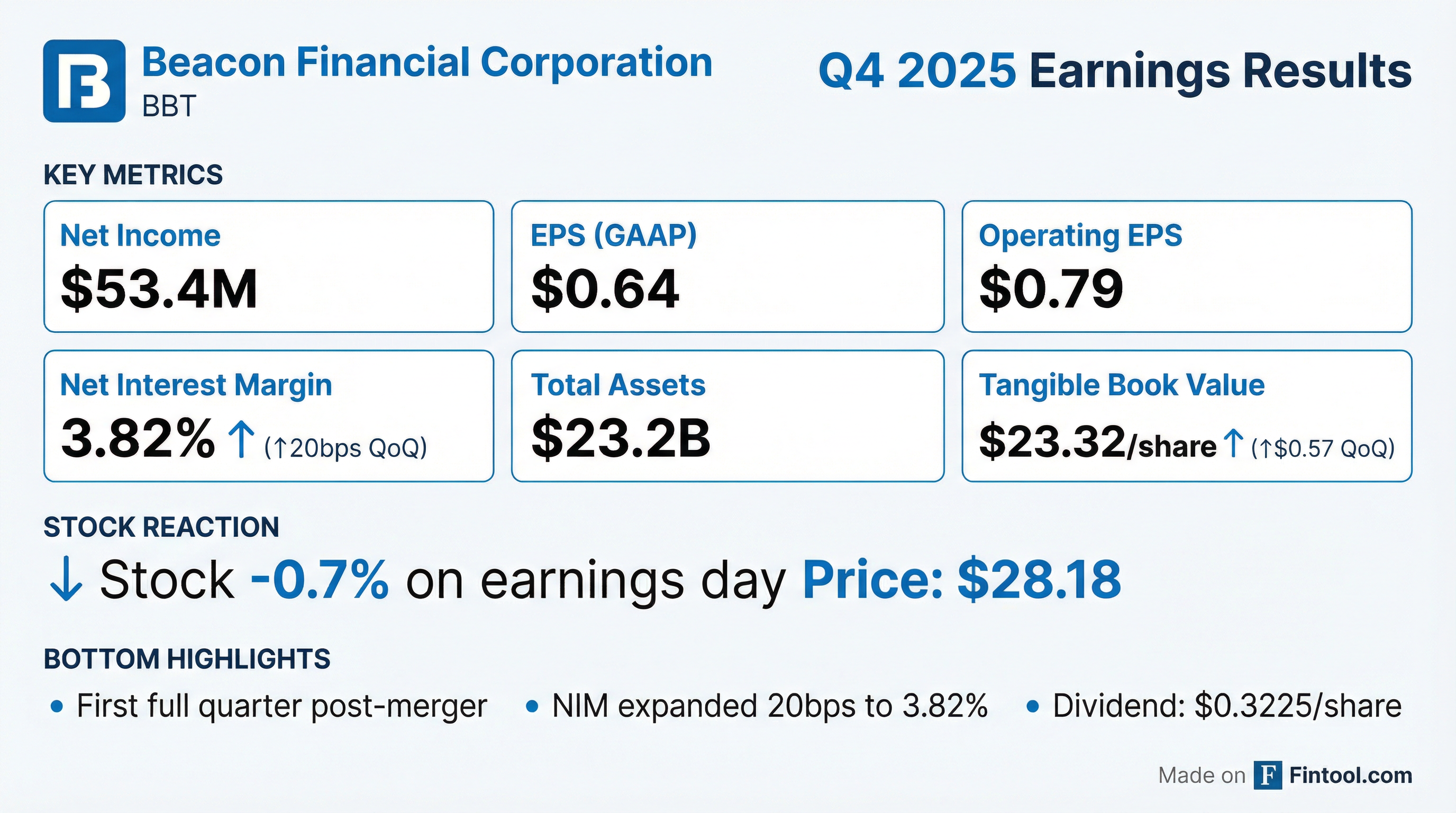

Beacon Financial (BBT)·Q4 2025 Earnings Summary

Beacon Financial Posts First Full Post-Merger Quarter: NIM Expands to 3.82%, Operating EPS Hits $0.79

January 28, 2026 · by Fintool AI Agent

Beacon Financial Corporation (NYSE: BBT) reported its first full quarter of results following the September 2025 merger of equals between Berkshire Hills Bancorp and Brookline Bancorp. The company delivered net income of $53.4 million ($0.64 EPS) on a GAAP basis and operating earnings of $66.4 million ($0.79 EPS) excluding $14.4 million in merger-related charges . The stock closed down 0.7% at $28.18 on the day of the announcement.

Did Beacon Financial Beat Earnings?

Context is critical here. This is the first full quarter post-merger, making traditional beat/miss comparisons challenging. The company was formed on September 1, 2025, with Q3 2025 reflecting only one month of combined operations .

Key takeaway: Operating EPS of $0.79 demonstrates the earnings power of the combined franchise. The Q3 loss was driven by $45.9 million in merger and restructuring expenses; Q4's $14.4 million in merger costs represent the tail end of integration spending .

What Changed From Last Quarter?

The quarter-over-quarter improvement was dramatic, but the comparison requires nuance since Q3 included only one month of combined operations.

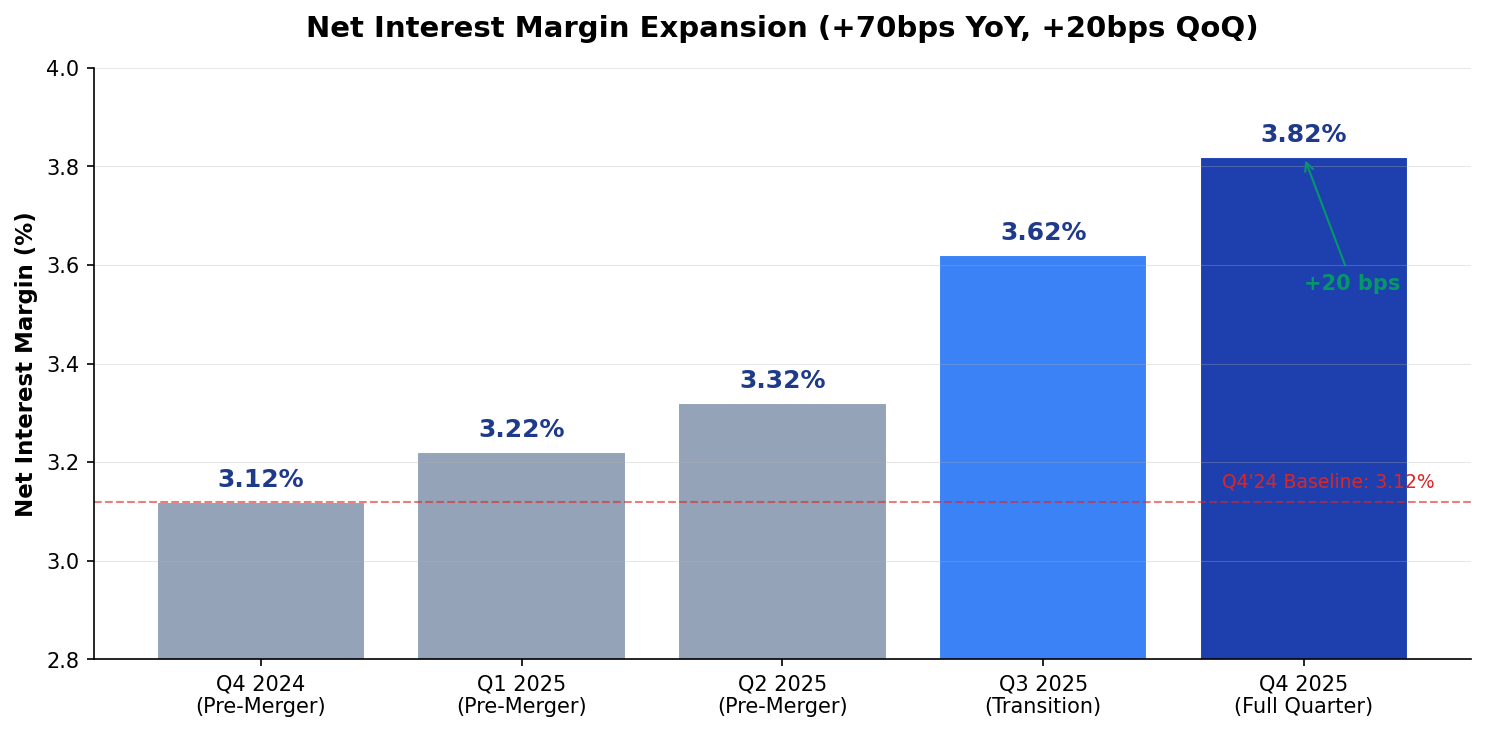

Margin Expansion Driving Results

Net interest margin expanded 20 basis points sequentially to 3.82%, and is now 70 basis points higher than Q4 2024's 3.12% . Management attributes this to:

- Yield improvement on earning assets: Interest-earning asset yield held steady at 6.01% while funding costs declined

- Deposit mix optimization: Brokered deposits declined $496 million while customer deposits grew $261 million

- Reduced borrowing costs: Total borrowed funds fell to $788 million from $1.08 billion in Q3

Efficiency Ratio Improving

The efficiency ratio improved to 63.09% from 91.57% in Q3 . The Q3 figure was distorted by merger costs; on an operating basis, the company is targeting a run rate of $119.8 million quarterly in operating expenses by Q2 2026 .

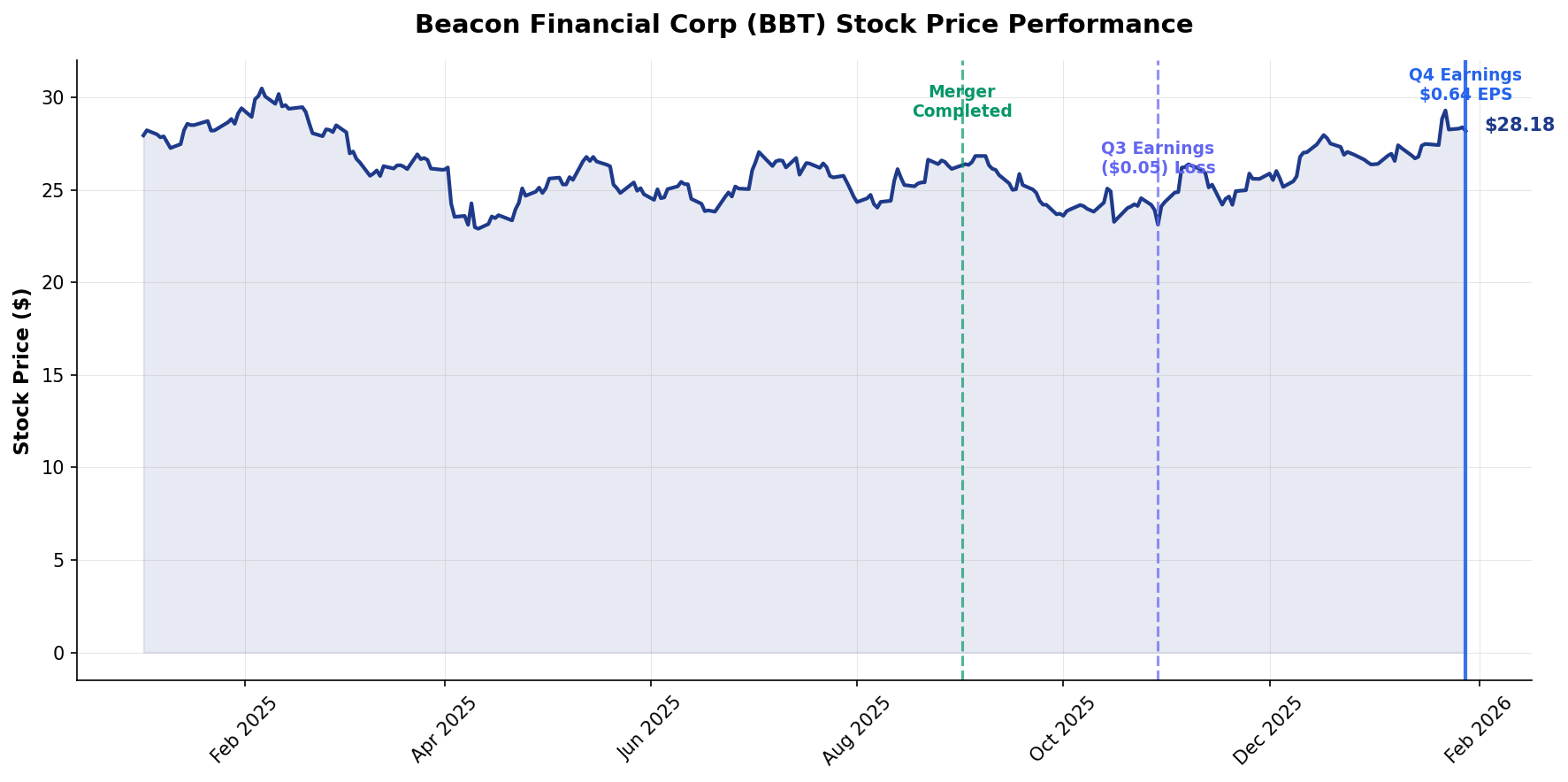

How Did the Stock React?

BBT shares dipped 0.7% on the earnings announcement, closing at $28.18 . The muted reaction suggests the results were largely in line with investor expectations for the newly combined company.

Post-merger performance context:

- Stock has traded between $22.27 and $30.50 over the past year

- Current price represents a 4.55% dividend yield on the $1.29 annualized dividend

- Trading at a modest discount to tangible book value of $23.32 per share

What Did Management Guide?

CEO Paul Perrault struck an optimistic tone, noting the company is "beginning to build momentum" with the combined organization and ongoing synergies .

Forward Guidance Highlights

Synergy Realization

Management confirmed they are on track to meet original operating expense targets by Q2 2026. The core system conversion is scheduled for February 2026, which delayed some synergy recognition .

Merger synergy targets:

- Pre-tax cost savings: $68.9 million (12.6% of combined expense base)

- After-tax savings: $51.7 million

- Pro forma quarterly operating expense run rate: $119.8 million by Q2 2026

Credit Quality: Any Concerns?

Asset quality showed some deterioration but remains manageable:

Key credit developments:

- Nonperforming assets increased $14.8 million to $116.7 million, largely driven by a $9 million Boston office loan with approximately 50% specific reserve

- Net charge-offs declined significantly to $9.0 million from $15.9 million in Q3, primarily driven by resolutions of a Boston office loan, a distressed mall loan, and an equipment financing loan

- Provision expense of $8.1 million was down from $20.3 million in Q3

Office Portfolio Exposure

The company provided detailed disclosure on its office CRE portfolio, which totals ~$1.2 billion or 6.5% of total loans :

- NPLs: ~2.8% of office portfolio

- Weighted average LTV: ~57%

- Weighted average debt service coverage: ~1.5x

- Boston exposure: ~19% of office portfolio (roughly half CBD/CBD-adjacent)

Capital and Dividend

The company's capital position strengthened during the quarter:

Dividend: The Board declared a quarterly dividend of $0.3225 per share, payable February 27, 2026 to stockholders of record February 13, 2026 . This represents a 41% payout ratio based on Q4 operating EPS and a 4.55% annualized yield .

Key Takeaways

-

First full quarter validates merger thesis: Operating EPS of $0.79 demonstrates the combined franchise's earnings power, with NIM expanding to 3.82%

-

Synergies on track but not yet fully realized: Core system conversion in February 2026 will unlock remaining expense synergies; full run-rate expected by Q2 2026

-

Credit quality bears watching: Office CRE remains a focus area, though metrics are manageable with strong reserve coverage at 1.40%

-

Attractive valuation: Trading below tangible book value of $23.32 with a 4.55% dividend yield

-

Management expects continued margin expansion: Guiding to 3.85%-3.95% NIM as rates decline and curve steepens

About Beacon Financial Corporation

Beacon Financial Corporation (NYSE: BBT) is the holding company for Beacon Bank & Trust, a full-service regional bank serving the Northeast created through the September 2025 merger of equals between Berkshire Hills Bancorp and Brookline Bancorp. Headquartered in Boston, the company has $23.2 billion in assets and more than 145 branches throughout New England and New York .

Conference call scheduled for 1:30 PM ET on January 29, 2026. View investor presentation