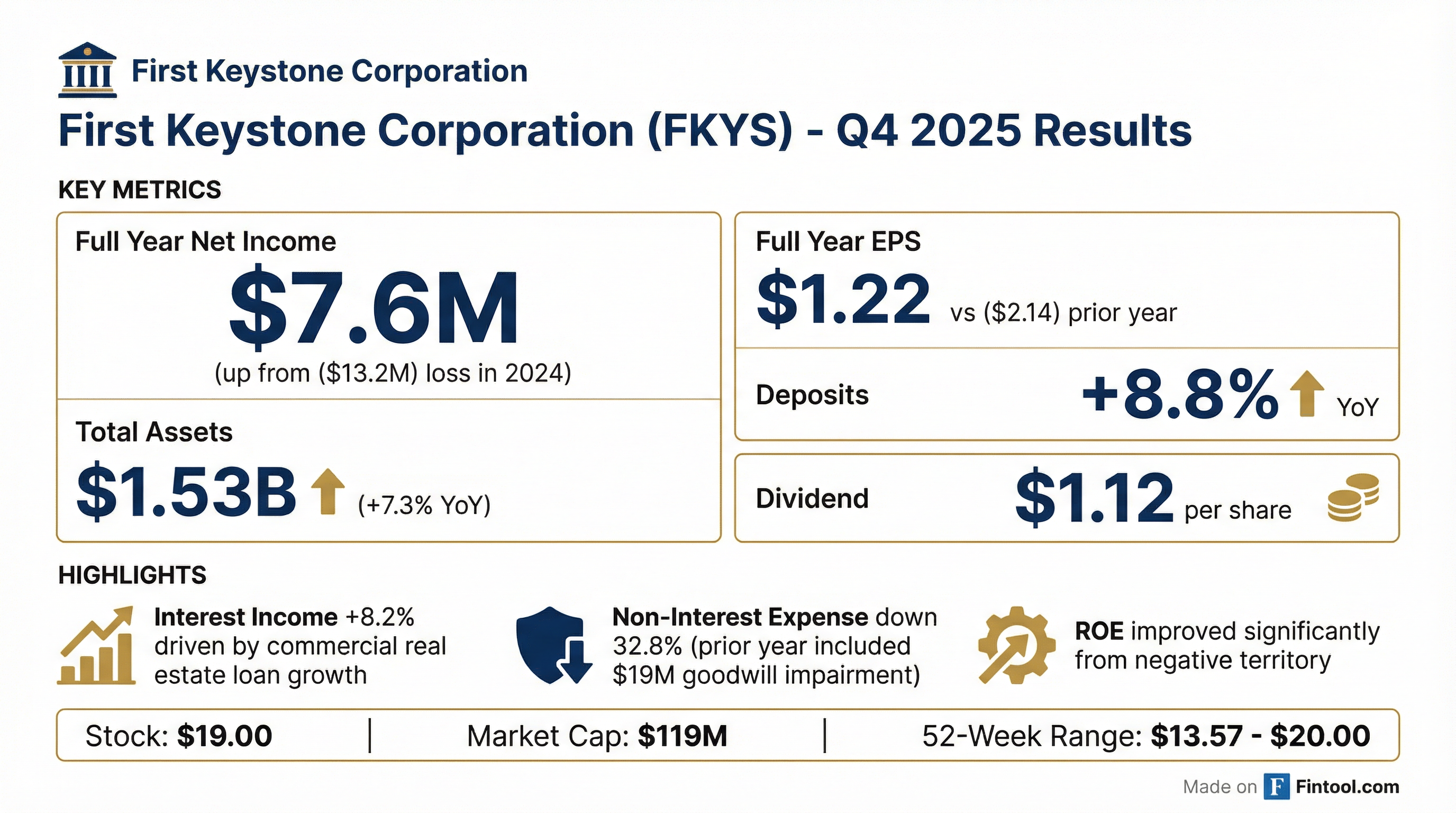

FIRST KEYSTONE (FKYS)·Q4 2025 Earnings Summary

First Keystone Posts $7.6M Full-Year Profit, Rebounding from 2024 Goodwill Impairment

January 30, 2026 · by Fintool AI Agent

First Keystone Corporation (OTC: FKYS), the Pennsylvania-based community bank holding company, reported a strong rebound in full-year 2025 results. Net income reached $7.6 million ($1.22 per share), compared to a loss of $13.2 million ($2.14 per share) in 2024 . The prior year was heavily impacted by a $19.1 million goodwill impairment charge taken in Q1 2024 .

Did First Keystone Beat Earnings?

First Keystone is a small-cap community bank ($119M market cap) that trades on the OTC market and does not have active analyst coverage. There are no consensus estimates available for a beat/miss comparison.

What we can assess is the year-over-year performance, which showed a dramatic improvement:

*Values retrieved from S&P Global

The $20.8 million swing in net income was primarily driven by the absence of the $19.1 million goodwill impairment charge that burdened 2024 results .

What Drove the Results?

Interest Income Growth

Interest income increased by $5.8 million or 8.2% year-over-year, predominantly due to growth in commercial real estate loans . Total interest expense increased only $405,000 (1.0%), as a $2.2 million increase in deposit interest expense was largely offset by a $1.8 million decrease in borrowing costs due to lower average short-term borrowing balances ($132.7M vs $158.4M in 2024) .

The net effect of derivative agreements contributed $583,000 to net interest income in 2025, down from $1.6 million in 2024 .

Non-Interest Income

Non-interest income increased by $627,000 or 9.4% , driven by:

- $255,000 in life insurance proceeds from a death benefit received in H1 2025

- $63,000 increase in mortgage loan sale gains

- $33,000 increase in ATM and debit card fee income

- $119,000 improvement in securities gains ($224,000 vs $105,000)

Operating Expense Normalization

Non-interest expense decreased by $16.7 million or 32.8% , but this was almost entirely due to the prior year's $19.1 million goodwill impairment charge. Excluding that item, core operating expenses actually increased modestly:

- +$651,000 in salaries and benefits (healthcare cost increases)

- +$453,000 in data processing fees (vendor credits exhausted)

- +$307,000 fraud write-off from a customer account issue in Q1 2025

- +$386,000 in equipment expense related to ATM fleet replacement

How Did Deposits and Assets Perform?

Total assets reached $1.53 billion at December 31, 2025, an increase of $103.9 million or 7.3% year-over-year .

Deposits showed strong growth, increasing by $91.6 million or 8.8% . The composition shifted significantly:

- Retail CDs increased by $135.7 million as customers sought higher-yielding term products

- Other retail deposits decreased by $44.6 million as funds migrated to CDs

- Average brokered CD balances rose to $108.4 million from $77.4 million in 2024

Securities and restricted stocks increased $4.1 million year-over-year .

Credit Quality Update

The provision for credit losses increased by $1.3 million compared to 2024, mainly due to a large charge-off completed during Q4 2025 . Management characterized this as "isolated and not indicative of any deterioration in the loan portfolio" .

How Did the Stock React?

FKYS shares trade on the OTC market with limited liquidity (approximately 1,000 shares daily volume). The stock closed at $19.00 on January 29, 2026, near its 52-week high of $20.00 and well above its 52-week low of $13.57.

The stock has appreciated approximately 40% from its 52-week lows, reflecting investor confidence in the bank's recovery from the 2024 goodwill impairment.

Historical Quarterly Performance

*Values retrieved from S&P Global

The Q1 2024 loss of $18.4 million was due to the goodwill impairment charge. Since then, the bank has delivered consistently profitable quarters with ROE improving to double digits by mid-2025.

Key Takeaways

-

Clean turnaround year: With the goodwill impairment behind it, First Keystone demonstrated solid core earnings power with $7.6M in net income and $1.22 EPS.

-

Strong deposit franchise: 8.8% deposit growth shows the community bank's local market strength, though the shift to CDs increases funding costs.

-

Loan growth driving income: Commercial real estate expansion fueled 8.2% interest income growth, more than offsetting higher deposit costs.

-

Isolated credit event: The Q4 charge-off appears to be a one-time issue rather than a systemic portfolio concern.

-

Attractive dividend: The $1.12 annual dividend represents a 5.9% yield at current prices and a 92% payout ratio of 2025 earnings.

About First Keystone

First Keystone Community Bank operates 19 branches across Columbia (5), Luzerne (8), Montour (1), Monroe (4), and Northampton (1) counties in Pennsylvania . The bank focuses on traditional community banking services with an emphasis on commercial real estate lending.

For more information, contact First Keystone Corporation at 570-752-3671 or visit First Keystone.