FIRST UNITED CORP/MD/ (FUNC)·Q4 2025 Earnings Summary

First United Delivers Record Core Earnings in 125th Anniversary Year as NIM Expands to 3.75%

February 4, 2026 · by Fintool AI Agent

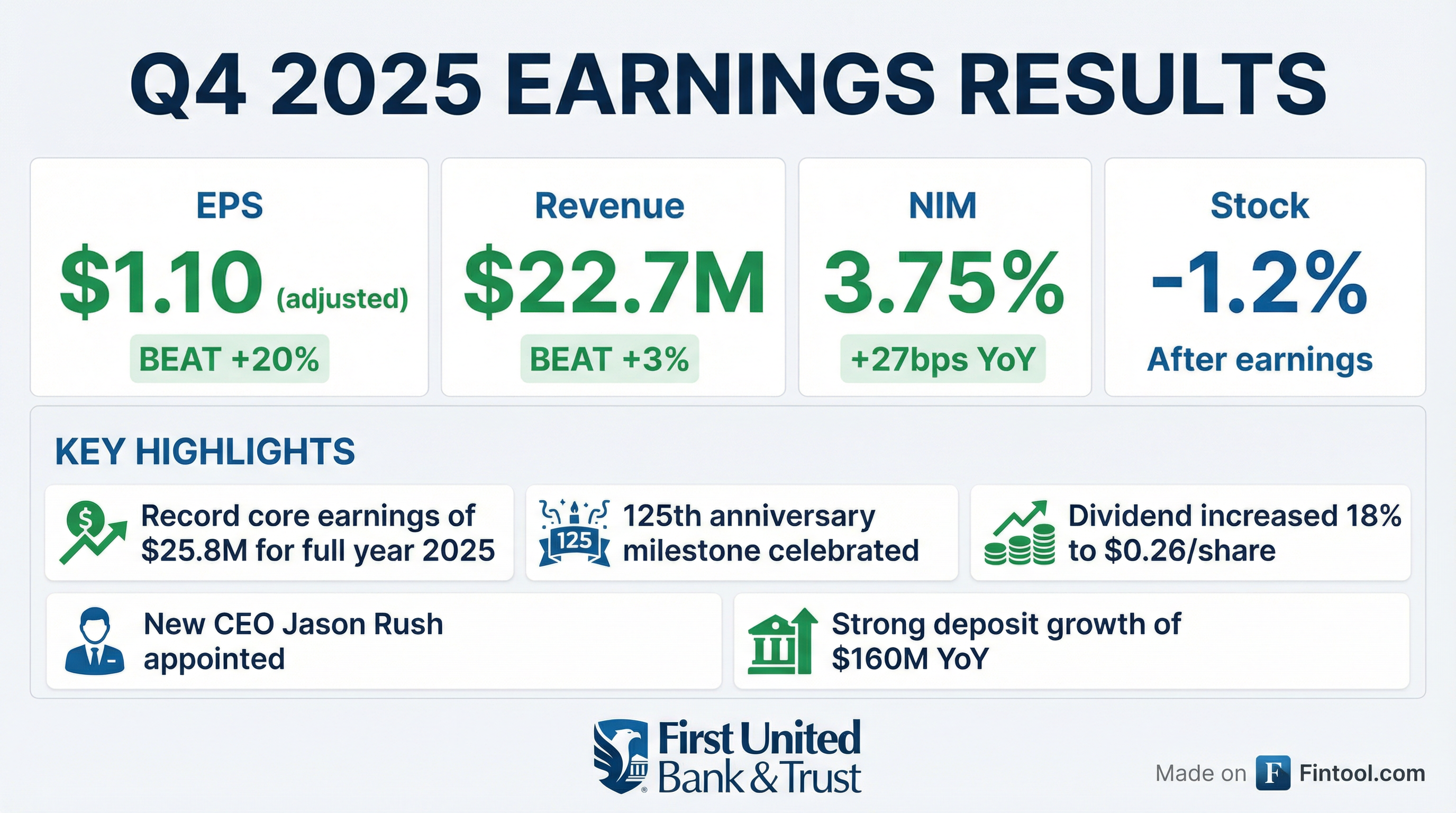

First United Corporation (NASDAQ: FUNC) reported Q4 2025 results that beat on both the top and bottom lines, capping a record year for the Maryland-based community bank holding company. Adjusted EPS of $1.10 crushed estimates by 20%, while net interest margin expanded to 3.75%—the highest level in years.

The quarter was impacted by a $1.6 million write-down on a legacy OREO property, which reduced GAAP EPS to $0.89. Excluding this non-recurring item, core earnings reached record levels for the year at $25.8 million, or $3.97 per diluted share.

Shares traded at $39.22 in the session following the release, down about 1.2% as investors digested the strong fundamentals alongside the one-time charge.

Did First United Beat Earnings?

Yes, and convincingly. Here's the beat/miss summary:

Values retrieved from S&P Global

The adjusted EPS beat was driven by NIM expansion, strong loan and deposit production, and disciplined expense management. GAAP results were held back by the OREO write-down.

First United has now beaten EPS estimates in 8 consecutive quarters—an impressive streak for a sub-$300M market cap regional bank.

What Drove the Strong Results?

Net Interest Margin Expansion

The headline story continues to be NIM expansion. Q4 2025 NIM of 3.75% was up 27 basis points YoY and 11 bps sequentially from Q3. For the full year, NIM was 3.67% vs 3.38% in 2024.

Key drivers:

- Loan repricing: Adjustable-rate loans repriced higher, adding 26 bps to loan yields YoY

- Stable funding costs: Deposit costs decreased 6 bps despite strong growth

- Balance sheet optimization: Repaid $25M FHLB advance at maturity in September 2025

Strong Loan and Deposit Production

Despite unusually high payoffs in the commercial portfolio, the bank delivered solid production:

Commercial pipeline remained strong at $61M at quarter-end, with $46.5M in unfunded construction commitments.

What Changed From Last Quarter?

The GAAP net income decline was entirely due to the $1.6M OREO write-down on a legacy participation loan originated in 2013. This was a one-time event following a cancelled contract and new letter of intent on the property.

Excluding this charge, core operating performance improved sequentially with higher net interest income and stable fee income.

What Did Management Say?

Executive Chairman Carissa Rodeheaver highlighted the milestone year:

"2025 was a truly remarkable year for First United as we celebrated our 125th anniversary—an extraordinary milestone in our history. Throughout the year, we had the privilege of honoring the relationships we've built with our clients while highlighting our ongoing commitment to future generations through trust, innovation, and meaningful community impact."

On leadership transition:

"I am pleased to recognize Jason B. Rush as First United's newly appointed President and Chief Executive Officer. We are confident that Jason will continue to advance our mission and uphold our uncommon commitment to exceptional service and comprehensive financial solutions."

Capital and Shareholder Returns

First United maintains strong capital ratios well above regulatory requirements:

Dividend: The board increased the quarterly dividend to $0.26 per share in Q3 2025, an 18% increase from the prior $0.22. The dividend payout ratio was 24% for the year.

Book Value: Tangible book value per share increased to $29.57 from $25.89 a year ago, a 14% increase driven by retained earnings.

Asset Quality Remains Solid

Credit metrics remained healthy:

Non-accrual loans decreased to $4.2M from $4.9M a year ago. The OREO write-down was on a legacy participation loan, not a new credit issue.

How Did the Stock React?

Shares were relatively muted following the release:

Data as of February 4, 2026

The modest decline likely reflects the GAAP miss (due to the OREO write-down) offsetting the strong core results. FUNC shares are up 59% over the trailing 12 months, significantly outperforming the S&P Small Cap Banks index (+13.5%).

Full Year 2025 Summary

First United delivered record core earnings for FY 2025:

Forward Outlook

Management's comments suggest continued focus on:

- Margin management: Higher cash levels should allow debt and brokered deposit repayments at maturity, supporting NIM

- Deposit repricing: Actively reducing deposit rates concurrent with market adjustments

- Growth markets: Enhanced sales presence in Morgantown, WV

- Technology investment: AI innovation initiative, new digital banking platforms

Near-term maturities to watch:

- $25M FHLB advance (March 2026)

- $40M FHLB advance (March 2026)

- $25M brokered CD (July 2026)

Key Takeaways

✅ Beat on fundamentals: EPS +20%, revenue +3%, NIM at multi-year high

✅ Record core earnings: $25.8M for 2025, best in company history

✅ Strong capital: All ratios well above regulatory minimums

✅ Leadership continuity: Smooth CEO transition with Jason Rush

⚠️ One-time charge: $1.6M OREO write-down impacted GAAP results

⚠️ High payoffs: Commercial portfolio experienced unusual payoff activity

For the full earnings transcript and filings, visit the FUNC documents page.