Draganfly (DPRO)·Q3 2025 Earnings Summary

Draganfly Q3 2025 Earnings: Defense Pivot Accelerates

Executive Summary

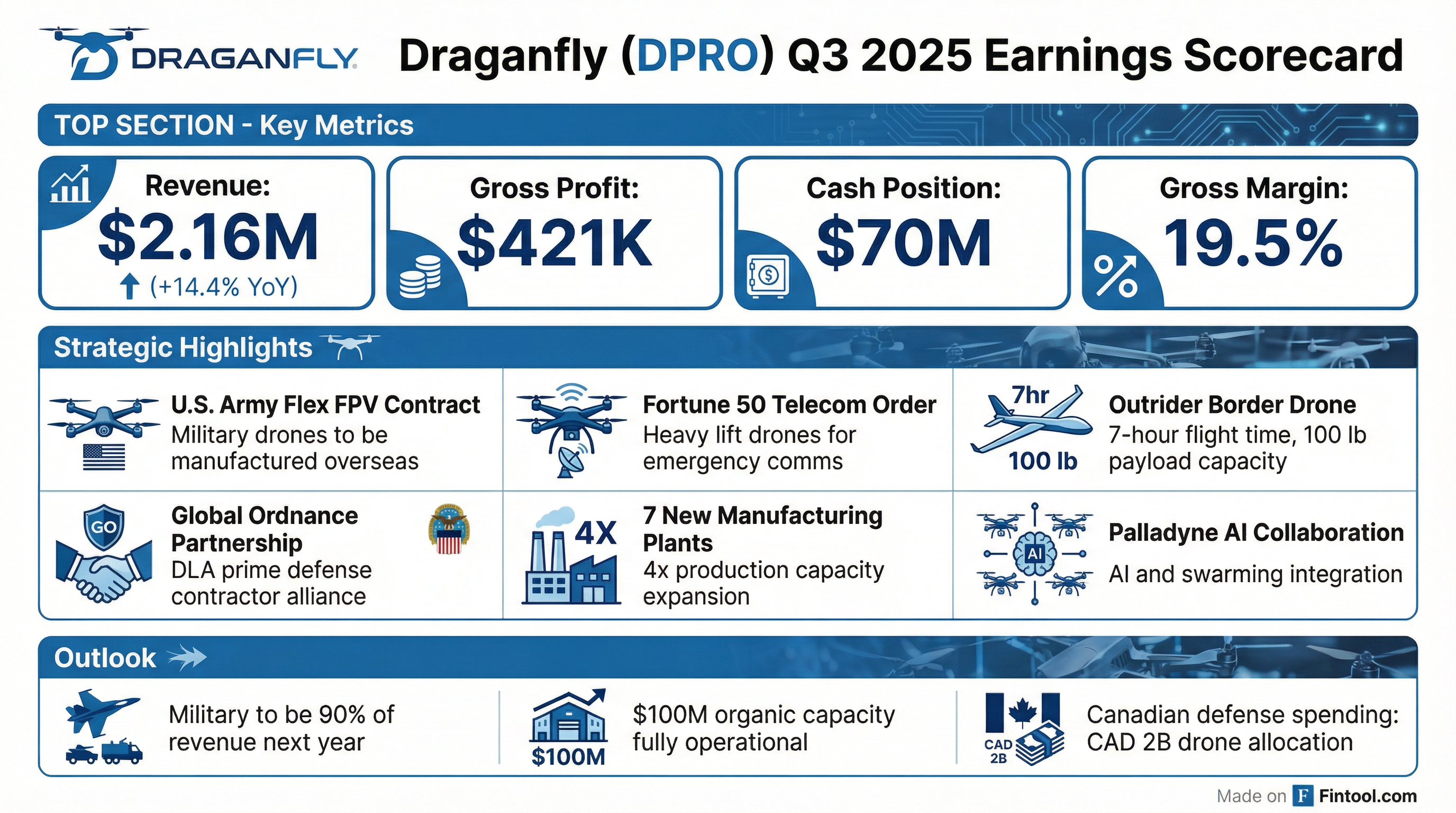

Draganfly (DPRO) reported Q3 2025 results with revenue of CAD $2.16M (+14.4% YoY), a modest miss versus consensus expectations. The quarter marked a strategic inflection point: the company secured a U.S. Army contract for Flex FPV drones that includes embedded manufacturing at overseas military bases, signaling a major shift toward defense revenue. Management expects military to comprise 90% of revenue in the coming year, with single orders "dwarfing" trailing three-year cumulative revenue. Cash position strengthened dramatically to ~$70M CAD following recent financings.

Key Stats:

Values in CAD; comprehensive loss includes derivative liability changes

Stock Performance & Market Reaction

The stock declined 4.7% on earnings day (Nov 12) and continued lower the following session (-8.9%), bringing the 2-day post-earnings decline to approximately 13%. However, context is important: DPRO had rallied substantially in the weeks prior on U.S. Army contract news (Sep 30) and the Global Ordnance partnership (Oct 9), with shares up ~145% from early September lows before earnings.

YTD Performance: +92.7% (from $3.29 at start of 2025)

Financial Results Deep Dive

Revenue Analysis

Revenue estimates from S&P Global

Q3 2025 revenue composition:

- Product Sales: $1.62M CAD (+22.1% YoY)

- Services: $530K CAD

Gross Margin Compression

Gross margin declined to 19.5% from 23.4% YoY. CFO Paul Sun noted a one-time inventory write-down of $43K; adjusted gross margin would have been 21.5%. The compression reflects product mix shift toward lower-margin military products versus higher-margin commercial sales.

Balance Sheet Transformation

Data from S&P Global

The dramatic balance sheet improvement came from financing activities:

- $13.75M public offering closed in Q2

- $25M registered direct offering with existing shareholders

- ~$8M warrant exercises

What Went Well

U.S. Army FPV Drone Contract

"This particular order isn't just about providing drones. It's actually providing supply chain and logistical support. We're actually training this particular section of the Army to actually be assembling and manufacturing our drones so that they can do modifications on the fly." — Cameron Chell, CEO

The landmark U.S. Army contract for Flex FPV drones represents a new paradigm: embedded hybrid manufacturing at overseas military facilities. This approach addresses the military's need for rapid iteration and field modifications without procurement cycles.

Outrider Border Drone Goes Live

"We're really excited about the 100 or so different government and international representatives that will be there witnessing and participating in those missions along the border in Arizona." — Cameron Chell

The Outrider drone—designed specifically for border operations with Cochise County Sheriff's Department—became operational in mid-November 2025. Key specs:

- 7-hour flight time (hybrid combustion/electric)

- 100 lb payload capacity

- Multi-mission: surveillance, logistics, interdiction, communications

Management noted the drone is being called the "Border Drone" and sees a hundreds of millions TAM globally for border security applications.

Strategic Partnerships Accelerating

What Went Wrong

Revenue Miss Despite Growth

Despite 14% YoY growth, revenue came in ~5% below consensus. Management has been explicit about capping sales for the past two years while rebuilding production capacity:

"Over the last two years, we basically had to cap our sales. We had to rebuild a bunch of our capacity in order to meet the demand of this and the other particular similar orders that we anticipate coming down."

Margin Pressure Continues

Gross margin has compressed from ~42% in Q4 2023 to ~20% in Q3 2025. While some is one-time inventory adjustments, the mix shift to military products (typically lower margin, higher volume) is structural.

Losses Widening

Net comprehensive loss of $5.4M (vs. $364K in Q3 2024) reflects:

- Derivative liability fair value changes ($1.8M non-cash loss)

- Higher operating expenses from scaling

- Investment in capacity ahead of large orders

Burn rate is approximately CAD $1.5M per month, implying runway of ~46 months at current cash levels.

Guidance & Outlook

Military Domination Coming

"Next year, it'll be 90% [military] just because one single order dwarfs the numbers that we've done for the last three years. And there's multiple types of those orders that are falling into place." — Cameron Chell

Capacity Expansion

Management is standing up 7 new contract manufacturing plants in the U.S., expected to deliver approximately 4x capacity by end of 2026.

Canadian Defense Opportunity

With Canada announcing 5% of GDP toward defense spending (including ~CAD $2B for drone technology), Draganfly is uniquely positioned as one of only two Canadian drone manufacturers with capacity.

Management Tone Evolution

Comparing Q3 2025 to Q2 2025 earnings calls reveals a notable shift:

Verdict: Significantly more confident, with concrete contract wins replacing aspirational language.

Q&A Highlights

On Future Financing

"There's not an acute need to raise cash... We have very good visibility to EBITDA positive and cash flow positive over some time here."

On M&A Strategy

"Our acquisitions... are very focused on the people. We're really about layering in the right personalities, people, and leadership and technical capability."

On Canada Market

"There might be two companies in the whole country of Canada that can address that market for the Canadian DND."

On Industry Consolidation

"There's going to be a big rush of folks into the industry. We've seen it seven or eight times before over the last 25 years. There's going to be fallout from it."

Subsequent Events (Post-Q3)

Key Takeaways

-

Revenue miss (-5%) masked by strategic progress — The U.S. Army embedded manufacturing contract represents a paradigm shift more valuable than any quarterly revenue figure

-

Balance sheet transformed — From ~$3M to ~$70M CAD cash provides credibility with large defense customers and runway to scale

-

Military pivot accelerating — Expect 90%+ military revenue mix, with single orders exceeding three years of cumulative historical revenue

-

Margin compression is strategic — Lower margins reflect mix shift to high-volume military products; absolute margin dollars will scale with volume

-

Capacity expansion critical — 7 new manufacturing plants (4x capacity) needed to fulfill pipeline; execution risk is real

-

Canadian tailwind — CAD $2B drone allocation from Canadian defense budget with only ~2 domestic manufacturers positioned to capture it

Links

- Company Profile: /app/research/companies/DPRO

- Transcript: /app/research/companies/DPRO/documents/transcripts/Q3-2025

- Prior Earnings: /app/research/companies/DPRO/earnings/Q2-2025

Report generated December 15, 2025