CELESTICA (CLS)·Q4 2025 Earnings Summary

Celestica Crushes Q4 as AI Demand Drives 44% Revenue Surge, Raises 2026 Outlook

January 29, 2026 · by Fintool AI Agent

Celestica delivered a blowout Q4 2025, with revenue surging 44% to $3.65 billion and adjusted EPS jumping 70% to $1.89—both exceeding the high end of guidance and analyst expectations. The company raised its 2026 outlook materially, now targeting $17 billion in revenue and $8.75 in adjusted EPS, driven by accelerating AI infrastructure demand from hyperscaler customers. On the earnings call, management provided bullish commentary on growth visibility extending into 2027 and beyond, with CCS segment growth expected to accelerate further.

Did Celestica Beat Earnings?

Yes—decisively. Celestica beat on both revenue and EPS, extending its streak of consecutive quarterly beats.

For full-year 2025, Celestica delivered revenue of $12.4 billion (+28% YoY) and adjusted EPS of $6.05 (+56% YoY), capping a transformational year for the company.

What Drove the Beat?

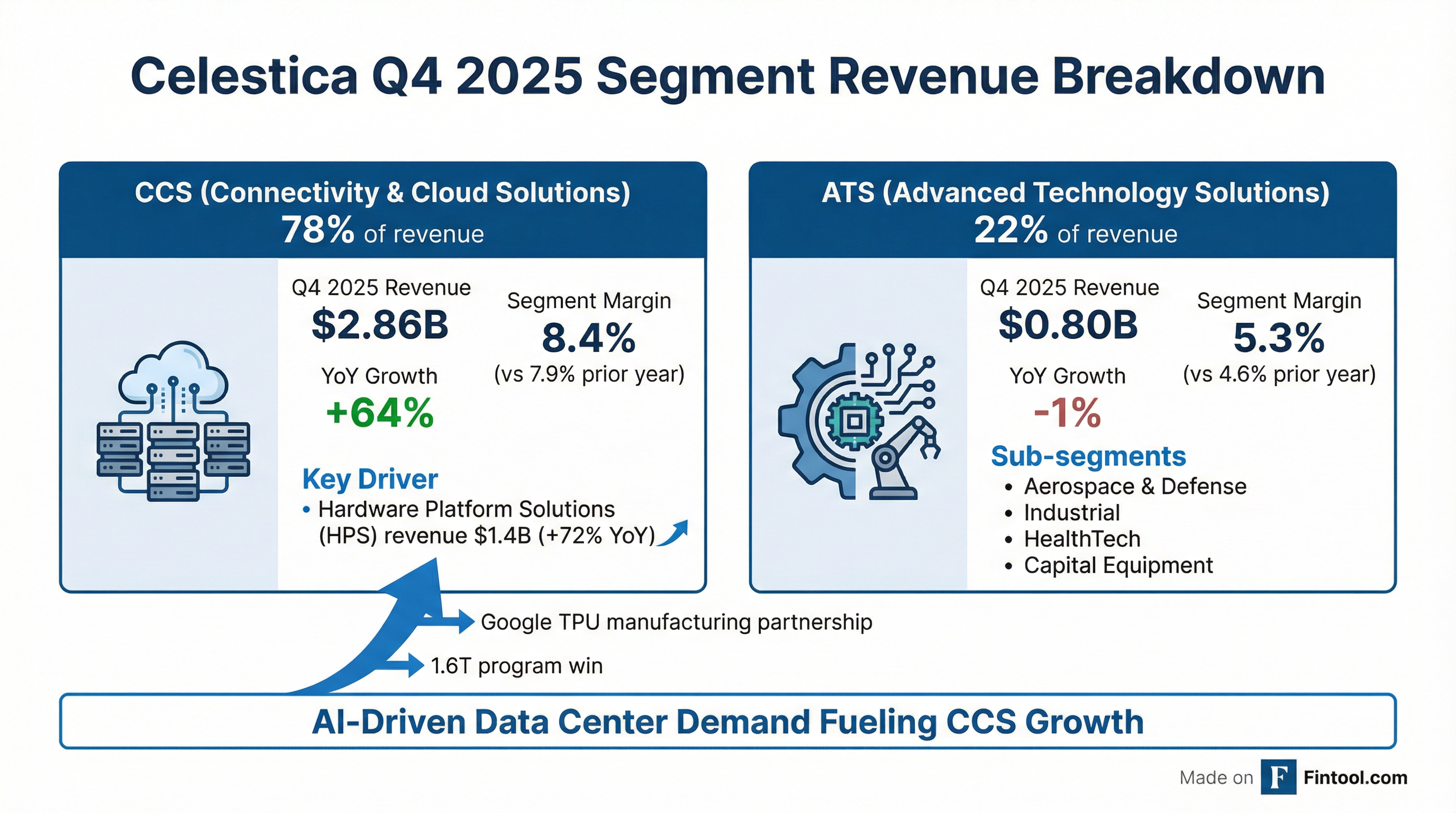

The Connectivity & Cloud Solutions (CCS) segment was the star performer, with revenue jumping 64% year-over-year to $2.86 billion—now comprising 78% of total revenue. Hardware Platform Solutions (HPS), which includes AI/ML compute platforms, grew an even more impressive 72% to approximately $1.4 billion.

The Advanced Technology Solutions (ATS) segment declined 1% to $0.80 billion, though margins improved to 5.3% from 4.6% in the prior year.

Customer concentration remains high: Three customers represented 36%, 15%, and 12% of Q4 revenue.

What Did Management Guide?

Celestica provided bullish guidance that exceeded expectations across the board:

Q1 2026 Guidance

2026 Full Year Outlook (Raised)

CEO Rob Mionis stated: "2025 was another exceptional year for the company... Our adjusted operating margin of 7.5% marked the second consecutive year of 100 basis points improvement, driven by growth in AI-related demand for data center technologies, strong operational execution, and improved operating leverage." He added that management's "optimism continues to strengthen regarding the significant pipeline of growth opportunities that lie ahead."

What Changed From Last Quarter?

Several significant developments emerged this quarter:

1. Google TPU Manufacturing Partnership Expansion

Celestica announced it is expanding US manufacturing capacity to support Google Tensor Processing Unit (TPU) production, with completion targeted for 2027. The company will also expand South East Asia capacity to support Google's TPU platform and networking technologies.

2. $1 Billion Capital Investment Plan

Management is increasing 2026 capex to approximately $1 billion (~6% of revenue) to align capacity with hyperscaler customer roadmaps. Key investments include:

- Expansion in Dallas-Fort Worth, Texas metro area

- Multiple new buildings at Thailand campus

- Investments in Mexico and Japan facilities

- New HPS design centers in Asia and US

3. Third 1.6T Program Win

Celestica was awarded a 1.6 terabyte switching platform program with a third hyperscaler customer, with production ramp expected in 2027. The company now has 10 active 1.6T programs, with 5 expected to ramp in H2 2026 and the remainder in 2027-2028.

4. Extended Growth Visibility

Management indicated the 2026 revenue growth trajectory "will be sustained into 2027," signaling multi-year demand visibility. CCS segment growth is now expected to be approximately $4.5 billion in 2026 (up from $3.5B implied 90 days ago) and approximately $7 billion in 2027 (up from ~$5B implied previously).

5. Capacity Expansion Details

The $1B capex plan includes:

- Texas: 700,000+ sq ft across Richardson campus and new Fort Worth site, plus new HPS design center in Austin

- Thailand: 1,000,000+ sq ft with expanded power, liquid cooling manufacturing, and testing capabilities

- Asia: New HPS design center in Taiwan

- Global: Upgrades in Mexico and Japan for geographic diversification

6. Operating Efficiency

Adjusted ROIC reached 43% in Q4, up 14 percentage points year-over-year. Cash cycle days improved to 61 days, 8 days better than prior year.

What Did Management Say in Q&A?

The earnings call Q&A surfaced several key insights:

On 2H 2026 Implied Slowdown

Analyst concern: Q1 guidance implies 51% YoY growth while full-year is 37%—is there a slowdown?

CFO Mandeep Chawla: "Customer forecasts right now for 2026 are higher than the $17 billion that we are guiding... We're just being pragmatic. We're focusing on securing supply... As we go through the year, we are working towards a higher number."

On Google Partnership

Addressing recent media speculation, CEO Rob Mionis was emphatic: "Our partnership with Google has never been stronger or more integrated. We have absolutely no indication there are new entrants into that market... As a preferred partner with Google on these leading-edge compute programs, we have a joint commitment to each other moving forward."

On Digital Native Customer

The "digital native" customer (widely believed to be a large tech company building custom silicon) remains on track: "The program is on track... we still expect it to be a meaningful contribution in 2027. We are actively working on the design aspects of the program, and we do believe that that program will still ramp in the beginning of 2027."

On Margin Trajectory with Enterprise Growth

CFO Chawla on mix concerns: "We don't necessarily expect a large mix headwind from growing of the enterprise business. We do make more money on networking in general, but with the leverage that we're getting and the very disciplined cost management, we still think that the enterprise business is going to be able to generate very strong profitability."

On Competitive Dynamics

CEO Mionis: "Some of the business that we decided not to play the pricing game on in 2025 have come back to us in 2026, because others could not execute on it. When we look at our competitive moat... very few of our competition can produce these products at scale."

On 1.6T Switching Roadmap

- 400G remains "very resilient" in 2026

- 800G continues to grow strongly

- 1.6T ramping in H2 2026 across multiple customers

- 3.2T samples expected late 2026, with co-packaged optics adoption expected at that node

On CapEx Returns

"We are making this sizable investment to tie to programs that we've already won... Should those wins continue, and we would expect that they would, we have no hesitation in increasing our CapEx."

How Did the Stock React?

Celestica shares rose 3.6% on the earnings release, closing at $345.23. The stock has been a massive outperformer:

The company has delivered 9 consecutive quarters of EPS beats, demonstrating consistent execution during the AI infrastructure build-out.

Financial Trends: 8-Quarter View

*Values retrieved from S&P Global

Revenue has grown sequentially every quarter, while adjusted operating margins have expanded from 6.5% to 7.7%.

Capital Allocation

Celestica generated $250.6 million in operating cash flow in Q4 and $155.9 million in free cash flow. For full-year 2025:

Management expects to fully fund the $1 billion 2026 capex organically through operating cash flow.

Key Risks to Monitor

Customer Concentration: Three customers represent 63% of revenue (36%, 15%, 12%). Any pullback from a major hyperscaler would materially impact results.

Tariff Exposure: The company assumes "no material changes to tariffs or trade restrictions" in its outlook. While substantially all tariffs are recovered from customers, policy changes could introduce margin pressure.

Execution Risk: The $1 billion capex plan requires successful execution across multiple geographies simultaneously.

AI Demand Sustainability: Results are heavily dependent on continued hyperscaler AI infrastructure spending. Any moderation in cloud capex could slow growth.

Bottom Line

Celestica delivered a standout Q4 powered by explosive growth in AI/ML compute platforms and networking infrastructure. The raised 2026 outlook (+6% on revenue, +7% on EPS) signals management's confidence in sustained demand, while the $1 billion capex commitment and Google TPU partnership underscore the company's deepening role in hyperscaler supply chains.

Key takeaways from the call:

- CCS growth trajectory accelerated: $4.5B in 2026 and ~$7B in 2027 (both up from prior expectations)

- Google partnership "never stronger" despite media speculation

- Competitive moat widening as rivals struggle to execute at scale

- Digital native customer still on track for 2027 ramp

- 400G/800G/1.6T all running concurrently in 2026—no cannibalization

With 9 consecutive EPS beats, 43% ROIC, and 270% stock appreciation over the past year, the key question becomes whether current valuations adequately reflect the growth runway—or if expectations have finally caught up. Management's "high confidence" framing and willingness to invest more suggests they see the opportunity as far from peaked.