AMTECH SYSTEMS (ASYS)·Q1 2026 Earnings Summary

Amtech Stock Crashes 32% After Hours as EPS Misses by 57% Despite AI Momentum

February 5, 2026 · by Fintool AI Agent

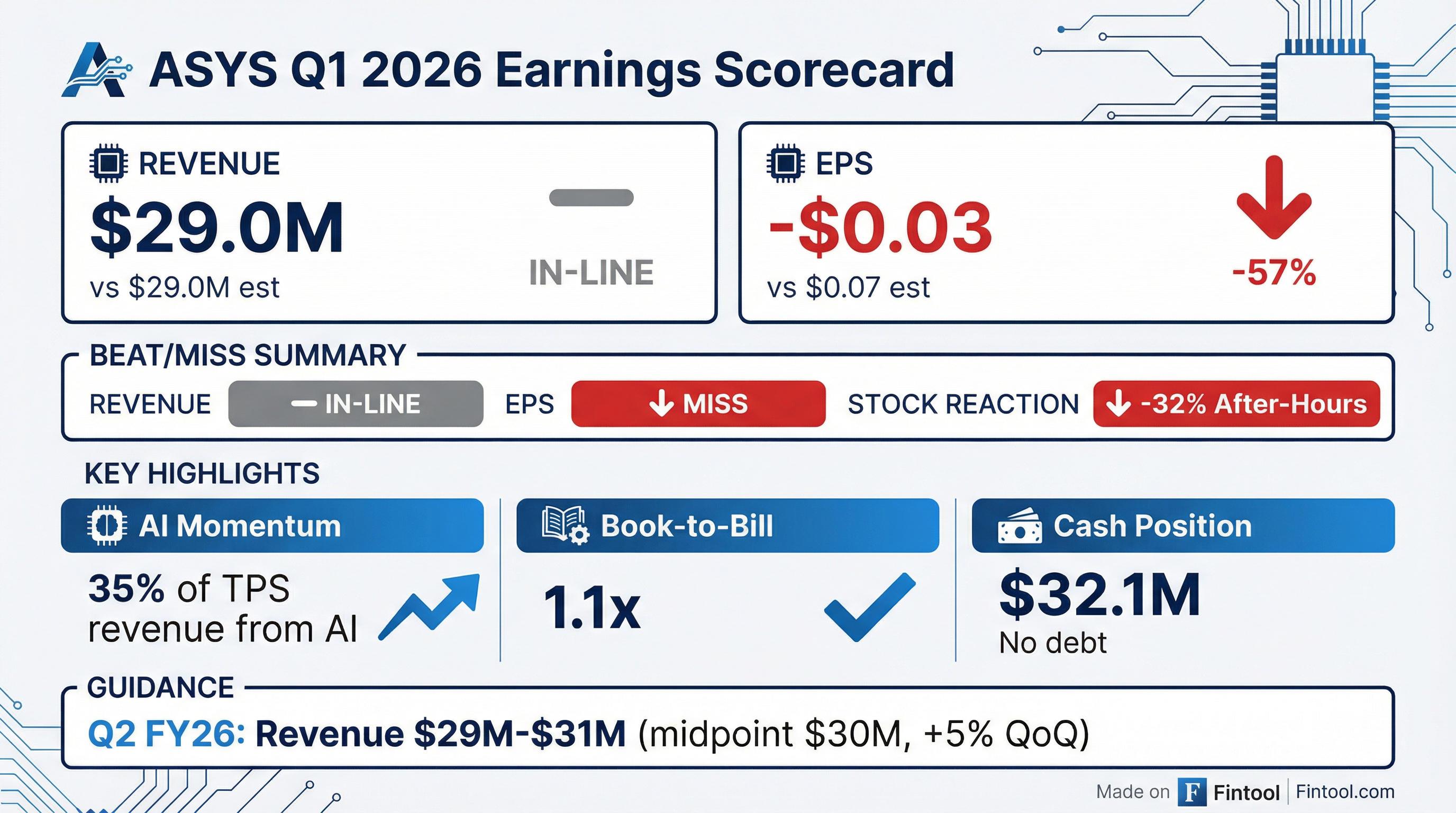

Amtech Systems (NASDAQ: ASYS) reported fiscal Q1 2026 results after market close, delivering revenue in-line with expectations but missing on EPS by a wide margin. The stock plunged 32% in after-hours trading despite management's upbeat commentary on AI demand and panel-level packaging wins. Revenue of $19.0M matched the $19.0M consensus, but EPS of $0.03 came in 57% below the $0.07 estimate, triggering a sharp selloff from $15.87 to $10.79.

Did Amtech Beat Earnings?

Revenue: In-Line | EPS: Significant Miss

Values retrieved from S&P Global

The EPS miss was driven by a combination of lower sequential revenue, higher R&D investment in next-generation AI packaging equipment, and unfavorable tax treatment. CFO Mark Weaver explained that U.S. entities are in a loss position with no tax benefit recognized due to a valuation allowance against deferred tax assets, resulting in an 83% effective tax rate.

Despite the earnings miss, management emphasized the quality of the quarter: a 1.1x book-to-bill ratio, $4.1M in operating cash flow (ninth consecutive quarter of positive operating cash flow), and gross margin expansion to 44.8% from 38.4% a year ago.

How Did the Stock React?

The market reaction was severe despite seemingly solid operational metrics.

The stock had rallied over 400% from its 52-week low of $3.20 heading into earnings, driven by AI-related semiconductor demand. The sharp reversal suggests expectations had gotten ahead of fundamentals, particularly given the EPS miss and modest Q2 guidance.

What Did Management Guide?

For Q2 FY2026, Amtech guided:

Values retrieved from S&P Global

The guidance midpoint of $20M represents a ~5% sequential increase but only matches the low end of Street expectations. Management attributed the expected growth to continued AI equipment demand in the Thermal Processing Solutions segment.

CEO Bob Daigle noted that some Q1 orders were pushed to Q3 at customer request to align with factory build-out schedules, suggesting pent-up demand that should materialize later in the fiscal year.

What Changed From Last Quarter?

Improving:

- AI Mix Accelerating: AI-related products now 35% of TPS revenue, up from 30% in Q4

- Panel-Level Packaging Wins: Received initial orders from "multiple industry leaders" for this emerging technology

- Cash Position: Increased to $22.1M from $17.9M, up 67% over the past 12 months with zero debt

- Gross Margin: 44.8% vs 44.4% sequentially, up from 38.4% YoY

Deteriorating:

- EPS Quality: GAAP EPS of $0.01 vs $0.07 in Q4 despite similar revenue

- PR Hoffman Weakness: Mature node semiconductor and silicon carbide customer demand remains weak

- SG&A/R&D Costs: Combined increase of $700K QoQ from investment in next-gen AI packaging and incentive compensation

Key Management Quotes

On AI demand visibility:

"Customers are more open around what they have planned for expansion these days because, obviously, with the rapid ramps, people are more concerned about making sure their supply chains, their supply base can support that. So we're feeling pretty good around it." — Bob Daigle, CEO

On panel-level packaging opportunity:

"Our sense is this is really the future of advanced packaging... the variety of customer orders that we received for that technology in this quarter, I think, was good validation about future demand." — Bob Daigle, CEO

On next-generation equipment:

"At this stage, I'm thinking... you're looking at probably 2027 before we would see any meaningful demand from that next generation equipment." — Bob Daigle, CEO

Segment Performance

Thermal Processing Solutions (TPS)

The core AI-exposed segment delivered:

- AI Revenue Mix: 35% of segment revenue, up from 30% in Q4 (~10% sequential growth in AI)

- Book-to-Bill: Drove overall 1.1x ratio with strong AI equipment orders

- Panel-Level Packaging: Initial orders received from multiple industry leaders

- Next-Gen Development: Processing samples for customers for higher-density packaging applications

Management expects AI demand to continue strengthening in Q3 and Q4, with new facility build-outs driving equipment orders.

Semiconductor Fabrication Solutions (SFS)

A mixed quarter with strategic progress offset by cyclical headwinds:

- Specialty Chemicals Win: First win for a medical device semiconductor application, product delivered in Q1

- Parts & Services: Improved bookings at Entrepix and BTU due to proactive business development

- PR Hoffman Weakness: Mature node semiconductor and silicon carbide demand remains pressured

Management characterized 2026 as an "investment year" for SFS, expecting double-digit growth and meaningful profits from recurring revenue streams beyond 2026.

Financial Trends

Revenue is down 22% YoY but this reflects intentional product line rationalization. The company has improved gross margins by 640 bps while generating $8.9M in cash over the past 12 months.

Q&A Highlights

On R&D investment priorities (Craig Irwin, Roth Capital): Management confirmed increased R&D spending in two areas: (1) next-generation AI packaging equipment for higher-density applications, and (2) specialty chemicals to build momentum behind the SFS growth strategy.

On AI demand visibility: CEO Daigle noted improving visibility as customers are more open about expansion plans. New facility build-outs (vs. squeezing equipment into existing facilities) are driving Q3-targeted orders.

On tax rate (Craig Irwin, Roth Capital): The 83% effective tax rate resulted from U.S. entities being in a loss position with no tax benefit recognized due to a valuation allowance. Foreign entity income is taxed normally while U.S. losses provide no offset.

Risks and Concerns

- Valuation Risk: Stock had rallied 400%+ from lows, creating high expectations

- Earnings Quality: GAAP EPS of $0.01 vs $0.07 consensus raises profitability concerns

- Mature Node Exposure: PR Hoffman weakness continues with no clear recovery timeline

- SFS Investment Year: 2026 positioned as investment year, delaying profitability

- Customer Concentration: AI demand concentrated among major OEMs/OSATs

- Next-Gen Timing: Meaningful revenue from next-gen equipment not expected until 2027

Forward Catalysts

- Q2 2026 Earnings: Expected late April/early May 2026

- Panel-Level Packaging Adoption: Customer ramps through 2026

- AI Capacity Build-outs: Q3-Q4 equipment deliveries for new facilities

- Specialty Chemicals Pipeline: Additional wins expected from robust opportunity pipeline

- Roth Capital Conference: Management presenting in March 2026