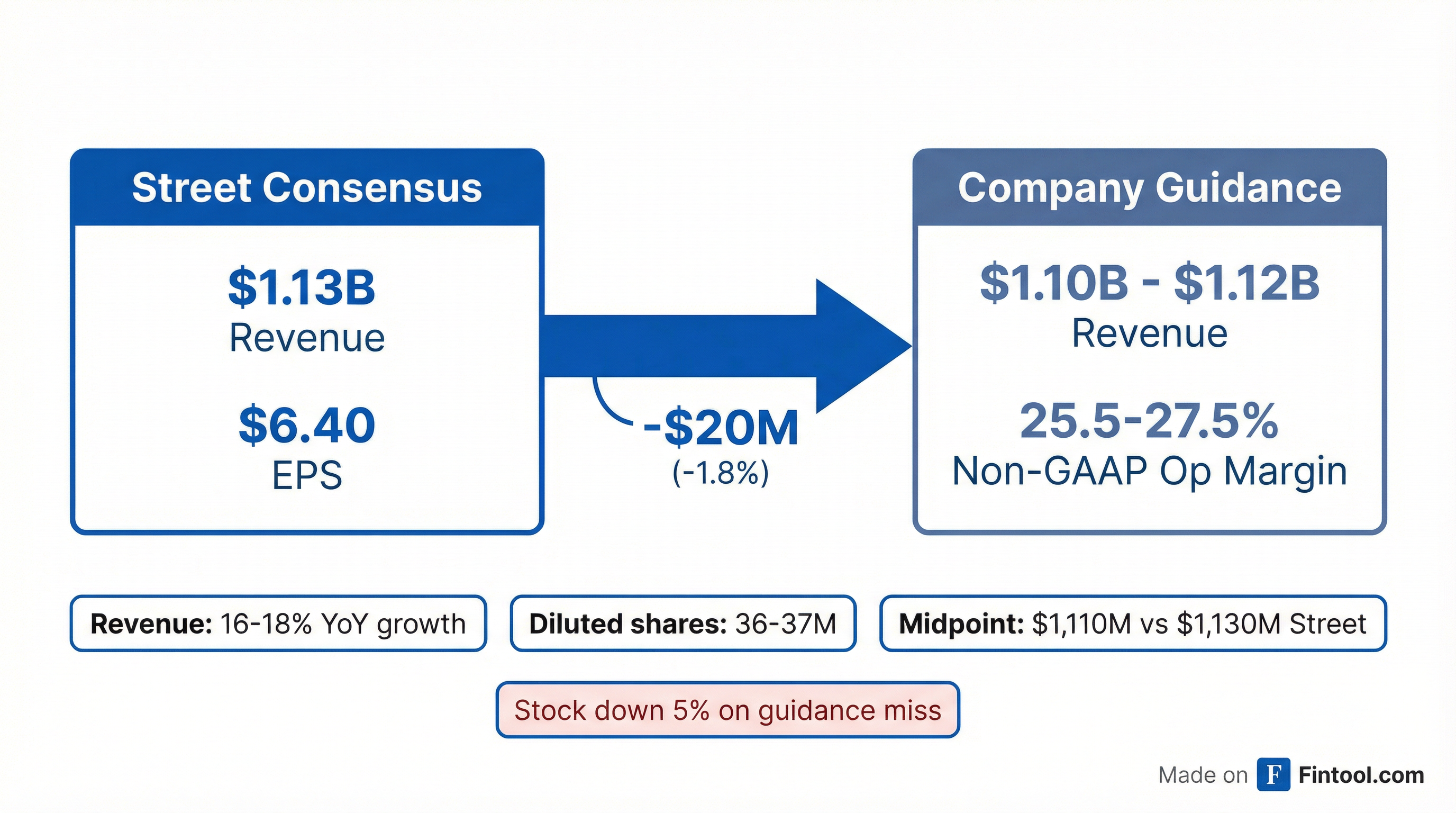

This is where the quarter gets complicated. Despite strong Q4 execution, FY 2026 guidance disappointed:

The revenue guidance midpoint of $1,110M implies 17% growth — a notable deceleration from 20% in FY 2025 and 25% in FY 2024.

CEO Shane Trigg emphasized the company's AI strategy: "Our AI-native Performance Platform, with continued investments in agentic AI and the resident experience, is powering the future of real estate. As we enter 2026, we are driving real, measurable performance outcomes for our customers."

How Did the Stock React?

APPF closed at $207.10, down 5.0% on the day, after trading as low as $204.07.

The reaction pattern is consistent with recent quarters — the stock has been volatile around earnings, dropping 18% after Q1 2025 results and falling 8% after Q4 2024, despite both quarters showing solid fundamentals.

What Changed From Last Quarter?

Operating leverage improved significantly:

- Non-GAAP operating margin expanded to 24.9% vs 20.2% in Q4 2024

- GAAP operating margin reached 17.6% vs 11.3% last year

- Stock-based compensation as a % of revenue declined to 6.2% from 7.8%

Unit growth accelerated:

- Total units under management grew 8% YoY to 9.4 million

- Added 500,000+ units in H2 2025 alone, demonstrating strong momentum

- Customer count grew 6% YoY to 22,096 customers

Cash flow strength:

- Operating cash flow of $65M (26.2% of revenue) vs $37M (18.0%) in Q4 2024

- Full year operating cash flow reached $242M (25.5% of revenue)

Revenue Breakdown by Segment

*Note: Core Solutions is being renamed to Subscription Services going forward.

Value Added Services continues to drive growth, representing 74% of total revenue.

Balance Sheet Highlights

Notable: AppFolio repurchased $145.7M of stock during 2025, yet still ended the year with higher cash and a stronger balance sheet.

Historical Performance: 8-Quarter Trend

Beat/Miss History

Source: Yahoo Finance

The inconsistent relationship between beat/miss and stock reaction underscores that investors are focused on forward guidance and growth trajectory, not just quarterly results.

Management Commentary & Customer Highlights

CEO Shane Trigg emphasized the company's milestone journey: "When I joined in 2020, we set a goal to reach $1 billion in revenue. This year, we're poised to hit that milestone. It's a testament to what's possible when we stay focused on our customers, deliver industry-leading innovation, and maintain operational discipline."

AI Adoption Leadership: AppFolio highlighted a stark contrast with the industry — while 50% of AI users in property management report they cannot rely on AI features in their core PMS, 98% of AppFolio's customers are actively using one or more AI capabilities.

Industry Sentiment: According to AppFolio's new property management benchmark report:

- 81% of property managers feel positive entering 2026

- 77% expect to increase unit counts (up from 65% a year ago)

- 45% plan to consolidate software solutions, underscoring the value of unified platforms

Customer Success Stories:

Advanced Management Company (12,000 multifamily units, Southern California): "Before, we were relying on nine separate systems to manage our properties, which made it impossible to deliver a truly seamless resident experience. AppFolio's AI-native platform changed all of that. By consolidating our data and automating our core workflows, we freed up our teams to focus instead on creating meaningful connections with our residents." — Danielle Holloway McCarthy, President

T.R. Lawing Realty (~3,000 units, Charlotte): "We could not do what we do without AppFolio. The reliable platform, with its support, innovativeness, and ability to make our lives easier, truly allows us to do our jobs, be more professional, productive, and transparent, and provide the five-star customer service our owners and residents expect." — Joe Remsen, President

Other Key Metrics from the Call:

- Premium tier adoption (Plus and Max) exceeded 25%

- Added over 500,000 units in H2 2025 alone

- Resident Onboarding Lift (with Second Nature) and LiveEasy now contributing to Value Added Services

Key Risks and Concerns

- Growth deceleration — Revenue growth guided to 16-18% for FY 2026 vs 20% in FY 2025

- Valuation pressure — Stock trades at ~35x FY 2026 EPS estimates with decelerating growth

- Market saturation — 8% unit growth suggests TAM penetration may be maturing

- AI investment returns — Significant investments in agentic AI with uncertain near-term payback

Forward Catalysts

- Q1 2026 earnings (expected late April/early May) — First look at FY 2026 execution

- Product innovation — AI-native platform enhancements and agentic AI features

- Unit growth acceleration — Whether 8% growth can stabilize or improve

- Margin expansion — Guided 25.5-27.5% non-GAAP operating margin suggests continued leverage

The Bottom Line

AppFolio delivered a clean Q4 beat with improving profitability and strong cash flow generation. However, the 5% stock decline reflects investor concern about growth deceleration — FY 2026 revenue guidance of $1.10-1.12B came in 2% below consensus, implying mid-to-high-teens growth vs 20%+ in recent years.

The company's strategic pivot toward AI-native solutions and agentic AI represents a bet on differentiation, but investors are clearly looking for proof points that these investments will translate into accelerating growth or sustained market share gains. At ~35x forward earnings with decelerating growth, the stock needs to demonstrate stronger unit economics or reacceleration to justify the multiple.

Conference call held on January 29, 2026.

Related Links: