DEUTSCHE BANK AKTIENGESELLSCHAFT (DB)·Q4 2025 Earnings Summary

Deutsche Bank Delivers Record €7.1B Profit, Beats on EPS and Revenue

January 29, 2026 · by Fintool AI Agent

Deutsche Bank delivered a strong finish to its transformation, beating Q4 2025 estimates on both EPS (+14.8%) and revenue (+3.5%) while posting record annual profits of €7.1 billion. The German lender achieved all 2025 targets, including a 10.3% return on tangible equity (ROTE) and 64% cost-income ratio, setting the stage for its "scaling the global house bank" strategy through 2028.

Did Deutsche Bank Beat Earnings?

Deutsche Bank delivered a solid double-beat in Q4 2025:

For the full year, the results were even more impressive:

Values retrieved from S&P Global and company filings.

CEO Christian Sewing emphasized the milestone: "We delivered on all our 2025 targets. Thanks to strong momentum across all our businesses, we reported revenues of €32 billion... We delivered record profits in 2025, with pre-tax profit of €9.7 billion and net profit of €7.1 billion."

What Did Management Guide for 2026?

Deutsche Bank raised the bar for 2026, signaling confidence in continued momentum:

CFO James von Moltke noted that NII growth will be largely "locked in through swaps" with around 90% of the structural hedge rollover secured. The bank expects provisions for credit losses to "trend moderately downwards in 2026" as commercial real estate pressures ameliorate.

For Q1 2026 specifically, management set a baseline expectation of flat revenues year-over-year, but added: "we are encouraged by the very good start we've seen in January." Incoming CFO Raja Akram noted planning assumptions used $1.18 EUR/USD exchange rate, with current rates "completely manageable."

The longer-term roadmap targets >13% ROTE by 2028 and a cost-income ratio below 60%, up from 10.3% and 64% respectively in 2025.

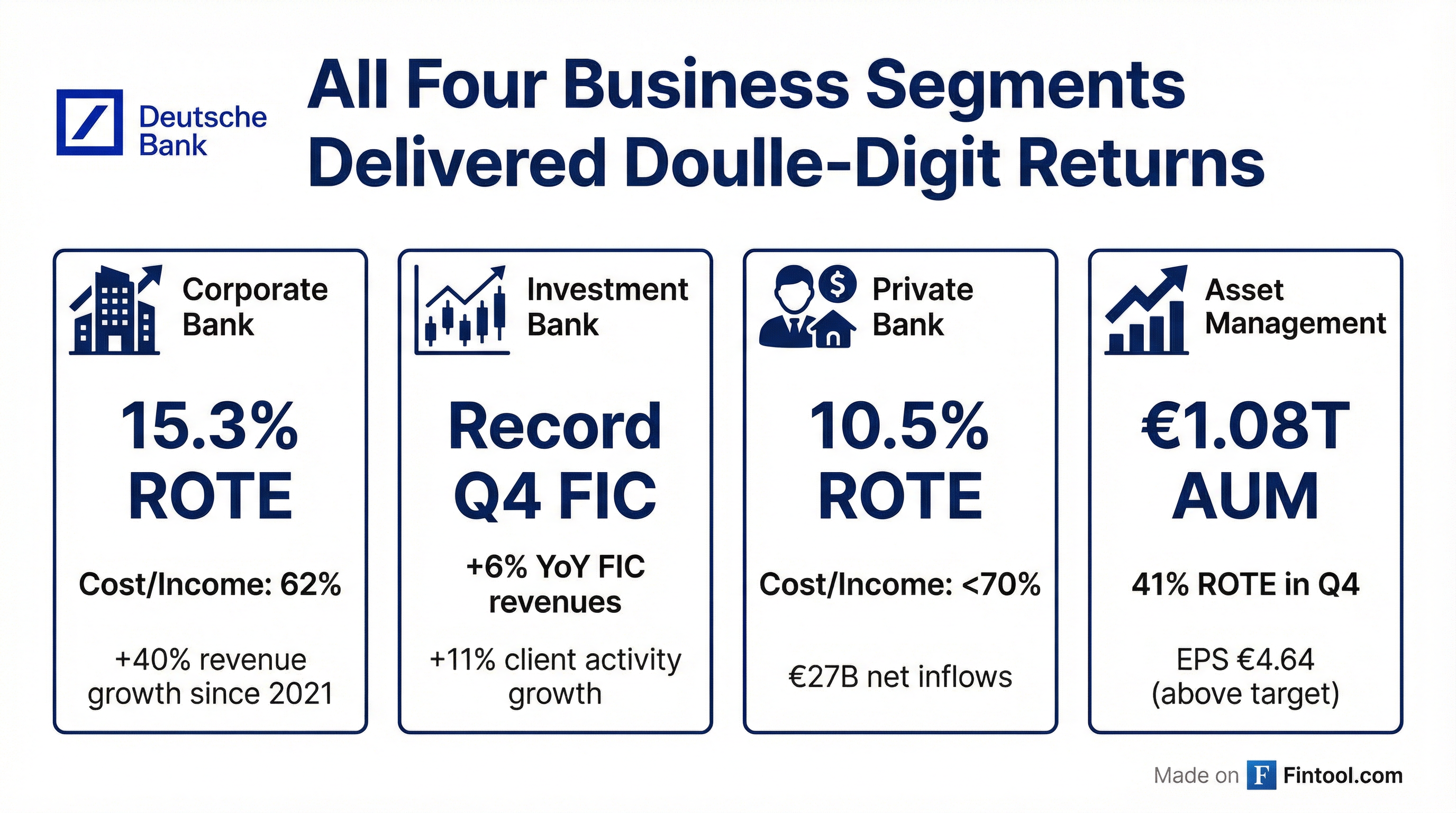

How Did Business Segments Perform?

All four divisions achieved double-digit returns in 2025 for the first time, validating the "global house bank" strategy:

Corporate Bank

- ROTE: 15.3% | Cost-Income: 62%

- Revenues stable despite lower rates and FX pressures

- Deposits increased €25 billion in Q4 alone

- Revenue growth of 40%+ since 2021

- Net fee and commission income grew 5% YoY

Investment Bank

- Q4 FIC revenues: +6% YoY (strongest Q4 on record)

- Client activity up 11% in 2025

- IBCM pipeline "strongest it has been at this point for a number of years" — double-digit higher than 2025

- January start: "Super strong start in January" for debt origination

Private Bank

- ROTE: 10.5% | Cost-Income: <70%

- NII growth of 10% year-over-year

- €27 billion net inflows for the year

- 126 branch closures completed, ~1,600 workforce reductions; 100 more closures planned for 2026

- Wealth Management: 24 relationship managers hired in first 3 weeks of January, 40 more signed

Asset Management (DWS)

- AUM: €1.08 trillion

- Q4 ROTE: 41%

- Full-year EPS of €4.64 (beat targets)

- €10 billion net inflows in Q4

- Raised 2028 targets: 10-15% annual EPS growth, cost-income ratio below 55% by 2027

What About Capital Returns and Dividends?

Deutsche Bank significantly accelerated shareholder returns, exceeding its multi-year target:

Cumulative distributions for 2021-2025 reached €8.5 billion, exceeding the original €8 billion target. Management indicated plans for an additional share buyback in H2 2026: "We will be looking to do a further share buyback this year."

CEO Sewing on the buyback process: "If we deliver on our plan, and I don't see any clouds for the time being that we can't deliver, then I think we have all the right to have another discussion with the regulator."

The CET1 ratio of 14.2% provides a strong capital buffer, even after absorbing Q4 headwinds including the discontinuation of transitional rules for sovereign debt (+27 bps impact) and annual operational risk-weighted asset updates (+17 bps).

Management targets operating between 13.5%-14% CET1 on an ongoing basis and plans to increase Significant Risk Transfers (SRTs) by approximately 25% over the next couple of years — €5 billion incremental for 2026 and 2027.

Funding Strategy and Liability Stack Optimization

Deutsche Bank made a notable strategic decision regarding its funding composition. The bank will no longer seek to benefit from the Moody's Loss Given Failure (LGF) notch in its senior non-preferred rating — a voluntary decision that aligns with European peers.

Group Treasurer Richard Stewart explained the rationale: "We have been benefiting from the LGF notch in our Senior Non-Preferred rating during our transformation phase, which is now in the rearview mirror. We've seen two upgrades of our ratings with Moody's, which positions our senior non-preferred rating well within investment-grade territory."

The move allows Deutsche Bank to rebalance from senior non-preferred to senior preferred, making the overall balance sheet more efficient. The 2026 issuance plan reflects this:

The bank's improved credit profile was further validated by S&P raising its outlook to positive in Q4 2025, driven by improving earnings and greater resilience. Recent issuances achieved the bank's tightest spreads since the introduction of Tier 2 and AT1 debt classes.

How Did the Stock React?

Despite the strong results, Deutsche Bank shares traded modestly lower on the day as results were largely priced in after the strong rally.

The muted reaction likely reflects:

- Results largely priced in — stock had rallied 112% from 52-week lows

- Cautious Q1 guidance — management guided flat revenues YoY

- Investment phase ahead — €900 million incremental investments in 2026

Over the past 8 quarters, Deutsche Bank has beaten on both EPS and revenue in 5 of 8 quarters, demonstrating consistent execution.

What Changed From Last Quarter?

Key shifts from Q3 2025:

The most notable shift was the CFO transition — James von Moltke presented his final quarterly results before handing over to Raja Akram. CEO Sewing acknowledged: "The successes we are discussing with you today owe a great deal to James' professionalism and his outstanding dedication to our bank."

In his final remarks, von Moltke reflected: "Being able to hand over the CFO role at a moment when the bank stands on strong foundations, enjoys business momentum and strong client engagement, and is able to execute with discipline and purpose, is deeply meaningful."

Key Management Quotes

On 2025 delivery:

"We delivered on all our 2025 targets... We see this as a great start towards our commitment of greater than 13% by 2028." — CEO Christian Sewing

On 2026 outlook:

"Business momentum going into 2026 has been good and sets us up well as we start scaling our franchise." — CFO James von Moltke

On European positioning:

"We are seen as the European alternative, also outside Europe, for the clients, is gaining momentum." — CEO Christian Sewing

On investor sentiment:

"The biggest theme in Davos last week, next to all the geopolitical discussions, was actually the investors talking about redistributing their assets... they see alpha in Europe, and they see alpha in Germany." — CEO Christian Sewing

On long-term ambition:

"Delivering on our 2028 agenda will enable us to reach our long-term goal to become the European champion in banking." — CEO Christian Sewing

On what "European Champion" means:

"In all the key segments that we engage in as a European bank... we want to be in market leading position. We already have a leading position in FIC in Europe. We are number 3 in Asia. We are number 7 in the US, so we have aspiration to be number 5 in the US, and that would actually make us the leading European bank in that space." — Incoming CFO Raja Akram

Q&A Highlights: What Analysts Asked

On German Stimulus and Growth Timing

When pressed on the path from 3% revenue growth in 2026 to 6% in 2027-2028, incoming CFO Raja Akram explained: "We have around an 8% conviction on the corporate bank... you can expect to see us exiting out of this year on corporate bank, perhaps not at the 8%, but mid-single digits."

CEO Sewing added critical color on timing: "EUR 2 billion out of EUR 5 billion we actually planned from Germany as an increase in revenues. Actually, the smallest part, a low three-digit million EUR number, is only in our plan for 2026. The real impact of that, what is happening in Germany, is in our revenue plan for 2027, 2028."

On FRTB Regulatory Relief

Multiple analysts asked about regulatory capital headwinds. CEO Sewing signaled optimism: "I witnessed over the last 12 weeks... a real reconsideration on the European side, what happens with regulation. The word simplification, the word reduction of regulation in certain items is gaining speed... I would be more than surprised, actually, if this [FRTB] would come into play."

The bank has budgeted FRTB impact conservatively, creating potential upside to capital ratios.

On Deposit Competition

When asked about competitive pricing pressure in Germany, Raja Akram noted: "We're certainly seeing some competitors coming in with teaser rates in January... We also have some campaigns running, so at this point, from a growth strategy perspective, we don't see an impact of us losing out on these deposits."

On the corporate side: "We have not seen too much deposit pricing trends changing... it's just not a matter of pricing, it's the capability that comes with it. It's, do they have the operational reliability? Do they have the network to move cash around?"

On Commercial Real Estate Tail Risk

CFO von Moltke was cautious: "I'm a little snakebit, having thought we'd seen a bottom in this market before, and then seen more floors broken through. Will there be really a floor put under the market this year in 2026? Particularly in the West Coast office sub-market... we do think we're in the tail of this cycle."

Von Moltke specified the geographic concentration: "West Coast is really our exposures that are challenged are in Seattle and LA." The challenges stem from new appraisals coming in lower, tenant departures reducing cash flows, and visible market valuations.

The bank exited approximately $2 billion of office exposure in Q4, with payoffs of low-LTV loans increasing the average LTV of the remaining book.

On Wealth Management Expansion

CEO Sewing provided hiring updates: "In the first three weeks of January, we have already from his anticipated growth, 24 people, relationship managers on the platform, another 40 have been hired."

On the AML Investigation

When asked about the Frankfurt prosecutor's visit, von Moltke addressed it directly: "The prosecutor is looking for information... on transactions that date back to the period between 2013 and 2018... We do not anticipate that it will have any impact on our financial or strategic plans."

What Are the Risks?

- Interest rate headwinds: Lower rates and FX pressures will impact H1 2026 comparisons before hedge benefits kick in — though management noted that with the German yield curve at its steepest since 2019, the bank benefits from higher long-term rates through its hedging strategy

- Commercial real estate: While improving, CRE provisions remain elevated with one larger single-name event in Q4; West Coast office market still uncertain

- Investment spend: €900 million incremental investments in 2026 will pressure near-term profitability

- Macro uncertainty: Management noted "elevated macroeconomic and geopolitical uncertainty"

- AML investigation: Frankfurt prosecutor reviewing 2013-2018 transactions for potential delayed suspicious activity reporting (no financial impact expected)

Forward Catalysts

- Q1 2026 results (late April) — First quarter under new CFO Raja Akram

- AGM (May 2026) — €1.00 dividend vote

- H2 2026 — Potential additional share buyback

- 2028 targets — >13% ROTE, <60% cost-income ratio

This analysis was generated by Fintool AI Agent based on Deutsche Bank's Q4 2025 earnings call transcript, Fixed Income Conference Call, and S&P Global data. Last updated: January 30, 2026.