COVENANT LOGISTICS GROUP (CVLG)·Q4 2025 Earnings Summary

Covenant Logistics Misses EPS on $24M Equipment Charge, But Sees Rate Momentum Building

January 30, 2026 · by Fintool AI Agent

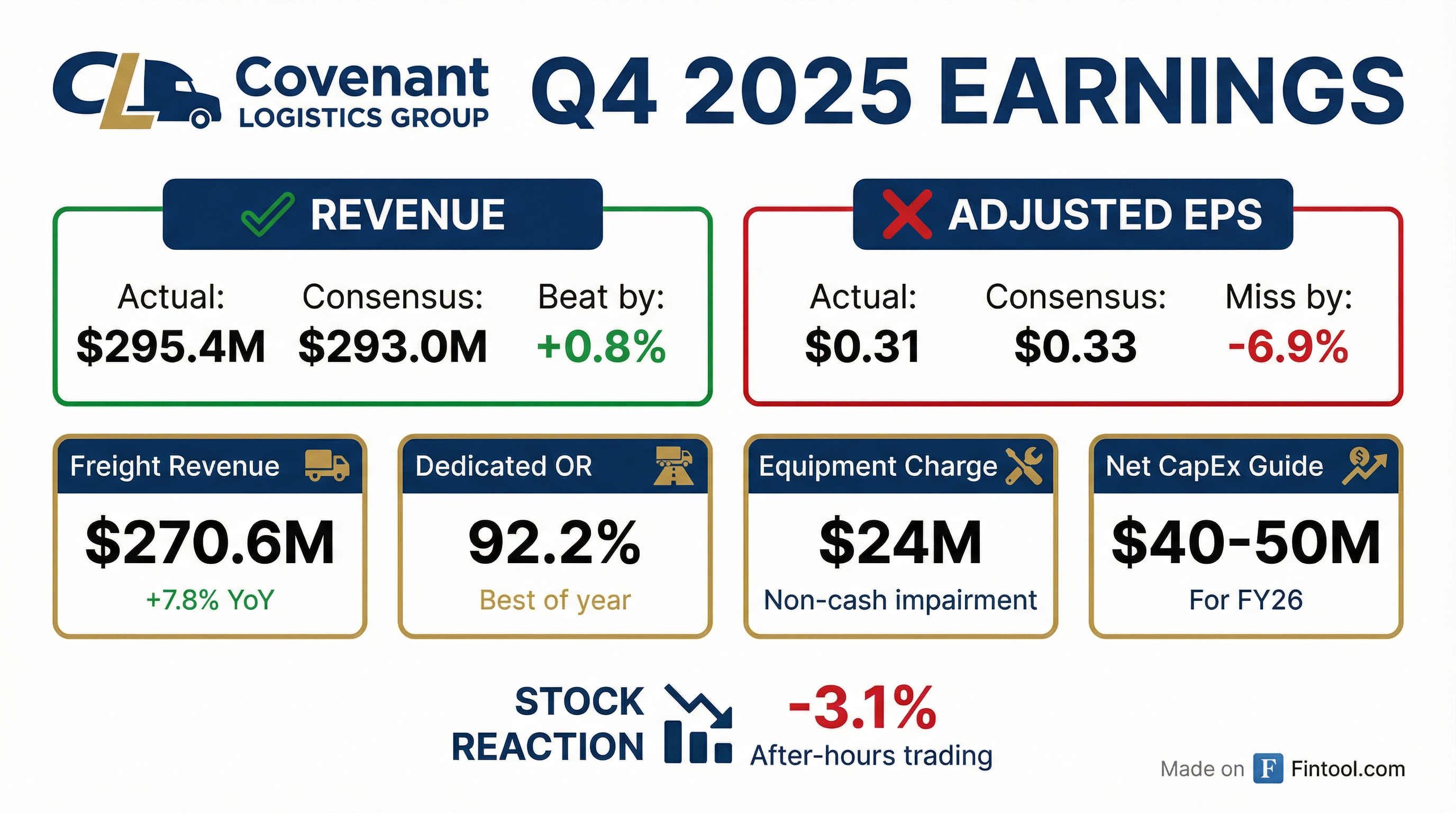

Covenant Logistics Group reported Q4 2025 results that showed revenue strength but margin compression, with a significant equipment impairment charge driving the EPS miss. More importantly for investors, management painted a bullish picture of the freight market turning—citing 33% higher bid activity, rate increases already secured, and capacity exiting the industry.

Did Covenant Logistics Beat Earnings?

Revenue: Beat by +0.8%

- Actual: $295.4M vs Consensus: $293.0M

- Consolidated freight revenue increased 7.8% YoY to $270.6M

Adjusted EPS: Missed by -6.9%

- Actual: $0.31 vs Consensus: $0.33

- GAAP EPS: -$0.73 (includes $24M non-cash equipment impairment)

Adjusted Operating Income: Shrank 39.4% to $10.9M due to margin compression in Expedited, Managed Freight, and Warehousing segments

*Values retrieved from S&P Global and company filings

What Drove the Equipment Charge?

The $24M non-cash impairment charge was the quarter's headline item. Management explained the rationale:

"With intentional fleet reductions and declining used equipment values in 2025, we deferred some trades, stacked up deliveries, and have too much underutilized equipment. To improve our operations and balance sheet, we have moved a group of assets to held-for-sale status and lowered our expectation on disposition prices."

Key details on the equipment charge:

- Fleet marked to market at fair value based on disposition channels

- No large gain/loss expected on subsequent sales—equipment repriced to current values

- Go-forward depreciation expected to be flat sequentially

- Average tractor age increased to 24 months (from 20 months YoY)

What Did Management Say About the Freight Market?

This was the most bullish freight market commentary from Covenant management in years. CEO David Parker expressed conviction that the industry is at or near equilibrium:

"We believe the freight market continues to evolve towards equilibrium between shippers and carriers. In fact, we might be at equilibrium now."

Evidence of market tightening:

Parker was emphatic about supply-side dynamics:

"I'm absolutely much more excited right now than I was three months ago... the green shoots are plentiful. Bids are up, we're getting new business at higher rates, and capacity is absolutely coming out of the market."

He pointed to DOT enforcement as a capacity driver—illegal CDL schools have been reduced from 39,000 to 33,000 under the new administration, with 6,000 shut down. Combined with English proficiency requirements, this is constraining driver supply.

How Did Each Segment Perform?

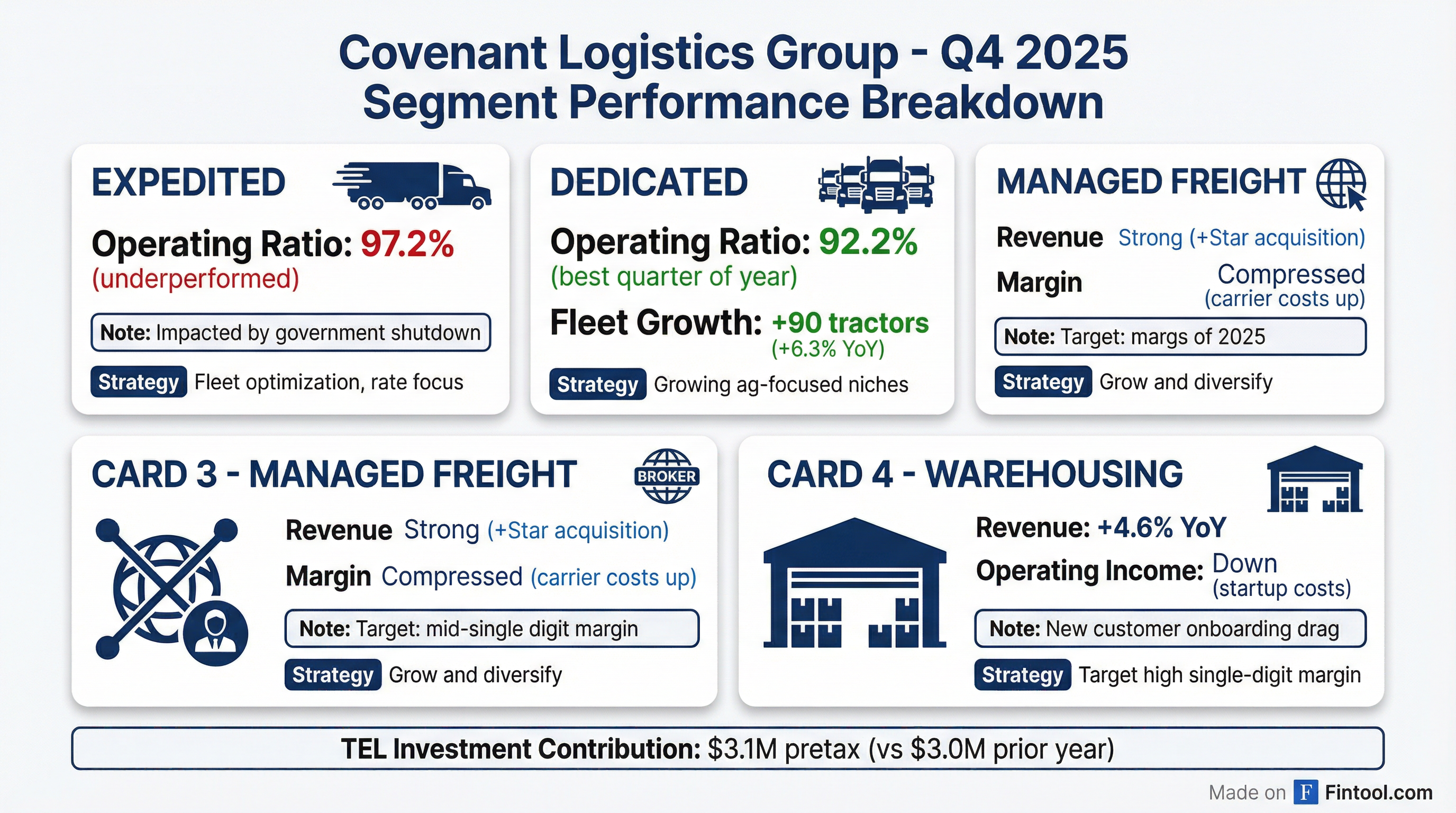

Expedited: Disappointing at 97.2% OR

- Operating ratio of 97.2% "did not meet expectations"

- Impacted by U.S. Government shutdown for nearly half the quarter

- Revenue per mile ex-fuel dropped due to lost military business

- Outlook: Expect 150-200 bps sequential OR improvement in Q1 if government business normalizes

- Long-term target: Operating ratio in the 80s

Dedicated: Best Quarter of the Year at 92.2% OR

- Operating ratio of 92.2% was the best of any quarter in 2025

- Grew fleet by 90 average tractors (+6.3% YoY)

- Continuing to win new business in high-service niches

- Strategy: "Weed and feed"—grow agricultural-related business, reduce commoditized exposure

- Long-term target: Operating ratio of 88-90

Managed Freight: Revenue Up, Margins Compressed

- Revenue benefited from Star Logistics Solutions acquisition (October 2025)

- Margins compressed due to rising cost to secure quality brokerage capacity

- Outlook: Q1 revenue likely below Q4 (which included peak season), then sequential growth

- Mid-single digit operating margin target generates acceptable ROIC given asset-light model

Warehousing: Growth with Startup Pain

- Freight revenue up 4.6% YoY (+$1.1M)

- Operating income declined $1.6M due to new customer startup costs and overtime

- Outlook: Q1 better than Q4, Q2 better than Q1—incremental improvement expected

- Target: High single-digit operating margin

What's the Star Logistics Acquisition?

Covenant acquired Star Logistics Solutions in October 2025, a small truckload brokerage with two niche customer bases:

- Government Emergency Management — State and federal disaster response contracts (episodic, high-margin)

- High-Service CPG Companies — Provides leverage to freight cycles that asset-based operations lack

"With synergies, we expect Star to be accretive to earnings during the first half of 2026."

The acquisition adds freight market upside that Covenant's asset-heavy model previously lacked. During the recent winter storms, this capability was already proving valuable:

"I was on the phone three times last night and twice already this morning... we're getting some really, really good rates on that, but that capacity out there is crazy tight."

What Did Management Guide?

Capital Plan for 2026:

- Net CapEx: $40-50M (down significantly from prior years)

- Fleet size: Modestly smaller by year-end 2026

- Goal: Reduce balance sheet leverage and improve return on capital

Fleet Strategy:

- Expedited: Trend down ~25 trucks per quarter as they optimize

- Dedicated: Flat truck count but improving margin profile

- Focus on "weed and feed"—exit commoditized freight, grow high-service niches

2026 Outlook:

"Regarding our outlook for the future, we remain optimistic about improving freight fundamentals, our ability to be more efficient with our equipment, and capture operating leverage and improve financial results in 2026. The improvements are likely to come later in the year."

Management cautioned that Q1 will face headwinds from seasonality, weather, and potential margin squeeze in Managed Freight.

How Did the Stock React?

Immediate reaction: Stock down ~3.1% to $25.03 in trading following the release

The stock has rallied significantly from its 52-week low, up over 40% from the ~$17.73 low, but remains 14% below the 52-week high.

What Changed From Last Quarter?

The biggest shift is in tone—management moved from "watching for signs" to "we might be at equilibrium now" with concrete evidence of rate increases and bid activity surging.

Q&A Highlights

On rate increases (David Parker):

"The average is kind of around that 3.5% number for the first three weeks of January... customers are very open. I think the customers realize that the industry has done horrible on rates for the last 4 years, and maybe there's some pity out there."

On capacity tightness (David Parker):

"Cargo theft has ticked up a little bit in the last 4 or 5 months... I'm seeing people say 'I need a high-value program. I need assets.' More in the past 6-8 weeks than in the last 6-8 months."

On go-to-market in an upturn (David Parker):

"I think the first couple of quarters when that happens... it's time to reclaim some of the profits that we've given away for the last four years. I'm not interested in running out and buying 200 trucks. I want to get my rates up to acceptable numbers."

On acquisition appetite (Tripp Grant):

"Doing an acquisition in 2026, in the midst of all this, could be beneficial long term, but I also think it creates a distraction. So our primary focuses are reducing our debt, providing flexibility, and taking advantage of this market swing."

What's Priced In Now?

The market appears skeptical of the turnaround narrative despite management's bullish commentary. The stock is trading at depressed multiples relative to normalized earnings potential:

Current valuation:

- Market cap: ~$628M

- Leverage ratio: 2.3x

- Return on invested capital: 5.6% (vs 8.1% prior year)*

The setup going forward depends on:

- Whether rate increases stick and expand beyond 3.5%

- Q1 weather impacts and government shutdown risk

- Managed Freight margin trajectory as carrier costs rise

- Used equipment market stabilization

If freight conditions continue improving as management expects, CVLG has significant operating leverage to normalized margins. The 80s OR target for Expedited and 88-90 for Dedicated would drive materially higher earnings.

*Values retrieved from S&P Global

Key Takeaways

- EPS miss was noise, not signal — The $24M equipment charge was a balance sheet cleanup, not an operational issue

- Freight market inflection — Management's most bullish commentary in years with concrete evidence (bids +33%, rates +3.5%)

- Dedicated momentum — 92.2% OR was the best quarter of 2025; agricultural niches continue to win

- Capital discipline — $40-50M net CapEx and smaller fleet prioritizes ROIC over growth

- Star adds optionality — Managed freight business now has freight cycle upside plus disaster response capability

- 2026 is back-half weighted — Q1 faces weather, seasonality, and potential margin pressure before improvements materialize

This analysis was generated by Fintool AI Agent based on Covenant Logistics Group's Q4 2025 earnings call held January 30, 2026.

Related: CVLG Company Profile | Q4 2025 Earnings Transcript | Q3 2025 Earnings