AXIS CAPITAL HOLDINGS (AXS)·Q4 2025 Earnings Summary

AXIS Capital Posts 18% Book Value Growth, Returns $1B to Shareholders in Record Year

January 28, 2026 · by Fintool AI Agent

AXIS Capital delivered another strong quarter, beating operating EPS estimates by 13% while achieving its best combined ratio performance in years. The Bermuda-based specialty insurer and reinsurer capped 2025 with record gross premiums written of $9.6 billion and returned $1 billion to shareholders through buybacks and dividends.

Did AXIS Capital Beat Earnings?

Operating EPS: Beat by 13.4% — AXIS reported operating EPS of $3.25 vs. consensus of $2.87. GAAP diluted EPS was $3.67, up 8.6% from $3.38 in Q4 2024.

Net Premiums Written: Mixed — $1.38 billion came in slightly below Street expectations of ~$1.44 billion, though it represents 12.9% growth year-over-year.

The key story here is profitability, not top-line growth. The combined ratio of 90.4% shows exceptional underwriting discipline, with favorable prior year reserve development of $30 million contributing 2.0 percentage points.

What Drove the Strong Quarter?

Catastrophe Losses Came in Light

Pre-tax catastrophe and weather-related losses were just $30 million (2.0% of net premiums), down sharply from $81 million (5.9%) in Q4 2024. The quarter included $17 million from Hurricane Melissa.

For the full year, catastrophe losses were $159 million (2.8%), well below the prior year's $226 million (4.3%).

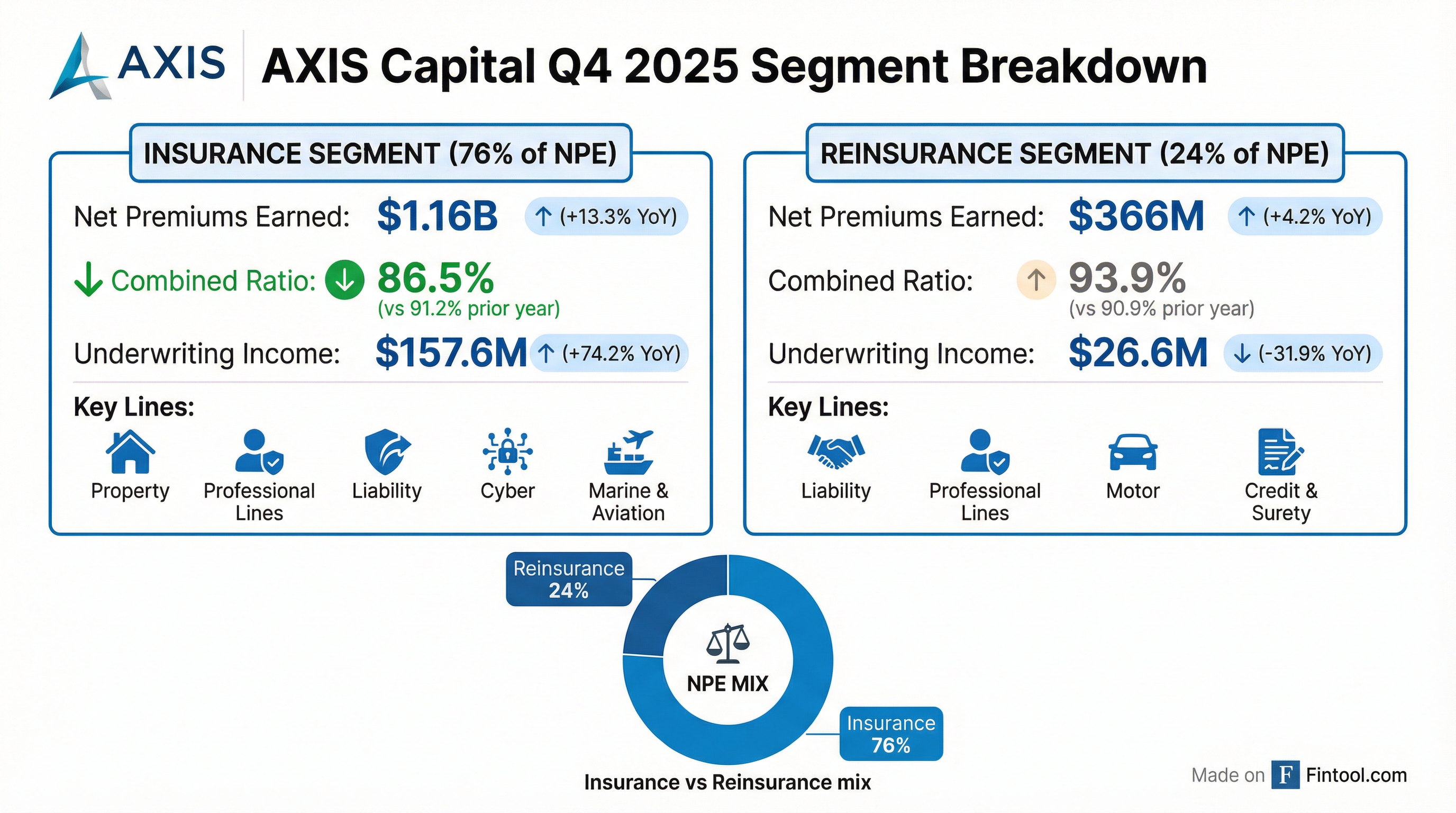

Insurance Segment Excelled

The Insurance segment was the star performer with a combined ratio of 86.5%:

Growth came across most lines, with Professional Lines (+$64M), Property (+$61M), and Liability (+$20M) leading the way.

Reinsurance Segment Steady

The Reinsurance segment delivered a 93.9% combined ratio, up from 90.9% in Q4 2024 due to higher loss ratios in liability and professional lines:

How Did the Stock React?

AXS shares rose +1.2% on the earnings release, trading at $103.78. The stock is up 59% over the past two years, significantly outperforming the broader insurance sector.

The muted reaction despite the EPS beat suggests the market was already positioned for strong results given the favorable catastrophe environment in Q4.

Full Year 2025: A Record Year

GAAP net income declined 7% year-over-year due to foreign exchange losses of $142 million (vs. gains of $51 million in 2024), but underlying operating performance improved significantly.

Capital Return Story

AXIS returned $1.0 billion to common shareholders in 2025:

- $888 million in share repurchases

- $139 million in dividends ($1.76 per share)

This represents approximately 17% of beginning-of-year common equity, an aggressive return pace that reduced diluted shares outstanding by 6.9% year-over-year.

Book value per diluted share grew 18.3% to $77.20, reflecting both strong operating performance and the impact of share buybacks.

What Did Management Say?

CEO Vince Tizzio highlighted the company's execution and five key messages for investors:

"AXIS is built for all seasons. As a specialist, we have an operating model that enables us to leverage our size and speed to pivot as needed across our business lines and geographies, serving as a competitive differentiator in today's changing risk landscape."

On profitable growth drivers:

"We would point directly to our new and expanded business classes, as well as the growing contributions from our dedicated lower middle market units and our recently introduced AXIS Capacity Solutions as proof points."

On disciplined cycle management:

"Our growth will not come at the expense of bottom line, and we remain steadfast in putting profits above premiums. In recent years, we have instilled a culture of strong cycle management, as evidenced by the repositioning of several of our businesses."

CFO Transition: This was CFO Pete Vogt's final earnings call before handing over to incoming CFO Matt Kirk, who has been with AXIS for three months in a transition role.

Investment Portfolio Update

Net investment income was $187 million in Q4 2025, down 5% from $196 million in Q4 2024 due to lower cash positions following the Enstar loss portfolio transfer transaction completed in Q2 2025.

The portfolio maintains an average credit quality of A+ with duration of 3.1 years.

Key Risks to Monitor

Loss Reserve Adequacy — While AXIS reported $87 million of favorable prior year reserve development in 2025, the company holds $18.1 billion in gross loss reserves. Any adverse development could pressure earnings.

Catastrophe Exposure — Despite the favorable Q4, AXIS remains exposed to natural catastrophes, particularly through its property insurance and reinsurance lines. The company noted ongoing losses from the Middle East Conflict ($22 million in 2025).

Bermuda Corporate Tax — A 15% corporate income tax now applies to AXIS's Bermuda pre-tax income effective January 1, 2025, resulting in an effective tax rate of 17.7% for the year.

Reinsurance Segment Margins — The current accident year loss ratio in the Reinsurance segment increased to 68.1% from 66.0%, indicating some margin compression.

What Is AXIS Capital's 2026 Outlook?

Management provided specific guidance on the earnings call:

Insurance Segment:

- Mid- to high single-digit gross premium growth expected

- Could push to double digits with Rak Re contributions

- Premium adequacy remains at long-term targets

Reinsurance Segment:

- Gross premiums could be down up to double digits

- Maintaining cautious stance on casualty and professional lines

- Bottom-line focused: "While the volume may be reduced, we remain confident in the portfolio's expected underwriting profitability"

Expense Ratio:

- G&A ratio target of 11% remains intact for 2026

- 2025 G&A ratio of 12.4% included elevated variable compensation; normalized was ~11.6%

Combined Ratio:

- Expecting around 90% combined ratio for 2026

- Catastrophe losses expected in 4-5% range (vs. 2.8% in 2025)

- Some pressure on ex-cat attritional loss ratio (~1 point) due to rate/trend not fully offset by mix

Q&A Highlights

On Cyber Exposure: CEO Tizzio noted an "escalating risk landscape impacted by increasing ransomware attacks" made worse by AI-enabled threats. Combined with pricing pressure from MGAs, "we will continue to maintain a cautious and selective appetite, and do not see cyber as a growth area for the foreseeable future."

On Reserve Position: Both outgoing CFO Vogt and incoming CFO Kirk expressed confidence in reserves. Reserve releases of $30M in Q4 came from short-tail lines (property, credit surety) — not from long-tail casualty. An independent third-party actuary completed a year-end review providing "additional confidence."

On Lower Middle Market Growth: "The submission volume in this area of our company is just substantial. It's just substantial." — CEO Tizzio on the runway for lower middle market business, which is driving property growth in both U.S. and U.K. through enhanced technology enabling straight-through processing.

On New Business Contribution: About $150 million of Q4 insurance growth came from new and expanded business classes, which management views as premium adequate and creating "new revenue streams in terms of products, forms of distribution, and customer segmentation."

On AXIS Capacity Solutions (ACS): The new third-party capital initiative booked its first premiums in Q4 — approximately $20 million in insurance GWP. Net earned impact will flow through 2026-2029 as the Rak Re deal structure matures.

On Capital Return: "Our number one priority is organic growth," said CFO Vogt. Share buybacks will remain "opportunistic" and could be "lumpy" depending on market conditions. The 2025 elevated payout ratio was boosted by the Enstar LPT transaction providing extra capital.

Looking Ahead

AXIS enters 2026 well-positioned with clear execution priorities:

- Insurance growth in mid-to-high single digits, potentially double digits with Rak Re

- Reinsurance discipline — bottom line over volume, willing to shrink if necessary

- Expense leverage — investments in technology and new teams expected to drive G&A to 11%

- Capital allocation — organic growth prioritized, opportunistic buybacks continue

Related Resources: