A10 Networks (ATEN)·Q4 2025 Earnings Summary

A10 Networks Posts Record Revenue, Beats on Both Lines

February 4, 2026 · by Fintool AI Agent

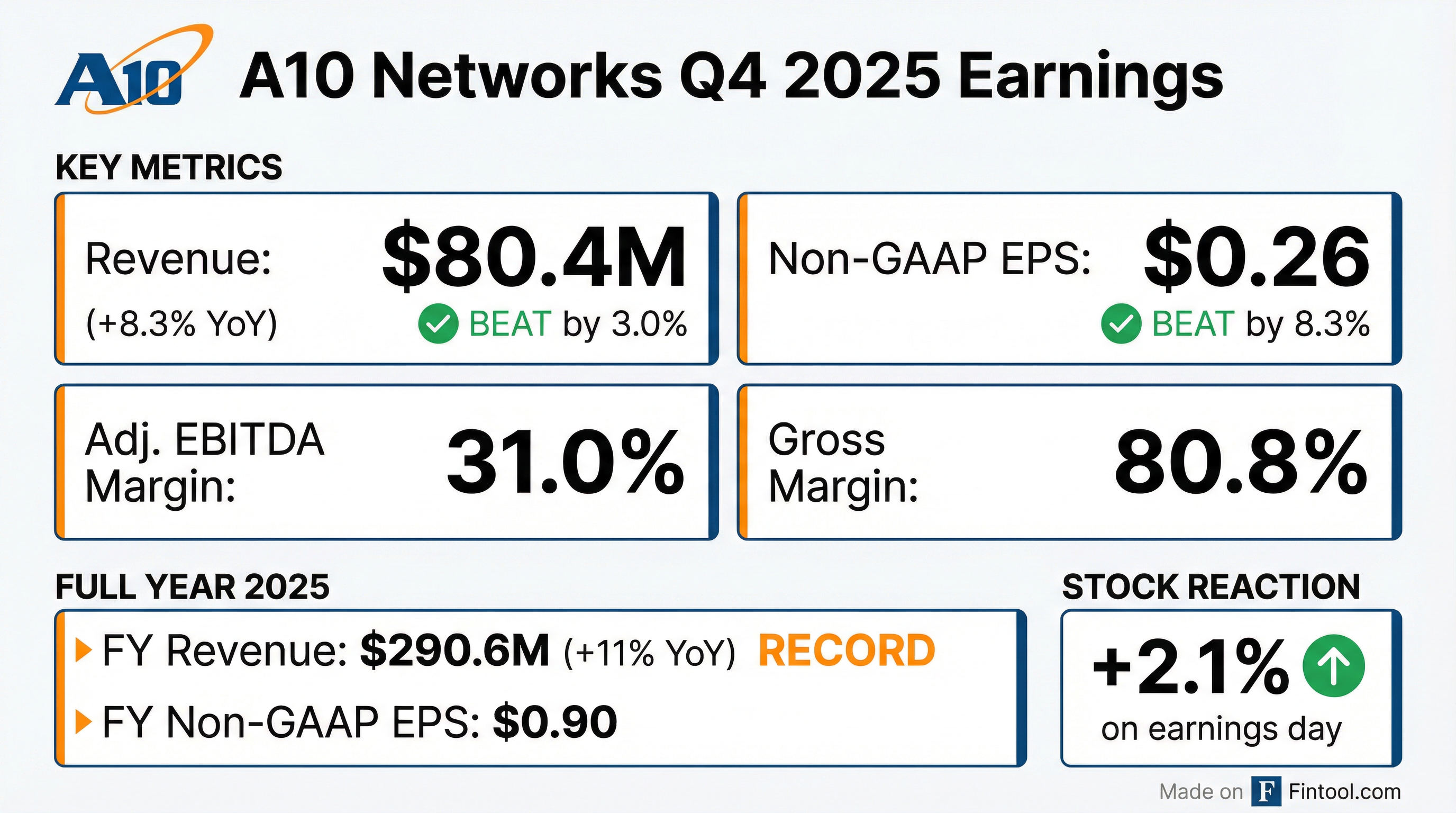

A10 Networks (NYSE: ATEN) delivered a clean beat on both revenue and earnings in Q4 2025, posting record quarterly revenue of $80.4M (+8.3% YoY) and non-GAAP EPS of $0.26, exceeding consensus estimates by 3.0% and 8.3% respectively . The cybersecurity and application delivery company extended its streak of profitable growth, with security-led revenue exceeding the 65% long-term target . CEO Dhrupad Trivedi emphasized that A10 is "positioned squarely in front of multiple durable secular catalysts" including AI infrastructure investment .

Did A10 Networks Beat Earnings?

Yes. A10 Networks beat on both lines in Q4 2025:

*Consensus estimates from S&P Global

This marks A10's ninth consecutive quarterly beat, with the company consistently outperforming Street expectations across both revenue and earnings metrics.

Full Year 2025 Highlights:

How Did the Stock React?

ATEN shares rose 2.1% to $17.50 on the earnings release, trading within the day's range of $17.01-$17.63 . After-hours trading showed further strength at $17.60.

The stock has traded in a range of $13.81 to $21.90 over the past 52 weeks. The positive reaction reflects investor confidence in A10's execution and the company's ability to deliver profitable growth in a competitive cybersecurity landscape.

What Did Management Guide?

For FY 2026, A10 management provided strong forward guidance :

Management expects expanding net margin and EBITDA margin, with EPS growth exceeding revenue growth rate . The company also announced plans to host an Investor Day to provide additional strategic context: "We will provide additional strategic and solution context around our growth drivers and market positioning at an upcoming Investor Day, including a deeper discussion of the factors that drive these expectations" .

Key Management Quotes:

"A10 continues to benefit from strong end demand across its portfolio, capturing market share as customers deploy our solutions to support AI infrastructure and driving growth ahead of the market." — Dhrupad Trivedi, CEO

"A10's strategic position, aligned with the increasingly pressing demands for high-throughput, low-latency, and integrated security, are benefitting us as we work with customers on their data center buildouts." — Dhrupad Trivedi, CEO

"Building on our execution in 2025, operational discipline remains foundational to our business model as we enter 2026, supporting sustained top- and bottom-line growth." — Dhrupad Trivedi, CEO

What Changed From Last Quarter?

Revenue Acceleration: Q4 revenue of $80.4M represented an acceleration from Q3's $74.7M, with sequential growth of 7.6% . This is notably stronger than the typical Q4 seasonality pattern.

Margin Expansion: Adjusted EBITDA margin expanded to 31.0% in Q4, up from 29.3% in Q3 2025, driven by operating leverage and continued expense discipline .

Segment Mix Shift:

Service provider revenue was "weighted towards cloud providers, further indication of our success in strategically aligning our offerings with AI infrastructure build-out" . Non-cloud service provider revenue was flat year-over-year, reflecting an ongoing mix shift as customers prioritize security and next-generation networking over legacy infrastructure .

Geographic Mix:

Americas continued to strengthen, "reflecting the benefits of A10's investments in our enterprise segment and strength of AI infrastructure build-out" . CFO Michelle Caron noted that "macro-related headwinds, such as persistent inflation and threat of tariffs in rest of the world, were more than offset by strength in Americas" . For the full year, Americas revenue increased 30% while EMEA increased 12%, offsetting a decline in APJ .

Quarterly Revenue and Profitability Trends

A10 has delivered consistent margin expansion over the past two years, with non-GAAP operating margin improving from 18.5% in Q1 2024 to 26.6% in Q4 2025—an 810 basis point improvement .

Balance Sheet and Capital Allocation

A10 ended Q4 2025 with a strengthened balance sheet following the March 2025 convertible notes offering:

Convertible Notes: In March 2025, A10 issued $225M of convertible senior notes maturing April 2030 with a 2.75% coupon . Management indicated potential uses include general corporate purposes, organic growth investments, and potential M&A .

Capital Returns to Shareholders:

A10 returned a total of $86.3M to investors in FY 2025 :

The Board declared a quarterly dividend of $0.06 per share, payable March 2, 2026 to stockholders of record on February 16, 2026 . The company has $53.4M remaining on its $75M share repurchase authorization .

Cash Generation: A10 generated nearly $85M in cash flow from operations in FY 2025, enabling continued investment in the business while returning capital to shareholders .

Q&A Highlights

The earnings call Q&A provided additional color on key investor concerns:

Service Provider Growth Sustainability: Management noted that while the majority of SP growth came from cloud-oriented companies building AI and cloud infrastructure, traditional telcos also showed improvement in Q3/Q4. The telco investment was twofold: improving security posture for networks and enterprise services, and adding capacity to manage more data, users, and traffic .

Why Specific Guidance Now? When asked why A10 is providing specific revenue guidance for the first time in 2-3 years, CEO Trivedi explained: "As we see the last few quarters... we have continued to make the base of our revenue more durable. And as we are getting more of that from enterprise or large enterprise, as well as SP, as well as AI spending, I think in aggregate, we think we can sustain kind of the momentum" .

APJ Weakness Details: The majority of APJ underperformance was Japan-specific, driven by low GDP growth, persistent inflation, and tariff concerns. Outside of Japan, performance was "close to company average" .

CapEx Increase Explanation: The Q4 CapEx uptick had two drivers: (1) back-end infrastructure investments for the ThreatX acquisition including hosting services, data centers, and SOC capabilities, and (2) early-stage AI infrastructure for customer demos and POCs including "new kinds of processors and chips and GPUs" .

Competitive Wins: In most competitive situations, A10 is displacing incumbents. The exception is security solutions where customers may be implementing new protocols rather than replacing existing vendors .

Agentic AI Discussion: When asked about agentic AI opportunities, management indicated it's early but engagement is focused on helping customers use AI for business goals—particularly predictive analytics and network insights for service providers over the next 2-3 years. They're also working on security posture for new traffic types and low-latency distributed network architectures .

AI-Driven Traffic & Security: On whether AI is driving higher DDoS attack volumes, management said it's "a little early to quantify" but noted that AI facilitates more sophisticated attacks and generates new traffic patterns that didn't exist before: "when people constantly feed prompts and get feedback, as opposed to not having that traffic before" .

Key Takeaways and Investment Considerations

Positives:

- Record performance: Both quarterly and annual revenue hit all-time highs

- Margin expansion: Adjusted EBITDA margin reached 31% in Q4, up from 28.5% in FY 2024

- Beat streak: Nine consecutive quarters of beating consensus estimates

- Strategic flexibility: $377.9M in liquidity for growth investments and M&A

- Security momentum: Security-led revenue exceeded the 65% long-term target

- Strong 2026 outlook: 10-12% revenue growth and 12-14% EPS growth guided

Considerations:

- Geographic concentration: Americas now represents 64% of revenue, up from 56% a year ago —while a strength, it increases regional dependency

- APJ weakness: Asia-Pacific Japan revenue share declined from 27% to 22% YoY, driven primarily by Japan-specific macro headwinds

- New debt: The $225M convertible notes add leverage to a previously debt-free balance sheet

- Supply chain monitoring: CFO Caron noted the company is "closely monitoring the broader supply environment, including the memory segment" but doesn't expect customer delivery impacts due to proactive supply planning measures

Forward Catalysts

- Q1 2026 Investor Event: Management announced plans to host an investor event during Q1 2026 to provide strategic context on growth drivers and market positioning

- AI Infrastructure Demand: Company positioned to benefit from data center buildouts supporting AI workloads

- M&A Optionality: With $377.9M in liquidity and the convertible notes proceeds, A10 has significant capacity for acquisitions

- Continued Share Repurchases: $53.4M remaining on the $75M authorization provides ongoing buyback capacity

Customer and Market Position

A10 Networks serves critical infrastructure for major enterprises and service providers:

- 9 of Top 10 Telecom Operators

- 8 of Top 10 Cloud Providers

- 21 of Top 50 Fortune Global 500

- 15 of Top 25 Video Gaming Companies

- 5 of Top 10 Media Companies

Management highlighted that investments in next-generation networking and security are yielding positive results, with the company positioned to benefit from AI workload deployment and cybersecurity demand .