ESAB (ESAB)·Q4 2025 Earnings Summary

ESAB Beats Q4 Estimates, Announces Transformative $1.45B Eddyfi Acquisition

February 2, 2026 · by Fintool AI Agent

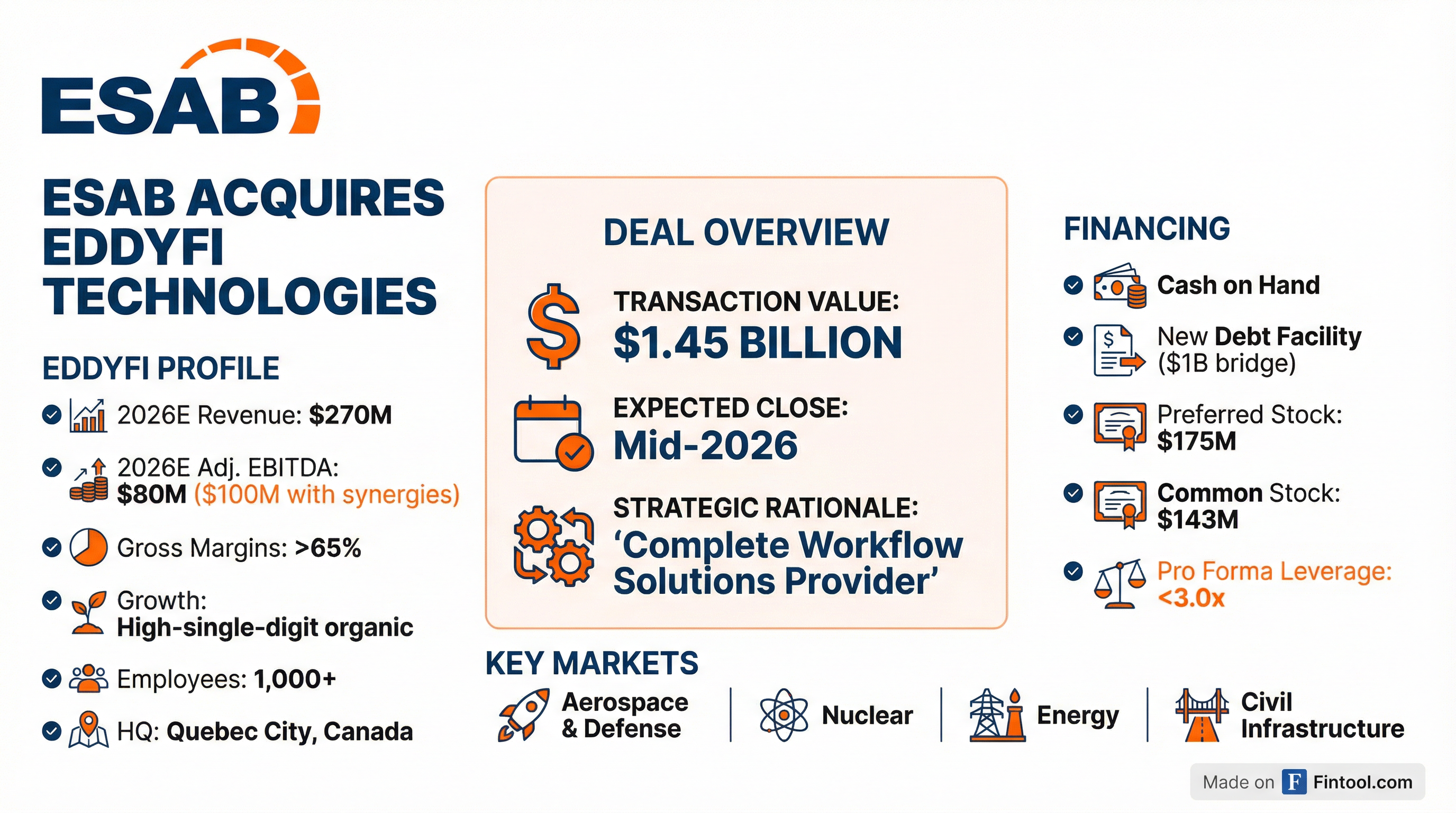

ESAB Corporation delivered a solid Q4 2025, beating both revenue and EPS consensus estimates while announcing a transformative $1.45 billion acquisition of Eddyfi Technologies. The deal positions ESAB as the "unrivaled provider of complete workflow solutions" spanning fabrication, inspection, and monitoring—a strategic pivot that expands its total addressable market by approximately $5 billion.

Shares closed at $121.10 (+1.1%) on the news but traded down to $119.34 (-1.5%) after hours, reflecting investor digestion of the dilutive equity financing required to fund the transaction.

Did ESAB Beat Earnings?

Yes—ESAB beat on both top and bottom lines.

Values retrieved from S&P Global

The beat extends ESAB's streak—the company has beaten EPS estimates for eight consecutive quarters, demonstrating consistent execution of its ESAB Business Excellence System (EBX).

What Changed From Last Quarter?

The Eddyfi acquisition is the headline, but the core business continued to improve:

Note: Q4 was impacted by softer December sales due to customer shutdowns, partially offsetting typical year-end seasonality

Key changes:

- Americas recovery continues: The U.S. delivered mid-single-digit growth in Q3 and appeared to maintain momentum into Q4

- Equipment mix accelerating: Equipment and automation grew high single-digits, supporting the shift to higher-margin products

- EWM integration advancing: The September 2025 acquisition of EWM is now being integrated with cross-selling opportunities emerging

The Eddyfi Deal: What Investors Need to Know

Strategic Rationale

CEO Shyam Kambeyanda framed the deal as a pivotal step in ESAB's "compounder journey":

"With the addition of Eddyfi, ESAB becomes the unrivaled provider of a full workflow solution spanning fabrication, inspection and monitoring. This acquisition further expands ESAB's total addressable market by approximately $5 billion and accelerates our journey toward a portfolio that is faster growing, higher margin and less cyclical."

Eddyfi Financial Profile

Eddyfi Business Mix

Sales by End Market:

- Nuclear: 30%

- Infrastructure: 24%

- Energy Infrastructure: 19%

- Aerospace & Defense: 12%

- Other: 15%

Sales by Technology:

- Electromagnetic Testing: 43%

- Ultrasonic Testing: 29%

- Automated Inspection: 28%

Geographic Mix: NAM 37%, Europe 30%, Asia 17%, Other 16%

Deal Financing

ESAB is funding the $1.45B transaction with a mix of:

- Cash on hand

- $1.0B bridge loan from JPMorgan Chase (364-day senior unsecured)

- $175M Mandatory Convertible Preferred Stock (6.50% Series A) — includes $125M from the Rales family (Mitchell: $100M, Steven: $25M)

- $143M Common Stock (1.25M shares at $114/share)

Pro forma leverage: Expected <3.0x by year-end 2026

Key End Markets

Eddyfi strengthens ESAB's exposure to attractive, high-growth sectors:

- Aerospace & Defense

- Nuclear power generation

- Energy infrastructure

- Civil infrastructure

What Did Management Guide?

FY 2025 Preliminary Results (excluding Russia)

FY 2026 Outlook (Standalone, Excludes Eddyfi)

Important: This guidance excludes Eddyfi, which is expected to close mid-2026. The combined company will be larger, but also carrying higher leverage and integration costs initially.

How Did the Stock React?

The muted initial reaction likely reflects:

- Equity dilution: The $318M equity raise (preferred + common) dilutes existing shareholders

- Integration risk: $1.45B is a large deal for a $7.3B market cap company

- Leverage concerns: Even at <3.0x, the balance sheet will be stretched during integration

However, if management executes on synergies and Eddyfi delivers on its growth profile, the stock could re-rate as the "compounder thesis" gains credibility.

Management Credibility Check

ESAB has delivered 8 consecutive quarterly EPS beats, demonstrating consistent execution. Key credibility markers:

Positives:

- Beat-and-raise pattern has been consistent

- EWM acquisition (September 2025) closed ahead of schedule

- Organic growth returned to positive in Q3 2025 as guided

- Rales family participation ($125M) signals insider confidence in the Eddyfi deal

Watch Items:

- Americas margins still below target (restructuring underway)

- Integration of multiple deals simultaneously (EWM + Eddyfi)

- 22%+ EBITDA margin target by 2028 requires flawless execution

Forward Catalysts

Key Risks

- Integration execution: Managing EWM and Eddyfi integrations simultaneously

- Leverage: Pro forma debt load leaves less flexibility

- End market cyclicality: Industrial demand tied to capex cycles

- Tariff exposure: Americas segment remains sensitive to trade policy

- Russia exposure: Continues to be excluded from "Core" metrics

The Bottom Line

ESAB delivered another solid quarter, but the real story is the $1.45B Eddyfi acquisition. If management executes—and their track record suggests they can—this deal transforms ESAB from a welding equipment company into a comprehensive workflow solutions provider with higher margins, faster growth, and less cyclicality.

The stock's muted reaction creates potential opportunity for investors who believe in the compounder thesis. Watch for:

- Regulatory approval timeline

- Integration milestones

- Q1 2026 organic growth confirmation

Data sources: ESAB Corporation 8-K filed February 2, 2026; Q3 2025 Earnings Call Transcript; S&P Global estimates.