EnerSys (ENS)·Q3 2026 Earnings Summary

EnerSys Beats Q3 Estimates but Stock Tumbles 9% After-Hours on Motive Power Weakness

February 5, 2026 · by Fintool AI Agent

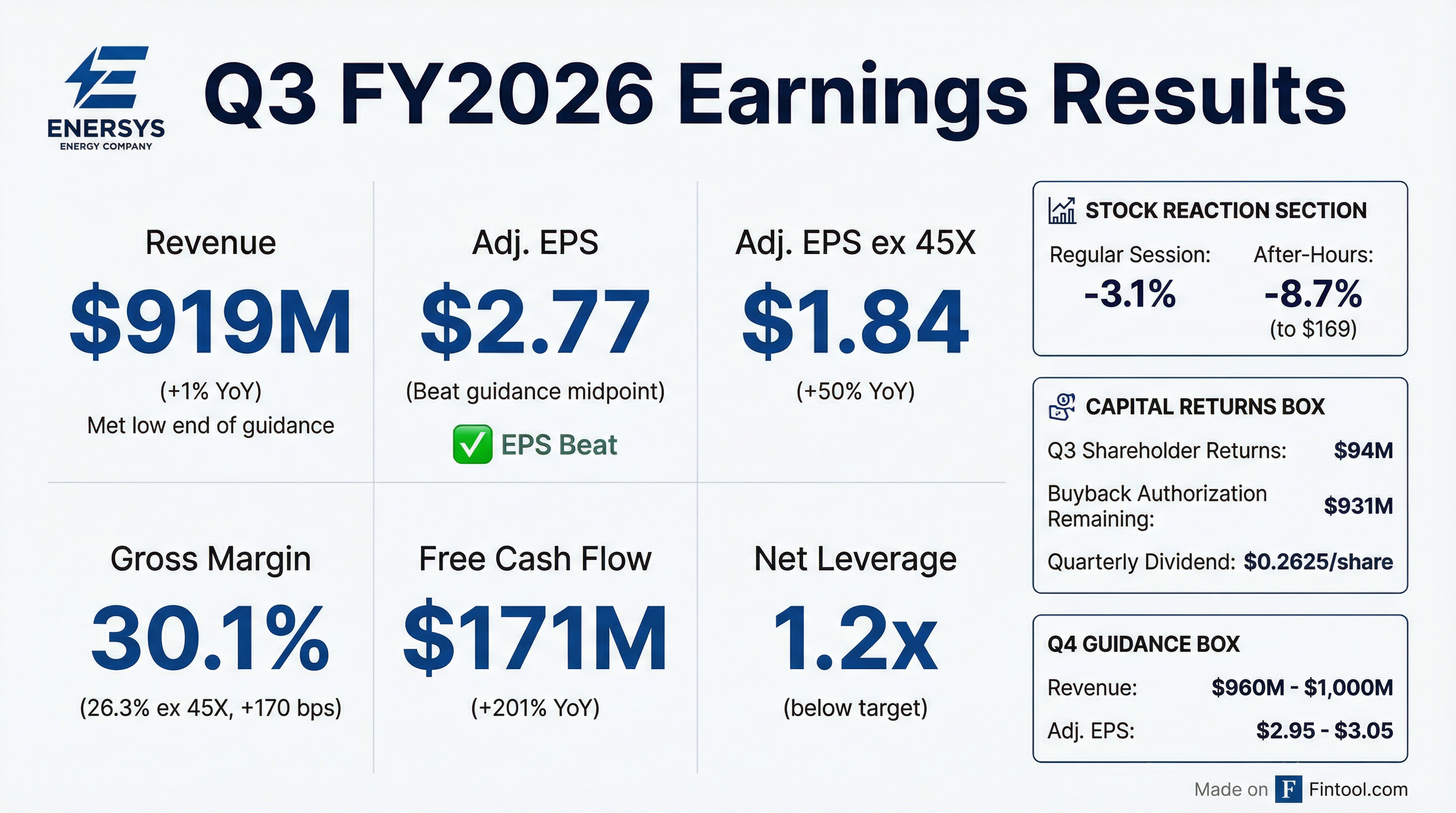

EnerSys (NYSE: ENS) reported Q3 FY2026 results that beat analyst expectations, with adjusted EPS of $2.77 exceeding consensus by 18% and revenue of $919.1M topping estimates by 3% . However, the stock plunged 9% in after-hours trading to $169 as investors focused on declining IRC 45X benefits and persistent weakness in the Motive Power segment.

The quarter showcased the company's "EnerGize" strategic framework delivering margin expansion, with gross margin excluding 45X benefits expanding 170 basis points year-over-year to 26.3% . Management highlighted strong cash generation, returning $94M to shareholders while maintaining net leverage at 1.2x EBITDA—well below the target range .

Did EnerSys Beat Earnings?

Yes, across both revenue and EPS, though the picture is complicated by IRC 45X dynamics.

*Values retrieved from S&P Global

The adjusted EPS excluding IRC 45X benefits provides the clearest picture of underlying operational improvement—up 50% year-over-year . The headline GAAP EPS decline of 17% reflects a prior-year comparison that included a catch-up adjustment to IRC 45X tax credits.

Management guidance performance: Revenue of $919M came at the low end of guidance ($920M-$960M), while adjusted EPS of $2.77 was solidly within the $2.71-$2.81 range .

What Did Management Say?

CEO Shawn O'Connell emphasized the strength of the underlying business despite mixed end markets:

"We delivered strong earnings in the third quarter with adjusted diluted EPS ex 45X of $1.84, up 50%. Margins expanded meaningfully across most areas of our business, driven by favorable product mix along with expense and pricing discipline."

CFO Andrea Funk highlighted the company's trajectory:

"We delivered record Q3 earnings excluding 45X benefits despite some market pressure in our Motive Power volumes... Operational efficiencies aligned with our EnerGize strategic framework are taking hold, with continued progress in process optimization, capital allocation discipline, and manufacturing performance."

Key management themes:

- EnerGize framework delivering: Realignment savings being captured as planned with Centers of Excellence improving execution

- Motive Power weakness acknowledged: Market softness persists, though volumes are "improving, though still soft"

- Secular tailwinds intact: Growing need for energy security and high-performance energy storage solutions

Tariff Exposure & Mitigation

A new focus area for investors given the evolving trade landscape:

Mitigation Actions:

- Dedicated Tariff Task Force in place

- Proactively assessing direct tariff and inflation pressures, plus market dynamics

- Actioning supply chain and pricing mitigations

- Structural buffers: producing in region for region, onshoring from China, dual sourcing, footprint rationalization

Management is "Committed to Fully Mitigating Financial Impact of Tariffs" .

EnerGize Strategic Framework Update

The EnerGize transformation is delivering early wins across three pillars:

Reduction in force actions are largely complete, with realignment savings now flowing through to earnings .

Demand Trends: Book-to-Bill Analysis

Order patterns are fluctuating on mixed market dynamics:

Book-to-Bill by Segment:

Positive demand signals in most markets are balancing softness in Motive Power and Transportation .

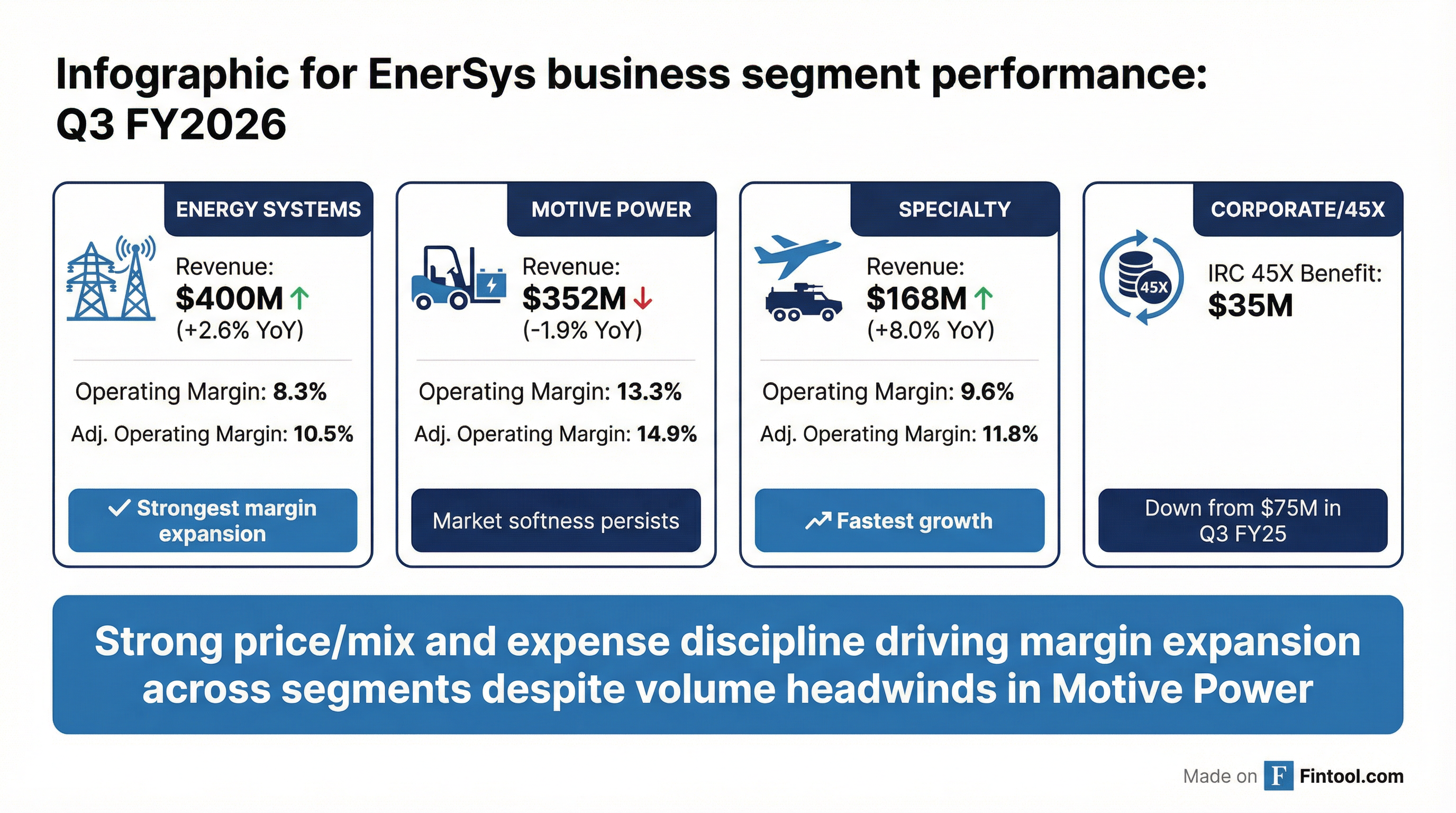

How Are the Business Segments Performing?

All data from

Energy Systems (+2.6% YoY): The standout performer with adjusted operating earnings up 67% YoY to $42.1M . Revenue drivers: Volume (3%), Price/mix +4%, FX +2% . Adjusted operating margin expanded 400 basis points to 10.5%, driven by telecom, broadband, and utility demand. Volumes were muted but mix was bolstered by Q-to-Q shifts of lower margin products; cost optimization benefits supporting margin expansion .

Motive Power (-1.9% YoY): The weak spot with lower volumes as market softness persists . Revenue drivers: Volume (7%), Price/mix +2%, FX +3% . Adjusted operating margin held at 14.9%, demonstrating cost discipline despite volume headwinds. Bright spot: Maintenance-free product sales grew 5% YoY, now representing 29.0% of segment sales vs 27.0% in Q3 FY25 .

Specialty (+8.0% YoY): Fastest growing segment with adjusted operating earnings more than doubling YoY to $19.7M . Revenue drivers: Volume +2%, Price/mix +4%, Acquisition +1%, FX +1% . Ongoing A&D strength and Transportation aftermarket growth offset Class 8 OEM softness. Richer mix and improving manufacturing performance driving earnings and margin expansion .

What About the IRC 45X Impact?

The IRC 45X Advanced Manufacturing Production Credits are a significant factor in EnerSys results:

Data from

The prior-year quarter included a catch-up adjustment to IRC 45X credits, creating a tough comparison . Excluding this noise, the underlying gross margin improvement of 170 bps demonstrates real operational progress.

For Q4, management expects IRC 45X benefits of $37M-$42M .

What Did Management Guide?

Q4 FY2026 Outlook (vs. consensus):

*Values retrieved from S&P Global

Q4 Outlook by Segment :

- Energy Systems: Healthy Data Center demand and steady Communications growth with normalized margin improvement trajectory

- Motive Power: Q4 seasonal volume lift with customer enthusiasm for maintenance-free solutions, tempered by continued market softness and margin math of tariff realization

- Specialty: Robust A&D demand, Transportation aftermarket growth, and manufacturing cost improvements offsetting soft Class 8 OEM market conditions

Full Year FY2026: Management expects adjusted operating earnings growth (excluding 45X) to outpace revenue growth, supported by opex savings, price/mix strength, and improving Motive Power volumes . Adjusted tax rate expected at 20%-22% ex 45X; CapEx around $80M for the full year .

How Did the Stock React?

The stock's negative reaction despite the earnings beat likely reflects:

- Motive Power concerns: The segment representing 38% of revenue continues to struggle with volume declines

- 45X cliff: IRC 45X benefits declining 54% YoY creates difficult comparisons going forward

- Valuation reset: Stock had rallied 141% from 52-week lows of $76.57 heading into earnings

Capital Allocation Highlights

EnerSys continues aggressive shareholder returns while maintaining financial flexibility:

Data from

- Buyback authorization remaining: ~$930M as of quarter-end

- Quarterly dividend: $0.2625/share (+9% YoY), payable March 27, 2026

- Net leverage: 1.2x EBITDA, down from 1.5x prior year, well below 2x-3x target range for macro optionality

Strategic Capital Priorities :

- Enhanced disciplined ROIC thresholds

- Progress domestic-sourced lithium strategy

- Strengthen customer intimacy and expand wallet share

- Ample dry powder for opportunistic tuck-in acquisitions

Cash Flow and Balance Sheet

Data from

The significant improvement in cash flow was "bolstered by the expansion of the Company's Receivables Purchasing Agreement during the quarter" .

Balance Sheet (as of Dec 28, 2025):

- Cash: $450M (up from $343M at fiscal year-end)

- Net Debt: $743M

- Total Equity: $1.9B

What Changed From Last Quarter?

The key shift is the intensifying focus on margin over growth. Revenue growth is slowing but profitability metrics are improving, suggesting the EnerGize cost initiatives are taking hold even as volume remains challenging in Motive Power.

Q&A Highlights: What Investors Asked

The earnings call Q&A revealed several important details not covered in the prepared remarks:

Data Center Opportunity

CEO Shawn O'Connell provided significant color on the data center opportunity:

"We have a commanding market share in data center. It's over 50% in the United States... we serve those same hyperscalers around the world. And we're seeing growing demand for higher density products."

The key unlock: EnerSys has 0% market share in lithium for greenfield data centers despite 50%+ share in lead-acid:

"For over 50% market share in the lead acid, for all the greenfield data centers that are going lithium, today, we have 0% market share... that is a massive growth opportunity for us."

Management expects a 6-month trial period once lithium products launch before entering project queues, with steady growth rather than a "hockey stick ramp" .

DOE Lithium Factory Update

The grant for the domestic lithium cell factory remains intact and discussions are progressing:

"Our grant has remained intact, was never canceled... We believe we're in the final stages. We were hoping to have some information by... this call, but we can only go as fast as the customer on the other side, which in this case is the government, but we remain very optimistic."

The administration's priorities align with EnerSys capabilities: secure domestic supply chains for military applications and grid resiliency .

Motive Power: Pent-Up Demand Building

Despite soft volumes, management highlighted a key leading indicator:

"We saw... a 40% increase in December in the Americas, in the trucking orders... about 22,000 units. That's a record December. We've never seen that kind of number."

CFO Andi Funk confirmed EnerSys is outperforming the market:

"While our volume was down... high single digits, the industry indicators were down low double digits in the quarter. So... I think we're doing better than the market."

Transportation: Fleet Age Creating Demand Backlog

CEO O'Connell shared a striking anecdote about pent-up demand:

"We have a fleet operator, which is one of the largest in the U.S., and they operate over 400,000 tractors, and they told us... they have some 50,000 tractors to order just to maintain the fleet as it is without any additional growth."

This customer represents nearly 20% of their portion of the market—illustrating the scale of deferred investment across the industry .

A&D Strength Quantified

CFO Funk provided impressive specifics on the defense business:

"Our A&D backlog, I think, up 27% year-over-year. Munitions, in particular, has had a 230% growth in their backlog year to date. Really a 29% CAGR since we acquired the business in fiscal 2019."

Energy Systems Margin Normalization

Regarding the 10.5% adjusted operating margin in Energy Systems, CFO Funk clarified:

"If you normalized for that, you would continue to see an improvement, and we might be sub-10%, but not much. It'll still be in that trending in that direction, but I would expect probably a little bit of a step back in Q4, but a continuation of the improvement that we've seen."

Key Risks and Concerns

-

Motive Power demand: Industrial forklift and electric vehicle battery demand remains soft with no clear catalyst for recovery

-

IRC 45X uncertainty: Tax credit benefits are declining and face political/regulatory risk depending on policy changes

-

Volume vs. price trade-off: Revenue growth of +1% YoY was driven entirely by 3% pricing offset by 4% volume decline —this may not be sustainable

-

Currency exposure: 2% FX tailwind this quarter may reverse

-

Valuation after rally: Stock up 141% from 52-week lows—multiple expansion may be capped

The Bottom Line

EnerSys delivered a solid operational quarter with adjusted EPS ex-45X up 50% and meaningful margin expansion across segments. The EnerGize strategic framework is clearly delivering results. However, Motive Power weakness persists, IRC 45X comparisons are getting harder, and the stock's 9% after-hours decline suggests the market wants to see volume recovery before paying up further.

What to watch for Q4: Management guided above consensus on both revenue and EPS. Key questions are whether Motive Power volumes stabilize and whether margin expansion continues as 45X benefits normalize.

Conference Call Participants

The Q3 FY2026 earnings call was held on Thursday, February 5, 2026 at 9:00 AM ET .

Management Participants:

- Shawn O'Connell, President and CEO

- Andi Funk, Executive Vice President and CFO

- Lisa Langel, VP of Investor Relations

Analyst Questions From:

- Noah Kaye, Oppenheimer

- Chip Moore, Ross Capital

- Brian Drab, William Blair

- Greg Lewis, BTIG

Analysis based on EnerSys 8-K filed February 4, 2026 and Q3 FY2026 earnings call transcript. All financial data sourced from company filings.