FIRST REAL ESTATE INVESTMENT TRUST OF NEW JERSEY (FREVS)·Q4 2025 Earnings Summary

FREVS Posts Steady Q4 as AFFO Surges 440% Despite Commercial Occupancy Drag

January 29, 2026 · by Fintool AI Agent

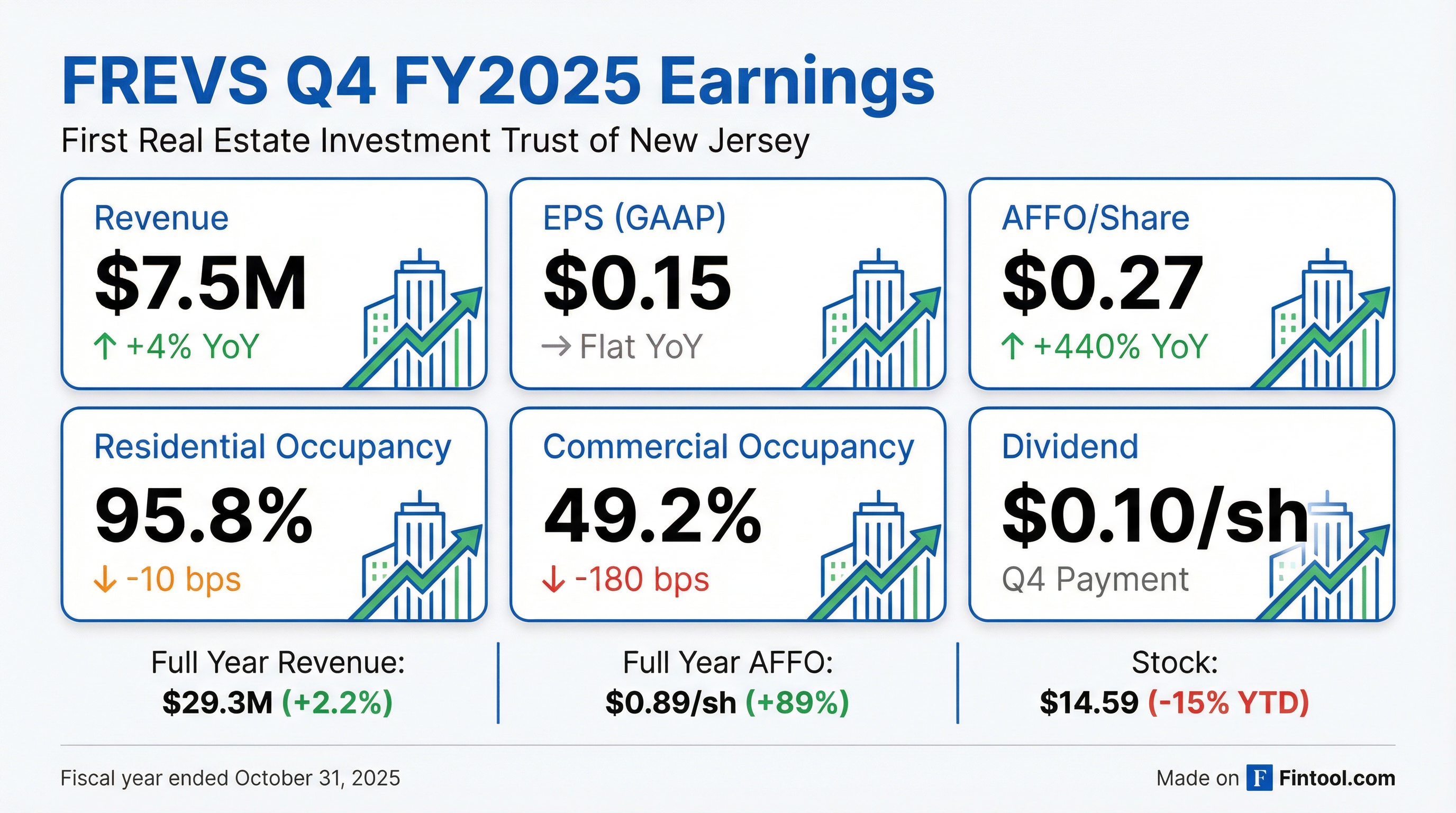

First Real Estate Investment Trust of New Jersey (OTC: FREVS) reported Q4 FY2025 results showing a tale of two segments — the residential portfolio delivered steady growth with 4% revenue gains and strong 95.8% occupancy, while commercial properties continued to struggle with sub-50% occupancy rates. The standout metric was AFFO per share, which surged 440% year-over-year to $0.27 from just $0.05, reflecting lower capital expenditure requirements and improved operating performance.

What Were the Key Numbers?

Full year FY2025 revenue reached $29.3M (+2.2% YoY), with AFFO per share of $0.89 versus $0.47 in the prior year — an 89% improvement.

How Did the Stock React?

FREVS shares traded at $14.59 heading into the Q4 FY2025 earnings release. The stock has declined approximately 15% from its January 2025 highs of $17.16, though it has recovered substantially from its November 2025 lows near $11.01. Trading volume remains extremely thin at just 500-1,400 shares per day, typical for this micro-cap OTC-traded REIT with a market cap of approximately $109 million.

Note: As an OTC-traded micro-cap REIT, FREVS has no analyst coverage. Beat/miss analysis is not available.

What Changed From Last Quarter?

Positive developments:

- Residential segment revenue increased ~$200K driven by higher base rents across most properties

- Received ~$100K from Cobb Theatre bankruptcy proceedings (Rotunda property sold previously)

- Capital expenditures on apartments dropped significantly — only $145K this quarter vs $671K in Q4 FY2024, driving the AFFO surge

- General and administrative expenses declined due to prior-year Sinatra litigation costs not recurring

Negative developments:

- Commercial occupancy continued to deteriorate: 49.2% vs 51.0% in Q4 FY2024

- Investment income declined ~$200K due to lower cash/Treasury balances

- Dividend significantly reduced ($0.10 vs $0.70 last year)

What's the Segment Performance Story?

The residential vs. commercial divergence is stark:

Residential NOI improved to $3.23M from $3.07M in Q4 FY2024, while Commercial NOI increased slightly to $885K from $842K.

For the full year, residential NOI reached $12.6M (+5.3% YoY) while commercial NOI declined to $2.5M from $3.1M (-18%).

Troubled properties:

- Preakness Shopping Center (Wayne, NJ): Occupancy declined to 44.7% from 46.3%, with revenue down ~$350K for the year

- Westwood Plaza: Occupancy plunged to 29.1% from 34.8%, with revenue down ~$200K

What's the Financing Situation?

A key risk factor: The $25 million mortgage secured by Preakness Shopping Center reached maturity on August 1, 2025.

The company is working with ConnectOne Bank on modifications and has received multiple short-term extensions under existing terms. Management "expects this loan to be further extended," but cautioned there is "no assurance" a definitive agreement will be reached.

*Values retrieved from S&P Global

What's the Dividend Outlook?

The Board has significantly reduced the quarterly dividend:

At the current $14.59 share price and $0.40 annualized dividend run-rate ($0.10 × 4), the implied dividend yield is approximately 2.7%. The Board will "continue to evaluate the dividend on a quarterly basis."

What Should Investors Watch?

Near-term catalysts:

- Preakness mortgage resolution — Will ConnectOne Bank extend or refinance the $25M loan? Failure to reach terms could force asset sales or restructuring

- Commercial occupancy stabilization — Can management stem the bleeding at Preakness and Westwood Plaza?

- Dividend policy — Will the reduced payout level be maintained or further adjusted?

Risk factors:

- Extremely illiquid stock (avg volume ~500 shares/day)

- Commercial segment structural decline with sub-50% occupancy

- Concentrated NJ/NY property base

- No analyst coverage or institutional ownership data

First Real Estate Investment Trust of New Jersey is a publicly traded (OTC: FREVS) REIT organized in 1961. Its portfolio of residential and commercial properties are located in New Jersey and New York, with the largest concentration in northern New Jersey.

Related: FREVS Company Profile | Q4 FY2025 8-K Filing