CLOROX CO /DE/ (CLX)·Q2 2026 Earnings Summary

Clorox Q2 FY2026: Revenue Beats but EPS Misses as Margins Contract

February 3, 2026 · by Fintool AI Agent

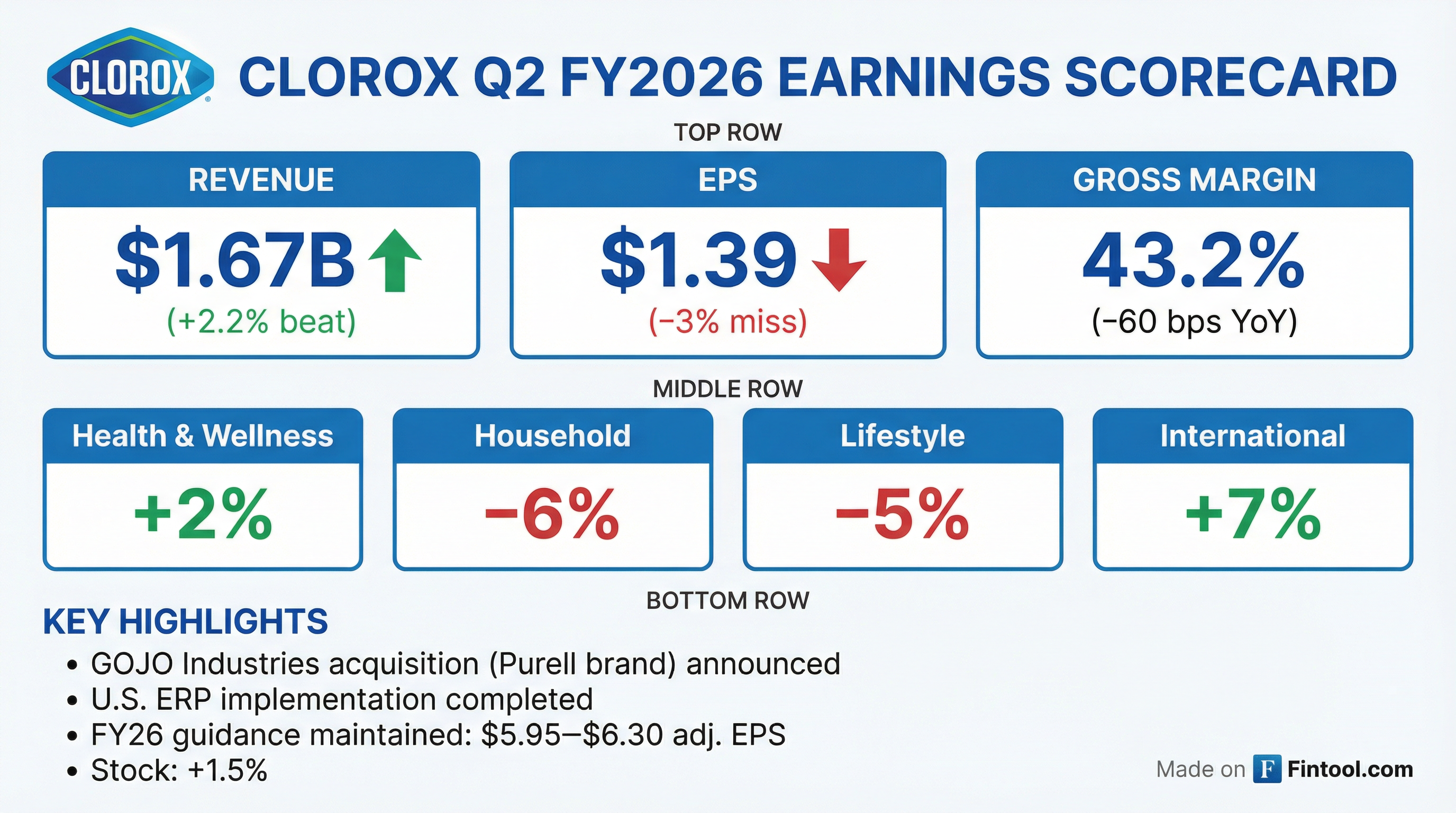

Clorox (NYSE: CLX) delivered mixed Q2 FY2026 results, with revenue beating consensus by 2.2% while adjusted EPS missed by 2.9%. The quarter was highlighted by the strategic announcement of the GOJO Industries acquisition (Purell brand) and completion of the company's multi-year ERP transformation. Shares rose 1.5% on the day as the revenue beat and maintained guidance provided some reassurance despite margin headwinds.

Did Clorox Beat Earnings?

Clorox posted a split result with revenue outperforming expectations while earnings fell short:

*Values retrieved from S&P Global

Net sales decreased 1% year-over-year to $1.67 billion, primarily driven by lower consumption partially offset by shipments ahead of consumption for several businesses. Organic sales also declined 1%.

The EPS miss was driven by:

- Gross margin contraction: Down 60 basis points to 43.2% from 43.8% in the year-ago quarter due to higher manufacturing and logistics costs

- Lapping prior year benefits: The year-ago quarter included $25M in cyberattack insurance recoveries

- Lower tax benefits: Lapping tax rate benefits in the prior period

Note on Q2 shipments: CFO Bellet disclosed ~1 point of sales favorability in Q2 from higher-than-expected shipments ahead of consumption, primarily related to retailer inventory pre-build for the final ERP manufacturing phase. This will reverse in Q3.

What Did Management Guide?

Clorox maintained its full-year FY2026 outlook, though management noted expectations are now at the lower end of ranges due to order fulfillment challenges earlier in the year:

Important context: The most significant driver of the FY2026 outlook is transitory. Clorox shipped about two weeks of inventory ahead of consumption at the end of FY2025 as retailers built inventory in advance of its ERP transition. This is creating a ~7.5 point headwind to year-over-year sales and ~$0.90 drag on EPS.

This guidance excludes the impact from the GOJO Industries acquisition, which is expected to close before the end of FY2026.

How Did the Stock React?

CLX shares rose +1.5% to $114.98 on earnings day, outperforming despite the EPS miss. The stock traded in a range of $111.66 to $115.48 intraday.

*Values retrieved from S&P Global

The positive reaction likely reflects:

- Revenue beat providing some top-line relief

- GOJO acquisition seen as strategically positive

- Maintained guidance removing downside uncertainty

- ERP transition completing a major milestone

What Changed From Last Quarter?

Key deltas from Q1 FY2026:

*Values retrieved from S&P Global

Sequential improvement drivers:

- Q1 bore the brunt of the ERP inventory drawdown impact

- Q2 benefited from shipments ahead of consumption for several businesses

- Final phase of U.S. ERP implementation completed in January

How Did Segments Perform?

Segment performance was mixed, with International strength offsetting domestic weakness:

All values from

Segment highlights:

-

Health & Wellness (+2%): Driven by incremental shipments related to ERP transition and strong Professional Products performance

-

Household (-6%): Weakness from lower consumption and unfavorable price mix due to shift to larger sizes in Bags and Wraps. EBIT down 54% on manufacturing and logistics cost headwinds

-

Lifestyle (-5%): Lower consumption across Food, Water Filtration, and Natural Personal Care. Despite sales decline, EBIT grew 3% on lower advertising investments

-

International (+7%): Standout performance driven by favorable price mix, FX tailwinds, and higher volume. Organic sales grew 5% excluding FX. EBIT surged 48% on higher sales and cost savings

What's the GOJO Acquisition About?

The biggest strategic announcement was the definitive agreement to acquire GOJO Industries, adding the iconic Purell brand to Clorox's portfolio.

Strategic rationale:

- Expands Clorox's position in health and hygiene for consumers and businesses globally

- Complements existing cleaning and disinfecting portfolio

- Expected to close before end of FY2026

CEO Linda Rendle expressed confidence in the integration: "They have a very strong management team, a very talented team, advanced operations... we feel like we could have confidence in integration, that we would be able to do this seamlessly."

Notably, Clorox's Health & Wellness segment has delivered a 4% 10-year CAGR, making this a strategic doubling down on a proven growth area.

The current outlook does not include any financial impact from this acquisition.

What Are the Key Margin Drivers?

Gross margin contracted 60 basis points year-over-year to 43.2%:

All values from

Key takeaway: Despite strong cost savings (+170 bps) and positive pricing (+60 bps), manufacturing and logistics headwinds of 240 basis points overwhelmed the improvements. This is the primary area management needs to address going forward.

Back-half phasing: CFO Bellet guided Q3 gross margin to be "about flat" year-over-year with "solid expansion" in Q4. Key drivers include: (1) higher cost savings run rate in H2, (2) incremental ERP-related logistics costs phasing out by Q4, and (3) ~50 bps benefit from the Glad JV termination flowing through in H2.

Capital Allocation & Cash Flow

All values from

Year-to-date free cash flow improved 6% to $326 million despite sales headwinds, reflecting improved working capital management and lower capex.

8-Quarter Financial History

*Revenue and margin values retrieved from S&P Global. Q2 FY26 EBITDA estimated from adjusted EBIT plus D&A.

The Q3 FY24 net loss reflects the impact of the August 2023 cyberattack. Subsequent quarters show recovery trajectory, though the ERP transition has created significant quarter-to-quarter volatility.

Q&A Highlights: What Did Management Reveal?

The earnings call Q&A provided important context on category trends, innovation timing, and the competitive environment:

Sequential Improvement Confirmed

Management noted consumption improved through Q2 and into January: "We saw, as we expected, a sequential improvement in the quarter... we're growing share in the last week." However, Rendle cautioned that weather-related stocking in late January adds noise to the data.

Category Outlook: 0-1% Growth Expected

Clorox expects category growth of 0-1% in the back half—consistent with the relatively flat trends seen in H1. For the Ignite strategy's 3%-5% growth algorithm to work, categories need to return to historical 2%-2.5% growth, plus ~1 pt from professional and international businesses.

Private Label Not a Major Threat

Despite consumer value-seeking behavior, private label only gained 0.1 share points last quarter: "Consumers still want brands, and we just need to figure out the right way to make sure we're giving them the right price, the right pack, at the right moment."

Litter & Glad Remain Competitive

Both categories are seeing elevated promotional activity versus historical norms. Management acknowledged higher promotional spending but emphasized disciplined strategic promotions rather than broad price cuts. Scoop Away promotions at Costco are having a disproportionate impact on measured merchandising data.

ERP Transition Completing

The final manufacturing phase went live in January, completing the multi-year ERP transformation. Q3 will include ~$0.08 of EPS adjustment, then adjustments end. Optimization and automation benefits should begin flowing through in FY2027.

What's the Back-Half Innovation Pipeline?

Management detailed several key innovation launches ramping in H2 FY2026:

On the allergen platform, Rendle stated: "This is one that we're launching not just to have a launch in our back half of the year, but to be a platform that we can build on for many years to come. We're already selling the second and third wave of this platform out with retailers."

Importantly, most shelf resets won't occur until late Q3 or early Q4, so the full share impact will be back-end loaded.

What Does FY2027 Look Like?

CFO Luc Bellet provided a preview of the FY2027 setup: "As you remember, we essentially shifted some sales that should have been in fiscal year 26 to fiscal year 25... next year, when you have normalized shipment and sales, you would have a pickup of about 3.5 point on sales and a pickup of about $0.90 in EPS."

This mechanical tailwind from ERP normalization should provide a significant boost to reported growth in FY2027, independent of underlying category performance.

Key Risks and Concerns

-

Manufacturing & Logistics Costs: The 240 bps headwind to gross margin is significant and management needs to demonstrate better cost control

-

Consumer Weakness: Categories remain "challenged and volatile" with consumers displaying value-seeking behaviors—trading to larger sizes for better price-per-unit, smaller sizes for lower outlay, and shifting to value channels like dollar stores and club

-

Market Share Pressure: Order fulfillment challenges earlier in the year led to consumption and market share losses

-

Tariff Uncertainty: Forward-looking statements cite U.S. trade policy and tariffs, especially with China, as risk factors

-

Integration Risk: GOJO acquisition adds execution complexity

Forward Catalysts

- GOJO Integration: Acquisition expected to close before end of FY2026; will expand health and hygiene portfolio

- ERP Benefits: With U.S. implementation complete, productivity and efficiency gains should begin to materialize

- Back-Half Innovation: Strong innovation slate expected in H2 including Clorox PURE allergen-neutralizing platform

- Glad JV Buyout: Repurchasing P&G's 20% stake expected to add ~50 bps to gross margin annually (partial benefit in FY26)

Key Takeaways

The Good:

- Revenue beat of 2.2% despite challenging consumer environment

- International segment strong with +7% sales and +48% EBIT growth

- GOJO acquisition adds strategic Purell brand

- ERP transformation complete, unlocking future efficiencies

- Free cash flow +6% YoY despite sales headwinds

The Concerns:

- Adjusted EPS missed by 2.9%

- Gross margin contracted 60 bps on manufacturing/logistics costs

- Household segment EBIT down 54%

- Guidance at lower end of range due to order fulfillment issues

- Stock down 28% from 52-week highs

For more information, view the CLX company profile or read the Q2 FY2026 transcript.