DAQO NEW ENERGY (DQ)·Q4 2024 Earnings Summary

Daqo New Energy Q4 2024 Earnings

Polysilicon giant weathers brutal market with $2.2B cash cushion while recording largest quarterly loss in company history

Executive Summary

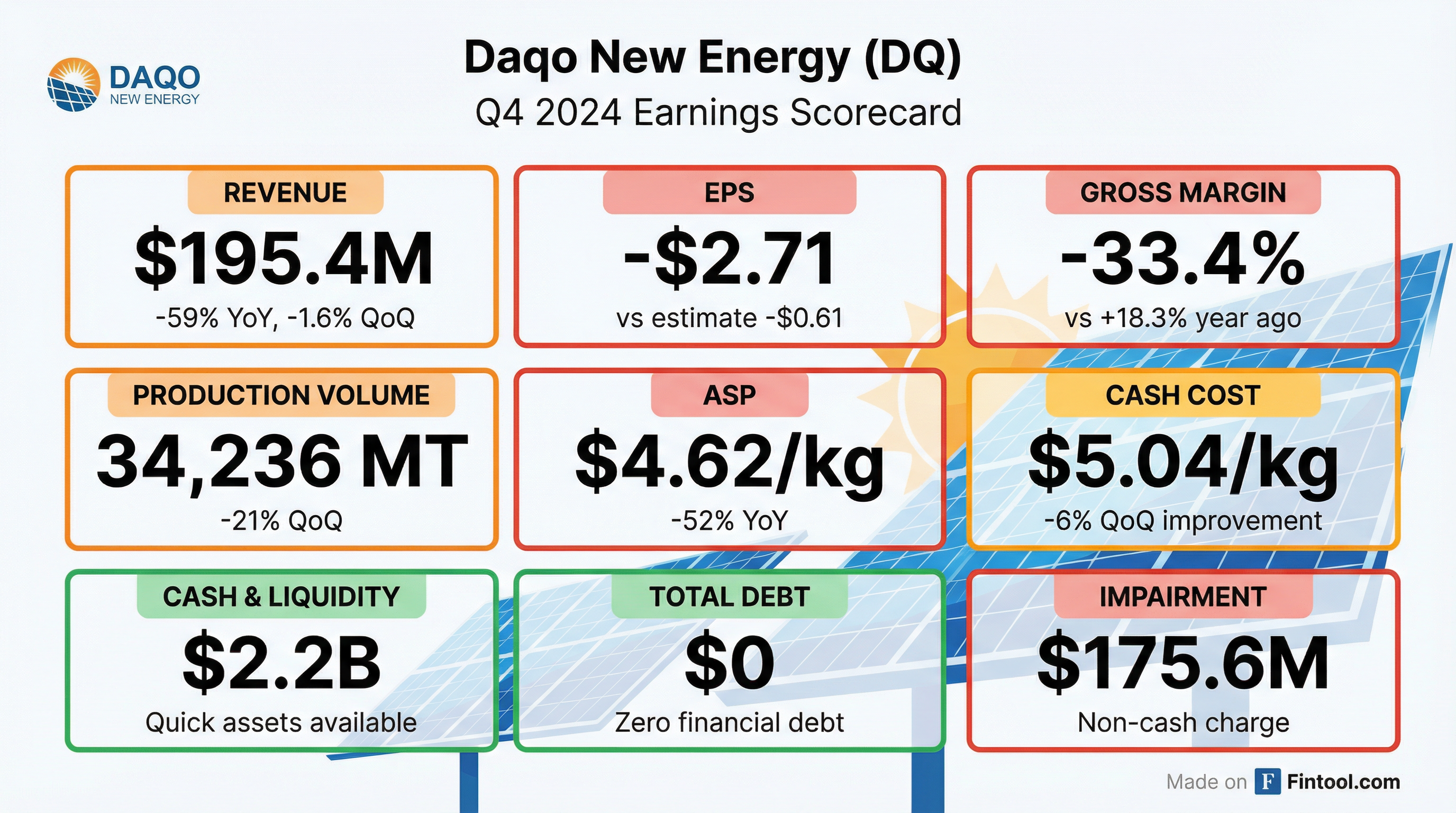

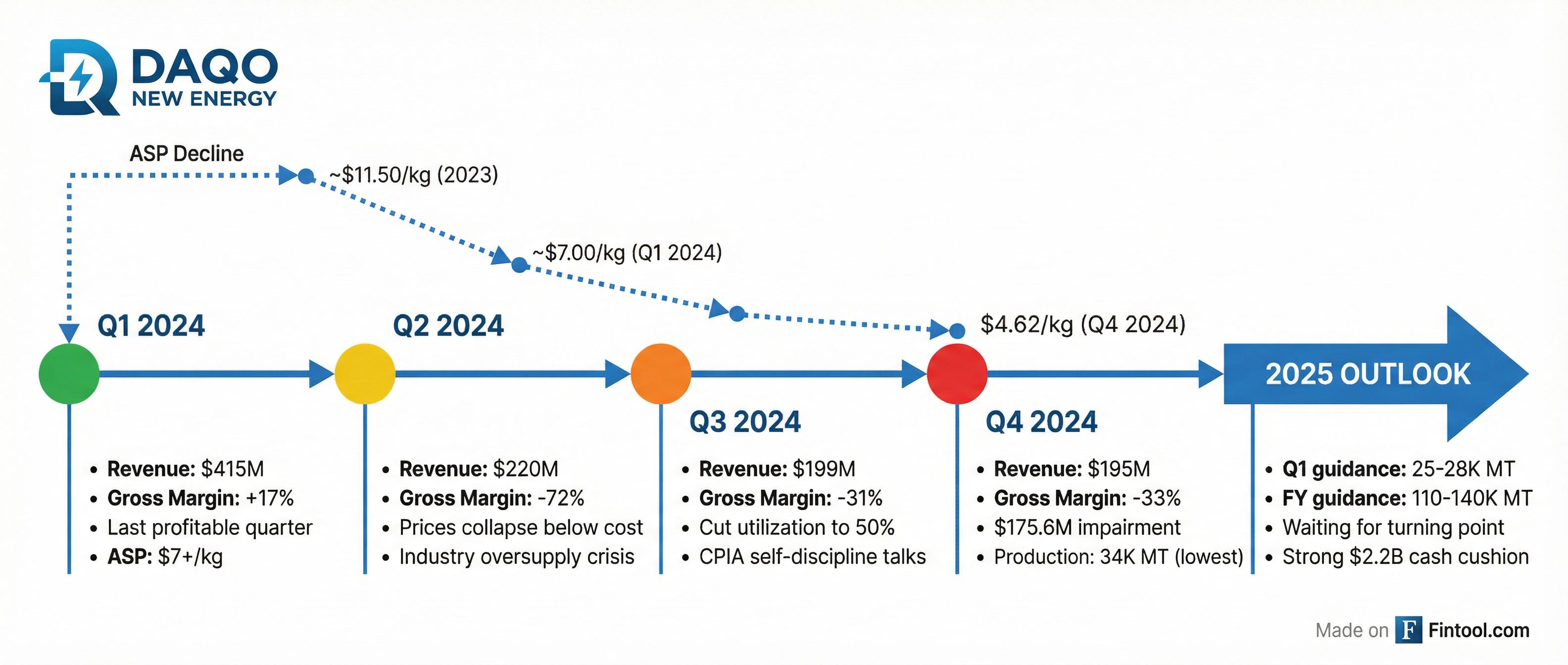

Daqo New Energy (NYSE: DQ) reported Q4 2024 results on February 27, 2025, capping a brutal year for China's polysilicon industry. The company posted its fourth consecutive quarterly loss as oversupply crushed selling prices below production costs.

Key Takeaway: Revenue beat estimates by 27% ($195M vs $155M expected), but EPS missed massively (-$2.71 vs -$0.61 expected) due to $175.6M non-cash asset impairment charge.

The 2024 Crisis Timeline

What Went Well

Strong Balance Sheet Preserved

"Despite the losses, Daqo New Energy continued to maintain a strong balance sheet and ample cash reserves. At the end of 2024, the company had a cash balance of $1.0 billion, short-term investments of $10 million, bank notes receivables of $55 million, and a fixed term bank deposit balance of $1.1 billion."

Cash Cost Improvement

"Thanks to our relentless efforts to improve operational efficiency, our cash cost declined further to $5.04/kg, a 6% quarter-over-quarter decline compared to $5.34/kg in the third quarter."

N-Type Product Mix

The company increased N-type polysilicon (higher efficiency) from ~40% in 2023 to 70% in 2024.

What Went Wrong

Massive Impairment Charge

"The company recognized $175.6 million in fixed asset impairment loss, mainly related to its older polysilicon production lines in the fourth quarter of 2024, due to the continuous downward trend in the polysilicon selling prices that impaired the recoverability of carrying amounts of these assets."

Prices Below Cash Cost

- Average Selling Price: $4.62/kg

- Cash Cost: $5.04/kg

- Loss per kg sold: -$0.42 (before depreciation)

Production Cuts Continue

Financial Results

Stock Price Performance

Revenue Trend

Gross Margin Collapse

Full Year 2024 Summary

Beat/Miss Context

Q4 2024 Estimates vs Actual

Note: Revenue beat was driven by higher-than-expected sales volume. EPS missed due to the $175.6M non-cash impairment charge, which added ~$2.10 to the loss per share.

Historical Beat/Miss Record

Guidance Changes

Q1 2025 Outlook

- Production: 25,000-28,000 MT (vs 34,236 MT in Q4 2024)

- Utilization: ~35% of nameplate capacity

Full Year 2025 Outlook

- Production: 110,000-140,000 MT (vs 205,068 MT in 2024)

- Strategy: Maintain low utilization until industry turning point

"We plan to maintain a relatively low utilization rate in 2025 until a turning point emerges in the sector."

Management Commentary

Market Outlook

"In the short run, we are likely to see poly prices to increase in the next couple of months, at least before the end of the second quarter of 2025... We expect supply to be in the range of 90-100K MT at least until May, primarily driven by the seasonality effect of hydroelectric power."

Pricing Expectations

Industry Self-Regulation

"On December 6, 2024, led by the China Photovoltaic Industry Association, our Company, along with other major solar PV manufacturers, have reached consensus that implementing self-discipline would be fundamental to mitigating the irrational competition amid falling prices and heightened global trade pressures."

Supply-Side Reform

"The National Energy Administration and in partnership with the Ministry of Industry and Information Technology and the National Development and Reform Commission... they're looking at how to stem the losses within the industry... It might be some combination of capping production, some kind of production quota, and retiring inefficient capacity or older technology."

Q&A Highlights

On Government Policy Timing

Q: When might supply-side reform policy be released? (Philip Shen, Roth Capital)

"China will have its high-level central government committee meeting coming up in early March. We believe, from what we heard, it could be around that time because that's the time when the government announces a lot of their policies."

On 2025 Production Guidance

Q: Is the 110-140K MT guidance aligned with self-regulation measures? (Alan Lau, Jefferies)

"Our production target is based on our own company strategy while complying to the self-regulation measures. Our primary goal in 2025 is to maintain a level that would meet our customer demand while capping or reducing our cash burn for the entire year."

On FBR Technology

Q: What's your view on Fluidized Bed Reactor (FBR) technology? (Alan Lau, Jefferies)

"Modified Siemens Process has been refined over decades and has delivered proven cost efficiency, scalability, and high-quality polysilicon... FBR has its inherent risks, such as its purity challenges. It's still not possible to use 100% FBR in downstream production."

On Share Buyback

Q: When will the $100M buyback program begin? (Alan Lau, Jefferies)

"We are still closely monitoring when would be a good timing to start repurchasing. Based on the recent news and our assessment of the market environment, we're waiting for a turning point... because this cycle would be somewhat prolonged."

Key Takeaways

-

Worst Quarter, But Survived: $180M loss with $176M impairment, but $2.2B liquidity cushion ensures survival

-

Deep Production Cuts: Q1 2025 guidance of 25-28K MT is only ~35% utilization; FY 2025 of 110-140K MT is <50%

-

Industry Consolidation Coming: CPIA self-regulation + potential government intervention could rationalize supply

-

Cash Cost Leader: Despite losses, cash cost improved 6% QoQ to $5.04/kg, positioning for recovery

-

No Debt Advantage: Zero financial debt while competitors burn through credit lines

-

Price Recovery Possible: Management expects N-type prices to tick up to RMB 40-45/kg in H1 2025

Analyst Sentiment

Average Price Target: $32.16 (Range: $28.60 - $37.00)

Links

- Company: /app/research/companies/DQ

- Transcript: /app/research/companies/DQ/documents/transcripts/Q4-2024

- Prior Earnings: Q3 2024

Report generated December 15, 2025