Princeton Bancorp (BPRN)·Q4 2025 Earnings Summary

Princeton Bancorp Posts Solid Year Despite Q4 Miss, Stock Holds Steady

January 29, 2026 · by Fintool AI Agent

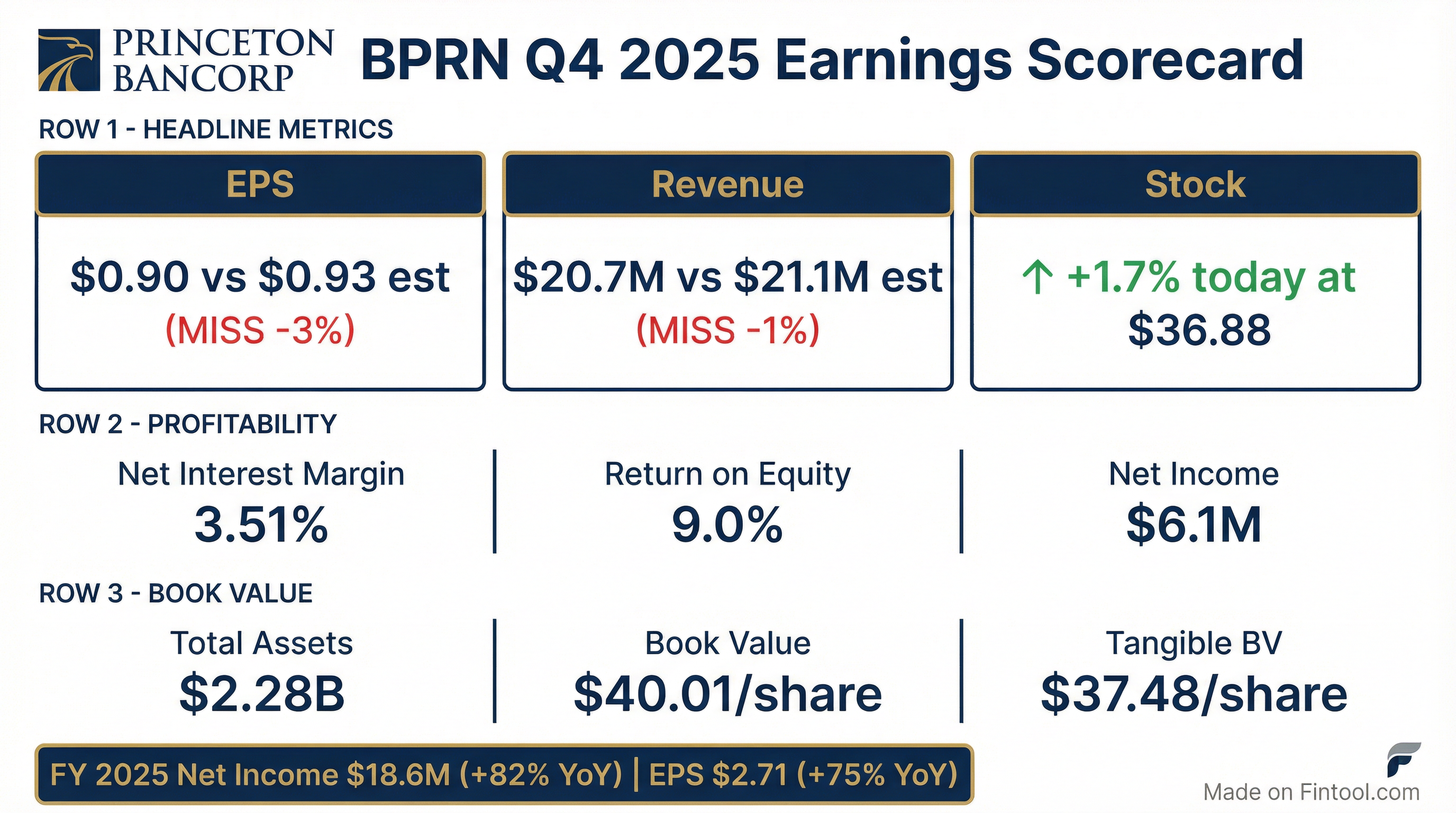

Princeton Bancorp (NASDAQ: BPRN), the holding company for The Bank of Princeton, reported Q4 2025 results that slightly missed analyst expectations but capped off a strong recovery year. Net income of $6.1 million ($0.90 per diluted share) came in 3.2% below the $0.93 consensus, while total revenue of $20.7 million missed the $21.1 million estimate by 1.4%.

Despite the modest miss, shares rose 1.7% to $36.88 on the news, as investors focused on the full-year turnaround: FY 2025 net income surged 82% to $18.6 million, with EPS of $2.71 versus $1.55 in 2024.

Did Princeton Bancorp Beat Earnings?

No — slight miss on both EPS and revenue, but context matters.

*Consensus from S&P Global (2 analysts)

The miss was driven primarily by net interest margin compression, which fell 26 basis points sequentially to 3.51%. However, management noted this was partially offset by an 8.5% reduction in operating expenses quarter-over-quarter and an 11% increase in non-interest income.

What Changed From Last Quarter?

Q4 2025 showed sequential deceleration after a strong Q3, though management highlighted improving fundamentals:

Key drivers of the sequential decline:

- Interest income fell $1.0 million (3.0%) due to lower yields on interest-earning assets (-32 bps)

- Average loans declined $15.6 million and average investments fell $20.9 million

- Provision for credit losses swung to $102K expense vs. $672K reversal in Q3

Bright spots:

- Operating expenses cut by $1.2 million through lower salaries, professional fees, and FDIC insurance

- Other non-interest income rebounded $595K after a Q3 loss on an equity investment

Full Year 2025: The Turnaround Story

The quarterly miss obscures what was actually a remarkable year for Princeton Bancorp:

The 2024 results were significantly impacted by the Cornerstone Financial Corporation acquisition, which brought $7.8 million in merger-related expenses. With that integration behind them, the bank's underlying profitability has normalized.

What Did Management Say?

CEO Edward Dietzler struck a confident tone despite the quarterly miss:

"The Bank achieved another strong quarter, with net income of $6.1 million and diluted EPS of $0.90. These results were supported by an increase in non-interest income of over 11%, as well as a reduction in operating expenses of 8.5%."

Management pointed to both sequential and year-over-year improvements in operational efficiency, suggesting the cost savings achieved in Q4 are sustainable.

Balance Sheet and Capital Position

Princeton Bancorp maintains strong capital ratios well above regulatory minimums:

Capital ratios (Dec 31, 2025):

- Total Capital to Risk-Weighted Assets: 13.98%

- Tier 1 Capital to Risk-Weighted Assets: 12.93%

- Tier 1 Capital to Average Assets: 11.12%

The decline in total assets and deposits reflects runoff in certificates of deposit ($45M) and money market deposits ($26M), partially offset by growth in interest-bearing demand deposits ($33M).

Asset Quality: Credit Issues Behind Them?

Asset quality improved materially during 2025, with non-performing assets falling 39% from year-ago levels:

The improvement came primarily from $10.0 million in charge-offs during 2025, with $9.9 million of that taken in Q2 2025. The allowance for credit losses now covers 123% of non-performing loans, up from 87% a year ago.

How Did the Stock React?

Shares of BPRN rose 1.7% on the day to $36.88, suggesting the market viewed the results as acceptable given the strong full-year performance.

Stock metrics:

- 52-week range: $27.25 - $37.99

- Price/Book: 0.92x (trading below book value)

- Price/Tangible Book: 0.98x

The stock trades at a meaningful discount to book value, which may reflect concerns about the regional banking sector or limited analyst coverage (only 2 analysts). Year-to-date, BPRN has risen approximately 7% from $34.43 at year-end 2024.

Forward Risks and Catalysts

Risks highlighted in the filing:

- Higher tariffs from the Trump administration

- Elevated inflation and potential recession

- Interest rate sensitivity and deposit competition

- Geographic concentration in New Jersey, Philadelphia, and New York metro areas

Potential catalysts:

- Continued margin expansion if rates stabilize

- Further operating expense leverage from Cornerstone integration

- Stock repurchase program execution (treasury stock increased $7.9M in 2025)

- Book value accretion above current stock price

The Bottom Line

Princeton Bancorp's Q4 miss was modest and overshadowed by an impressive full-year recovery. Net income nearly doubled year-over-year as merger costs faded and operational efficiency improved. The stock's muted reaction (+1.7%) suggests investors are looking through the quarterly noise to the underlying fundamentals: improving credit quality, solid capital ratios, and a stock trading below tangible book value.

The key question for 2026 is whether net interest margin can stabilize or re-expand. With the Fed's rate path uncertain, deposit costs will be the swing factor to watch.

Company Profile: Princeton Bancorp, Inc. (NASDAQ: BPRN) is the holding company for The Bank of Princeton, a New Jersey state-chartered commercial bank with 28 branches in New Jersey, five in the Philadelphia area, and two in the New York City metro area. The bank was founded in 2007 and acquired Cornerstone Financial Corporation in 2024.