Earnings summaries and quarterly performance for Commercial Bancgroup.

Research analysts who have asked questions during Commercial Bancgroup earnings calls.

Recent press releases and 8-K filings for CBK.

Commercial Bancgroup, Inc. Announces Fourth Quarter and Full Year 2025 Results and IPO Completion

CBK

Earnings

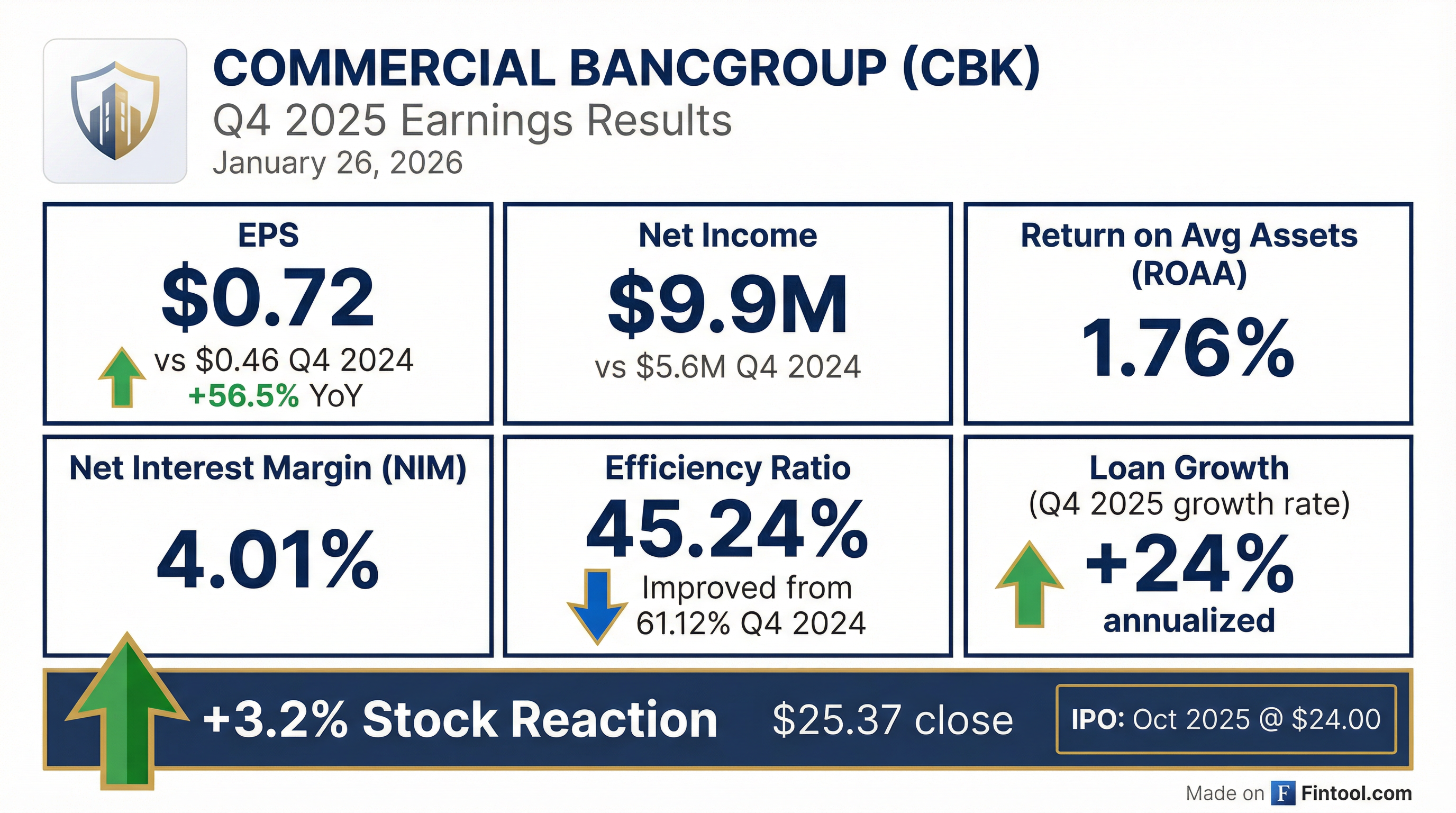

- Commercial Bancgroup, Inc. reported net income of $9.9 million, or $0.72 per diluted common share, for the fourth quarter of 2025, and $36.9 million, or $2.92 per diluted share, for the full year 2025.

- The company completed its initial public offering (IPO) on October 1, 2025, pricing 7,173,092 shares at $24.00 per share, with the financial impacts reflected in the fourth quarter 2025 results.

- As of December 31, 2025, total assets were $2.291 billion, total net loans increased to $1.9 billion (up 3.7% from December 31, 2024), and total deposits were $1.8 billion (down 6.3% from December 31, 2024).

- Key performance metrics for Q4 2025 included a Return on average assets (ROAA) of 1.76%, a Return on average equity (ROAE) of 15.26%, and an efficiency ratio of 45.24%.

Jan 26, 2026, 9:40 PM

Commercial Bancgroup Reports Strong 2025 Financial Results and Strategic Capital Actions

CBK

Earnings

M&A

Debt Issuance

- Commercial Bancgroup reported strong financial results for 2025, with Net Income of $36,942 thousand, Earnings Per Share of $2.92, and a Core ROAA of 1.66%. The company's balance sheet as of December 31, 2025, showed Total Assets of $2,291 million, Total Loans of $1,856 million, and Total Deposits of $1,816 million.

- The company executed a stock reclassification and a 250-for-1 forward stock split on September 18, 2025. Additionally, it repaid a $20.3 million note payable in October 2025 and redeemed $6.2 million of Trust Preferred Securities in January 2026, strengthening its capital position.

- Asset quality remained robust at year-end 2025, with NPAs and 90 Days Past Due as a percentage of Assets at 0.28% and a Loan Loss Reserve to NPAs ratio of 274%.

- The company continues its M&A strategy, having completed seven acquisitions, including the remaining minority stake in AB&T in June 2024, which expanded its presence into the Charlotte MSA.

Jan 26, 2026, 9:00 PM

Commercial Bancgroup Reports Q3 2025 Results Following Successful IPO

CBK

Earnings

M&A

- Commercial Bancgroup successfully completed its public company offering on September 30, 2025, marking its first earnings call as a public entity.

- For Q3 2025, net income increased 3.3% to $9.5 million, revenue rose 4.6% to $22.9 million, and EPS grew 4% to $0.77 compared to Q3 2024. Year-to-date through Q3 2025, net income was $27.1 million (up 4.9%), revenue was $66.9 million (up 1.9%), and EPS reached $2.22 (up 6.2%).

- The company anticipates strong loan closing volume for Q4 2025, expecting moderate loan growth for the full fiscal year despite earlier payoffs, and reported a net interest margin of $4.05 for September.

- Management sees a positive M&A environment and is actively looking for acquisition opportunities for banks in the $500 million to $750 million size range.

Oct 28, 2025, 2:00 PM

Commercial Bancgroup Reports Q3 2025 Earnings and IPO Completion

CBK

Earnings

M&A

Guidance Update

- Commercial Bancgroup successfully completed its public company offering on September 30, 2025, marking its first earnings call as a public company.

- For Q3 2025, the company reported net income of $9.5 million, a 3.3% increase over Q3 2024, and revenue of $22.9 million, a 4.6% increase. Earnings per share for the quarter were $0.77, up 4% year-over-year, and tangible book value per share increased 14.5% to $19.05.

- Year-to-date for the first nine months of 2025, net income was $27.1 million, a 4.9% increase, and revenue was $66.9 million, a 1.9% increase. The efficiency ratio held strong at 47.6% for the first nine months.

- The company anticipates strong loan closing volume for Q4 2025, which is expected to offset payoffs and provide moderate growth for the full fiscal year. The net interest margin for September was $4.05, with expectations to remain strong.

- Management is actively pursuing M&A opportunities, particularly for banks in the $500 million to $750 million range, and sees a positive M&A climate.

Oct 28, 2025, 2:00 PM

Commercial Bancgroup Completes IPO and Reports Q3 2025 Earnings

CBK

Earnings

M&A

Guidance Update

- Commercial Bancgroup successfully completed its public company offering on September 30, 2025, marking its first earnings call as a public company.

- For Q3 2025, the company reported net income of $9.5 million, a 3.3% increase year-over-year, and earnings per share of $0.77, a 4% increase over the prior year.

- For the first nine months of 2025, net income was $27.1 million, a 4.9% increase, with earnings per share of $2.22, a 6.2% increase.

- The company anticipates strong loan closing volume for Q4 2025, expecting to achieve moderate loan growth for the entire fiscal year 2025. The net interest margin for September was $4.05, and management is actively pursuing M&A opportunities for banks in the $500 million-$750 million range.

Oct 28, 2025, 2:00 PM

Commercial Bancgroup, Inc. Announces Third Quarter 2025 Results and IPO Details

CBK

Earnings

Delisting/Listing Issues

Debt Issuance

- Commercial Bancgroup, Inc. reported net income less non-controlling interest of $9.5 million, or $0.77 per diluted common share, for the third quarter of 2025, an increase from $9.2 million, or $0.74 per diluted common share, for the same period in 2024.

- Total operating revenue increased to $22.9 million for the three months ended September 30, 2025, compared to $21.9 million for the three months ended September 30, 2024.

- The company's common stock began trading on The Nasdaq Stock Market LLC on October 2, 2025, under the ticker symbol "CBK", following its initial public offering (IPO) priced at $24.00 per share on October 1, 2025. The company received net proceeds of approximately $30.6 million from the IPO, which will be used to repay indebtedness and redeem outstanding subordinated debentures.

- Tangible book value per share was $19.05 as of September 30, 2025, an increase from $16.64 per share as of September 30, 2024.

- As of September 30, 2025, total assets decreased by 3.8% to $2.2 billion, and total deposits decreased by 8.1% to $1.8 billion from December 31, 2024.

Oct 28, 2025, 12:07 PM

Commercial Bancgroup, Inc. Closes Initial Public Offering

CBK

Delisting/Listing Issues

- Commercial Bancgroup, Inc. (CBK) announced the closing of its Initial Public Offering (IPO) on October 3, 2025.

- The IPO comprised 7,173,092 shares of common stock at a public offering price of $24.00 per share, raising over $172 million in total.

- Commercial Bancgroup, Inc. sold 1,458,334 shares, receiving approximately $30.6 million in net proceeds, which it intends to use for debt repayment and general corporate purposes.

- The company's common stock began trading on the Nasdaq Capital Market under the ticker symbol "CBK" on October 2, 2025.

Oct 3, 2025, 8:21 PM

Quarterly earnings call transcripts for Commercial Bancgroup.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more