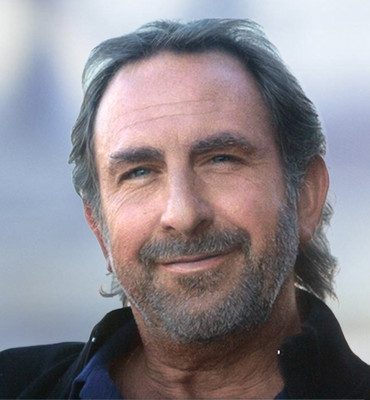

Jacob Lalezari

About Jacob Lalezari

Dr. Jacob P. Lalezari (age 66) is CytoDyn’s Chief Executive Officer, appointed CEO on January 26, 2024 after serving as Interim CEO beginning November 17, 2023 . He is a physician-executive with >30 years in clinical research; he founded and leads Quest Clinical Research and previously served as CytoDyn’s interim Chief Medical Officer/Chief Science Advisor in 2020 . Company pay-versus-performance data show a turnaround in FY2025: value of an initial $100 shareholder investment rose to 209.94 and net income of $3.745 million, versus losses in FY2024 and FY2023 (negative $49.841 million and $79.824 million), respectively . Education: M.D. (University of Pennsylvania), M.A. (University of Virginia), B.A. (University of Rochester); Board-certified in Internal Medicine .

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| CytoDyn | CEO | Jan 26, 2024–present | Leads development/financing strategy; appointed after interim tenure . |

| CytoDyn | Interim CEO | Nov 17, 2023–Jan 26, 2024 | Stabilization during transition and preparation for clinical restart . |

| CytoDyn | Interim CMO/Chief Science Advisor | Mar–Nov 2020 | Clinical/scientific guidance on leronlimab programs . |

| Virion Therapeutics | Chief Medical Officer | 2018 | Immunotherapy program leadership . |

| Quest Clinical Research (Lalezari Medical Corp.) | CEO & Medical Director | Founded 1989; ongoing | Ran Phase I–III trials across HIV, viral diseases; long-standing PI experience . |

External Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Siempre Unidos (Honduras) | Board Member & Medical Director | Since 2006 | Oversight of HIV/primary care clinics in Honduras . |

| NP2 (non-profit pharma) | Board Member & Vice President | Since 2018 | Non-profit drug development governance . |

Fixed Compensation

| Metric | FY 2024 | FY 2025 |

|---|---|---|

| Base Salary ($) | 152,242 | 400,000 |

| Target Bonus (% of salary) | 40% (effective Jan 26, 2024) | 40% |

| Actual Bonus Paid ($) | 70,000 (discretionary; tied primarily to lifting FDA clinical hold) | 30,000 (discretionary; performance goals not met) |

Notes: FY2025 Compensation Committee concluded none of the FY2025 goals were met but approved modest discretionary cash bonuses .

Performance Compensation

- Annual cash incentive plan metrics/weighting: Not quantitatively disclosed; target set at 40% of base salary; FY2025 goals mirrored Board strategic goals; Committee used discretion for payouts .

| Incentive | Metric | Weighting | Target | Actual/Payout | Vesting |

|---|---|---|---|---|---|

| Annual Cash Incentive (FY2025) | Corporate/individual goals | Not disclosed | 40% of salary | $30,000 discretionary (goals not met) | N/A |

| Annual Cash Incentive (FY2024) | Corporate/individual goals | Not disclosed | 40% of salary (pro-rated from Jan 26) | $70,000 discretionary (driven by lifting FDA clinical hold) | N/A |

| Stock Options (Grant 1) | Time-based options | N/A | 3,000,000 options (3/7/2024, $0.21 strike) | Grant-date fair value $459,624 | 46 equal monthly installments from 6/7/2024 (remaining 34 months from 6/7/2025) |

| Stock Options (Grant 2) | Time-based options | N/A | 3,000,000 options (10/28/2024, $0.13 strike) | Included in FY2025 option value $342,000 | 36 equal monthly installments from 6/30/2025 |

Additional context:

- In January 2024, the Compensation Committee canceled underwater options and re-granted at $0.21 with identical vesting to better align incentives, a practice that reduces dilution vs. issuing incremental awards but is a repricing red flag .

Equity Ownership & Alignment

| Ownership Detail | Value |

|---|---|

| Total beneficial ownership (Sep 15, 2025) | 2,312,500 shares; less than 1% of outstanding |

| Vested vs. unvested options (May 31, 2025) | Exercisable: 1,625,000 (875,000 @ $0.21 exp 3/7/2034; 750,000 @ $0.13 exp 10/28/2034); Unexercisable: 4,375,000 |

| Shares pledged as collateral | No pledging disclosure; company prohibits hedging; pledging not specified |

| Insider transactions (recent) | Form 4 filed Oct 30, 2024 reporting 3,000,000 option grant dated Oct 28, 2024 (time-vested, $0.13 strike) |

| Ownership guidelines | Not disclosed in proxy; anti-hedging policy in place |

Employment Terms

- Agreement: At-will employment; either party may terminate at any time; initial base salary $400,000; eligible for annual bonus (target 40%) and equity awards under 2012 Plan .

- Severance: No severance benefits provided under CEO employment agreement .

- Change-in-control/tax: 280G “modified cutback” applies to avoid excise tax; clawback compliance per applicable laws and company policies .

- IP/Confidentiality: Employee inventions assignment and NDA remain in force; Delaware law/jurisdiction .

Compensation Structure Analysis

- Cash vs. equity mix: Equity-heavy via large annual option grants (3.0 million in FY2024 and 3.0 million in FY2025), aligning upside to long-term share price but creating potential dilution .

- Shift/guarantees: Base salary steady at $400k; FY2025 performance goals not met yet discretionary bonus paid ($30k), diluting strict pay-for-performance linkage .

- Repricing risk: January 2024 cancel-and-regrant of underwater options at $0.21 (identical vesting) is a governance red flag despite dilution rationale .

- Consultant/peer group: Aon/Radford advises committee; FY2025 peer group comprised 17 pre-commercial biotech peers (Phase I/II) .

Related Party Transactions

- Quest Clinical Research (owned by Dr. Lalezari) served as a clinical site for prior COVID-19 trials; terms negotiated by former CRO pre-dating his CEO role. Since June 1, 2023: largest balance owed ≈ $0.4 million; payments ≈ $0.1 million; outstanding ≈ $0.3 million as of Aug 31, 2025 . Prior disclosure shows cumulative payments since June 1, 2021 ≈ $1.2 million; outstanding ≈ $0.4 million as of Aug 31, 2024 .

Performance & Track Record

- Execution markers: Compensation committee cited lifting of FDA clinical hold in FY2024 in awarding discretionary bonuses to management, including $70k to the CEO .

- Financial outcomes: Pay-versus-performance table shows FY2025 value of $100 investment at 209.94 and net income of $3.745 million vs. FY2024/FY2023 net losses (–$49.841 million; –$79.824 million) .

- Capital/going-concern context: Auditor reports in prior years included substantial doubt about going concern; auditor transitions in 2024–2025 (MGO to BF Borgers to Marcum to CBIZ) .

Compensation Committee & Governance

- Committee composition (FY2025): S. Simes (Chair), T. Urbach, K. Brunke – all independent .

- Anti-hedging policy prohibits hedging transactions in company stock; pledging not specified .

- Director comp/structure disclosed; not directly applicable to CEO analysis .

Multi‑Year CEO Compensation Summary

| Metric | FY 2024 | FY 2025 |

|---|---|---|

| Salary ($) | 152,242 | 400,000 |

| Bonus ($) | 70,000 | 30,000 |

| Stock Option Awards – Grant-date Fair Value ($) | 459,624 | 342,000 |

| All Other Compensation ($) | 3,500 | 11,850 |

| Total ($) | 685,366 | 783,850 |

Outstanding CEO Equity (as of May 31, 2025)

| Grant | Exercisable | Unexercisable | Strike | Expiration | Vesting Details |

|---|---|---|---|---|---|

| Options (3/7/2024) | 875,000 | 2,125,000 | $0.21 | 3/7/2034 | Remaining 34 equal monthly installments from 6/7/2025 |

| Options (10/28/2024) | 750,000 | 2,250,000 | $0.13 | 10/28/2034 | 36 equal monthly installments from 6/30/2025 |

Insider Activity & Potential Selling Pressure

- Reported insider filing for the CEO on Oct 30, 2024 (Form 4) reflected the 3,000,000 option grant dated Oct 28, 2024; time-based vesting; no sales disclosed in that filing . The FY2025 proxy’s outstanding awards corroborate the two large grants (0.21 and 0.13 strike) and vesting cadence .

Investment Implications

- Alignment and risk signals: Heavy use of time-vested options aligns upside with TSR but discretionary bonuses despite unmet FY2025 goals and the January 2024 cancel-and-regrant indicate weaker pay-for-performance discipline (red flag) . Low personal beneficial ownership (<1%) limits “skin-in-the-game,” though large unvested options create retention hooks .

- Overhang/pressure: 6.0 million CEO options outstanding with monthly vesting create potential incremental supply from exercises and sale-to-cover over time, though no CEO sales were disclosed in the cited filing; monitor additional Forms 4 for selling pressure .

- Governance/related parties: RPTs with Quest are disclosed and governed by Audit Committee policy; continued balances may draw investor scrutiny; anti-hedging policy in place, pledging not addressed .

- Retention/exit economics: CEO has no contractual severance; company-level change-in-control costs for CEO are limited, with 280G cutback and clawback provisions embedded—generally shareholder-friendly on exit economics .

- Company execution context: FY2025 positive PVP and net income are constructive, but historical going-concern disclosures and auditor changes highlight funding/execution risk, a factor for incentive design and investor confidence .