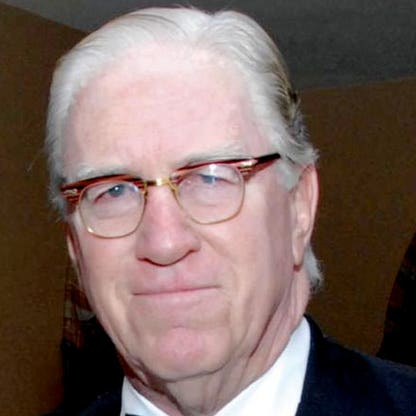

B. Francis Saul II

About B. Francis Saul II

B. Francis Saul II is Chairman and Chief Executive Officer of Saul Centers, Inc. (since June 1993), age 92, with over 45 years leading the broader Saul Organization; prior roles include Chairman/CEO of B.F. Saul Company (since 1969) and Chairman/CEO of B.F. Saul Real Estate Investment Trust and Chevy Chase Bank (1969–2009) . Saul holds significant insider ownership (46.5% beneficially owned as of Feb 28, 2025), aligning him closely with shareholders . Performance context: the company’s Pay vs. Performance disclosure shows TSR value of a $100 investment at $98.23 as of 2024 (down from $112.91 in 2021, up from $63.94 in 2020), and net income of $67.7 million in 2024 .

Company performance snapshot:

| Metric | FY 2023 | FY 2024 | YoY |

|---|---|---|---|

| Revenue ($) | $249,057,000* | $261,178,000* | 4.9%* |

| EBITDA ($) | $162,409,000* | $167,620,000* | 3.2%* |

Values retrieved from S&P Global.*

TSR and Net Income trend (from Pay vs. Performance):

- Value of $100 investment (Saul Centers TSR): 2020 $63.94; 2021 $112.91; 2022 $91.04; 2023 $93.56; 2024 $98.23 .

- Net Income (thousands): 2020 $50,316; 2021 $61,649; 2022 $65,392; 2023 $69,026; 2024 $67,703 .

Past Roles

| Organization | Role | Years | Strategic Impact/Notes |

|---|---|---|---|

| Saul Centers, Inc. | Chairman, CEO; Director | Since Jun 1993 | Long-tenured leadership and deep familiarity with portfolio and operations . |

| Saul Centers, Inc. | President | Oct 2019 – Apr 2021 | Oversight during period of portfolio execution . |

| B.F. Saul Company | Chairman & CEO | Since 1969 | Leads private Saul Organization affiliates related to BFS . |

| B.F. Saul Real Estate Investment Trust | Chairman & CEO (Trustee since 1964) | Since 1969 | Real estate platform leadership . |

| Chevy Chase Bank, F.S.B. | Chairman & CEO | 1969 – 2009 | Financial services leadership experience . |

External Roles

| Organization | Role | Years | Notes |

|---|---|---|---|

| Chevy Chase Trust Company; ASB Capital Management, LLC | Chairman | Current | Governance/finance leadership outside BFS . |

| National Gallery of Art | Trustees Council Member | Current | Civic/cultural governance . |

| National Geographic Society | Trustee Emeritus | Current | Non-profit governance . |

| Johns Hopkins Medicine Board | Trustee Emeritus | Current | Healthcare governance . |

| Brookings Institution | Honorary Trustee | Current | Public policy governance . |

Fixed Compensation

- CEO base salary: $125,000 (unchanged May 1, 2023 to May 1, 2024) .

- Annual bonus: determined subjectively; in Dec 2024 CEO received $25,000 (20% of base) .

- All Other Compensation (CEO): $9,000 SERP contribution in 2024; 2023 included director compensation ($49,083) and $9,000 SERP; 2022 included director compensation ($56,430) and $9,000 SERP .

| Year | Base Salary ($) | Bonus ($) | Bonus % of Salary | All Other Compensation ($) | Notes |

|---|---|---|---|---|---|

| 2024 | 125,000 | 25,000 | 20% | 9,000 | SERP contribution |

| 2023 | 125,000 | 25,000 | N/A | 58,083 | Includes director fees and equity/option awards per footnote |

| 2022 | 125,000 | 25,000 | N/A | 65,430 | Includes director fees and equity/option awards per footnote |

Retirement/Deferred Comp (SERP):

- CEO contributions/credits (2024): Exec contribution $3,000; Company contribution $9,000; 2024 SERP earnings $92,069; Aggregate balance $1,268,854 at 12/31/2024 .

- Company matches up to three times the executive’s contribution; earnings linked monthly to High Yield Index “yield to worst” methodology .

Performance Compensation

Program structure (2024 Stock Incentive Plan):

- Restricted shares for officers split 50% time-vested and 50% performance-based .

- Time-vested: vests annually over five years .

- Performance-based: vests on the fifth anniversary; earned 50%–150% of target based on annual funds from operations (FFO) vs Board target (90% threshold for 50% payout; 110% for 150%) .

CEO 2024 grants and valuation:

| Award Type | Grant Year | Shares Granted | Performance Adjustment Range | Grant Date Fair Value ($) | Not-Yet-Granted Perf. RS (Shares) |

|---|---|---|---|---|---|

| Restricted Stock (50% time / 50% perf.) | 2024 | 28,000 | ± up to 150% based on FFO | 1,133,766 | 12,000 |

Vesting/selling pressure indicators:

- No stock options exercised and no restricted stock vested for any NEOs in 2024 .

Pay versus performance context:

- Company states it does not link “compensation actually paid” (CAP) with TSR, net income, or financial measures; awards determined subjectively and historically included options .

Equity Ownership & Alignment

- Beneficial ownership (as of Feb 28, 2025): 11,632,086 shares (46.5% of class) for Saul II; includes 22,500 currently exercisable options and 724,000 Operating Partnership (OP) units convertible subject to Ownership Limit; includes extensive affiliated/entity holdings; spousal shares disclaimed .

| Holder | Beneficial Ownership (Shares) | % of Class | Components/Notes |

|---|---|---|---|

| B. Francis Saul II | 11,632,086 | 46.5% | Includes 22,500 options currently exercisable; affiliated entity holdings; 724,000 of OP units convertible (subject to cap) . |

Policies and practices:

- Executive stock ownership guidelines: “At present, the Board of Directors does not prescribe any stock ownership guidelines for our executive officers” .

- Hedging/short sales prohibited for all employees, directors, and NEOs .

- Pledging: proxy provides carve-out that a pledge/foreclosure of OP units held by the Saul Organization does not, by itself, trigger a Change in Control, if creditor does not convert units to shares . No explicit disclosure of CEO pledging of BFS common stock identified in the proxy .

Director deferred share plan participation:

- CEO balance of deferred fee share account: 48,843 shares as of March 1, 2025; 3,003 shares credited in 2024/25 period .

Employment Terms

- Contracts/severance/CIC: The Company does not have employment or severance agreements with any executive officers; no predetermined termination or change-of-control compensation plan is in place for NEOs .

- Clawback: incentive-based compensation recoupment policy adopted in 2023 per SEC/NYSE rules; also plan-level misconduct restatement clawback authority under the 2024 Stock Incentive Plan .

- Non-compete/non-solicit: not disclosed in proxy.

Board Governance

Leadership and independence:

- Saul II serves as combined Chairman and CEO; the Board does not have a lead independent director. The Board asserts this structure provides unified leadership; 7 of 12 directors are independent; Audit, Compensation, and Nominating/Governance Committees comprise solely independent directors .

- Board/committee meetings and attendance: Board met five times in 2024; all directors attended at least 75% of meetings; all 12 directors attended the 2024 annual meeting; one executive session and one independent director meeting held in 2024 .

Committee roles:

- Audit Committee: members Caraci, Clancy (Chair), Platts; Clancy and Platts designated “audit committee financial experts”; met seven times in 2024 .

- Compensation Committee: members Caraci and Platts (Chair); met three times in 2024 .

- Nominating & Corporate Governance: members Caraci and Platts (Chair); met once in 2024 .

- Executive Committee: members Caraci and B. Francis Saul II (Chair); did not meet in 2024 .

Family relationships on the Board:

- CEO is father of Vice Chairman Patricia Saul Lotuff and director Andrew M. Saul II, and grandfather of director Willoughby B. Laycock .

Director compensation (non-employee directors):

- Cash retainers: $65,000 board retainer; Audit Committee members $10,000; Audit Chair $15,000; paid quarterly .

- Annual equity: 2,000 restricted shares to continuing non-employee directors after each annual meeting; three-year ratable vesting; full vest on Change in Control .

- 2024 Director Compensation Table (non-employee directors) shows representative totals and grant valuation at $37.44 per share for 2,000-share awards granted May 20, 2024 .

Say-on-Pay and shareholder feedback:

- 2023 advisory vote on executive compensation received approximately 94.8% support; the Board adopted a triennial vote frequency; committee viewed results as endorsement and made no material changes .

Performance Compensation (Detailed Plan Table)

| Metric | Weighting | Target Definition | Payout Scale | Payout Determination | Vesting |

|---|---|---|---|---|---|

| Funds From Operations (FFO) vs Board Target | 50% of RS grant (perf. RS tranche) | Annual FFO target set by Board | 50% payout at 90% of target; linear to 150% at 110% of target; 90% minimum to vest | Subjective compensation decisions overall; CAP not directly linked to TSR or net income | Perf. RS vests at 5th anniversary; time-vested RS vests ratably over 5 years |

Related Party Transactions and Conflicts

- Shared Services with Saul Organization: allocation-based shared personnel and services; 2024 billings $11.4 million; year-end payable $1.2 million; includes $847,600 corporate HQ sublease rent in 2024; arrangements approved annually by independent Audit Committee .

- Insurance Agency: B.F. Saul Insurance, Inc. earned ~$449,300 in commissions/fees tied to company’s insurance program in 2024 .

- Management time: CEO and certain officers also serve in Saul Organization entities; CEO expected to spend less than a majority of management time on Company matters over extended periods .

- Exclusivity/ROFR: right of first refusal structure intended to minimize conflicts between BFS and Saul Organization on shopping centers/commercial properties .

Equity Ownership & Alignment (Supplemental)

| Item | Detail |

|---|---|

| Options (CEO) | 22,500 currently exercisable included in beneficial ownership . |

| OP Units | 724,000 OP units included as convertible (subject to Ownership Limit); pledge/foreclosure of such units does not itself trigger a Change in Control if not converted to shares . |

| Stock Ownership Guidelines (Execs) | None prescribed at present . |

| Hedging/Short Sales | Prohibited for all employees, directors, and NEOs . |

| 2024 Vesting Events | No RS vesting; no option exercises by NEOs . |

Employment Terms (Supplemental)

| Provision | CEO Status |

|---|---|

| Employment Agreement | None; no predetermined severance or CIC plan for NEOs . |

| Clawback | SEC/NYSE-compliant recoupment policy (Oct 2, 2023); additional misconduct restatement clawback under plan . |

| Non-Compete/Non-Solicit | Not disclosed in proxy. |

Company Performance Context (from Pay vs Performance)

| Year | CEO SCT Total ($) | CEO CAP ($) | Avg NEO SCT Total ($) | Avg NEO CAP ($) | TSR (Value of $100) | Peer TSR (FTSE Nareit Equity) | Net Income ($000s) |

|---|---|---|---|---|---|---|---|

| 2024 | 1,384,835 | 1,399,251 | 1,099,961 | 1,131,981 | 98.23 | 123.35 | 67,703 |

| 2023 | 302,294 | 302,294 | 944,714 | 940,496 | 93.56 | 113.46 | 69,026 |

| 2022 | 293,174 | 293,174 | 896,356 | 802,676 | 91.04 | 99.78 | 65,392 |

| 2021 | 248,465 | 248,465 | 680,841 | 929,317 | 112.91 | 131.86 | 61,649 |

| 2020 | 193,906 | 193,906 | 706,527 | 540,224 | 63.94 | 92.05 | 50,316 |

Investment Implications

- Alignment and control: Saul’s 46.5% beneficial ownership provides powerful alignment with long-term equity value but also concentrated control; absence of executive stock ownership guidelines is mitigated by this significant personal stake .

- Pay structure and incentives: CEO cash compensation remains modest ($150k in salary+bonus for 2024), with 2024 adding a material RS grant ($1.13m) split evenly between time-vested and FFO-linked performance RS; lack of hard-wired annual cash metrics and stated non-linkage of CAP to TSR/net income signal a highly discretionary framework, partially offset by FFO-based equity vesting design and a formal clawback policy .

- Vesting/selling pressure: No 2024 vesting or option exercises for NEOs suggests limited mechanical selling pressure in the near term from vest schedules; monitor future 5th-anniversary performance-vesting cliffs from 2024 awards .

- Governance risks: Combined Chair/CEO, no lead independent director, and multiple family members on the Board elevate independence concerns, though a majority of the Board and all key committees are independent with regular executive sessions . Say‑on‑pay support was high (94.8% in 2023), indicating investor tolerance for the structure to date .

- Related-party exposure: Ongoing shared services ($11.4m in 2024), HQ sublease ($847.6k), and intra-organization insurance commissions (~$449k) underscore persistent related-party dynamics; the Board relies on independent Audit Committee approval and ROFR/exclusivity frameworks to mitigate conflicts. Investors should continue to monitor the scale and pricing of these transactions relative to peers .

Notes:

- Financial performance (revenue/EBITDA) values are from S&P Global via GetFinancials and marked with an asterisk. Values retrieved from S&P Global.*