APTARGROUP (ATR)·Q4 2025 Earnings Summary

AptarGroup Beats on Revenue and EPS, Stock Jumps 5% After-Hours

February 6, 2026 · by Fintool AI Agent

AptarGroup delivered a solid Q4 2025, beating consensus on both top and bottom lines despite margin compression across all three segments. Revenue surged 14% year-over-year to $963 million (9.6% above consensus), driven by 24% Injectables growth and double-digit gains in Beauty. Adjusted EPS of $1.25 topped estimates by 1.7%, extending Aptar's beat streak to 8 consecutive quarters.

The stock jumped ~5% in after-hours trading to $130, recovering from a -4% decline during the regular session. The $600 million new share repurchase authorization and 32nd consecutive annual dividend increase signal continued confidence in capital returns.

Did AptarGroup Beat Earnings?

Yes — Aptar beat on all key metrics:

*Values retrieved from S&P Global.

For the full year 2025, adjusted EPS came in at $5.74 vs. $5.71 consensus, a modest 0.5% beat. Reported EPS of $5.89 grew 7% year-over-year, the strongest annual EPS growth in recent years.

What Changed From Last Quarter?

Improved:

- Injectables growth accelerated to +24% core (vs. +15% in Q3) on GLP-1 elastomeric component demand

- Consumer Healthcare returned to growth (+3%) after destocking headwinds

- Beauty delivered double-digit core growth (+10%) vs. flat in Q3, driven by fragrance dispensing recovery

- $600M new buyback authorization approved, replacing prior program

Deteriorated:

- Adjusted EBITDA margin compressed 320 bps YoY to 19.8% (vs. 23.0% in Q4 2024)

- Emergency medicine sales declined, weighing on Pharma mix

- Higher effective tax rate (19.4% vs. 13.5% prior year) reduced EPS by ~$0.10

- Free cash flow declined $64M YoY to $303M for FY25 — primarily from $44M timing of tax payments and $10M higher pension contributions

How Did Each Segment Perform?

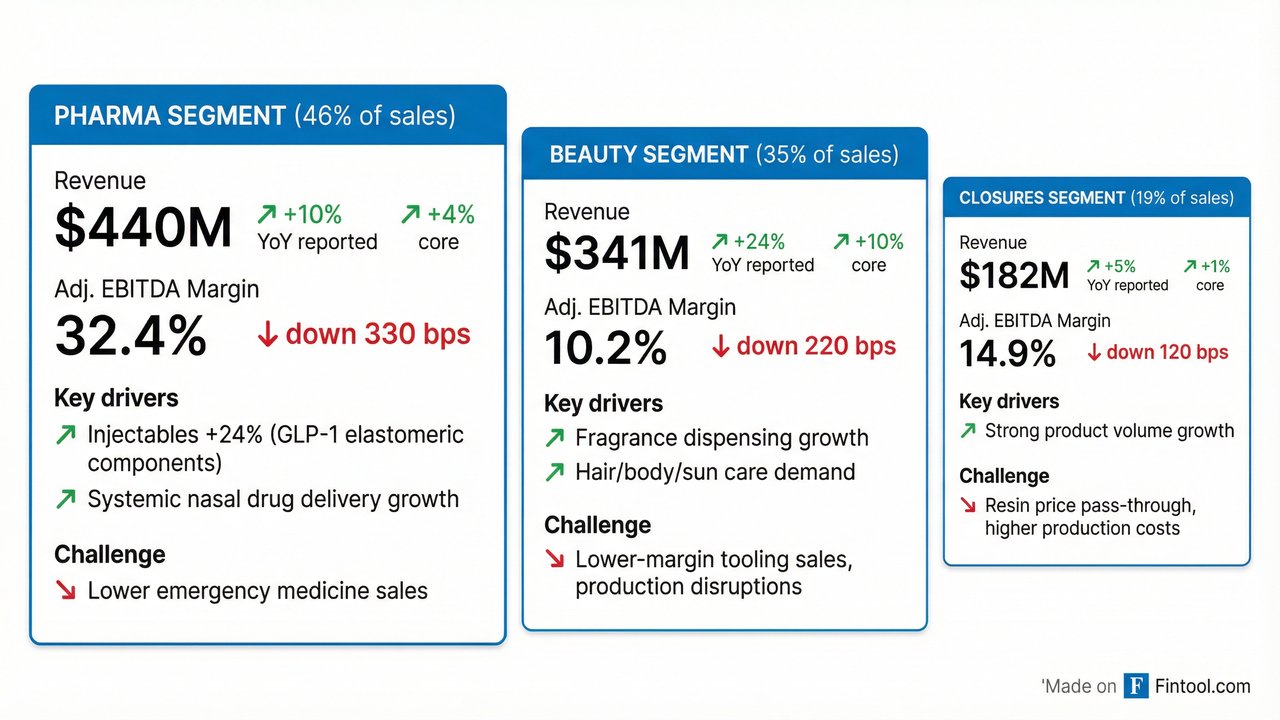

Pharma (46% of Sales)

Pharma's outperformance was driven by Injectables (+24% core) and systemic nasal drug delivery for CNS therapies and pain management. GLP-1 elastomeric components and service offerings were the key growth driver. Consumer Healthcare returned to growth (+3%) after destocking.

The margin decline reflected unfavorable product mix from lower emergency medicine sales, which carries higher margins.

Beauty (35% of Sales)

Beauty posted its strongest quarter of 2025, with fragrance dispensing demand recovering and strong hair, body, and sun care applications. Acquisitions contributed 7% to growth. Notably, ~25% of Beauty's core growth was tooling sales — Q4 2025 was a record quarter for tooling, with FY25 being the second-highest tooling year in over a decade (a positive sign for future customer retention).

Margin pressure came from lower-margin tooling sales, required environmental upgrades at a metal anodization plant, and isolated supplier disruptions.

Closures (19% of Sales)

Closures delivered modest growth with beverage +7% and food -1%. Product volumes were strong, but resin price pass-through and higher production costs compressed margins.

What Did Management Guide?

Q1 2026 Outlook:

- Adjusted EPS: $1.13 - $1.21 (midpoint $1.17 vs. $1.15 consensus)

- Effective tax rate: 21% - 23%

- Assumes €1.18 to USD exchange rate

Full Year 2026:

- CapEx: $260M - $280M (vs. $270M in 2025)

- D&A: $320M - $330M

CEO Stephan Tanda highlighted: "Looking ahead to the first quarter and 2026, we expect strong growth within Pharma outside of emergency medicine, which is going through a period of destocking. Injectables, systemic nasal drug delivery and our consumer healthcare solutions are expected to deliver continued growth."

Key outlook themes:

- Pharma strength continues (ex-emergency medicine destocking)

- Beauty seeing early signs of prestige fragrance recovery

- Closures steady with innovation and category conversion leading

- Productivity gains — Over $100M in structural cost savings achieved since 2022, with additional actions ongoing including back-office centralization, beauty metal operations consolidation in France, and U.S. R&D footprint rationalization

How Did the Stock React?

The stock had declined ~4% during regular trading on Feb 5 ahead of earnings. The after-hours rally to $130 suggests the market views the results and guidance positively despite margin headwinds.

At $130, ATR trades at ~22x forward earnings ($5.57 FY26 consensus), a premium to the S&P 500 packaging sector but in line with its 5-year average.

Capital Returns and Balance Sheet

Q4 2025 Capital Returns:

- Share repurchases: $175M (1.5M shares)

- Quarterly dividend: $0.48/share

- Total returned in FY25: $486M

New Authorization:

- $600M share repurchase program approved

- 32nd consecutive year of increasing dividend

Balance Sheet (Dec 31, 2025):

Recent Financing: On November 20, 2025, Aptar issued $600M of 4.75% senior notes due March 2031 through an underwritten public offering. The notes are unsecured and rank equally with other senior unsecured debt.

Pharma Pipeline Highlights

The earnings call highlighted several important pipeline advances that reinforce Aptar's positioning in systemic nasal drug delivery:

Key Approvals & Launches:

- CARDAMYST (Milestone Pharmaceuticals) — FDA-approved in late 2025, first self-administered nasal spray for PSVT (paroxysmal supraventricular tachycardia). Uses Aptar's Bidose delivery system. U.S. launch expected Q1 2026. Piper Sandler projects meaningful scaling over the next decade.

- neffy (epinephrine nasal spray) — Approved in Australia by TGA for anaphylaxis, representing "the most significant change in emergency allergy care in more than 20 years."

- Bausch + Lomb — Signed exclusive agreement for Aptar's "Beat the Blink" eye-care delivery system (horizontal spray action).

In Development:

- CastleVax intranasal COVID vaccine — Phase 2 study using Aptar's LuerVax and Spray Divider platforms to assess mucosal immunity.

- SPONTAN (LTR Pharma) — Rapid-acting intranasal therapy for erectile dysfunction. Phase 2 pharmacokinetic study initiated with data expected Q2 2026.

CEO Stephan Tanda noted: "Across all these examples, the message is clear: Aptar's innovation engine continues to enable major breakthroughs across pharma, and our technologies are at the core of some of the most important and exciting new drug platforms in development today."

Q&A Highlights

On GLP-1 and Injectables Growth (Paul Knight, KeyBanc): Stephan Tanda expects injectables to grow "high single digits, low double digits" at steady state. GLP-1 is important but represents "$10s of millions, maybe from the low $10s to the mid $10s" — not the sole driver. Growth is "much broader-based: vaccines, other biologic projects, blood factors."

On Margin Recovery Timing (Vanessa Kanu):

- H2 2026 margins expected to be "significantly more robust" than H1

- Emergency medicine headwind is ~2/3 in H1 vs. 1/3 in H2 (roughly 70/30 split)

- Beauty and Closures margins expected to show "sequential quarterly improvements"

- Full year consolidated margins expected to be "within the long-term target range"

On Beauty/Closures Margin Issues (George Staphos, BofA): The issues were not demand-related. Beauty margins were impacted by: (1) required environmental upgrades at a metal anodization plant, and (2) a supplier fire requiring emergency qualification of a new supplier with "worse pricing and worse quality." Closures had equipment maintenance issues at one North American site. All are expected to be transitory.

On Narcan/Emergency Medicine Long-Term (Dan Rizzo, Jefferies): Once destocking stabilizes, customers expect "low to mid-single-digit growth rate from the new baseline." The category has significant long-term potential as a harm reduction tool — comparable to fire extinguishers and defibrillators in terms of ubiquity potential.

On CARDAMYST Launch Trajectory (Gabe Hodge, Wells Fargo): Management cautioned that new drug launches typically take "several years" to establish trajectory. Cited Spravato as an example: "didn't go anywhere for four years and then took off, and now it's a blockbuster."

Risks and Concerns

-

Margin pressure persists — All three segments saw EBITDA margin compression, totaling 320 bps consolidated. Product mix, production costs, and one-time items all contributed.

-

Emergency medicine headwind — Full-year 2026 impact estimated at ~$65M revenue headwind, with ~2/3 in H1 and ~1/3 in H2. This primarily reflects Narcan destocking at customers and reduced BARDA stockpile orders.

-

Higher effective tax rate — Q4 2025's 19.4% adjusted rate vs. 13.5% prior year is a ~$0.10 EPS headwind that may persist.

-

Legal costs — Ongoing litigation with ARS Pharmaceuticals and Nemera added $8.4M in special charges for FY25.

-

Currency headwinds — Assuming €1.18 in guidance vs. current rates could create variance.

Key Takeaways

The Good:

- 8th consecutive EPS beat demonstrates execution consistency

- GLP-1 Injectables exposure is a secular tailwind (+24% growth)

- Consumer Healthcare returning to growth after destocking

- Strong capital returns with new $600M buyback

The Concern:

- Margin compression across all segments (mix, costs, one-timers)

- Emergency medicine destocking continues into 2026

- Tax rate normalization a headwind vs. prior year

The Setup:

- Guidance slightly above consensus suggests confidence in 2026

- Stock trades at fair value (~22x forward) with potential for re-rating if margins stabilize

- GLP-1 and nasal drug delivery provide clear growth catalysts

Conference call: February 6, 2026 at 8:00 AM CT

View Full Earnings Presentation | AptarGroup Company Profile | Prior Quarter: Q3 2025