CITIZENS & NORTHERN (CZNC)·Q4 2025 Earnings Summary

Citizens & Northern Beats on Adjusted EPS as Susquehanna Merger Drives 39% NII Growth

January 28, 2026 · by Fintool AI Agent

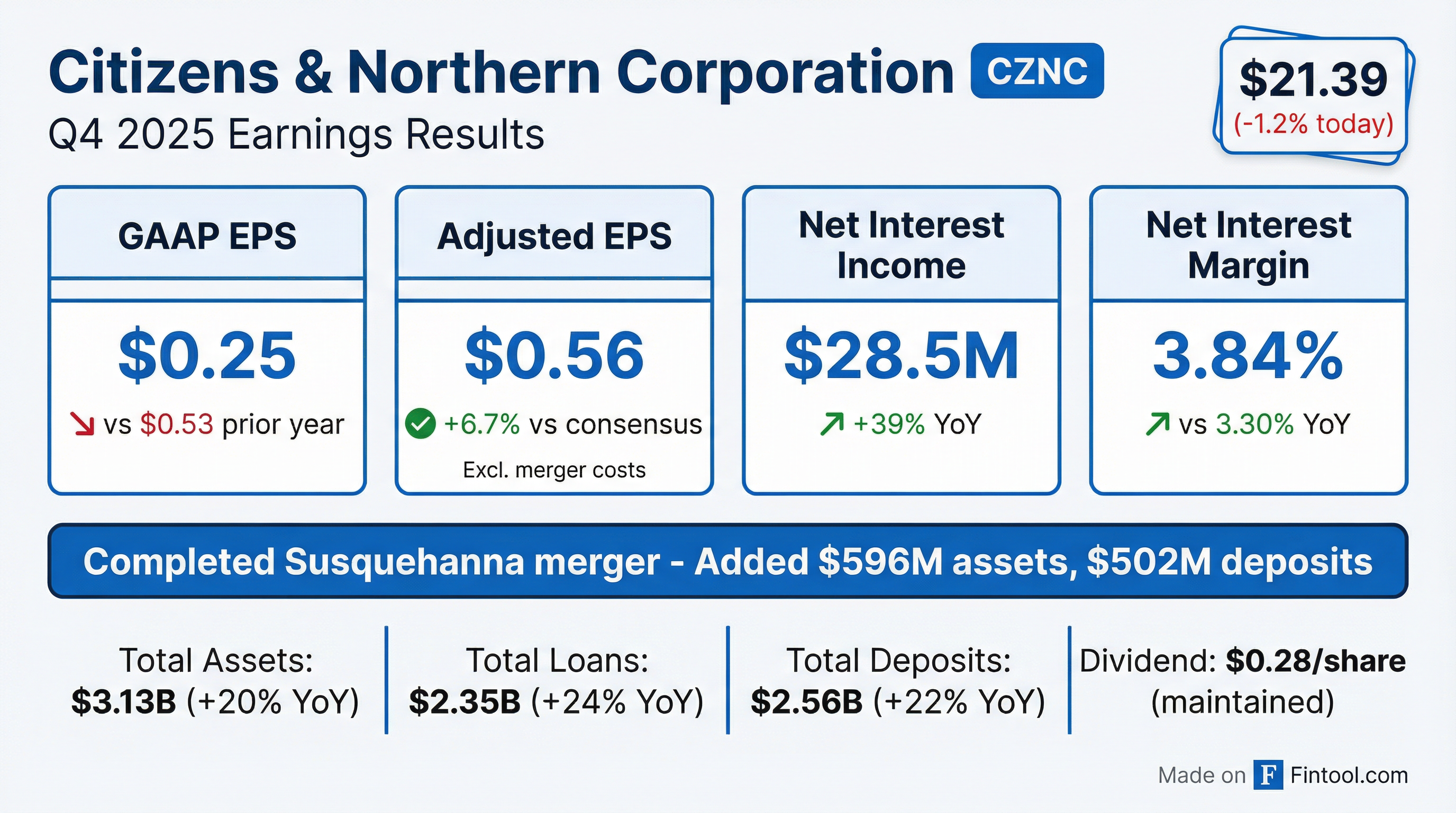

Citizens & Northern Corporation (NASDAQ: CZNC) reported Q4 2025 results that showcased the transformative impact of its Susquehanna Community Financial merger, completed October 1, 2025. While GAAP earnings were depressed by $6.9M in merger-related costs, adjusted EPS of $0.56 beat consensus by 6.7% . Net interest income surged 39% year-over-year to $28.5M as the combined entity benefits from improved scale and an expanded net interest margin of 3.84% .

Did Citizens & Northern Beat Earnings?

The headline number masks the underlying strength. GAAP EPS of $0.25 fell well short of the prior year's $0.53, but this comparison is misleading . Excluding $6.9M in pre-tax merger-related expenses (primarily system conversion, severance, and professional fees), adjusted EPS came in at $0.56 — beating both the consensus estimate of $0.525 and last quarter's adjusted EPS of $0.47 .

The merger-related expenses break down as follows :

- Core system conversion costs

- Severance payments

- Legal and professional fees

- Total pre-tax impact: $6.9M in Q4, $7.9M for full year 2025

What Did the Susquehanna Merger Add?

The October 1, 2025 merger with Susquehanna Community Financial was the defining event of the quarter . The transaction added substantial scale to Citizens & Northern's franchise:

Susquehanna operated in Lycoming, Northumberland, Snyder and Union counties in central Pennsylvania, giving CZNC expanded geographic reach . C&N issued approximately 2.3 million shares to former Susquehanna stockholders, valuing the deal at $44.6 million .

Purchase accounting impact: The acquisition added $10.8M in goodwill and $10.7M in core deposit intangibles, diluting tangible book value per share by $0.56 or 3.6% .

How Did Net Interest Margin Expand?

Net interest margin improvement was the standout story, reaching 3.84% in Q4 2025 — up 22 basis points from Q3 and 54 basis points year-over-year .

What drove the expansion?

- Deposit mix shift: Average brokered deposits plummeted from $61.5M in 2024 to $11.1M in 2025, reducing funding costs

- Yield improvement: Average yield on earning assets increased 12 bps QoQ while cost of funds decreased 25 bps

- Purchase accounting accretion: The merger contributed $789K in net accretion income, including $486K on loans and $303K on time deposits

- Securities portfolio restructuring: Post-merger, CZNC sold most of Susquehanna's securities and reinvested at higher yields, boosting the average portfolio yield to 3.03% from 2.71%

How Did the Stock React?

CZNC shares closed at $21.39 on January 28, 2026, down 1.2% on the day of the earnings release. After-hours trading showed additional weakness at $21.21.

The muted reaction likely reflects:

- GAAP earnings miss headline obscuring adjusted beat

- Market already pricing in merger synergies

- Conservative investor base typical of community banks

What Changed From Last Quarter?

Sequential improvements across core metrics:

The dramatic jump in loans and deposits reflects the full-quarter contribution from Susquehanna's portfolio. Organic loan growth was modest, with the merger accounting for $394M of the $409M increase .

What Are the Risks?

Credit quality bears watching. Nonperforming assets rose to 1.06% of total assets, up from 0.92% a year ago . This includes $6.8M of purchase credit deteriorated (PCD) loans acquired from Susquehanna .

The Q4 provision for credit losses was $1.32M, down from $2.16M in Q3 but up significantly from a credit of $531K in Q4 2024 . The allowance for credit losses now stands at $31M, including $7.1M added at acquisition for Susquehanna's loan portfolio .

Commercial real estate concentration: Non-owner occupied CRE totaled $570M at quarter-end, representing 24% of total loans. Office exposure specifically was $125M (5.3% of loans), with two loans totaling $2.8M in nonaccrual status .

What Is Management's Outlook?

Management did not provide explicit forward guidance but signaled confidence through:

- Maintained dividend: $0.28 per share quarterly, unchanged despite merger integration

- Strong liquidity: $1.2 billion in available funding sources, covering 149% of uninsured deposits

- Capital strength: All regulatory capital ratios exceed well-capitalized thresholds

Integration timeline: Merger expenses should wind down in early 2026 as system conversion is substantially complete. The company incurred $6.9M of its $7.9M total merger costs in Q4 alone , suggesting most heavy lifting is done.

Capital Allocation Priorities

Full Year 2025 Summary

The Bottom Line

Citizens & Northern delivered on the promise of its Susquehanna merger in Q4 2025. Strip away the one-time integration costs and you find a bank with improving fundamentals: adjusted EPS up 19% sequentially, net interest margin at its highest level in years, and meaningful scale gains. The 39% YoY surge in net interest income demonstrates what a well-timed community bank merger can achieve.

The near-term GAAP noise should clear by Q1 2026 as integration winds down. Investors focused on the $0.25 headline miss may be overlooking the underlying earnings power now approaching $2.00+ on an annualized adjusted basis.

Key metrics to watch going forward:

- Net interest margin sustainability above 3.75%

- Credit quality trends in the acquired Susquehanna portfolio

- Organic loan growth post-integration

- Operating expense normalization

For more on Citizens & Northern, see company research or read the full earnings call transcript.