Earnings summaries and quarterly performance for Elevra Lithium.

Research analysts covering Elevra Lithium.

Recent press releases and 8-K filings for ELVR.

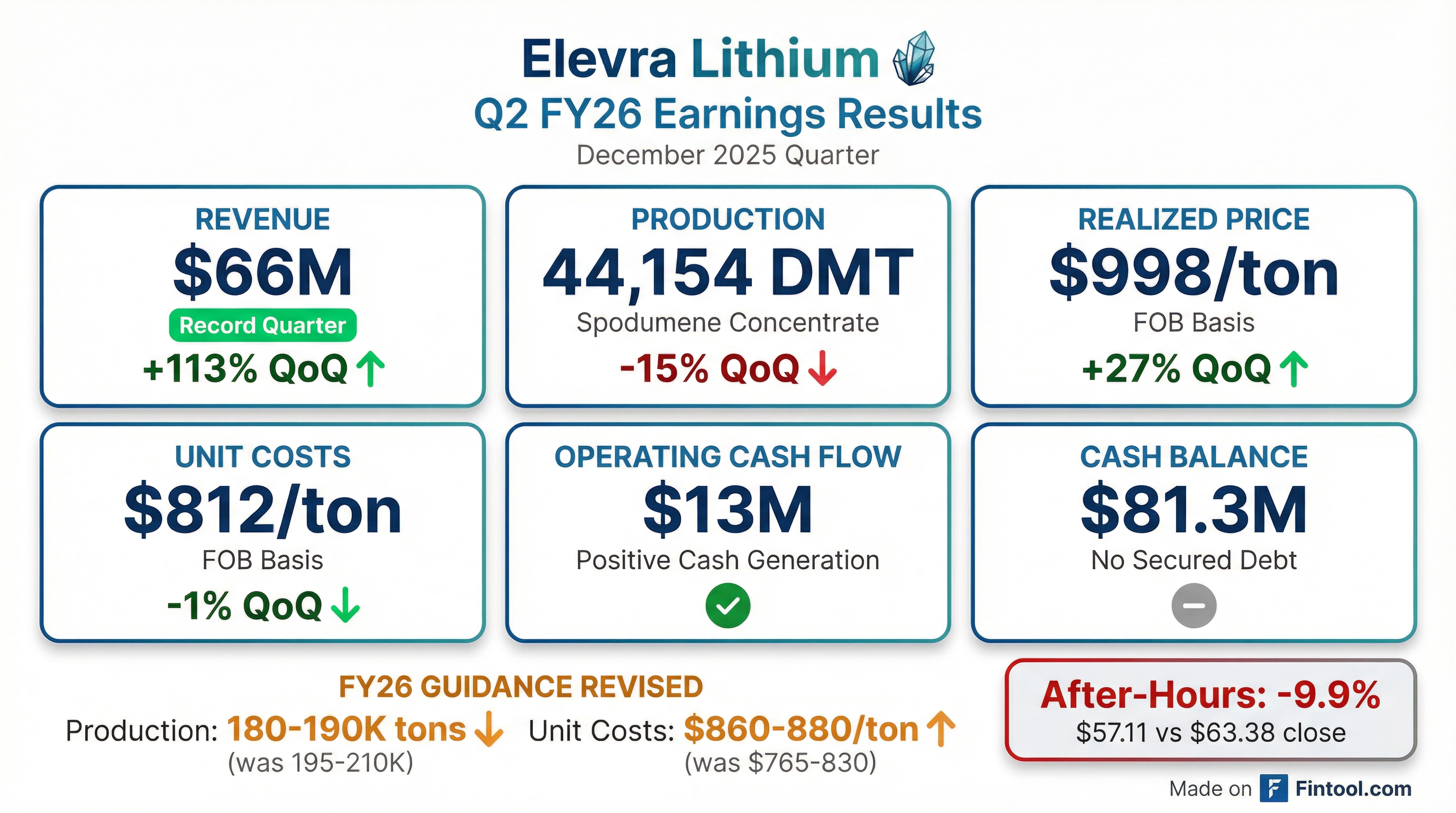

Elevra Lithium Reports Record Quarterly Revenue and Revises FY2026 Guidance

ELVR

Earnings

Guidance Update

CFO Change

- Elevra Lithium Limited achieved record quarterly revenue and a gross profit at its North American Lithium (NAL) operation for the December 2025 quarter.

- The company reported US$66 million in revenue, a 223% increase quarter-on-quarter, with the average realised selling price (FOB) rising 27% to US$998/dmt.

- Elevra has revised its FY2026 guidance, lowering spodumene concentrate production and sales targets, and increasing the unit operating cost sold guidance due to short-term operational conditions.

- Christian Cortes was appointed Chief Financial Officer during the December 2025 quarter, effective October 20, 2025.

Jan 28, 2026, 9:10 PM

Elevra Lithium Announces Share Issuances, Upcoming Quarterly Report, and Currency Change

ELVR

Share Issuance

Accounting Changes

Earnings

- Elevra Lithium Limited applied for the quotation of 47,660 ordinary fully paid shares on January 13, 2026, which were issued in settlement of vested Piedmont Equity Awards related to a merger.

- An additional 372,486 ordinary fully paid shares were issued on January 19, 2026, resulting from the conversion of unquoted Performance Rights under an employee incentive scheme, with 84,123 of these exercised by KMP Sylvain Collard.

- The company is scheduled to release its December 2025 Quarterly Activities Report on Wednesday, January 28, 2026.

- Effective July 1, 2025, Elevra Lithium Limited changed its presentation currency from Australian dollars to United States dollars (USD) for financial reporting, which will be reflected in the upcoming December 2025 Quarterly Report and FY26 Half-Year financial results.

Jan 22, 2026, 1:30 PM

Elevra Lithium to Implement Share Sale Facility, Transition OTCQB Listing, and Accelerate NAL Expansion

ELVR

Delisting/Listing Issues

New Projects/Investments

Guidance Update

- Elevra Lithium Limited has established a small shareholding sale facility for ASX ordinary shares valued under A$500 as of January 8, 2026, allowing eligible shareholders to sell without brokerage fees. Shareholders must return a Notice of Retention Form by March 2, 2026, to opt-out and retain their shares.

- The company's shares will transition from the OTCQB Venture Market to an unsponsored OTC quotation (Pink Limited Market) by February 2, 2026, due to the cost of maintaining the sponsored listing and low trading volumes. Elevra's ASX and Nasdaq listings will continue, and OTCQB holders can convert to Nasdaq-listed American depositary shares with waived issuance fees until February 27, 2026.

- Elevra Lithium announced an accelerated, staged expansion plan for its North American Lithium (NAL) project, anticipating a 15-20% increase in annual spodumene concentrate production by mid-CY27 and reaching 315ktpa by early CY28, with full completion by early CY29.

- The forecast post-expansion C1 LOM unit cash costs for the NAL project have been revised to US$630 per tonne, up from the previously reported US$562 per tonne, following a reallocation of site SG&A costs.

Jan 13, 2026, 1:30 PM

Elevra Lithium Reports Q1 FY26 Results and NAL Expansion Study

ELVR

Earnings

Guidance Update

New Projects/Investments

- Elevra Lithium reported Q1 FY26 revenue of $31 million and 52,003 dry metric tonnes produced, with $149 million in cash as of September 30, 2025.

- The company announced significant increases in Mineral Resources and Reserves for its key projects, with North American Lithium (NAL) increasing its Mineral Reserves by 124% to 49Mt at 1.11% Li2O and Moblan increasing its Mineral Resource by 30% to 121Mt at 1.19% Li2O.

- A scoping study for the NAL Brownfield Expansion targets an increase in production to 315 ktpa from the current 195-210 ktpa, with an estimated initial capital expenditure of US$270 million and a post-tax NPV(8%) of US$950 million.

- For FY26, Elevra Lithium guides for Spodumene Concentrate Production and Sales of 195,000 – 210,000 dmt and Unit Operation Costs Sold of US$765 - $830 / dmt.

Nov 6, 2025, 9:10 PM

Elevra Lithium Completes Merger, Reports Q1 FY26 Performance, and Details Expansion Plans

ELVR

M&A

Guidance Update

New Projects/Investments

- Elevra Lithium Limited completed its merger with Sayona Mining Limited and Piedmont Lithium Inc. on August 30, 2025 (AEST) / August 29, 2025 (ET), concurrently raising $69 million and effecting a 150-to-1 share consolidation.

- For the September 2025 quarter (Q1 FY26), North American Lithium (NAL) produced 52,003 dry metric tonnes (dmt) of spodumene and sold 25,975 dmt, with the average realised selling price increasing 14% to $1,198/dmt.

- The company's cash balance increased by $76.5 million to $148.8 million as of September 30, 2025.

- Elevra reaffirmed its FY26 production guidance of 195,000-210,000 dmt, sales guidance of 195,000-210,000 dmt, and unit operating costs of $1,175-1,275/dmt.

- A Scoping Study for the NAL Expansion projects a 55% increase in production capacity to 315ktpa and a ~30% reduction in unit operating costs to approximately US$562/dmt, with a Final Investment Decision targeted for H2 2027.

Oct 29, 2025, 8:10 PM

Sayona Mining Limited Announces Positive NAL Expansion Scoping Study Results

ELVR

New Projects/Investments

Guidance Update

- Sayona Mining Limited's NAL Expansion Scoping Study confirms a post-tax NPV(8%) of C$1,284M, an IRR of 26.4%, and a payback period of 46 months for the expansion project.

- The expansion is projected to increase annual nominal SC5.4 production to 315 ktpa and reduce the C1 unit cost to C$759/t (US$562/t) once fully operational, compared to the base case C1 of C$935/t (US$692/t).

- The initial capital expenditure for the expansion is estimated at C$366M (US$270M), with construction forecast to be complete by the end of CY29, and the project extends the mine life to 24 years using existing NAL Ore Reserves.

Sep 16, 2025, 12:30 PM

Elevra Lithium Ltd. Announces Merger Completion, Strong Financials, and Growth Plans

ELVR

M&A

New Projects/Investments

Guidance Update

- Elevra Lithium Ltd. has been formed following the merger of Sayona Mining and Piedmont Lithium, positioning it as a leading North American hard rock lithium producer with a pro forma cash position of approximately $227 million as of June 30.

- The company announced substantial resource and reserve growth, including a 124% increase in NAL's reserves since 2023 to 49 million tons and a 30% increase in Moblan's resource in a single year to 121 million tons.

- A scoping study for the NAL brownfield expansion projects an increase in production to 315,000 tons per year, with a post-tax NPV of $950 million and an IRR above 26% for a capital investment of $270 million.

- For FY26, production guidance is set at 195,000 to 210,000 tons, with unit costs expected to be between A$1,175 and A$1,275 per ton.

Sep 15, 2025, 10:30 PM

Sayona Mining Limited Announces FY25 Results and Merger Approval

ELVR

Earnings

M&A

Demand Weakening

- Sayona Mining Limited reported a revenue increase of 11% to $223 million for the year ended 30 June 2025, but a consolidated loss after income tax of $382 million, primarily due to a $271 million impairment of North American Lithium (NAL) assets.

- The company achieved record production of 204,858 dry metric tonnes and record sales of 209,038 dry metric tonnes of spodumene concentrate from NAL in FY25, representing increases of 31% and 32% respectively, despite a 16% decline in average realised selling prices.

- The merger with Piedmont Lithium was approved, leading to the formation of Elevra Lithium Limited, which is expected to create a premier North American lithium producer. The company also reported significant increases in reserves and resources at both NAL and Moblan projects, supporting potential future expansion.

Sep 2, 2025, 8:17 PM

Sayona Mining Limited Updates NAL Mineral Resource and Ore Reserve Estimates

ELVR

New Projects/Investments

- Sayona Mining Limited reported an 8% increase in its North American Lithium (NAL) Mineral Resource estimate to 95.0Mt at 1.15% Li2O.

- The company also announced a 124% increase in NAL Ore Reserves to 48.6Mt at 1.11% Li2O, effective June 30, 2025.

- The updated Life of Mine (LOM) plan for NAL is 45 years.

- Authier Ore Reserves are estimated at 10.5Mt at 1.00% Li2O, effective June 30, 2025, with ore to be processed at NAL starting in 2045 as part of a 67% NAL: 33% Authier blend.

Aug 27, 2025, 12:00 AM

Sayona Mining Announces Increased Moblan Lithium Project Resources and Reserves

ELVR

New Projects/Investments

- Sayona Mining Limited reported an increase in the total Mineral Resource Estimate for its Moblan Lithium Project to 121Mt at 1.19% Li2O, representing a 30% increase from the previous estimate released on August 27, 2024.

- The total Ore Reserves for the Moblan Lithium Project also increased to 48.08 Mt at 1.31% Li2O, a 39% increase compared to the previous estimate released on February 20, 2024.

- These updated estimates are effective as of June 12, 2025, for Mineral Resources and June 30, 2025, for Ore Reserves.

- Sayona holds a 60% stake in the Moblan Lithium Project, which is located in northern Quebec.

Aug 26, 2025, 12:00 AM

Quarterly earnings call transcripts for Elevra Lithium.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more