ENSIGN GROUP (ENSG)·Q4 2025 Earnings Summary

Ensign Group Surges 14% to 52-Week High After Double Beat, Guides +14% EPS Growth

February 5, 2026 · by Fintool AI Agent

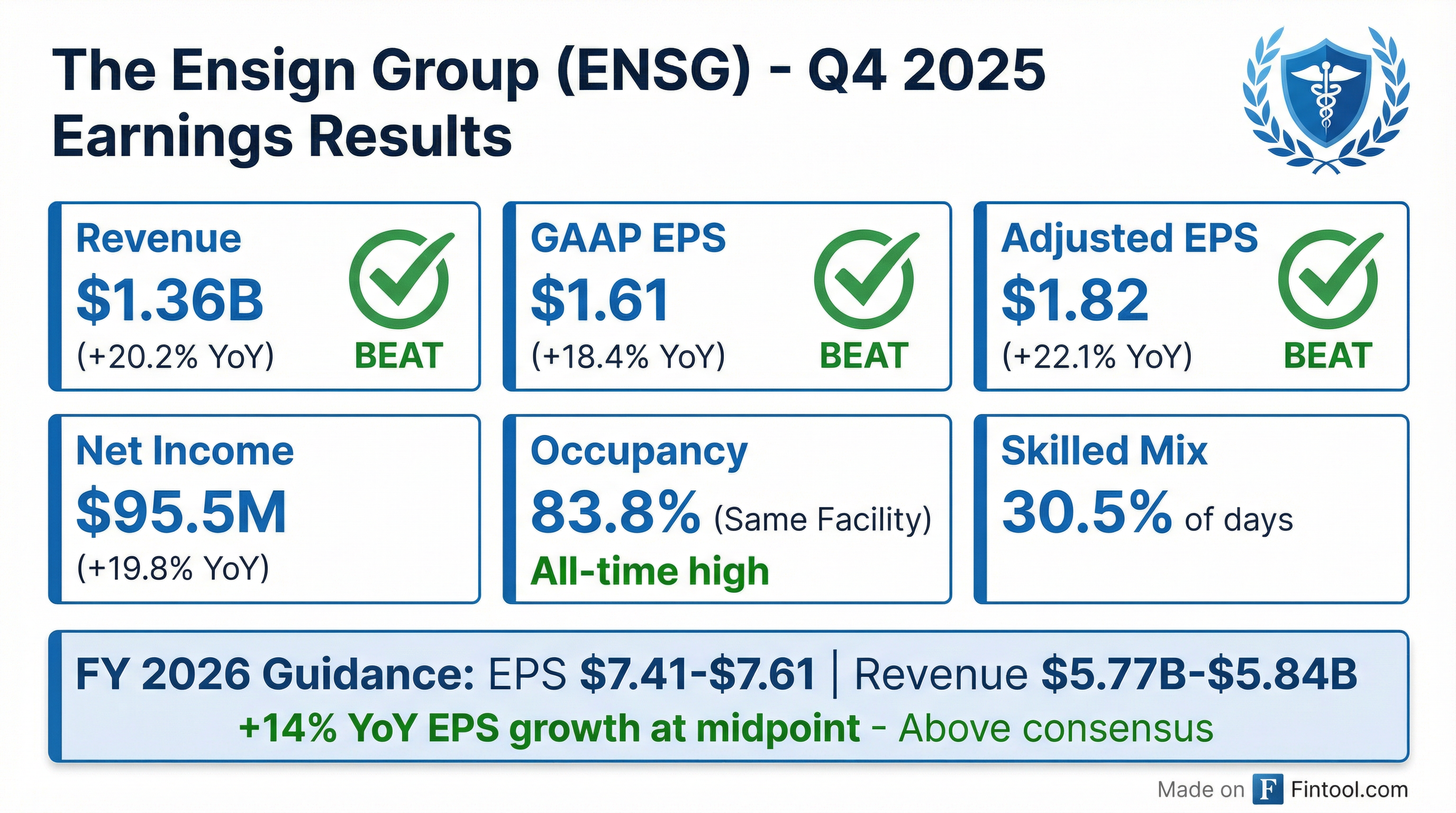

The Ensign Group (NASDAQ: ENSG) surged 14% to a new 52-week high after delivering another record quarter that beat on both the top and bottom line. The skilled nursing operator reported adjusted EPS of $1.82, crushing consensus by 13%, while revenue of $1.36 billion topped estimates by 6.3%.

The stock closed at $197.16 on February 5, hitting an intraday high of $199.01 on 2x average volume. Management issued 2026 guidance above Street expectations, projecting 14% EPS growth at the midpoint—signaling confidence in the company's organic growth runway and acquisition pipeline.

Did Ensign Beat Earnings?

Yes, decisively. Ensign delivered a double beat with strong momentum across all key metrics:

This marks Ensign's seventh consecutive EPS beat over the past eight quarters, with only Q2 2025 showing a slight miss. The company has established a pattern of under-promising and over-delivering.

Year-Over-Year Momentum

What Did Management Guide?

Management's 2026 outlook came in above consensus, reflecting confidence in continued organic execution and acquisition integration:

Key assumptions in guidance:

- Diluted weighted average shares: ~60.0 million

- Tax rate: 25.0%

- Includes acquisitions expected to close through Q1 2026

- Excludes stock-based compensation and acquisition-related costs

CEO Barry Port emphasized the organic growth runway: "At 83%, we have enough organic growth potential left in our organization to sustain our consistent earnings and revenue growth, even if we stopped acquiring."

What Changed From Last Quarter?

Occupancy Hits Record Levels

The key story this quarter is occupancy—same-facility occupancy reached 83.8%, an all-time high, up 2.9% year-over-year.

Skilled Mix Expansion Continues

Higher-acuity patients (Medicare, managed care, and other skilled) now represent 30.5% of nursing days, up from 29.1% a year ago. This drives higher revenue per patient day.

Medicare revenue improvements:

- Same Facilities: +15.7% YoY in Q4

- Transitioning Facilities: +11.3% YoY in Q4

Clinical Quality Driving Referrals

Management highlighted CMS data showing Ensign-affiliated facilities outperformed peers:

- 24% better annual survey results vs. state peers

- 33% better vs. county-level peers

- 19% advantage in 4- and 5-star rated buildings

Acquisition Activity

Ensign accelerated its acquisition pace, adding 17 operations during Q4 and since, including 12 real estate assets. For full-year 2025, the company acquired 51 operations.

Q4 2025 Acquisitions Included:

Leased Operations:

- The Health Center of Eastview (90 beds, Birmingham, AL)

- The Rehabilitation Center at Sandalwood (103 beds, Wheat Ridge, CO)

- Edgewater Health and Rehabilitation (69 beds, Lakewood, CO)

- Santa Rosa Care Center (144 beds, Tucson, AZ)

- Agave Grove Post Acute (225 beds, Glendale, AZ)

Real Estate Acquisitions (Standard Bearer):

- Stonehenge portfolio (7 facilities, Utah)

- Willow Point Rehabilitation (45 beds, Kansas City, KS)

- The Chateau Waco (123 beds, Waco, TX)

- Sunset Valley Rehabilitation (80 beds, Littlefield, TX)

- Wylie Oaks Healthcare (106 beds, Wylie, TX)

- Timber Ridge Health (48 beds, Stevens Point, WI)

Chief Investment Officer Chad Keetch noted: "Our building-by-building approach to transitions works for single operations, small portfolios and larger portfolios, particularly when a larger deal spans several markets and geographies."

Current Portfolio:

- 378 healthcare operations across 17 states

- 31 campuses with senior living

- 160 owned real estate assets (124 operated by Ensign affiliates)

Standard Bearer Real Estate Segment

The company's real estate segment (Standard Bearer) continues to deliver strong growth:

Full-year 2025 rental revenue reached $126.9M (+33.5% YoY) with FFO of $75.2M (+28.3% YoY).

Balance Sheet and Liquidity

Ensign maintains a strong financial position to fund continued acquisitions:

Cash from operations totaled $564.3 million for full-year 2025, up 63% from $347.2 million in 2024.

The company raised its quarterly dividend for the 23rd consecutive year (current rate: $0.065/share).

How Did the Stock React?

ENSG shares surged 13.8% on February 5, 2026, closing at $197.16—hitting a new 52-week high of $199.01 intraday. Volume was 2x the average at 1.07 million shares.

The double beat, above-consensus guidance, and record occupancy combined to drive the strongest single-day move in over two years. The stock is now up 66% from its 52-week low.

Facility Turnaround Highlights

Management highlighted two operations that exemplify Ensign's clinical-to-financial flywheel:

South Bay Post Acute (San Diego, CA)

This 98-bed facility has been an Ensign affiliate since 2014 and achieved 127% EBIT growth YoY in Q4—despite starting the year with 96% occupancy.

Key drivers:

- Developed specialized bariatric care capabilities, an underserved population in post-acute

- Remodeled rooms, invested in specialized equipment, implemented behavioral health support

- Medicare days increased 86%, managed care volume grew 22%

- Awarded new high-reimbursement managed care contracts

"By addressing the clinical and operational challenges that hospitals face when placing bariatric patients, South Bay positioned itself as a reliable solution for complex discharges."

Shoreline Health and Rehabilitation (Seattle, WA)

This 114-bed operation transitioned from "transitioning" to same-store status, posting 33% EBIT growth and record quarterly results.

Key drivers:

- CMS nursing turnover 60% lower than state average

- Frontline staff tenure averages 7+ years

- Zero registry staffing for two consecutive years

- Became the only facility in North Seattle accepting TPN (IV nutrition) patients

- Medicare days up 24%, managed care up 103% YoY

"By investing in its workforce and positioning itself as a solution to hospital discharge constraints, Shoreline continues to strengthen its standing as a high-performing, clinically sophisticated provider."

Labor and Workforce Update

Management provided encouraging updates on staffing dynamics:

COO Spencer Burton noted: "With time and with the right people, you're gonna see labor numbers get better and better. Overtime is moving in the same direction [as agency]."

New Construction Projects

Ensign completed two notable construction projects in California:

Vista Knoll Expansion (Vista, CA): Added 40 beds dedicated to behavioral health specialty care. The new wing achieved 98.3% occupancy within months of opening.

Grossmont Post Acute Replacement (La Mesa, CA): Built a brand-new state-of-the-art replacement facility across from Sharp Grossmont Hospital, adding 15 beds to the original license. Management emphasized this approach—moving patients and staff to a new building on day one—provides faster ROI than de novo construction.

Chad Keetch explained the strategy: "Building a brand-new building is really time-consuming and expensive... where you can do a replacement facility and essentially start with a new building, but you've moved the staff and the patients over on day one, it makes for a whole lot quicker return."

Q&A Highlights

M&A Pipeline and Valuations

Analysts asked about the acquisition environment. Chad Keetch described the market as "seller-friendly" with elevated valuations, but emphasized discipline:

"When there are high-quality assets that have newer construction, higher occupancies and higher skilled mix, those sometimes deserve a premium... the Stonehenge acquisition represented a premium over our historical acquisitions in Utah. However, just a few months after closing, these operations are performing well ahead of schedule."

Medicare Value-Based Purchasing

Management expressed confidence in CMS quality-based programs:

"Any time a new program is implemented, we get excited when either the state or the federal government looks to quality and looks for us to be measured upon quality... we have dashboards and other things that allow us then to ensure that we are measuring those outcomes."

AI and Technology Initiatives

Barry Port outlined Ensign's approach to AI adoption:

"We've been highly involved in looking at opportunities where we can leverage mostly our existing partnerships with our different software systems—ERP, clinical documentation—to leverage the data and information we have in a more effective way... We're really excited about how we can leverage the data we have about our patients and residents to make better and more nimble clinical decisions."

Behavioral Health Strategy

Management confirmed expansion into behavioral health and specialty programs, noting it's being done in "careful partnership with managed care plans" in mature markets like California, Arizona, and Texas.

Key Takeaways

- Stock Surges 14%: Shares hit a new 52-week high of $199.01 on 2x average volume, now up 66% from 52-week lows

- Double Beat: Revenue +6.3% and adjusted EPS +13% above consensus, marking the 7th beat in 8 quarters

- Record Occupancy: Same-facility occupancy hit all-time high of 83.8%, with room to grow toward the mid-90s seen at mature facilities

- Guidance Above Street: 2026 EPS midpoint of $7.51 is 3.3% above consensus, with 14% YoY growth implied

- Acquisition Machine Continues: 51 operations acquired in 2025, with more expected in Q1 2026

- Labor Momentum: DON turnover down 33%, CEOs-in-training at all-time high, zero registry staffing at top facilities

- Skilled Mix Tailwind: Higher-acuity patients now 30.5% of days, driving revenue per patient day expansion

- Strong Cash Generation: Operating cash flow up 63% YoY to $564M, funding organic growth and acquisitions

Related Links: