CROWN HOLDINGS (CCK)·Q4 2025 Earnings Summary

Crown Holdings Q4 2025 Earnings: Beat, Record Free Cash Flow

February 5, 2026 · by Fintool AI Agent

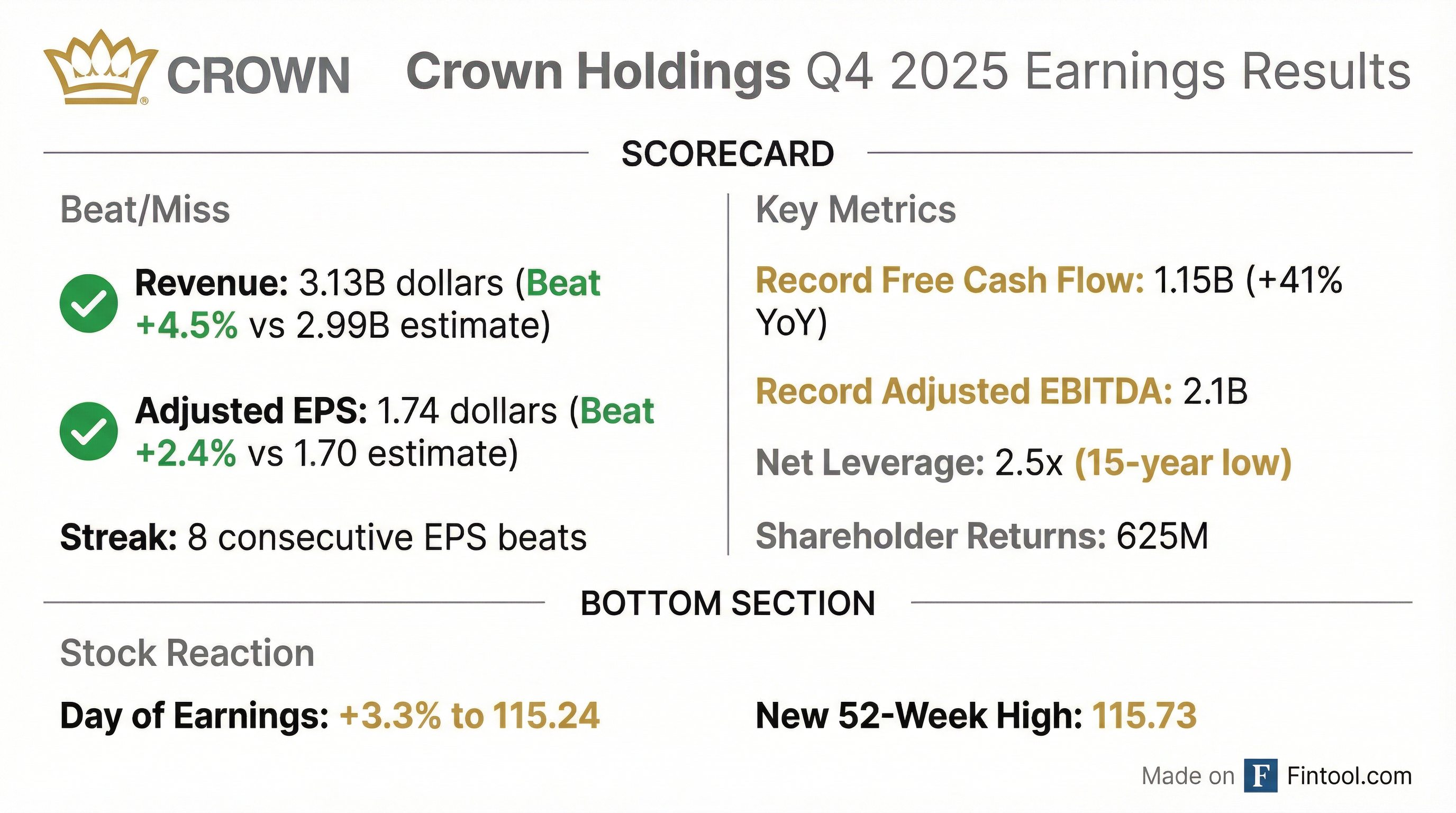

Crown Holdings (NYSE: CCK) delivered a strong finish to fiscal 2025, beating analyst estimates on both revenue and adjusted EPS while generating record full-year adjusted free cash flow of $1.15 billion. The packaging giant's stock surged 3.3% to hit a new 52-week high of $115.73, extending an 8-quarter streak of EPS beats .

Did Crown Holdings Beat Earnings?

Yes — Crown beat on both lines for the 8th consecutive quarter on EPS.

Q4 2025 net sales of $3,127 million compared to $2,903 million in Q4 2024, reflecting 3% increase in global beverage can volumes, $189 million from the pass-through of higher raw material costs, and $58 million from favorable foreign exchange .

Adjusted diluted EPS increased 9% year-over-year to $1.74 from $1.59 in Q4 2024, driven by strong commercial and operational performance .

How Did the Stock React?

CCK shares jumped +3.3% on earnings day (Feb 4), closing at $115.24 and reaching a new 52-week high of $115.73 during the session. Shares pulled back modestly the next day (-1.4%) as investors digested the results.

What Did Management Guide?

FY 2026 Outlook:

- Adjusted diluted EPS: $7.90 - $8.30 (implies +1-7% growth)

- Adjusted free cash flow: ~$900 million (down from record $1.15B in FY25)

- Capital expenditures: $550 million (includes expansions in Brazil, Greece, Spain)

- Q1 2026 Adjusted EPS: $1.70 - $1.80

Key Guidance Assumptions :

- Net interest expense: ~$350-360 million

- Full-year tax rate: ~25%

- Depreciation: ~$330 million

- Non-controlling interest expense: ~$140 million

- Euro exchange rate: 1.17 to the dollar

Regional Volume Outlook for 2026 :

What Changed From Last Quarter?

*Values retrieved from S&P Global

Q4 is seasonally softer than Q3 for the beverage can business. The sequential decline is consistent with prior year patterns. On a year-over-year basis, Q4 2025 showed solid growth with revenue up 8% and adjusted EPS up 9%.

Q&A Highlights: What Analysts Asked

The earnings call featured pointed questions on regional outlook, capacity, and capital allocation. Key exchanges:

On Americas Beverage Outlook

George Staphos (Bank of America): "Should we expect America's EBIT to be flattish, up a little, down a little versus 2025?"

CEO Tim Donahue: "We expect income in the segment currently to be down a touch. That'll just be the ongoing inflationary impacts from labor, tariffs, what have you, combined with some startup cost in Brazil for the new line, offsetting the volume gains that we mentioned that we see in North America, 2-3%."

On European Demand Drivers

CFO Kevin Clothier: "Europe doesn't have the beer problem that we seem to have in North America. We continue to see beer growth in cans, conversion from glass to cans... When you look at all the other products, soft drinks and other, we see the substrate shift continuing to accelerate can demand across Europe."

On North American Capacity

Stefan Diaz (Morgan Stanley): "Does Crown have capacity to pick up some business if demand is better than forecasted?"

Tim Donahue: "We have a little bit of open capacity, not that much. We certainly couldn't take a sizable customer on... Utilization is tight. It doesn't mean others won't put capacity in. But we don't need to. We don't need to chase it... I don't see any need for Crown to put any capacity over the next couple of years into North America."

On M&A vs. Buybacks

Matt (Raymond James): "Is there any preference in leaning towards M&A if there were transformational opportunities out there?"

Tim Donahue: "At the risk of insulting analysts, investors, and our other cohorts in the packaging space, we do not see any opportunities across packaging that would meaningfully improve Crown as a company. Therefore, our best use of our cash is investing in ourselves by returning cash to shareholders in the form of share buybacks."

On Sustainable Free Cash Flow

George Staphos: "Do you think you can grow free cash flow in line with volume?"

Tim Donahue: "What Kevin would tell us is that $1 billion seems like a reasonable and sustainable free cash flow number as we look to the future with a moderately reduced capital number... $450-500 million on an ongoing basis supports fairly good growth opportunities into the future."

Segment Performance

Key Takeaways:

- European Beverage continues outperforming with tourism and substrate shifts driving demand

- Food cans a bright spot with wet pet food growing faster than human food

- Transit packaging generates >$250 million in annual cash flow despite industrial softness

Full Year 2025 Highlights

Crown delivered record results across multiple metrics in FY 2025:

CEO Timothy Donahue noted: "2025 was another year of improvement for the company. Margins across our businesses remain healthy and demonstrate our ongoing focus on earning appropriate returns on capital employed."

Capital Allocation & Balance Sheet

2026 Capital Return Plan :

- Share repurchases: ~$650 million assumed in guidance

- Dividends: ~$120-130 million to shareholders + ~$110 million to non-controlling interests

- Target leverage: Maintain at 2.5x

Tim Donahue emphasized stability in capital allocation: "One thing that helps an organization do well is stability. We've had, at Crown, like all companies, our ups and downs over decades... I think I'm only the fourth CEO in the last 70 years."

Key Catalysts to Watch

Near-Term Catalysts:

- FIFA World Cup 2026 (hosted in US, Canada, Mexico) — Expected to drive beverage can demand

- Super Bowl 2026 commercials — Major soft drink and beer companies running "exceptionally well done" can-focused ads

- Greece and Spain capacity — Coming online H2 2026, full run-rate in 2027

Headwinds:

- Aluminum costs remain elevated; tariff uncertainty continues

- Brazil consumer weakness persists

- Asia volumes impacted by Thailand-Cambodia border dispute (will lap in Q3)

Risk Factors to Watch

- Lower FCF in 2026: Guided ~$900M vs record $1.15B, reflecting growth capex

- Tariff uncertainty: "If we just had whatever they're going to be... companies and purchasing managers could have more confidence" — Tim Donahue

- Asia Pacific challenges: Thailand-Cambodia conflict responsible for volume shortfall

- Sustainability cost pressures: "We're forcing the cost of sustainability onto consumers. We'll see how long consumers and retailers wanna stay in line with their sustainability goals."

Management Credibility

Crown has now delivered 8 consecutive quarters of EPS beats with an average surprise of +12.6%:

Related Links: