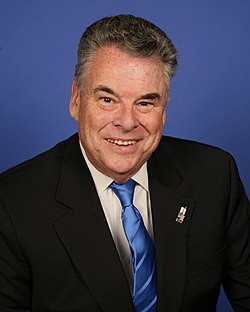

Michael Blitzer

About Michael Blitzer

Michael Blitzer was appointed President and Chief Executive Officer and to the Board on July 10, 2025, bringing two decades of public and private markets experience and SPAC sponsorship leadership . His background includes founding and co-leading Kingstown Capital since 2006, co-founding Inflection Point Asset Management in 2024, and prior roles at J.P. Morgan Securities and Gotham Asset Management; he taught investing at Columbia Business School for five years . Education: MBA, Columbia Business School; BS, Cornell University (Cornell Tradition Fellow) . BACQ is a SPAC; prior to the initial business combination, the company disclosed no cash compensation for executive officers or directors, and governance relies on independent committees for compensation decisions .

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Inflection Point Acquisition Corp. III | Chairman & CEO | Oct 2024–present | Leads SPAC franchise; sponsor-aligned capital deployment |

| IPXX | CEO & Director | Mar 2023–Mar 2025 | Led target search, negotiation, diligence for SPAC |

| IPAX | Co-CEO & Director | Feb 2021–Feb 2023 | Co-led SPAC execution through market cycle |

| Kingstown Capital Management | Founder & Co-CEO | 2006–present | Grew to multi-billion AUM; invested across SPACs, PIPEs, derivatives |

| Gotham Asset Management | Investment professional | Early career | Research investing under Joel Greenblatt’s firm |

| J.P. Morgan Securities | Capital markets | 1999–early 2000s | Advised global issuers in private debt/equity raises |

| Columbia Business School | Adjunct/Instructor | ~5 years in 2010s | Taught investing; talent pipeline and thought leadership |

External Roles

| Organization | Role | Years | Committee/Board Impact |

|---|---|---|---|

| Intuitive Machines, Inc. (Nasdaq: LUNR) | Director; Audit Committee member | Current | Financial oversight and capital markets advisory |

| USA Rare Earth, Inc. (Nasdaq: USAR) | Chair of Board | Current | Strategic direction and governance leadership |

| Signature Group Holdings | Director; Audit Committee | 2011+ (post-bankruptcy) | Turnaround governance and audit oversight |

| TREND AD (European mutual fund) | Board member | Prior | Cross-border fund governance |

| Greens Farms Academy | Trustee; Treasurer; Chair Investment Committee | Current | Endowment stewardship and investment policy |

Fixed Compensation

| Metric | FY 2024 |

|---|---|

| Base Salary ($) | $0 (Company disclosed no cash compensation for executive officers/directors prior to business combination) |

| Target Bonus (%) | Not disclosed |

| Actual Bonus Paid ($) | $0 (no cash compensation disclosed pre-business combination) |

Notes:

- Compensation for executive officers will be determined post-business combination by independent directors or an independent compensation committee .

Performance Compensation

No incentive plan metrics (revenue, EBITDA, TSR, ESG) or payouts for Mr. Blitzer were disclosed. The company stated executive compensation is set post-business combination; no performance-based awards are reported to date .

Equity Ownership & Alignment

| Category | As of Record Date (Sept 15, 2025) |

|---|---|

| Class A Shares Beneficially Owned (#) | 0 |

| Class B Shares Beneficially Owned (#) | 0 |

| Ownership (% of 33,758,333 outstanding) | 0% |

| Shares Pledged as Collateral | Not disclosed |

| Options (exercisable/unexercisable) | Not disclosed |

| Stock Ownership Guidelines | Not disclosed |

Context:

- Sponsor beneficially owns 425,000 Class A shares and 8,333,333 Class B shares; sponsor voting/investment discretion rests with managing members affiliated with Michel Combes and Andrew Gundlach, who disclaim beneficial ownership except to pecuniary interest .

- Mr. Blitzer and Mr. Shannon are affiliates of Inflection Point Fund I LP, a member of the Sponsor .

Employment Terms

| Item | Detail |

|---|---|

| Employment start date | Appointed CEO and Director effective July 10, 2025 |

| Indemnity agreement | Executed standard indemnity agreement upon appointment (July 2025) |

| Letter agreement joinder | Joined Oct 31, 2024 letter agreement in July 2025; waived certain redemption rights and agreed to vote shares in favor of an initial business combination |

| Clawback policy | Board adopted SEC/Nasdaq-compliant Executive Compensation Clawback Policy on Oct 16, 2024 (mandatory recovery on restatement; 3-year lookback; no indemnification) |

| Insider trading policy | Adopted Oct 16, 2024; designed to ensure compliance with laws and Nasdaq standards |

| Corporate opportunity waiver | Articles renounce certain corporate opportunities for directors/officers/sponsor, except those offered solely in capacity as Company fiduciary |

| Severance; change-of-control | Not disclosed |

Board Governance

- Board service: Director since July 10, 2025; dual role as CEO and director implies non-independence; independent committees are maintained per Nasdaq rules .

- Audit Committee: Kathy Savitt appointed Chair on April 10, 2025; membership updated July 10, 2025 to include Joseph Samuels and Antoine Theysset .

- Compensation Committee: Members Joseph Samuels and Antoine Theysset; Theysset serves as Chair; committee comprised of independent directors with authority to retain independent advisors .

- Committee charters and independence: Articles and governance disclosures require independent composition and quarterly Audit Committee meetings; Audit Committee monitors IPO terms and related-party conflicts .

Director Compensation

| Component | FY 2024 |

|---|---|

| Annual Cash Retainer ($) | $0 (no cash compensation disclosed pre-business combination) |

| Committee Membership Fees ($) | Not disclosed |

| Committee Chair Fees ($) | Not disclosed |

| Equity Grants (RSU/DSU) | Not disclosed |

Related Party & Sponsor Economics

- Pre-BC payments permissible: advisory/success/finder fees to Sponsor or affiliates; reimbursement of out-of-pocket expenses; up to $750,000 working capital loans from Inflection Point and up to $2,500,000 transaction cost loans from Sponsor/affiliates convertible into private placement units at $10 per unit at lender’s option .

- Affiliations: Mr. Blitzer and Mr. Shannon are affiliates of Inflection Point Fund I LP, a member of the Sponsor .

- July 2025 consulting engagement: MJP Advisory Group retained for diligence/valuation with $60,000 retainer upon signing definitive agreement and $16,000 monthly fee; indicative of increased deal preparation activity (not identified as related party) .

Risk Indicators & Red Flags

- Corporate opportunity renouncement: Articles broadly waive corporate opportunity duties for management and sponsor, increasing potential for perceived conflicts unless expressly offered in fiduciary capacity .

- Dual-role governance: CEO + director; not independent; mitigants include independent Compensation and Audit Committees with adopted charters and Nasdaq-compliant clawback policy .

- Sponsor-linked economics: Convertible loans and potential advisory/success fees to sponsor/affiliates can affect alignment depending on fee disclosure at merger proxy stage .

- Audit Committee oversight: Explicit mandate to review related-party transactions and conflicts .

Compensation Structure Analysis

- Pre-BC pay mix: 100% at-risk/contingent (no cash salary/bonus); compensation to be determined post-merger by independent directors or Compensation Committee .

- Alignment levers: Joinder agreement waiving redemption rights and voting in favor of the business combination signals sponsor/management alignment toward closing a deal .

- Clawback: Strong recoupment framework aligned with SEC/Nasdaq rules; recovery regardless of misconduct; no indemnification for clawback .

Performance & Track Record

- SPAC execution: Leadership roles across multiple SPACs (IPAX, IPXX, IPAC III) and investment experience in disruptive growth industries; board/audit experience at Intuitive Machines and prior turnaround governance at Signature Group Holdings .

- BACQ operating metrics (TSR, revenue, EBITDA growth) during his tenure are not applicable/disclosed given SPAC structure; merger process with Merlin Labs announced Aug 13, 2025 with planned domestication and name change on closing .

Investment Implications

- Near-term trading signals: No disclosed salary/bonus and absence of equity grants suggests limited insider selling pressure ahead of merger; watch for sponsor/affiliate fee and equity award disclosures in the merger proxy/S-4 to reassess alignment .

- Governance posture: Independent committees, clawback, and insider trading policies are positives; corporate opportunity waiver and sponsor-linked economics warrant enhanced scrutiny of related-party terms in deal documentation .

- Execution risk: Track record across SPACs and capital markets background supports deal-making capability; audit committee experience adds governance depth; alignment through joinder agreement supports transaction completion incentives .