BARFRESH FOOD GROUP (BRFH)·Q4 2025 Earnings Summary

Barfresh Hits Record Revenue, Guides to 146% Growth in FY 2026

January 29, 2026 · by Fintool AI Agent

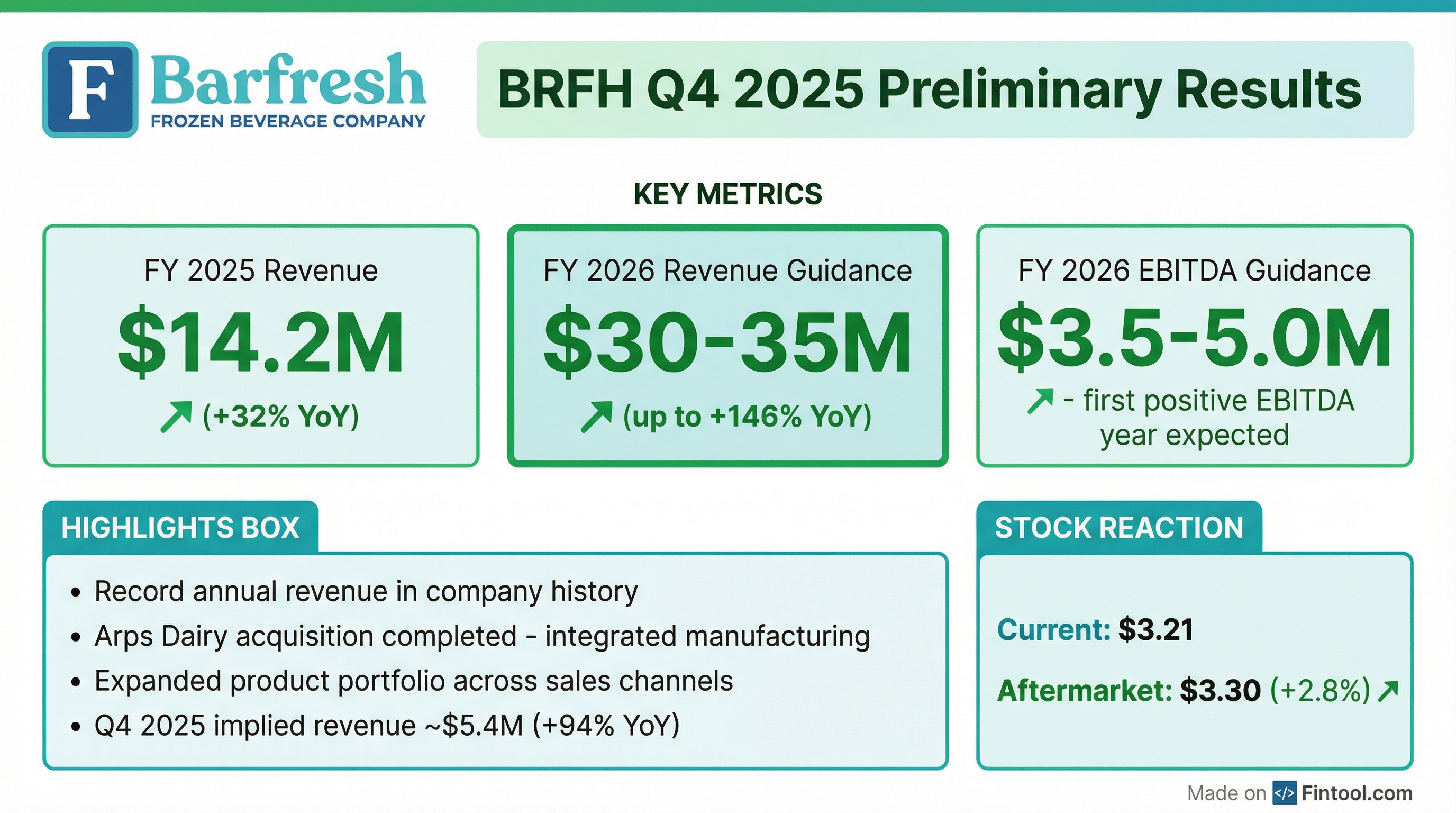

Barfresh Food Group (NASDAQ: BRFH) announced preliminary fiscal year 2025 revenue of $14.2 million, up 32% year-over-year and the highest annual revenue in company history. The company also issued aggressive FY 2026 guidance of $30-35 million in revenue and $3.5-5.0 million in Adjusted EBITDA, signaling a potential inflection to profitability.

Did Barfresh Beat Expectations?

Barfresh delivered preliminary FY 2025 revenue of $14.2M against FY 2024 revenue of $10.7M*, representing 32% YoY growth.

Implied Q4 2025 revenue of approximately $5.4 million (FY 2025 $14.2M minus $8.8M from Q1-Q3) represents a 94% increase versus Q4 2024's $2.8M. This marks the company's strongest quarter on record.

What Did Management Guide for FY 2026?

CEO Riccardo Delle Coste provided aggressive guidance for FY 2026:

This guidance implies Barfresh expects to more than double revenue while achieving its first profitable year at the EBITDA level. The $3.5-5.0M EBITDA guidance represents an implied EBITDA margin of 10-17% at the midpoint of revenue guidance.

What Changed From Last Quarter?

The key transformation is the Arps Dairy acquisition, which fundamentally changed Barfresh's operating model:

Before (Contract Manufacturing):

- Relied on third-party manufacturers

- Limited product flexibility

- Lower margin profile

- Capacity constraints

After (Integrated Manufacturing):

- Owned production facilities

- Enhanced product portfolio control

- Improved margin potential

- Scalable capacity for growth

Management stated: "The operational control and enhanced production capabilities we now possess with the completion of our Arps Dairy acquisition positions us to capitalize on the significant growth opportunities ahead."

How Did the Stock React?

Barfresh shares closed at $3.21 on January 28, down 1.2% on low volume ahead of the announcement. In after-hours trading following the release, shares moved to $3.30, up approximately 2.8% from the close.

The muted reaction may reflect:

- Preliminary (not final) results

- Small-cap illiquidity

- Market waiting for full Q4 details

What Are the Key Growth Drivers?

Barfresh serves three primary channels with frozen, ready-to-blend and ready-to-drink beverages:

- Education Market - K-12 schools requiring compliant beverage options

- Foodservice Industry - Institutional food service operators

- Restaurant Chains - Quick-service and casual dining concepts

The Arps Dairy integration enables:

- Expanded product portfolio across smoothies, shakes, and frappes

- Increased market share via owned manufacturing flexibility

- Improved unit economics through vertical integration

Historical Revenue Performance

Quarterly revenue trend shows accelerating growth momentum:

*Q4 2025 implied from $14.2M preliminary FY 2025 minus Q1-Q3 actuals.

Annual revenue progression shows consistent growth trajectory:

What Are the Risks?

Execution Risk: The FY 2026 guidance implies more than doubling revenue. This requires significant operational scaling that may face challenges.

Customer Concentration: Barfresh's education and foodservice focus creates potential seasonality and customer concentration risk.

Profitability Unproven: Despite guidance, Barfresh has never delivered positive annual EBITDA. The -$2.5M EBITDA in FY 2024* makes the $3.5-5.0M target a significant swing.

Small-Cap Illiquidity: With ~$51M market cap and low daily volume, the stock may be volatile and difficult to exit for institutional investors.

*Values retrieved from S&P Global.

What to Watch Next

- Full Q4 2025 Results — Detailed financials and segment breakdown

- Arps Dairy Integration Update — Manufacturing utilization and margin expansion

- Customer Pipeline — New education and foodservice contracts

- Q1 2026 Revenue — Early validation of $30-35M annual trajectory

Related: BRFH Company Overview | BRFH Transcripts