GOLUB CAPITAL BDC (GBDC)·Q1 2026 Earnings Summary

Golub Capital BDC Q1 FY2026: CEO Addresses 'SaaSpocalypse,' Plans for 'Challenging 2026'

February 5, 2026 · by Fintool AI Agent

Golub Capital BDC (GBDC) reported Q1 FY2026 results that CEO David Golub characterized as "not great, but solid, given the environment" . Adjusted NII of $0.38 per share translated to a 10.2% adjusted NII ROE, while adjusted net income of $0.25 per share delivered a 6.7% adjusted ROE .

But the earnings call was dominated by discussion of AI risk to GBDC's 27% software exposure—what Golub termed the "SaaSpocalypse" . He acknowledged the threat is real, not just market noise, but expressed confidence in the portfolio's positioning in enterprise-critical platforms with sticky workflows and proprietary data.

Management also set a cautious tone for the year ahead: "We expect these headwinds to continue for some time, and we're planning for a challenging 2026" . The board reset the quarterly base dividend to $0.33 per share (~9% of NAV) as part of this recalibration .

Did GBDC Beat Earnings?

GBDC slightly missed on both top-line and bottom-line metrics for Q1 FY2026 (quarter ended December 31, 2025):

The earnings miss was driven primarily by:

- Lower portfolio yields: Investment income yield of 10% was down 40 basis points sequentially, mostly driven by lower base rates

- Spread compression: Weighted average rate on new investments fell to 8.6%, down 30 basis points from prior quarter

- Higher non-accruals: Six portfolio companies moved to non-accrual status during the quarter, offset by one returning to accrual after restructuring

What Did Management Guide?

Management did not provide explicit quantitative guidance but offered several qualitative signals:

Distribution Policy Reset: The board reset the quarterly base dividend to $0.33 per share (~9% of NAV), down from the prior $0.39 run-rate . Management outlined their four long-standing dividend priorities: (1) maintaining stable NAV over time, (2) minimizing excise taxes, (3) adjusting base distribution infrequently, and (4) paying as high a yield as sustainable . The variable supplemental dividend policy will continue, distributing 50% of earnings above the $0.33 base .

Selectivity: GBDC closed on just 3.1% of deals reviewed in the quarter, at a weighted average LTV of ~43% . The median portfolio company EBITDA for originations was $81 million, maintaining focus on the core middle market .

Portfolio Contraction: Net funds growth was -$130 million as repayments and exits outpaced new originations . The investment portfolio decreased 1.5% to $8.6 billion at fair value .

How Did the Stock React?

Despite the slight earnings miss and NAV decline, GBDC shares rose +2.1% to $13.06 on results day .

Why the positive reaction?

- Distribution coverage of 115% suggests the dividend is well-supported

- Stock trades at 88% of NAV ($13.06 vs $14.84 NAV), providing a cushion

- $35.9M in share repurchases at $13.69 (92% of NAV) signals management confidence

- Credit quality, while deteriorating, remains manageable at 0.8% non-accruals

The stock is down 18% from its 52-week high of $16.01 but has found support near the $12.67 52-week low.

What Changed From Last Quarter?

NAV Bridge

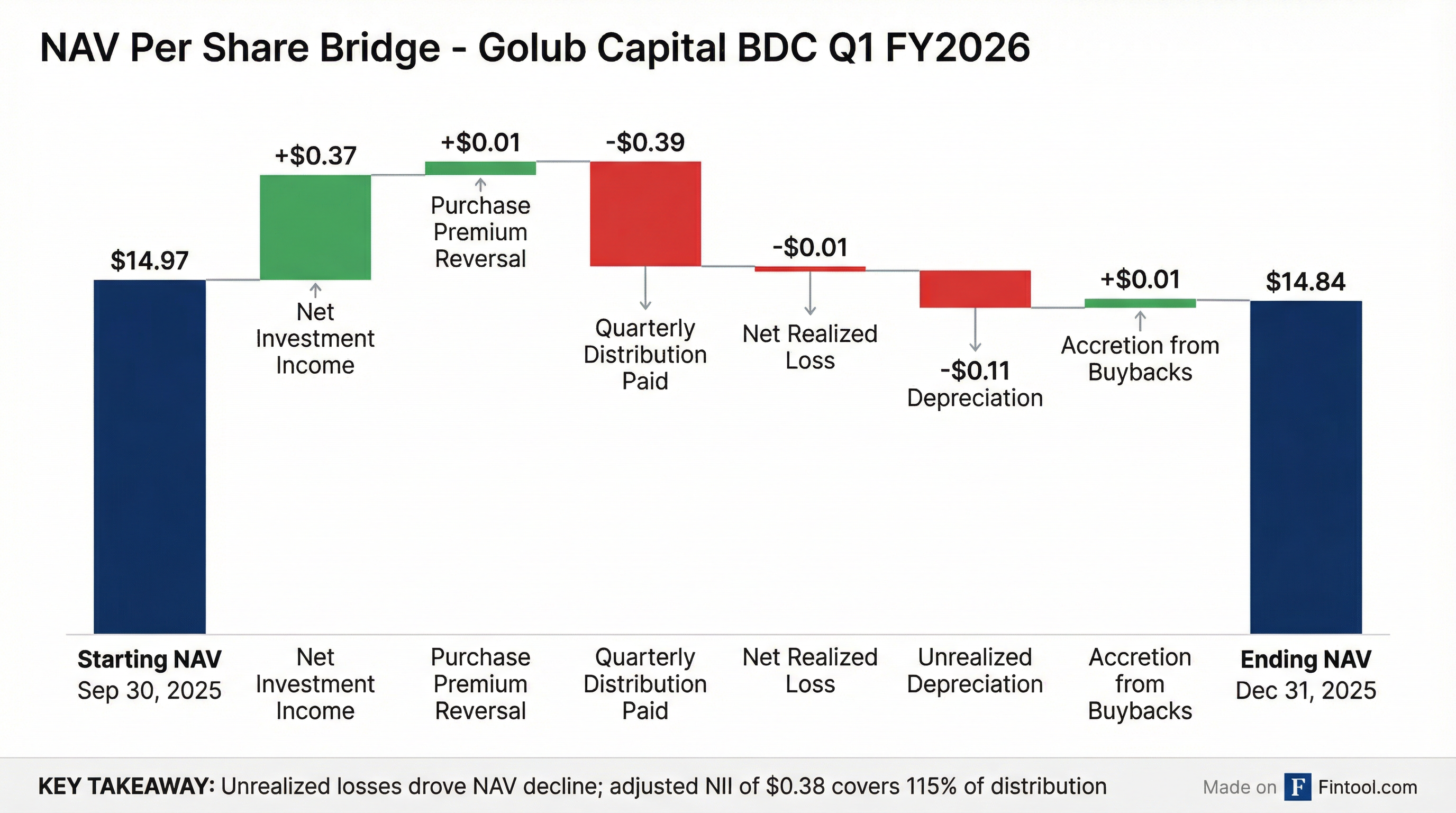

The NAV per share decline to $14.84 was driven by: adjusted NII of $0.38, a $0.39 distribution paid, adjusted net realized and unrealized losses of $0.13 (including $0.06 from equity markdowns on underperforming borrowers), and $0.01 accretion from share repurchases .

Portfolio & Credit Quality

GBDC maintains an $8.6 billion investment portfolio across 420 portfolio companies :

Portfolio Characteristics:

- 92% first lien, senior secured floating rate loans

- One-stop loans: ~87% of portfolio at fair value

- Average investment size: ~20 basis points

- Largest borrower: 1.6% of debt portfolio; top 10: 12%

Origination Quality:

- Highly selective: closed just 3.1% of deals reviewed

- Weighted average LTV: ~43%

- 60% of volume from existing sponsor relationships and portfolio company incumbencies

- 96% as sole or lead lender

- 18 new borrowers added in the quarter

Credit Quality:

- ~89% of portfolio in top two internal performance ratings

- Investments rated 3 (may underperform): 10.1% of portfolio

- Investments rated 1 and 2 (significant impairment risk): just 1.3%

- Non-accruals: 0.8% of fair value, 1.3% of amortized cost

- Number of non-accrual investments increased to 14

Non-accruals increased as six portfolio company investments moved to non-accrual, offset by one returning after restructuring .

Capital Structure & Liquidity

GBDC maintains strong liquidity with approximately $1.3 billion available from unrestricted cash, corporate revolver, and advisor revolver :

Debt Capital Structure:

- 49% unsecured notes with well-laddered maturities

- 81% floating rate debt (among highest in the sector)

- Weighted average cost of debt: 5.4% (down 20 bps sequentially)

- Net debt-to-equity: 1.23x, within target range of 0.85-1.25x

The floating rate debt structure helps modulate interest rate impacts—as portfolio yields compress from lower base rates, borrowing costs also decline .

Shareholder Returns

Distribution Policy Reset:

The board reset the quarterly base dividend to $0.33 per share (~9% of NAV) . This change reflects four long-standing dividend priorities:

- Maintaining stable NAV over time

- Minimizing excise taxes over time

- Adjusting base distribution infrequently

- Paying as high a yield as sustainable

The variable supplemental dividend policy will continue, distributing 50% of adjusted NII above the $0.33 base .

Share Repurchases: GBDC continued opportunistic repurchasing on an accretive basis . For calendar year 2025, total repurchases reached 5.5 million shares ($76.5 million), generating $0.01 per share of NAV accretion in Q1 .

Management views buybacks as good capital allocation when shares trade at a meaningful discount to NAV .

What Did Management Say About Software & AI Risk?

The Q&A session was dominated by questions about software exposure and AI disruption risk—what CEO David Golub called the "SaaSpocalypse." With 27% of the portfolio in software, this is a critical topic for investors.

Golub's Assessment:

"There's a real issue here. This is not just a market tantrum. AI is advancing more quickly than most people expected, and especially so in respect of tools that make coding easier. Some software companies are vulnerable to AI disruption as a result."

Why Golub Remains Confident:

- Track record: 20 years, 1,000 software deals, only 5 defaults (0.25% of $145B in commitments)

- Dedicated team: 25 professionals with 200+ years combined experience

- Proprietary framework: Risk mapping approach that steers toward resilient business models

What They Like:

- Enterprise-critical platforms with sticky, embedded workflows

- Long implementation cycles and high switching costs

- Market leaders with proprietary datasets (customer-generated or otherwise)

- Sponsors who are AI experts and guiding companies ahead of disruption

What They Avoid:

- Content creation software

- Analytical overlays

- Tool-based software

Three AI Impact Scenarios:

Golub outlined three scenarios for how AI could affect software credits :

"For good software companies, it's quite unlikely that you're going to see immediate collapse. You're going to see a melting as opposed to a meltdown."

On ARR Loans: Golub noted they were early originators 10 years ago but have reduced exposure in recent years as pricing tightened. In an environment of slower bookings, "ARR loans are tougher."

What Did Management Say About 2026 Outlook?

CEO David Golub set a notably cautious tone, describing "4 headwinds" facing the industry :

- Lower base rates — Compressing portfolio yields

- Tighter spreads — Across almost every credit asset class

- Muted M&A activity — Despite hopes for a breakout year

- Elevated credit stress — A protracted credit cycle

"We expect these headwinds to continue for some time, and we're planning for a challenging 2026."

The "Darwinian Moment":

Golub offered a bigger-picture view on where private credit is headed:

"After a period of growth and new entrants, the private credit industry is maturing and will now go through a Darwinian moment. Some firms will adapt and thrive, and some won't. This isn't a bad thing. We've been here before."

He emphasized that Golub Capital has a "playbook" for these environments: being very selective on new loans, early detection of underperformance, working with sponsors on early intervention, and minimizing realized credit losses .

Industry ROE Compression:

By Golub's estimates, public BDC net returns are on average ~4 percentage points lower year-over-year, based on earnings through September 30 . Dispersion between good and not-so-good managers has increased.

Q&A Highlights

Finian O'Shea (Wells Fargo) — Software Risk: Asked about AI firms "spooking the software market" and whether concern extends to GBDC's enterprise SaaS portfolio. Golub acknowledged real AI risk but emphasized proprietary diligence and portfolio positioning in "enterprise-critical" platforms with embedded workflows.

Ethan Kay (Lucid Capital) — Challenging 2026: Asked for expansion on "planning for a challenging 2026." Golub cited spreads at 5-year lows, muted M&A, and elevated credit stress. "I wanna be very candid with you and with our investors that this is a challenging environment right now."

Robert Dodd (Raymond James) — Unknown Unknowns: Pressed on whether software "moats" (proprietary data, sticky software) could evaporate faster than expected. Golub's response: expect equity valuation impact first, credit impact second. "You gotta blow past scenario one to get to scenario two or three."

Paul Johnson (KBW) — Software Trends Pre-AI: Noted software sector revenue growth in the Golub Altman Index has slowed. Golub confirmed a "slowdown in bookings" across software—corporate clients moving more slowly to adopt new products. Attributed it partly to cost pressure and digesting prior tech investments.

Key Risks & Concerns

-

Non-accrual trajectory: Six new non-accruals in one quarter is elevated; if this pace continues, it could pressure NAV and NII

-

Spread compression: New origination spreads are at 5-year lows; weighted average rate on new investments fell to 8.6%

-

Falling base rates: Investment income yield of 10% was down 40 basis points sequentially

-

Software/AI concentration risk: 27% software exposure amid "SaaSpocalypse" concerns; even resilient credits may see slower growth

-

Industry-wide headwinds: Public BDC returns ~4pp lower YoY; private credit entering "Darwinian moment"

Forward Catalysts

- Q2 FY2026 Earnings: Expected early May 2026

- Fed rate decisions: Lower rates will compress portfolio yields but reduce cost of floating-rate debt (81% floating rate debt structure)

- M&A recovery: Management watching for deal flow pickup—"I'd like to see more. I'm not saying it won't happen. I'm saying we haven't seen it yet."

- Software market repricing: If broadly syndicated loan and high yield markets tighten for software, could create opportunity for private credit specialists

- Supplemental distribution: Depends on adjusted NII exceeding $0.33 base; variable policy pays 50% of excess