DHT Holdings (DHT)·Q4 2025 Earnings Summary

DHT Holdings Delivers Blowout Q4 as VLCC Spot Rates Surge 80%

February 5, 2026 · by Fintool AI Agent

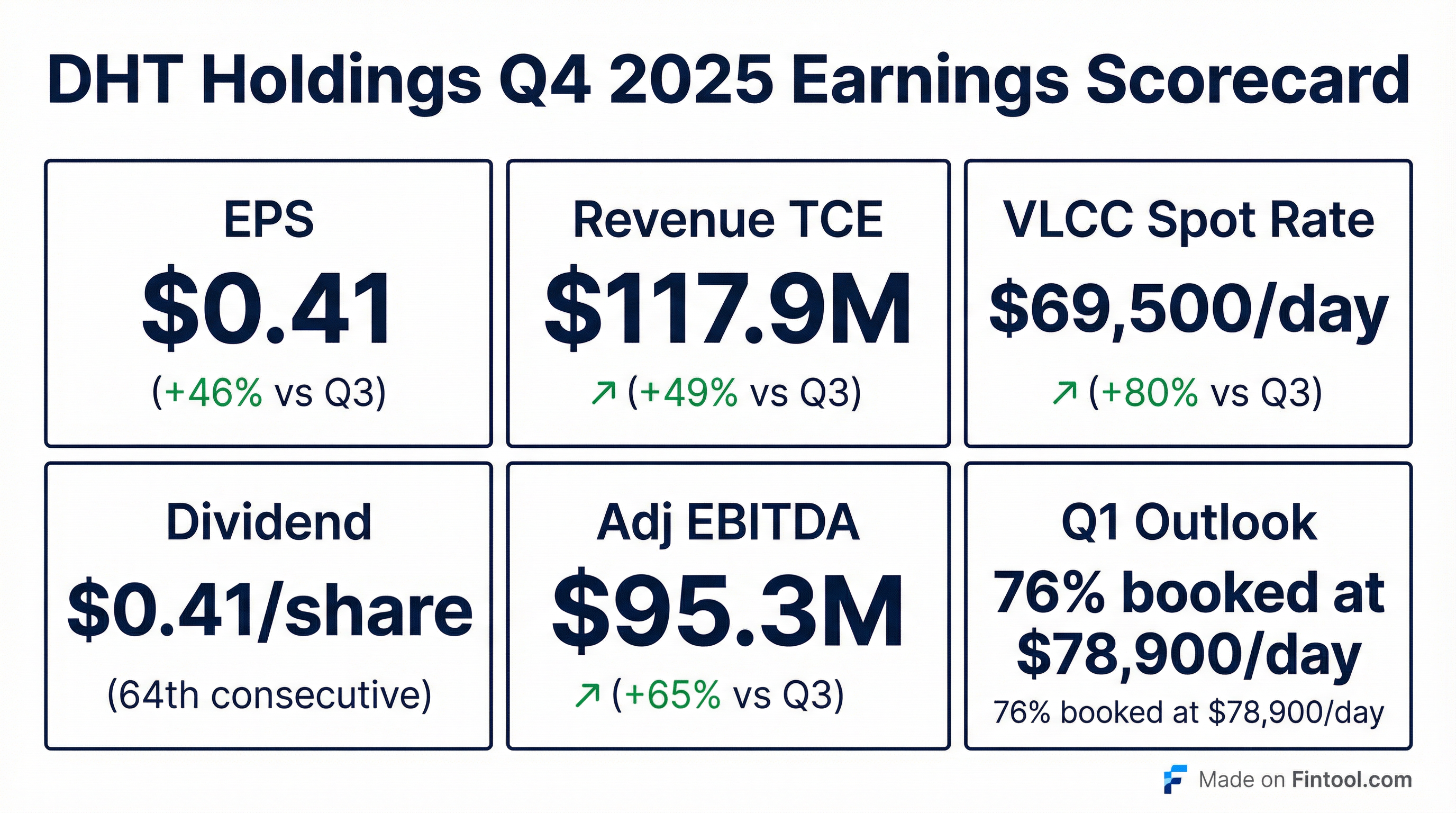

DHT Holdings (NYSE: DHT) reported a standout fourth quarter, with EPS of $0.41 more than doubling from Q3's $0.28 as VLCC spot rates surged 80% to $69,500/day . The crude oil tanker operator declared a matching $0.41 dividend—its 64th consecutive quarterly payout—and signaled even stronger conditions ahead with Q1 2026 spot bookings at $78,900/day .

The stock traded up approximately 1.9% after hours to $14.20, adding to a 47% gain over the past 12 months.

Did DHT Holdings Beat Earnings?

DHT's Q4 2025 results significantly exceeded prior quarters across all key metrics:

The dramatic improvement was driven by a surge in VLCC spot rates from $38,700/day in Q3 to $69,500/day in Q4—an 80% jump reflecting robust demand for compliant seaborne crude oil transportation and geopolitical risk premiums .

For full-year 2025, DHT generated net income of $211.0M ($1.31 EPS), up 16% from $181.5M ($1.12 EPS) in 2024 .

What Did Management Guide for Q1 2026?

DHT provided exceptionally strong Q1 2026 outlook data:

With spot rates booked at $78,900/day—13% higher than Q4's already-strong $69,500—and a cash breakeven of just $18,300/day, DHT is positioned for another exceptional quarter .

Management noted: "The VLCC market demonstrates significant strength driven by robust demand for compliant seaborne transportation of crude oil, and increased risk premiums related to geopolitical tensions" .

What Changed From Last Quarter?

Rate Environment Transformed: VLCC spot rates jumped from $38,700/day in Q3 to $69,500/day in Q4—the highest quarterly rate since the pandemic-era spike. This reflects both fundamental demand strength and market structure changes .

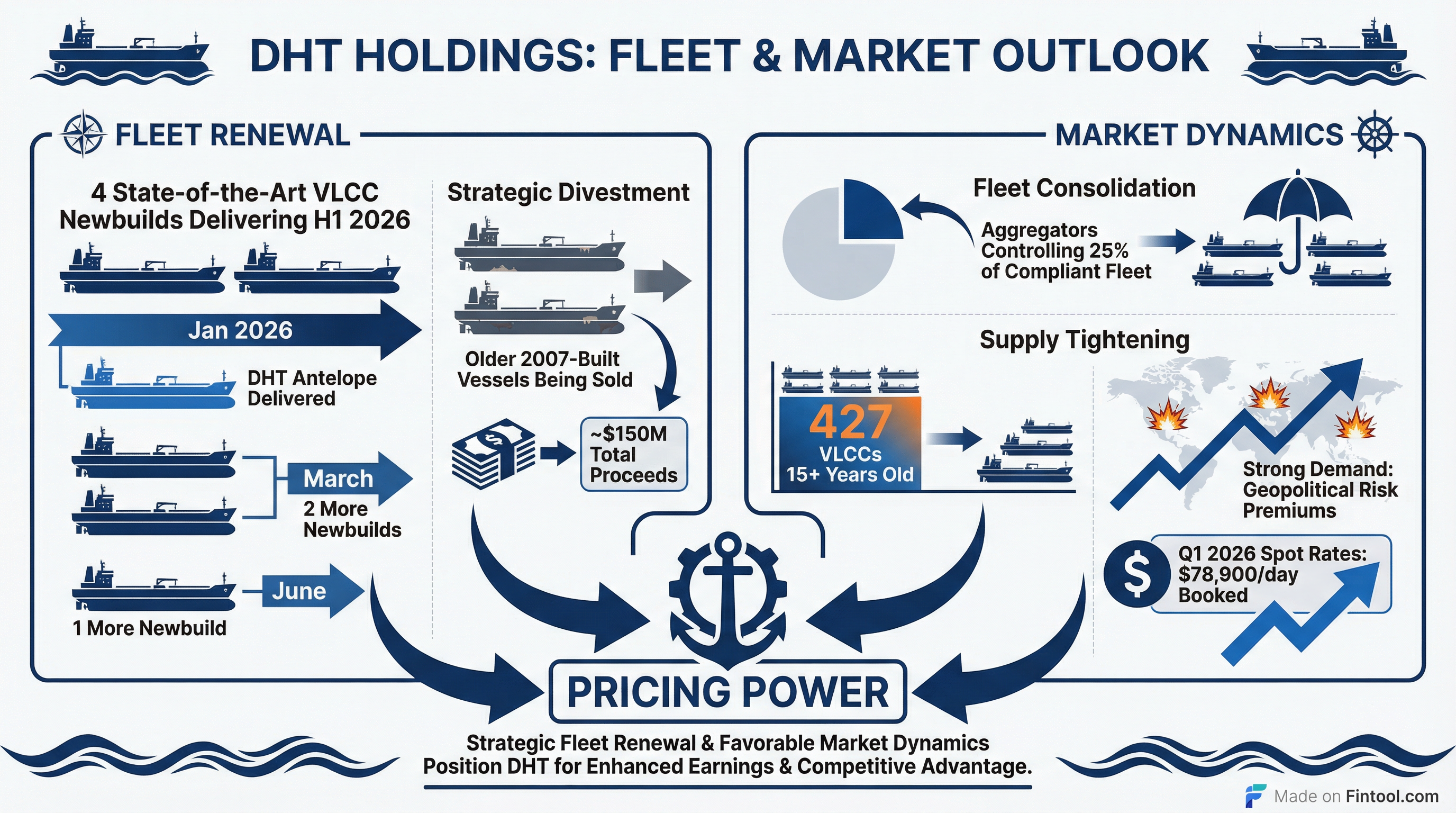

Fleet Renewal Accelerating: DHT is executing a fleet modernization strategy:

- Delivered: DHT Nokota (2018-built) in November 2025

- Delivered: DHT Antelope (first newbuild) on January 2, 2026

- Incoming: Three more newbuilds—two in March, one in June 2026

- Sold: DHT Europe and DHT China (2007-built) for $101.6M combined

- Sold: DHT Bauhinia (2007-built) for $51.5M, delivering June/July 2026

Capital Allocation: The company extended DHT Harrier's time charter with a global energy company for 5 years at $47,500/day (rising to $50,000/day in optional years)—a significant rate increase from prior terms .

What's the Market Structure Story?

Management highlighted a fundamental shift in VLCC ownership that could sustain elevated rates:

Fleet Consolidation: Private aggregators are nearing control of 25% of the compliant tramping VLCC fleet—described as a "critical market share" . DHT expects this consolidation to:

- Shift pricing dynamics

- Create pressure on timely ship availability

- Drive customer interest in securing reliability at premium rates

Aging Fleet Dynamics:

- Trading VLCCs: 897 vessels

- VLCCs 15+ years old by end-2026: 427 (48%)

- VLCCs 20+ years old by end-2026: 199 (22%)

- Sanctioned VLCCs: 151

- Current orderbook: 171 vessels

With nearly half the fleet aging past 15 years and only 171 newbuilds on order through 2029, supply constraints appear structural . Fast forward to end of 2029 with no scrapping: 528 VLCCs will be 15+ years old, and 303 will be 20+ years old—compared to just 171 new ships delivering .

Demand Side Often Misunderstood: CEO Harfjeld noted the commonly cited 1% global oil demand growth is measured over total liquids (~103M bbl/day). The relevant metric is seaborne crude—~41M bbl/day—where an additional 1M bbl/day represents ~2.5% demand growth . U.S. production is stabilizing but majors are bringing efficiency gains; Guyana and Brazil are growing meaningfully .

How Did the Stock React?

DHT shares closed at $13.94 on February 4, 2026 (down 2.65% in a weak market day), but traded up approximately 1.9% to $14.20 in after-hours following the earnings release.

12-Month Performance:

- Current Price: $13.94 (close) / $14.20 (after-hours)

- 52-Week High: $14.35 (February 2, 2026)

- 52-Week Low: $9.45

- 12-Month Gain: ~47%

The stock is trading near 52-week highs heading into what management describes as a "perfect storm" of favorable market conditions.

As CEO Harfjeld stated on the earnings call: "We are navigating a perfect storm of strong demand, geopolitical volatility, a rapidly aging global fleet, and significant consolidation of the compliant tramping fleets. At DHT, we are not just observers of this cycle, we are well positioned to benefit from it" .

Capital Returns and Balance Sheet

DHT maintains a disciplined 100% payout policy, returning all ordinary net income as dividends:

*Q3 2025 EPS of $0.28 included adjusted items; dividend based on ordinary net income.

Since updating the dividend policy in Q3 2022, DHT has paid $3.34 per share in cumulative dividends .

Balance Sheet Highlights (as of December 31, 2025):

- Cash: $79.0M

- Total Liquidity: $189M (including $110.5M RCF availability)

- Total Debt: $428.7M

- Net Debt per Vessel: $15.9M

- Debt to Total Assets: 17.6% (marked to market), 26.5% to book

Balance Sheet Strategy: On the call, management emphasized maintaining acquisition capacity: "We want to continue to invest and grow the business... to have that capacity in a balance sheet and do this organically and not being so reliant on printing new shares has been important" . DHT looked at secondhand opportunities late in 2025 but "prices ran away from us" . They retain capacity to acquire "a couple of modern ships without any new capital" .

Q&A Highlights: What Analysts Asked

The earnings call Q&A revealed several key themes from institutional investors:

Time Charter Market Heating Up

When asked about reconciling rising spot exposure with the opportunity for premium time charters, CEO Svein Moxnes Harfjeld confirmed: "Basically all end users or customers now are in the market to secure time charters... the rates that they are being offered are above last done" . He noted rumors of a 1-year charter at $85,000/day currently on subs—a significant step-up from the Harrier's $47,500/day 5-year deal .

Management explained customers are "worried about reliability and not really having access to ships or potentially be held hostage to a market where ships are being held back" .

Fleet Consolidation Deeper Dive

On the aggregators controlling 25% of the compliant tramping fleet, Harfjeld clarified this is based on the true available fleet of ~600 ships—after removing sanctioned vessels, state-owned shuttle services (China Inc., Saudi Arabia, Japan Inc.), and non-tramping capacity . The aggregators are predominantly acquiring 10-15 year old vessels from smaller owners with 2-5 ships, consolidating pricing power and information flow .

When asked if 25% market share is enough to shift dynamics: "If you are a big operator... you have ships in the market all the time, and you have very good information flow. But if you own two, three ships... there's meaningful time between every time you fix" .

Venezuela: A New Demand Catalyst?

Regarding Venezuela's potential return to compliant crude exports, management expects oil will "predominantly go to the U.S." initially, but noted China is a major creditor seeking repayment in oil . Trafigura and Itochu are reportedly being engaged as marketers, which would make them the counterparty for compliant tanker owners like DHT .

"It has to be clear that there's no OFAC risk for a company like DHT in moving that oil... everybody sort of expects that has to be resolved in a proper fashion" .

Newbuild Economics and Shipyard Pricing

On newbuild costs, Harfjeld indicated 2029 slots at Hanwha Ocean are pricing at ±$130M—with one yard slightly below, one above . He noted DHT is waiting for clarity on the USTR issue between U.S. and China (postponed to November) before making final decisions on Chinese-built vessels, which comprise ~70% of the current orderbook .

Shadow Fleet Demolition

A key question addressed protocols for scrapping the sanctioned fleet. Harfjeld revealed that one of the two largest cash buyers in the demolition market is seeking OFAC approval to transact with sanctioned counterparties and acquire vessels for scrapping . "Some of these ships now that are very old... are losing out on work because conditions or maybe some crew don't want to work on them... they will have to go" .

Key Risks and Watchpoints

- Rate Volatility: VLCC spot rates can swing dramatically—Q3's $38,700/day vs Q4's $69,500/day illustrates the volatility

- Geopolitical Dependencies: Current rate premiums tied to sanctions and trade disruptions could normalize

- USTR/China Tariff Risk: ~70% of VLCC orderbook is Chinese-built; clarity on U.S.-China shipbuilding tariffs expected November 2026

- Newbuild Execution: Remaining payments of $235M on newbuilding program

- Customer Concentration: Top 5 customers represented 69% of Q4 shipping revenues

Forward Catalysts

- March 2026: Two VLCC newbuilds scheduled for delivery

- Q1 2026 Earnings: Strong Q1 bookings at $78,900/day should translate to another exceptional quarter

- June 2026: Fourth newbuild delivery, plus DHT Bauhinia sale completion

- Fleet Consolidation: Continued aggregator activity could further tighten supply

Data sourced from DHT Holdings Q4 2025 Earnings Call Transcript, Earnings Presentation, 6-K filing, and market data as of February 5, 2026.