ESTEE LAUDER COMPANIES (EL)·Q2 2026 Earnings Summary

Estée Lauder Beats on EPS, Raises Guidance—But Stock Plunges 11% After Hours

February 5, 2026 · by Fintool AI Agent

Estée Lauder delivered its strongest quarterly performance in four years, with adjusted EPS of $0.89 crushing both consensus ($0.82) and the year-ago period ($0.62) . Revenue came in at $4.23 billion, up 6% year-over-year and slightly ahead of the $4.22 billion Street estimate . The company raised full-year guidance—yet shares cratered 11% in after-hours trading to $105.94 as investors focused on tariff headwinds and cautious second-half commentary.

Did Estée Lauder Beat Earnings?

Yes—ninth consecutive beat. Estée Lauder continues its impressive turnaround under the "Beauty Reimagined" transformation:

CEO Stéphane de La Faverie declared this "a pivotal year" as Beauty Reimagined "has invigorated our business as we execute the biggest operational, leadership, and cultural transformation in our history" .

Retail Sales Trend Improving: Global retail sales improved from -4% in Q1 to flat in Q2 (as travel retail decline moderated), with retail sales +4% in H1 excluding travel retail .

What Drove the Beat?

Mainland China Roars Back

The turnaround story is most evident in China, which posted +13% organic growth—the second consecutive quarter of double-digit gains :

- Ranked #1 in prestige beauty on Tmall during 11.11 Global Shopping Festival

- La Mer ranked #1 in luxury on Tmall

- Share gains in every category across brick-and-mortar and online for calendar 2025

- Operating income in Mainland China nearly doubled (+97% YoY) to $148M

Profit Recovery and Growth Plan (PRGP) Delivering

Margin expansion was fueled by cost discipline from the restructuring program:

- $207M in restructuring charges this quarter (vs. $181M prior year)

- Over 80% of expected PRGP gross benefits now approved

- Net reduction of 6,000+ positions approved (of 5,800-7,000 target)

- Strategic partnership with Accenture for Enterprise Business Services announced November 2025

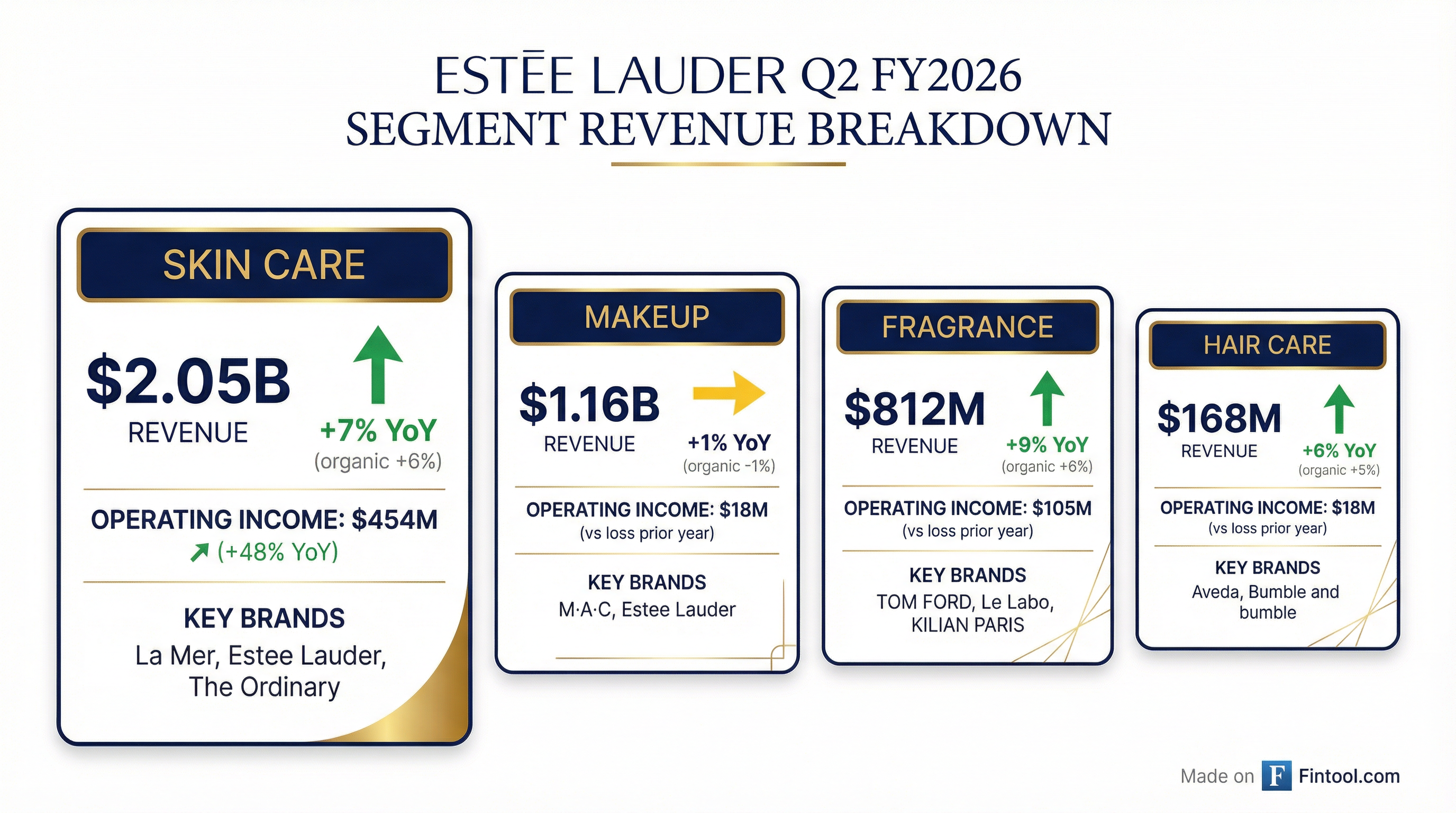

How Did Segments Perform?

Key segment insights:

- Skin Care benefited from La Mer's Treatment Lotion franchise, Estée Lauder's Re-Nutriv longevity portfolio, and The Ordinary's Volufiline serum launch

- Makeup was pressured by an accrual for Double Wear returns ahead of next-gen matte formula launch (Feb 2026); partially offset by M·A·C's Sephora rollout

- Fragrance saw Luxury Brands (TOM FORD, Le Labo, KILIAN PARIS) grow high-single-digits across all regions

What Did Management Guide?

Estée Lauder raised its FY2026 outlook, reflecting confidence from first-half performance while remaining "cautious amid ongoing macroeconomic uncertainty" :

Tariff headwinds factored in: The company expects ~$100M impact to FY2026 profitability from enacted tariffs, net of mitigation strategies, mostly in H2 .

What's Concerning for H2?

Despite the raised outlook, management flagged several headwinds:

- Q3 margin contraction of ~50 bps expected due to timing of consumer-facing investments and tariff impacts

- Duty-free retailer transition at Beijing and Shanghai airports creating transitory headwind

- Negative trends expected to persist in rest of Northern Asian travel retail

How Did the Stock React?

Despite beating on both top and bottom line, shares dropped sharply after hours:

Why the disconnect? The market appears to be reacting to:

- Q3 margin warning — 50bps contraction is a reversal after several quarters of expansion

- Tariff uncertainty — $100M impact assumption may prove conservative if trade policy evolves

- Travel retail weakness — Northern Asia travel retail "negative trends expected to persist"

- Valuation stretched — stock had rallied 47.6% over the past year heading into earnings

What Changed From Last Quarter?

Improvements:

- China sustained double-digit growth (Q1: +13% organic, Q2: +13% organic)

- Fragrance returned to profitability ($105M OI vs. Q1's $86M)

- Free cash flow improved to $581M for H1 vs. $114M prior year

Concerns:

- Tariff commentary more prominent — specific rates cited (Switzerland 39%, Canada 35%, China 30%, etc.)

- Guidance raised but with explicit margin contraction warning for Q3

- The Americas flat for full year (vs. modest growth expected prior)

Geographic Breakdown

The Americas improvement was entirely due to lapping prior-year impairments ($861M of goodwill/intangible charges in Q2 FY25) .

Europe Color from Q&A: Management described Europe as "a tale of multiple cities"—UK returned to positive territory in Q2, Spain and Italy showing strength (share gains in fragrances), while France and Germany face subdued consumer sentiment .

Priority Emerging Markets: Accelerated to double-digit organic growth in Q2, driven by Turkey, Middle East, Thailand, and mid-single-digit growth in India .

Capital Allocation & Cash Flow

The company declared a $0.35 quarterly dividend payable March 16, 2026 .

Key Strategic Initiatives

"One ELC" Operating Model Launched: Management unveiled a new unified operating structure aligning brands, regions, and functions as "one team with one culture and one operating ecosystem" :

- Simplified structure with fewer layers and silos

- Enterprise Business Services partnership with Accenture to transform shared services globally

- Technology partnerships with Microsoft, Google, and Shopify to accelerate AI deployment

Distribution expansion:

- Amazon presence expanded to 12 brands across 10 markets

- TikTok Shop launched in U.S., Southeast Asia, U.K., and Germany

- M·A·C launching in Sephora (U.S.) in coming weeks

Technology partnerships:

- Shopify strategic partnership for digital infrastructure; first TOM FORD store live in UK (Jan 2026)

- Jo Malone London AI Scent Advisor launched using Google's Gemini and Vertex AI

Brand innovation:

- Innovation on track to represent at least 25% of sales for FY2026

- Speed-to-market accelerating: 19% of innovation now launched in less than a year (vs. 16% initial expectation), targeting 30%

- Re-Nutriv's oil developed at China Innovation Labs in just 15 months

- Estée Lauder's Double Wear Concealer achieved #1 new product rank in U.S. prestige makeup (calendar 2025)

Q&A Highlights

The analyst Q&A session provided important color on execution and outlook:

Americas Momentum (Goldman Sachs)

CEO Stéphane de La Faverie emphasized the turnaround: "We come out of ten years of market share loss in the Americas... When you look at calendar 2025, we've been able to gain share in volume. We needed to reengage our brand to recruit consumers, and we've been able to do it" . Key wins include:

- Clinique and The Ordinary are #1 and #2 in skincare

- Clinique and MAC are #1 and #2 in makeup

- Strong performance at Ulta and upcoming MAC launch at Sephora U.S.

Travel Retail Deep Dive (Citi)

On the complex travel retail landscape:

- Hainan: "January in Hainan was in high double digit for us, again, gaining market share across many of our brands"

- Airport Transition: Beijing/Shanghai airports transitioning from Sunrise to CDF, Wangfujing, and Avolta—causing temporary disruption

- Market Share Focus: CFO Akhil noted ELC is "winning in West TR... winning in Hainan by quite a distance, and we are winning in markets like Japan, Thailand"

Makeup Profitability Path (Deutsche Bank)

CFO acknowledged makeup margins remain challenged but improving:

- Q2 profitability impacted by returns accrual for Double Wear next-gen launch

- MAC entering TikTok Shop in U.S. and Germany, with MAC U.S. already gaining share in lip category

- Innovation coming faster: 19% of innovation now in <1 year (vs. 16% initial expectation)

China Discounting Reduction (Barclays)

Important margin context: "Our discount levels in China are coming down while we are driving this outstanding growth and outperformance of the market" . Specific Q2 share gains in China:

- Skincare: +22 bps

- Makeup: +87 bps

- Fragrance: +100 bps

- Haircare: +85 bps

Channel Mix Evolution (Morgan Stanley)

Department stores now represent 30% or less of North America business (down from historical highs) :

- 12 brands now on Amazon U.S.

- Specialty-multi penetration increasing

- Freestanding luxury fragrance stores expanding

- The Ordinary driving high double-digit growth entirely in high-growth channels

Going for Top of Guidance

CEO was emphatic: "We are going for the top end of the new guidance that we are giving, both in top line and bottom line for this fiscal year... That's the mission"

Forward Catalysts

The Bottom Line

Estée Lauder delivered a strong beat that validates the Beauty Reimagined turnaround strategy—China is back, margins are expanding, and the restructuring is on track. However, the 11% after-hours drop signals investor anxiety over H2 headwinds: tariffs, travel retail weakness, and Q3 margin contraction.

For long-term investors, the question is whether this pullback creates an opportunity to buy a genuine turnaround at a discount, or whether the market is correctly discounting execution risks and macro uncertainty ahead.

View more on Estée Lauder | Q2 FY2026 Transcript | Prior Quarter: Q1 FY2026