COLONY BANKCORP (CBAN)·Q4 2025 Earnings Summary

Colony Bankcorp Q4 2025 Earnings: NIM Hits 3.32%, TC Federal Integration Begins

January 28, 2026 · by Fintool AI Agent

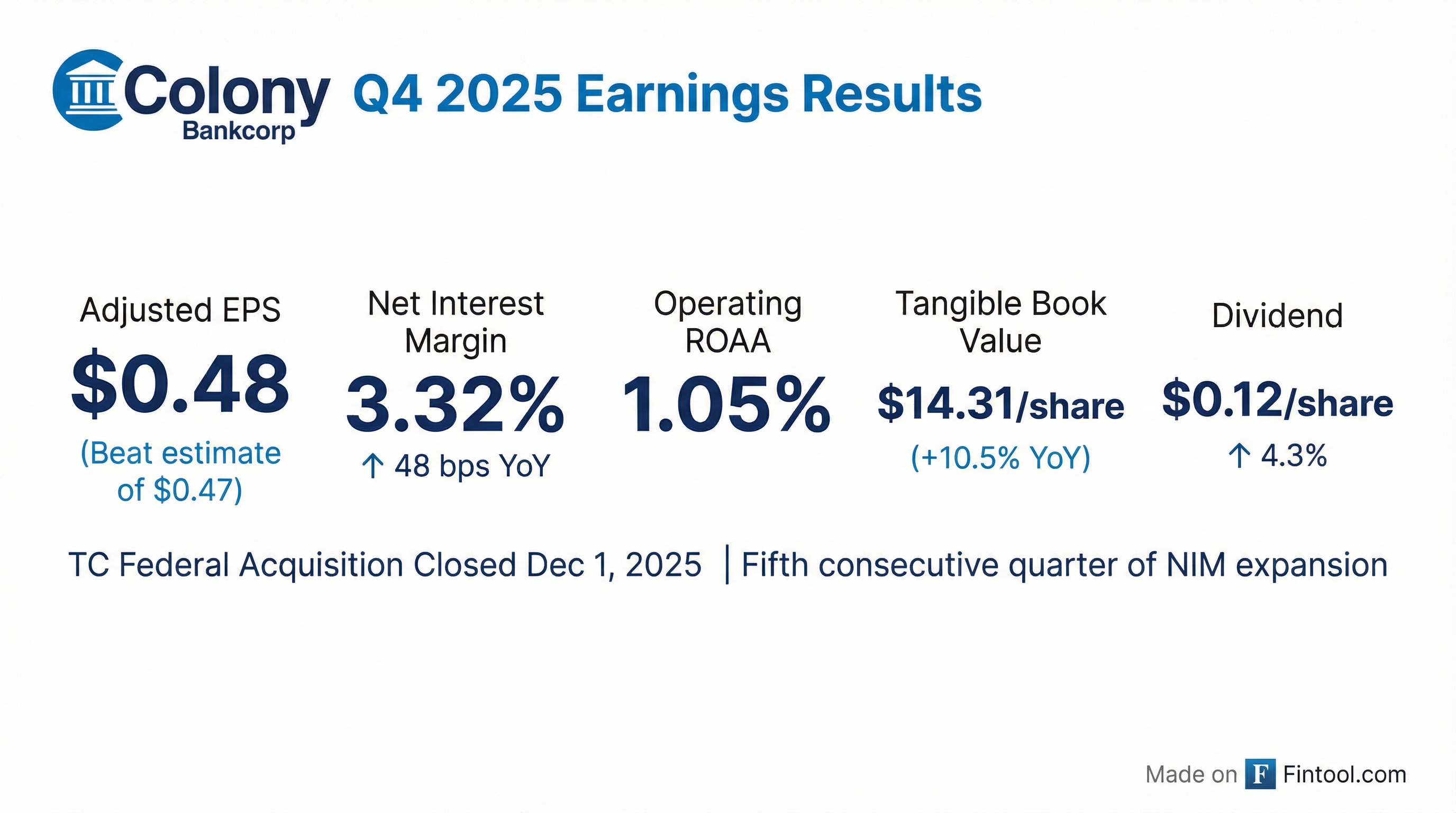

Colony Bankcorp (NYSE: CBAN), Georgia's largest community bank by deposit market share, delivered solid Q4 2025 results highlighted by a fifth consecutive quarter of net interest margin expansion and the successful close of its TC Federal acquisition. Adjusted EPS of $0.48 met analyst expectations, while the company raised its quarterly dividend and signaled confidence in continued margin improvement through 2026.

Did Colony Bankcorp Beat Earnings?

Colony Bankcorp reported Q4 2025 results that were largely in-line with consensus expectations:

GAAP EPS of $0.42 included $1.3 million in acquisition-related expenses from the TC Federal merger. On an operating basis excluding these items, EPS of $0.48 represented a 9% increase from $0.44 in Q4 2024.

The company has now beaten or met EPS estimates for eight consecutive quarters, demonstrating consistent execution:

What's Driving Net Interest Margin Expansion?

The standout metric this quarter is the continued improvement in net interest margin, which expanded to 3.32%—up from 2.84% in Q4 2024 (+48 bps YoY) and 3.17% in Q3 2025 (+15 bps QoQ).

Key drivers of NIM expansion:

- Interest-earning asset yields improved — Income on interest-earning assets increased $4.7 million YoY to $40.9 million

- Funding costs declined — Expense on interest-bearing liabilities decreased $684K YoY to $14.8 million

- Cost of deposits fell to 2.07% — Down from 2.38% in Q4 2024

CEO Heath Fountain expressed confidence the momentum will continue: "Margin continues to expand at a steady pace and we are well positioned to see that continue over the next year."

What Changed This Quarter? TC Federal Acquisition

The transformational event this quarter was the close of the TC Federal acquisition on December 1, 2025, which significantly expanded Colony's footprint:

Strategic rationale:

- Entry into Thomasville, Tallahassee, and Jacksonville markets in Florida

- Strengthens presence in coastal Georgia/Savannah MSA

- Enables cross-sell of mortgage, insurance, and merchant services

Management expects tangible book value earnback in less than 2.5 years (improved from earlier guidance of <3 years), with $5.6 million in total cost savings targeted. Core system conversion is scheduled for Q1 2026.

How Did the Stock React?

CBAN shares were essentially flat on the earnings release, trading up +0.27% to $18.56 in the session the results were announced.

The muted reaction likely reflects that the results were largely in-line with expectations, and the TC Federal acquisition impact was already anticipated. The stock has rallied significantly over the past year as NIM expansion materialized.

Capital Position and Dividend

Colony raised its quarterly dividend to $0.12 per share (from $0.115), a 4.3% increase and the fourth consecutive annual dividend raise.

Capital ratios remain well above "well-capitalized" regulatory minimums despite the acquisition:

Tangible book value per share grew to $14.31, up 10.5% YoY from $12.95 in Q4 2024.

The company also repurchased 46,973 shares at an average price of $16.50 during the quarter.

Asset Quality: Watching Closely

Asset quality metrics showed some deterioration, though management attributed much of it to the TC Federal acquisition adding legacy nonperforming loans:

Management noted: "Credit quality remains stable overall, despite some quarter-to-quarter variability in the fourth quarter. The portfolio continues to reflect solid fundamentals, and we remain focused on maintaining strong credit discipline."

The increase in the allowance for credit losses to $23.0 million reflects the adoption of ASU 2025-08, which required an initial allowance of $4.6 million on acquired TC Federal loans.

Segment Performance

Colony operates three distinct business segments. The Banking Division drove the majority of earnings growth:

The SBSL segment saw lower gain-on-sale income from SBA loans ($1.4M vs. $2.6M in Q4 2024), while Mortgage Banking returned to profitability as production improved.

What Did Management Guide?

Management provided more specific forward guidance on the earnings call:

CEO Heath Fountain on achieving profitability targets: "We were able to hit [1% ROA] in the second quarter and maintain it through the rest of 2025. I'm proud of our team's accomplishments... We now set our sights on our next goal of a 1.20 ROA and believe that we can achieve that on a quarterly basis starting in the second quarter of 2026."

Near-term catalysts:

- TC Federal system conversion — Mid-Q1 2026, with remaining cost savings captured in Q2

- Mortgage loan sale — $30M portfolio sale expected in Q1

- Wealth management transition — Colony Financial Advisors moving to dual-employee model, AUM doubled to $460M

M&A Outlook: More Deals Expected in 2026

CEO Heath Fountain provided unusually candid commentary on the M&A pipeline, suggesting another deal could be announced this year:

"We continue to see an increased level of activity from an M&A perspective, and we are actively having conversations with potential M&A targets. We're at a place where we feel comfortable moving forward with another opportunity, and we believe that given the level of conversations and activity we've seen in the industry, we'll have the opportunity to announce another transaction at some point in 2026."

M&A strategy preferences:

- Negotiated deals preferred over competitive bids — seeking "partnership" vs. "true sale"

- Target size: $750M-$1B more likely; larger deals face more competition

- Geographic focus: Georgia primary, plus contiguous states (SC, TN, AL, FL)

- Execution capability: Prepared to do "more than one at the same time" given faster regulatory approvals

Fountain noted the current regulatory environment is more favorable: "Approvals are happening quickly, and we would not be opposed to lining up more than one at the same time. I think our team can handle that."

Q&A Highlights

On SBSL business risk-adjusted returns (Christopher Marinak, Janney):

Fountain explained the variability in small business lending profitability: "It's certainly high-risk lending... Going back a couple of years, we had the opportunity to do some higher volume of higher risk, but higher return loans that had both high yields and a low cost to originate with the Flash and Lightning programs." He noted that while the business won't return to prior peak levels, "we expect it to improve sort of from the run rate we had this year."

On loan growth and pricing discipline (David Bishop, Hovde Group):

Management acknowledged increased competition: "It's definitely getting more competitive... We're going to need to be a little more competitive on that front in order to get the kind of growth that we want from a pricing perspective." New and renewed loan yields were 7.33% in Q4, expected to decline toward prime.

On deposit funding capacity:

Fountain expressed confidence in organic deposit growth: "We feel confident we can bring that all together at the right time and grow organically deposits to fund loans over the next few years." The company has $65M in investments rolling off in 2026 at 3.10% yields, providing additional flexibility.

On hiring outlook:

Colony is not pursuing aggressive hiring, instead being "opportunistic for hires within our footprint, particularly as it comes to displacement from other M&A activity." Fountain described this as "more in the handful type area" rather than large teams.

Key Takeaways

Positives:

- Fifth consecutive quarter of NIM expansion (3.32%, +48 bps YoY)

- TC Federal acquisition closed on time, TBV earnback improved to <2.5 years

- Dividend increased 4.3% to $0.12 per share

- Capital ratios remain strong post-acquisition

- Operating ROAA achieved 1.00% for full year 2025; 1.20% target for Q2 2026

- Active M&A pipeline with potential for another deal in 2026

- Wealth management AUM doubled to $460M; transitioning to higher-margin dual-employee model

Watch Items:

- NPAs increased to $24.7M (partially acquisition-related)

- SBSL segment profitability declined significantly

- Integration execution risk through Q1 2026

- Loan growth trending toward lower end of 8-12% guidance

- Increased lending competition pressuring pricing

Colony Bankcorp delivered a solid quarter that demonstrated continued progress on its core strategy of margin expansion, disciplined M&A, and building diversified fee income streams. Management's unusually candid commentary on the M&A pipeline suggests additional acquisitions could be announced this year. With TC Federal integration underway and NIM tailwinds expected to persist, Colony appears well-positioned to reach its 1.20% ROAA target over the coming quarters.

Data sourced from Colony Bankcorp Q4 2025 8-K filing dated January 28, 2026 and Q4 2025 earnings call transcript dated January 29, 2026. Values retrieved from S&P Global for estimates data.