Great Elm Group (GEG)·Q2 2026 Earnings Summary

Great Elm Posts $16.5M Loss as Investment Volatility Overshadows Platform Growth

February 5, 2026 · by Fintool AI Agent

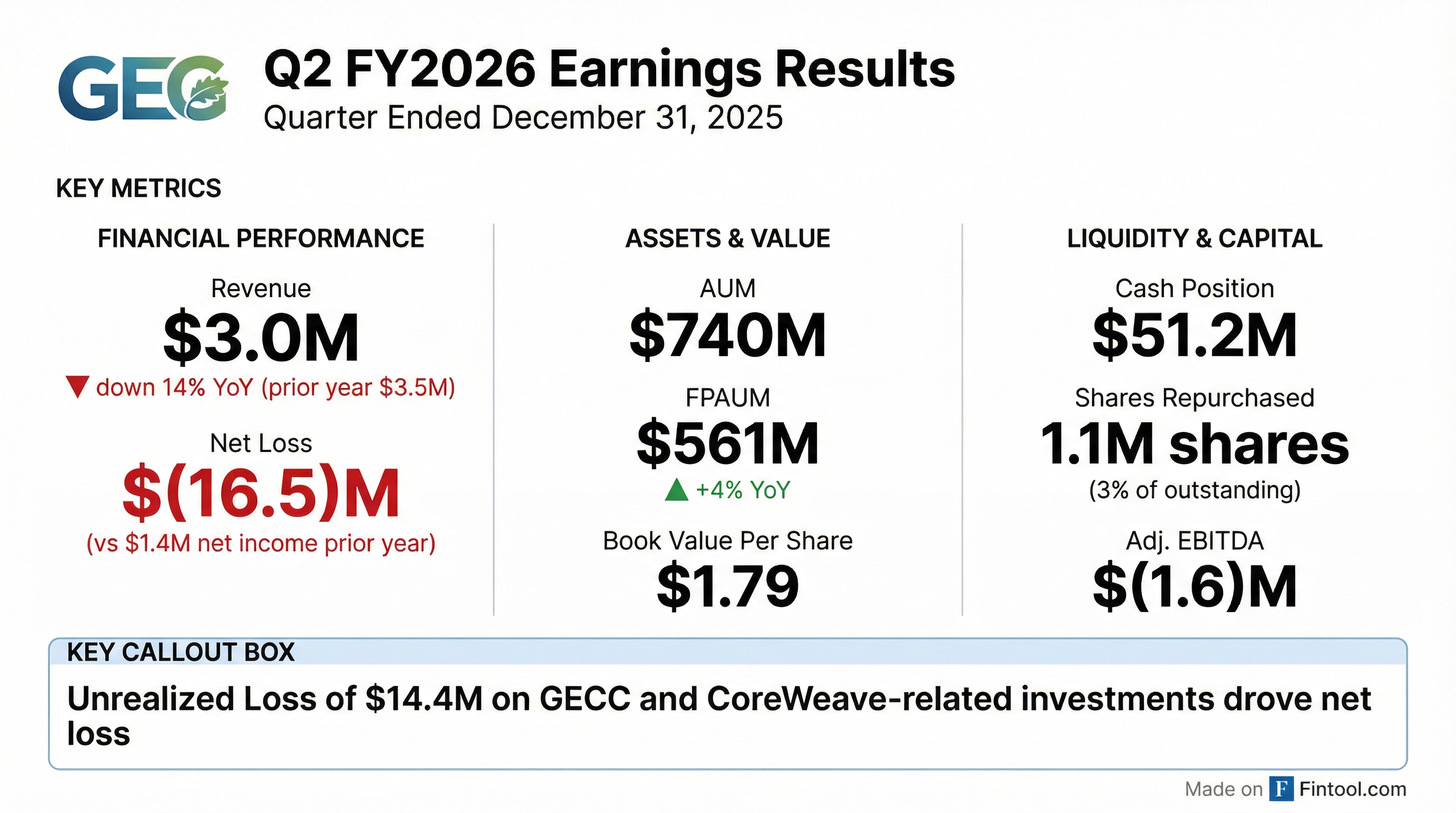

Great Elm Group (NASDAQ: GEG) reported fiscal Q2 2026 results that showed the double-edged nature of its investment-heavy business model. While fee-paying AUM grew 4% year-over-year to $561 million and the real estate platform continued scaling, a $14.4 million unrealized loss on investments swung the company from profitability to a $(16.5) million net loss.

Did Great Elm Beat Earnings?

No — significant miss driven by investment markdowns.

Revenue declined 14% YoY due to the absence of a build-to-suit property sale ($0.6M) and incentive fees ($0.5M) that were recognized in the prior-year period. This was partially offset by $0.4M in new construction management revenue from Monomoy Construction Services (MCS), acquired in February 2025.

The net loss was almost entirely driven by investment volatility — $14.4M in unrealized losses on GECC common stock and CoreWeave-related SPVs, partially offset by $2.3M in realized gains.

What Drove the Investment Losses?

Great Elm's balance sheet is heavily exposed to its own managed vehicles:

- GECC exposure: GEG owns ~10% of Great Elm Capital Corp., its public BDC with ~$310M AUM

- CoreWeave-related SPVs: Early investment that has returned $5.8M in distributions to date versus $5M original investment, with management citing "continued upside potential"

The GECC investment faced headwinds as management "positioned GECC for recovery" following a challenging calendar H2 2025, including hiring a new Head of Research with 25 years of credit experience and re-underwriting all investments.

How Is the Real Estate Platform Performing?

The Monomoy real estate platform continued to scale across its three verticals:

The Monomoy REIT (MREIT) acquired three properties for ~$8.9M at attractive cap rates and has access to $100M in term loan financing from Kennedy Lewis Investment Management (KLIM), with an option for an additional $50M.

What Changed From Last Quarter?

Credit business wind-down: Management commenced an orderly wind-down of the Great Elm Credit Income Fund (GECIF) in response to "recent portfolio events and market conditions." The fund posted a 20.1% net return over its 26-month life from inception through December 2025.

Capital structure optimization at GECC: Issued $57.5M of 7.75% Notes due 2030 and redeemed $40M of 8.75% Notes due 2028, lowering interest costs.

Aggressive buybacks continue: Repurchased 1.1M shares (3%+ of outstanding) at $2.47/share in the quarter. Since program inception, 6.4M shares (~20% of original float) have been repurchased for $12.7M at $1.99 average, with $12.3M remaining capacity.

How Did the Stock React?

GEG shares traded at $2.03 as of February 4, 2026, down from a 52-week high of $3.51 and near the 52-week low of $1.76. The stock is trading at approximately 13% discount to book value of $1.79/share.

Balance Sheet Strength

GEG ended the quarter with a robust cash position to support strategic deployment:

What Are the Forward Catalysts?

- MBTS property sale: Third build-to-suit property substantially complete and being marketed for sale in H2 FY26

- Fourth BTS project: Engaged with "high-quality tenant" on fourth design-build project

- GECC portfolio optimization: New Head of Research and re-underwritten portfolio may stabilize investment performance

- Continued buybacks: $12.3M remaining capacity at prices near book value

- KLIM partnership: Up to $150M in leverageable capital to accelerate real estate expansion

Risks and Concerns

- Investment volatility: GEG's P&L is heavily exposed to mark-to-market swings on its GECC and SPV holdings

- GECIF wind-down: Loss of a managed vehicle reduces platform breadth

- Small scale: $561M FPAUM generates only ~$2.2M in quarterly management fees

- Illiquid stock: Very low daily volume (~5K-25K shares) limits institutional participation

- Concentration risk: Heavy reliance on Monomoy REIT ($425M AUM) and GECC ($310M AUM) for fee generation

Key Takeaways

Great Elm's Q2 FY26 results highlight the challenge of building a diversified alternative asset manager at small scale. While the real estate platform is executing well and management is deploying capital at attractive prices through buybacks, the company's investment portfolio remains a source of significant earnings volatility. With the stock trading near book value and a $51M+ cash position, the thesis hinges on whether management can grow FPAUM to a level where recurring fees dominate the P&L.