EZCORP (EZPW)·Q1 2026 Earnings Summary

EZCORP Crushes Q1 as Pawn Demand Surges, Stock Jumps 9% After-Hours

February 4, 2026 · by Fintool AI Agent

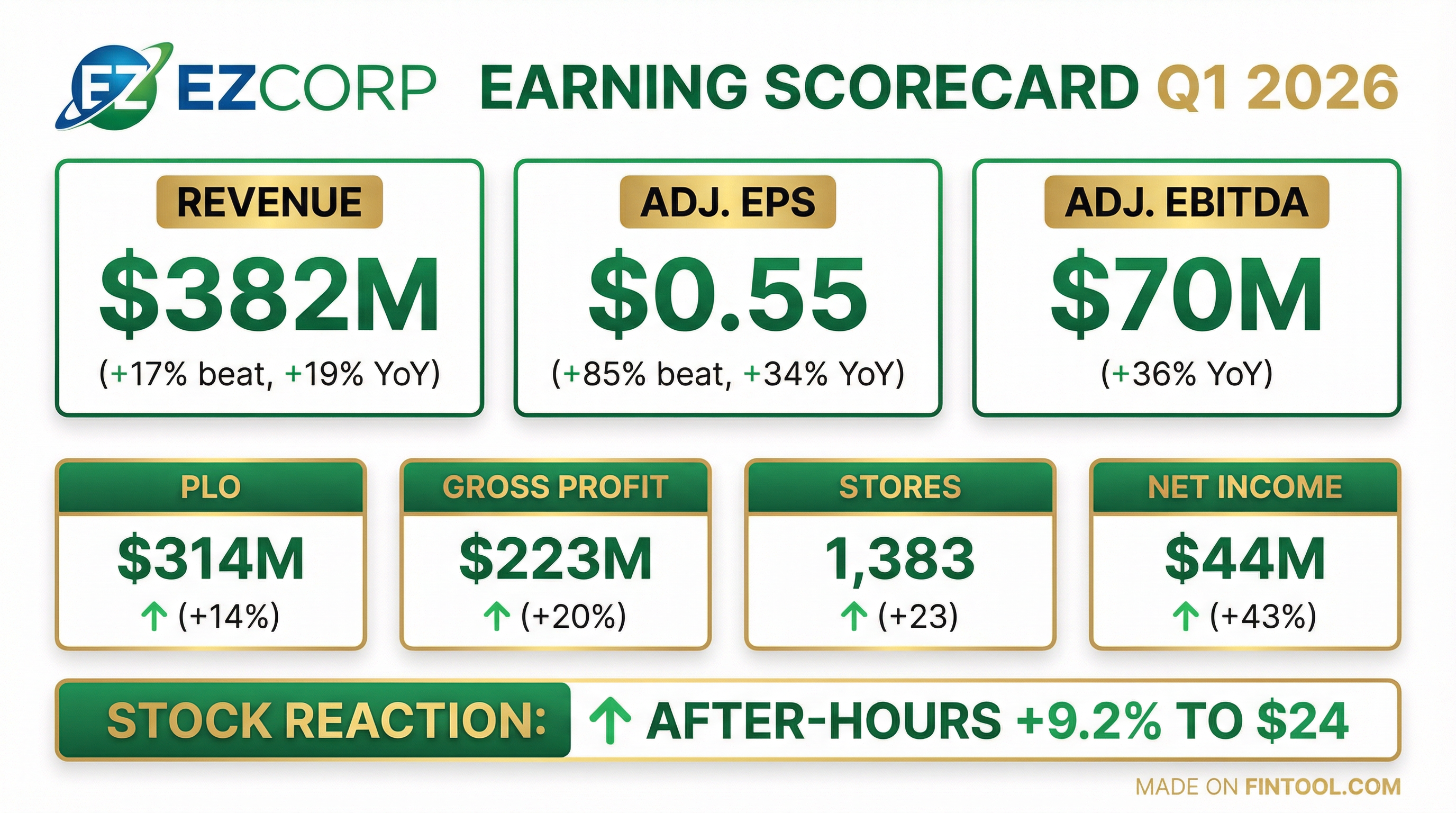

EZCORP delivered a blowout Q1 FY2026, posting record revenue and earnings that demolished Wall Street estimates. Revenue surged 19% YoY to $382M, beating consensus by 17%, while adjusted EPS of $0.55 exceeded expectations by a staggering 85%. The stock jumped 9.2% in after-hours trading to $24.00 as investors cheered the results and two accretive acquisitions closed in January.

Did EZCORP Beat Earnings?

Decisively. EZCORP delivered one of its largest earnings beats in recent history:

The company's eighth consecutive quarter of beats underscores the resilience of the pawn business model amid a challenging consumer environment.

Key operational metrics also impressed:

- Pawn Loans Outstanding (PLO): $307.3M (+12% YoY)

- Net Earning Assets: $554M (+17% YoY)

- PLO to Inventory Ratio: 1.2x (healthy lending discipline)

- Store Count: 1,500 stores across 16 countries (post-acquisitions)

- Average US Loan Size: $231 (+12% YoY)

- Jewelry as % of US PLO: 68% (up 310 bps YoY)

How Did the Stock React?

EZPW shares surged in after-hours trading following the earnings release:

The after-hours move pushed shares above the 52-week high set during the regular session, reflecting investor enthusiasm for both the earnings beat and the growth trajectory.

What Changed From Last Quarter?

Three key developments stand out:

1. Jewelry Scrap Sales Exploded

Jewelry scrap sales surged 139% YoY to $39.9M, with gross margin expanding from 23% to 34%. The dramatic improvement was driven by:

- Higher gold prices

- Increased jewelry purchases/forfeitures

- Improved scrap processing efficiency

2. Latin America Accelerated

The Latin America segment delivered 28% revenue growth (19% constant currency), with PLO up 36% YoY. Store count increased by 21 to 836 locations, with 14 acquisitions and 7 de novo openings.

3. Merchandise Margins Improved

Merchandise sales gross margin expanded 200 bps to 37%, driven by pricing optimization and inventory management.

What Did Management Say?

CEO Lachie Given struck an optimistic tone:

"We are off to an exceptional start to fiscal 2026, delivering record first quarter revenue and PLO, and outstanding organic earnings growth. Our team drove superior results, with more than 35% growth in net income and adjusted EBITDA, supported by sustained demand for immediate cash solutions and high-quality, affordable secondhand goods."

On capital allocation:

"With a highly liquid balance sheet, we are well positioned to execute on our pawnbroking growth strategy, while remaining disciplined in capital allocation."

On the competitive environment:

"EZCORP is off to an exceptional start to fiscal 2026, delivering one of the strongest quarters in our history. We achieved record first-quarter revenue and PLO, along with outstanding earnings growth for our shareholders. Our team's disciplined execution and the operating leverage inherent in our platform drove more than 35% growth in both net income and EBITDA."

On using AI to improve operations:

"We're doing a much better job of using data and AI to lend better at the counter. And that has the down-the-flow impact, all sorts of impact on inventory, on margin, and on turns."

What Acquisitions Closed?

Two significant deals closed in January, adding 117 stores:

Post-acquisitions, EZCORP now operates 1,500 pawn stores across 16 countries.

Management noted Puerto Rico represents the most significant SMG growth opportunity, with 29 stores and potential for "significantly more."

Q&A Highlights

On M&A pipeline post-acquisitions:

"The M&A pipeline definitely remains strong. Clearly, we've taken the biggest one in North America out of that equation now by buying SMG. But it remains strong, particularly in Mexico and other Latin American countries... The US is more in the single-digit stores now. We need to get good at consistently buying ones, twos, and threes."

On tax refund season impact (Q2 outlook):

"We've generally seen in the US pawn business going from December to March an 8%-9% decrease in PLO in the last couple of years. It does look like it's going to be slightly higher than that."

On gold price risk management: CFO Tim Jugmans explained that EZCORP lends based on long-term gold price trends rather than daily fluctuations, with built-in margin protection: "The recent up and down of the gold price in the last week, no effect whatsoever... We're not lending at the rate we're going to scrap at. So there is a margin already built in."

On new investor interest:

"We are absolutely seeing a lot more interest activity, firstly, in the industry and then secondly, in our stock. We are seeing the big active, fundamental, long-only funds showing much more interest... I think the stock is fundamentally underpriced because we are growing so rapidly."

On Mexico minimum wage impact: CFO noted that Mexico's minimum wage increased 13% on January 1, 2026, which will start coming through in Q2 on top of prior year increases.

Segment Breakdown

U.S. Pawn highlights:

- PLO expanded 9% to $239.9M, with same-store PLO up 8%

- Average loan size rose 12% to $231, driven by higher jewelry prices

- Jewelry now represents 68% of US PLO, up 310 bps YoY

- Merchandise sales +8%, margin expanded 170 bps to 38%

- Scrap margins expanded from 23% to 34% on elevated gold prices

- Store count: 547 across 19 states

Latin America Pawn highlights:

- PLO expanded 23% to $67.4M, with same-store gains of 12%

- Average loan size improved 16% to $102.9 (constant currency)

- Jewelry now represents 47% of LatAm PLO, up 650 bps YoY

- Merchandise margin expanded 380 bps to 34%

- Inventory turnover improved to 3.1x from 3.0x

- Store count: 836 across 4 countries (+7 de novo, +14 acquired)

Balance Sheet Strength

EZCORP ended Q1 with a fortress balance sheet:

The cash build reflects $300M in Senior Notes issued in Q2 FY2025, providing significant firepower for M&A.

What Are the Risks?

Near-term concerns to monitor:

-

Mexico minimum wage inflation: Mexico's minimum wage increased 13% on January 1, 2026, on top of prior year increases. This will pressure LatAm margins starting Q2.

-

Scrap margin normalization: Management explicitly warned that once gold stabilizes, "we'd expect approximately two quarters of elevated scrap gross profit margin before margins begin to normalize towards historical levels."

-

US inventory turnover declined: Inventory turnover fell to 2.5x from prior periods, though aged general merchandise remains manageable at 3.1% of GM inventory ($1.7M). Higher jewelry mix naturally carries longer sale cycles.

-

Integration execution risk: SMG was a private company that "now has to operate in a public company world." Expect expense increases in finance, legal, and IT functions.

-

Tax refund season headwind: Historical pattern shows 8-9% PLO decline from December to March due to loan paydowns from tax refunds.

Forward Catalysts

Historical Performance

EZCORP has delivered consistent beats over the past 8 quarters:

EZCORP reports Q1 FY2026 results for the quarter ended December 31, 2025. The company uses a September 30 fiscal year-end. This analysis incorporates the earnings call held February 5, 2026.