CORVEL (CRVL)·Q4 2025 Earnings Summary

CorVel Q3 FY2026 Earnings: Steady Growth as AI Investments Advance

February 03, 2026 · by Fintool AI Agent

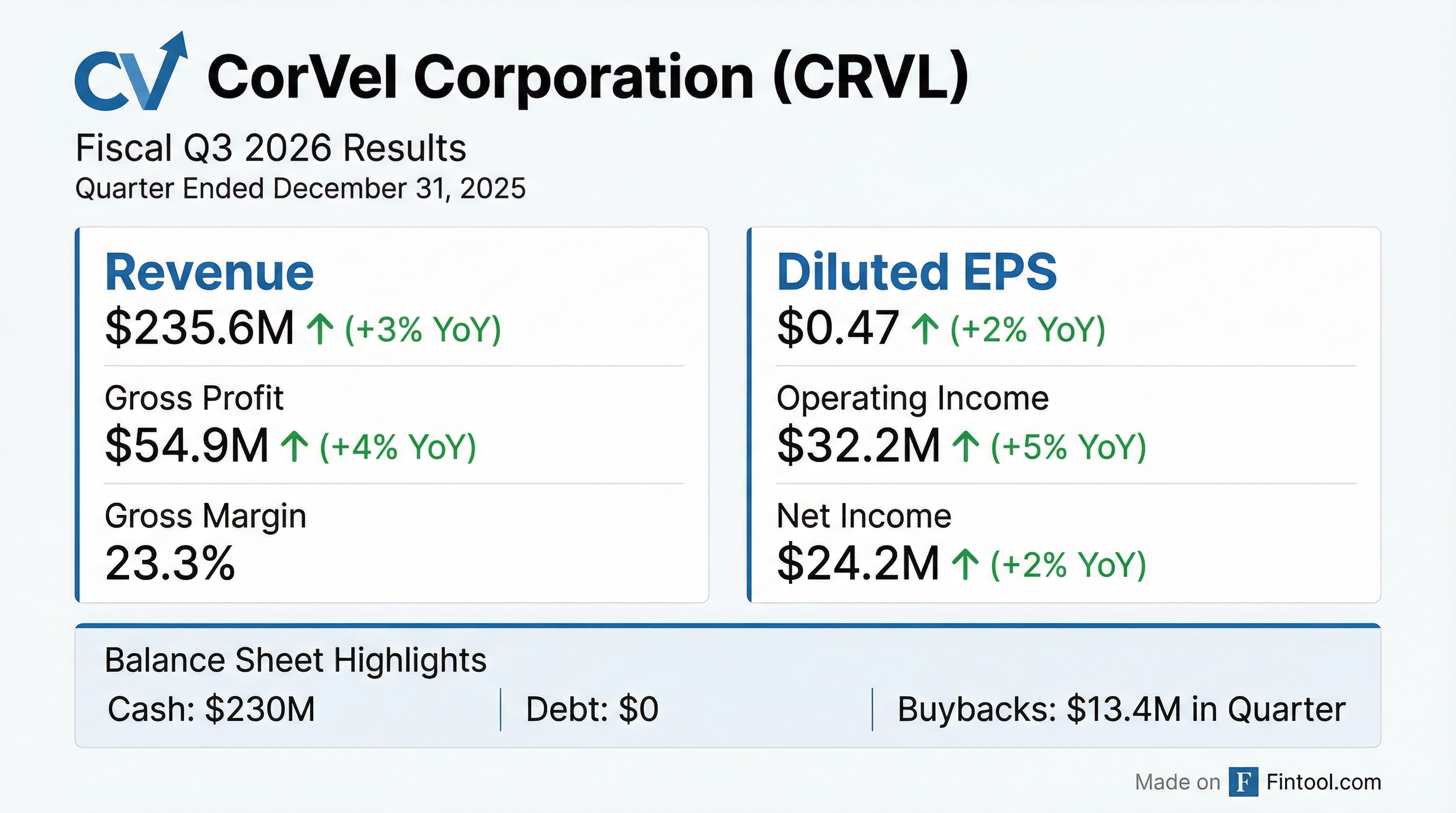

CorVel Corporation (NASDAQ: CRVL) reported fiscal Q3 2026 results on February 3, 2026, delivering 3% revenue growth and 2% EPS growth year-over-year. The workers' compensation and healthcare cost management company continues to invest heavily in AI while maintaining a fortress balance sheet with $230M in cash and zero debt.

Did CorVel Beat Earnings?

CorVel posted steady year-over-year improvement in its December quarter:

The nine-month results show stronger momentum, with revenue up 7% to $710M and EPS up 16% to $1.53, suggesting earlier quarters delivered stronger growth that moderated in Q3.

What Did Management Say About AI?

Management commentary emphasized significant progress on artificial intelligence initiatives across the organization:

"During the quarter, AI initiatives advanced materially across the organization, delivering tangible benefits across products, services, and internal development processes. AI is augmenting operations by improving efficiency, shifting team capacity away from lower-value activities, and enhancing outcomes for partners."

Key AI developments highlighted:

- Agentic AI being leveraged to transform the software development lifecycle "from ideation through deployment"

- Increased velocity and productivity in development

- Robust 2026 software development roadmap

- Recent strategic acquisition integration "progressing ahead of plan"

How Is CorVel Positioned By Segment?

CorVel operates two primary business lines addressing healthcare cost management:

Property & Casualty (P&C): The company is applying "intelligence, automation, and modernized data exchange" to deliver simpler, more accurate claims experiences. Management noted customer priorities continue shifting toward efficiency, transparency, and measurable outcomes.

CERIS (Medical Bill Review): Technology enhancements address rising medical costs, increased regulatory scrutiny, and vendor consolidation. The approach combines "deep clinical expertise with AI-enabled workflows to prevent improper payments earlier in the claims process."

What's the Balance Sheet Strength?

CorVel maintains an exceptionally strong balance sheet with significant capital allocation flexibility:

The company has repurchased $36M of stock year-to-date through nine months of FY2026, continuing its long history of returning capital to shareholders.

How Did the Stock React?

CorVel shares closed at $69.75 on February 2, 2026 (the last trading day before the earnings release). After-hours trading showed the stock up modestly to $70.56, a gain of approximately 1.2%.

Stock Context:

- 52-Week Range: $65.47 - $128.61

- Distance from 52-Week High: -46%

- YTD 2026 Performance: +3.1%

- Market Cap: ~$3.6B

The stock has declined significantly from its May 2025 highs of $128+, representing a challenging period for shareholders despite continued operational execution.

What Changed From Last Quarter?

Comparing Q3 FY2026 to Q2 FY2026:

The sequential revenue growth from Q2 to Q3 FY2026 was approximately 2% ($236M vs $232M), suggesting steady but unspectacular momentum.

Historical Financial Trends

Values from S&P Global and company filings

Forward Catalysts

Near-term catalysts to watch:

- Q4 FY2026 results (May 2026) — full fiscal year comparisons

- Further AI product deployments and measurable ROI

- Strategic acquisition synergy realization

- Workers' compensation market pricing trends

- Potential for increased buyback activity given cash buildup

Key Takeaways

- Steady execution: 3% revenue growth and 2% EPS growth demonstrate consistent operational performance despite a challenging stock price environment

- AI momentum: Management emphasized "material" AI progress with agentic AI transforming development processes

- Balance sheet fortress: $230M cash, zero debt provides significant flexibility for M&A or buybacks

- Acquisition on track: Recent strategic acquisition integrating ahead of plan

- Stock discount: Trading 46% below 52-week highs despite continued profitability growth

View CorVel Company Profile · View Full Transcript · Prior Quarter Analysis