CNO Financial Group (CNO)·Q4 2025 Earnings Summary

CNO Financial Delivers 11% Operating EPS Growth, Sets Record Sales Year

February 5, 2026 · by Fintool AI Agent

CNO Financial Group (NYSE: CNO) delivered another strong quarter, with Q4 2025 operating EPS of $1.47, up 12% year-over-year. The middle-market life and health insurer achieved all 2025 guidance metrics while posting record insurance sales, marking its 14th consecutive quarter of strong production. Full-year operating EPS grew 11% to $4.40, and the company returned $386 million to shareholders—up 11% from 2024.

Did CNO Beat Earnings?

Yes—across all key metrics. CNO exceeded guidance and delivered strong YoY growth:

Full Year 2025 Performance:

The gap between net income and operating income reflects non-economic accounting impacts from market volatility, a $101.9 million goodwill impairment, and $20.3 million in technology modernization (TechMod) expenses.

What Drove the Beat?

CEO Gary Bhojwani highlighted three key drivers:

- Record Insurance Sales: Total NAP grew 15% to $479.2 million, with both Consumer (+15%) and Worksite (+15%) divisions contributing

- Strong Investment Performance: Average yield on allocated investments improved to 4.92% vs 4.87% a year ago

- Disciplined Expense Management: Expense ratio improved to 18.1% in Q4 (18.9% for full year, excluding significant items)

"CNO once again delivered an excellent quarter and full-year performance, demonstrating the consistent, repeatable results that continue to drive our momentum. We posted our 14th consecutive quarter of strong insurance sales." — Gary C. Bhojwani, CEO

On future growth priorities, Bhojwani emphasized: "Producing agent count growth is important, but I think it's a distant second to agent productivity. If you force me to pick, I will always emphasize productivity."

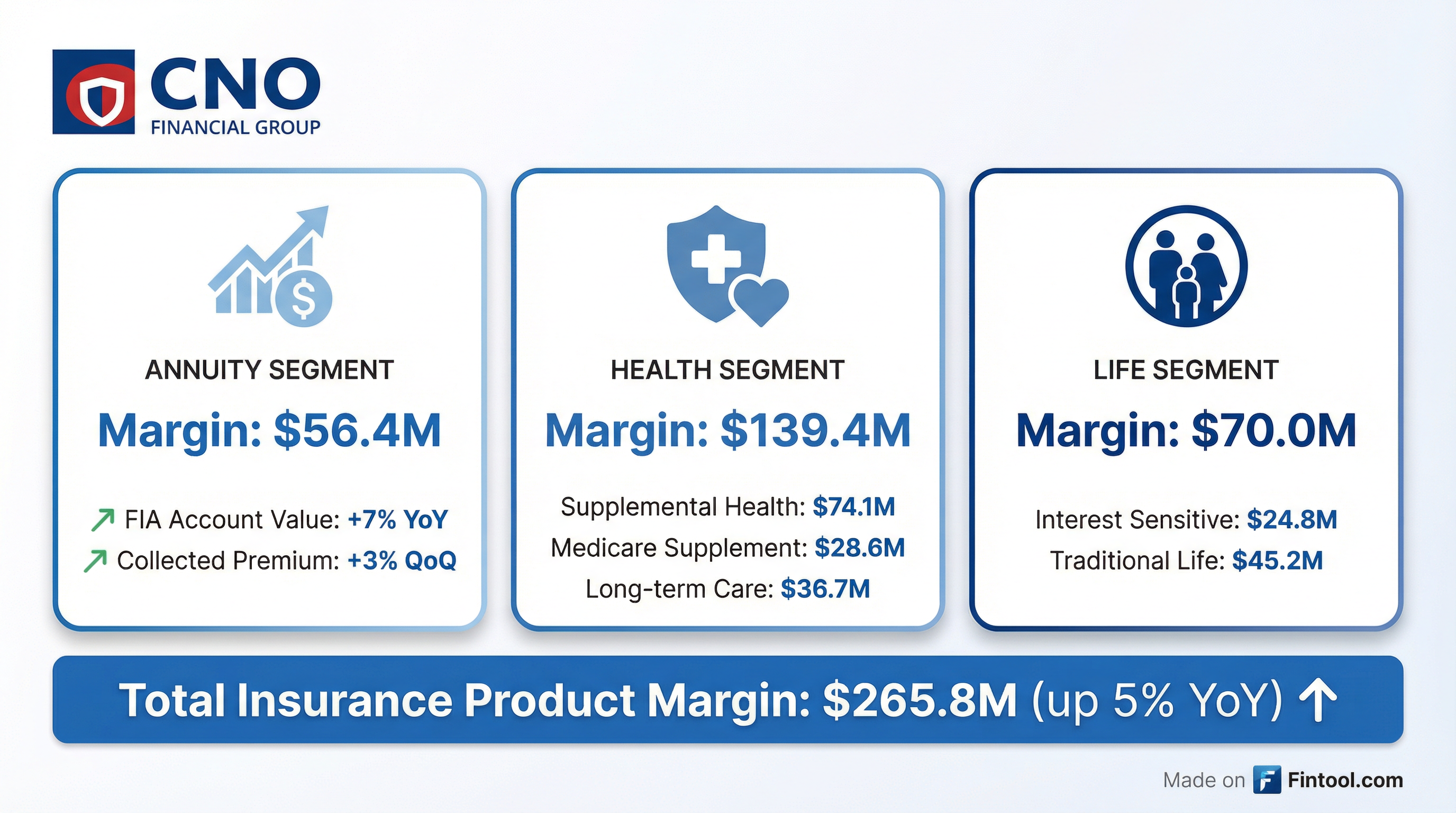

How Did Insurance Products Perform?

CNO's three product segments all delivered solid margins:

Key segment highlights:

- Annuity: Fixed indexed annuity account values grew 8% YoY to $11.6 billion. Annuity collected premiums hit $508.3M in Q4

- Health: Medicare Supplement NAP surged 92% in Q4—the best quarter since 2009. Supplemental health margin expanded on growth in the block

- Life: Traditional life margin improved to 25% of insurance policy income, up from 21% in FY 2024

What Did Management Guide?

2026 Guidance:

Longer-term target: Management is targeting a 200 basis point improvement in run-rate operating ROE through 2027, off a 2024 base of 10%.

The 2026 midpoint of $4.35 implies modest contraction from 2025's $4.40, but management emphasized this reflects normalized results without 2025's favorable actuarial review impacts ($37.5 million in significant items).

What Changed From Last Quarter?

Positive developments:

-

Worksite Exit Completed: CNO exited the fee services side of the Worksite business, taking a $17.3M non-operating charge. This streamlines the business and eliminates a drag on fee income

-

TechMod Progress: The three-year technology modernization initiative is on track with $20 million invested in 2025 and $75 million planned for 2026. The total investment of ~$170 million through 2027 is designed to modernize legacy systems. Free cash flow guidance is net of this investment.

-

Capital Position Strengthened: Debt-to-capital ratio improved to 26.2% from 32.1% a year ago, primarily due to repaying $500M in notes in Q2 2025

-

Bermuda Reinsurance: Executed second reinsurance transaction with Bermuda affiliate, bolstering free cash flow generation

Areas to watch:

- Net income declined 49% YoY in Q4 due to non-economic fair value changes and goodwill impairment—but these are excluded from operating earnings

- Q1 typically sees seasonally highest claims, mortality, and advertising expenses

How Did the Stock React?

CNO shares closed at $42.31 on February 5, 2026, down 0.7% on the day of the earnings release. The stock is trading near its 52-week high of $44.19.

Valuation context:

- Market Cap: ~$4.0 billion

- 50-day average: $41.92

- 200-day average: $39.43

The muted reaction suggests the beat was largely expected given CNO's consistent execution. The stock has gained ~22% over the past year.

What Did Analysts Ask?

On earnings emergence and future growth (Suneet Kamath, Jefferies): Management confirmed they are hitting target returns across the product portfolio, with the sales momentum of recent years now translating into earnings growth. CEO Bhojwani emphasized: "Beyond 2027, we would continue to see ROE improvement"—signaling the 12% target isn't the endpoint.

On macro headwinds and layoffs: Bhojwani acknowledged "significant lack of visibility" heading into 2026, noting layoffs could help recruiting but hurt discretionary purchases. Medicare Supplement sales should remain resilient as a non-discretionary product, but annuities, life, and long-term care could face pressure if economic conditions weaken.

"There's still 11,000 folks turning 65 every day, and those folks still have an absence of alternatives in terms of long-term planning. That represents the opportunity for us." — Gary Bhojwani, CEO

On Medicare Advantage vs Medicare Supplement: Management is "economically indifferent" between the two products, but operationally prefers Medicare Supplement because CNO manufactures and distributes it, and those consumers typically have higher net worth with better cross-sell opportunities.

On investment portfolio (Eric, CIO): Software exposure is approximately $250 million (~60-70 bps of assets), with a "strong tilt toward mission-critical software, systems of record, proprietary data, and cybersecurity." In alternatives, less than 10% of the $1.4B private credit allocation is exposed to software. Management sees potential opportunity if valuations cheapen.

On Bermuda reinsurance: CFO McDonough noted the guidance doesn't contemplate additional treaties beyond the two already in place, but the historical cadence of one transaction per year "should be a decent indication of the cadence going forward."

On demographics: Bhojwani confirmed the peak of 65-year-olds turning retirement age is expected around 2030-2035, after which the number will gradually decline but still represent a "very significant opportunity" for years to come.

What Are the Key Investment Considerations?

Bull case:

- 14 consecutive quarters of strong sales momentum

- Clear path to ROE improvement through 2027 (and beyond, per management)

- Strong capital position with low leverage (26% debt-to-capital)

- Attractive middle-market positioning with captive distribution moat

- 11,000 daily age-65 transitions provide secular demographic tailwind through 2030-2035

Bear case:

- 2026 operating EPS guidance implies slight decline from 2025

- Long-term care insurance (12% of liabilities) carries tail risk

- Goodwill impairment signals challenges in some business lines

- Rising competition in Medicare Supplement market

- Macro uncertainty could pressure discretionary product sales (annuities, life, LTC)

Forward Catalysts

- Q1 2026 Earnings: Expected early May 2026

- Investor Day: Watch for updates on 2027 ROE target progress

- Capital Deployment: $420.4M remaining share repurchase authorization

- TechMod Milestones: Three-year initiative runs through 2027

CNO Financial Group secures the future of middle-income America through its family of brands: Bankers Life, Colonial Penn, Optavise, and Washington National. The company serves 3.2 million policyholders with $38.8 billion in total assets.

Related: CNO Company Profile | Q4 2025 Earnings Transcript | Q3 2025 Earnings