GRAHAM (GHM)·Q3 2026 Earnings Summary

Graham Corporation Posts 21% Revenue Growth, Record Backlog Hits $516M

February 6, 2026 · by Fintool AI Agent

Graham Corporation (NYSE: GHM), a global leader in mission-critical fluid, power, heat transfer, and vacuum technologies for Defense, Energy & Process, and Space industries, delivered strong Q3 FY2026 results with 21% revenue growth and 79% EPS improvement. The company achieved a record backlog of $515.6M and raised full-year guidance following the strategic acquisition of FlackTek in January 2026.

Did Graham Corporation Beat Earnings?

Graham delivered a decisive beat on both revenue and earnings:

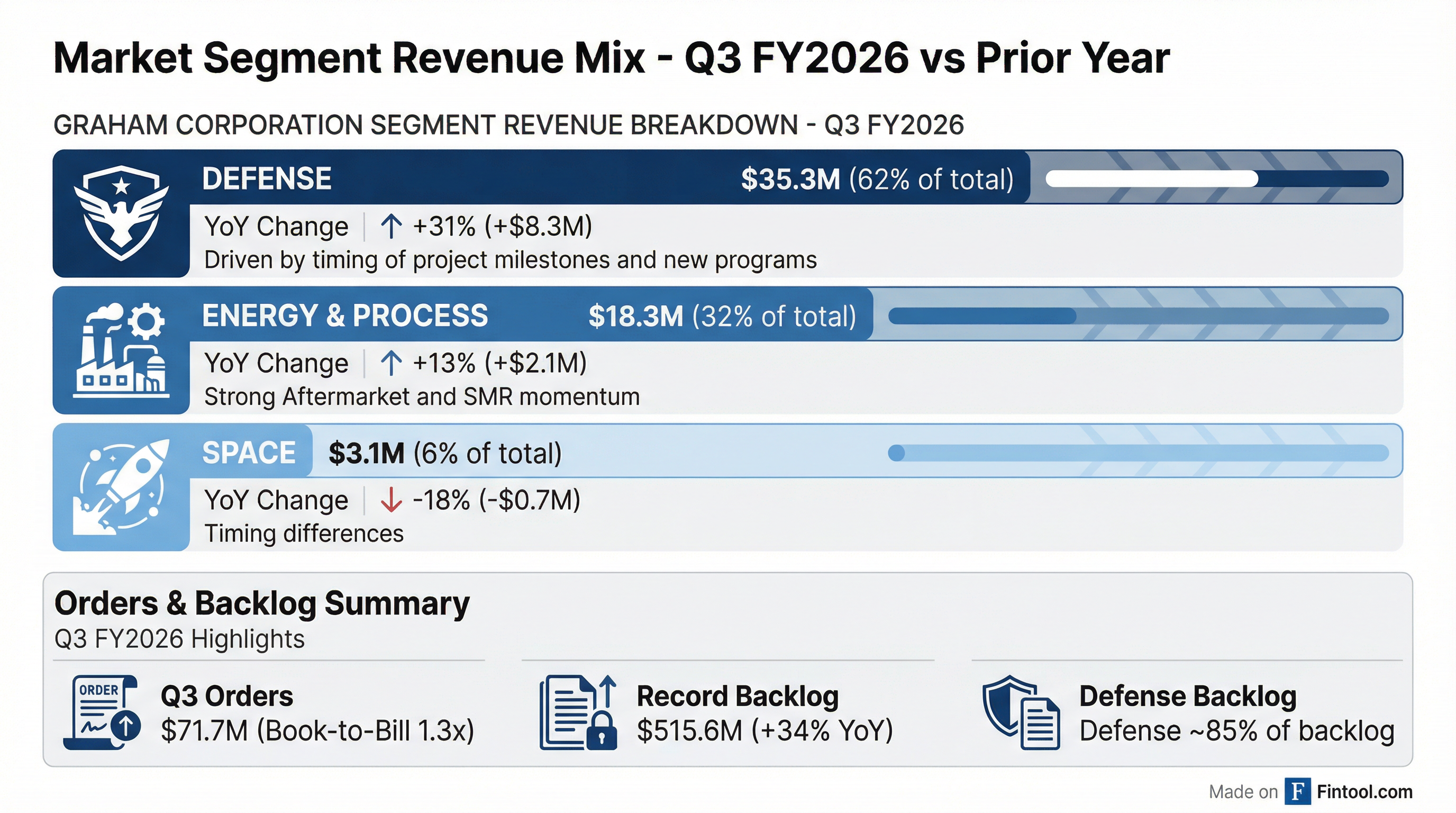

Revenue drivers: The Defense market contributed $8.3M to growth (+31% YoY) driven by timing of project milestones, new programs, and expansion of existing programs. Energy & Process added $2.1M (+13% YoY) from strong Aftermarket sales and momentum in New Energy markets, particularly small modular reactors (SMRs).

Margin dynamics: Gross margin declined 100 bps to 23.8% due to sales mix and a higher level of material receipts which carry lower margins. The prior year also benefited from a $0.3M BlueForge Alliance grant that did not repeat. However, operating leverage improved with operating margin expanding 80 bps and Adjusted EBITDA margin expanding 210 bps.

What Did Management Guide?

Graham raised full-year FY2026 guidance across key metrics, reflecting strong performance through nine months and contributions from the FlackTek acquisition:

Tariff impact: Management expects tariffs to add $1.0-1.5M in incremental costs versus the prior year, already reflected in guidance.

CFO Christopher Thome stated: "We are pleased with our performance through the first nine months of fiscal 2026 and continue to see strong demand across most of the markets we serve. Reflecting this momentum, including the contribution from the FlackTek acquisition, we are increasing our full-year fiscal 2026 guidance."

How Did the Stock React?

GHM shares closed at $73.75 on February 5, 2026, with aftermarket trading indicating $75.00 (+1.7%) following the earnings release. The stock has tripled from its 52-week low of $24.78, reflecting the defense spending tailwind and operational improvements.

Key price levels:

- 52-Week High: $79.13

- Current Price: $73.75

- 50-Day Average: $66.39

- 200-Day Average: $53.57

- Market Cap: ~$810M

What Changed From Last Quarter?

Segment Performance Shift

Defense (62% of revenue): Revenue of $35.3M increased 31% YoY, representing the strongest segment performance. Defense orders of $49.6M (+637% vs prior year Q3) reflected major program wins. Defense now represents ~85% of backlog.

Energy & Process (32% of revenue): Revenue of $18.3M increased 13% YoY. Aftermarket sales totaled $10.8M (+11% YoY). Strong New Energy momentum, particularly in SMRs, offset weaker Aftermarket orders which declined $5.2M from record prior-year levels.

Space (6% of revenue): Revenue of $3.1M declined 18% YoY due to timing. However, orders increased 132% to $7.5M, and backlog grew 63% YoY to $28.6M, indicating future recovery.

Record Backlog Provides Visibility

Backlog conversion timeline: Approximately 35-40% of backlog expected to convert in the next 12 months, 25-30% in 1-2 years, and the remainder beyond 2 years. This provides exceptional revenue visibility for an industrial company.

FlackTek Acquisition Expands Technology Platform

On January 23, 2026, Graham completed the acquisition of FlackTek Manufacturing for $35M (85% cash, 15% stock), with up to $25M in performance-based earnouts over four years.

Strategic rationale:

- Establishes advanced mixing and materials processing as third core technology platform alongside vacuum/heat transfer and turbomachinery

- Purchase price of

12x projected adjusted EBITDA ($30M calendar 2026 revenue) - 1,200-2,500+ units installed globally with deep portfolio of proprietary IP

- Revenue mix: ~60% Energy & Process, ~15% Defense, ~10% Space

- Graham amended its credit facility, increasing borrowing limit from $50M to $80M

- Pro forma leverage ratio of ~1.2x post-closing

Mega platform: FlackTek's Mega product line is a category-defining platform capable of "processing multi-hundred kilogram batches... delivering a step change in manufacturing throughput, enabling customers to reduce mixing cycles from hours to minutes." The platform has been production-validated in mission-critical, safety-sensitive applications including solid rocket motor manufacturing.

CEO Malone on strategic fit: "Advanced mixing, specifically dual asymmetric mixing, is the exact marry of turbomachinery and vacuum and heat transfer. It literally is the blend of those two core physics-based technologies."

Balance Sheet Remains Strong

Capital allocation priorities: The company continues investing in automation, advanced testing, and new technical capabilities to enhance productivity and support margin expansion. CapEx for Q3 FY2026 was $2.2M, focused on capacity expansion and productivity improvements.

Note: Post-quarter, Graham borrowed ~$20M to fund the FlackTek acquisition, resulting in pro forma leverage of ~1.2x.

Key Management Quotes

CEO Matthew Malone on execution: "Our third quarter results reflect continued strong, disciplined execution across the organization as we progress through the back half of fiscal 2026. Revenue growth and profitability were driven by solid performance across our end markets and supported by a record backlog, which provides meaningful visibility into future demand."

On strategic direction: "We continue to invest in automation, advanced testing, and new technical capabilities that enhance productivity and support margin expansion. In addition, the recent acquisition of FlackTek in January 2026 meaningfully expands our technology portfolio and further positions Graham to deliver differentiated, mission-critical solutions to our core end markets."

Q&A Highlights

Defense CapEx & Capacity Investments

When asked about shipbuilders announcing significant CapEx increases, CFO Chris Thome noted: "The fortunate thing for Graham is we've been making these investments for several years at this point... we believe that we have opened up capacity through efficiency improvements by the equipment we've already implemented." Graham expects to continue investing 7-10% of revenue in capital expenditures.

M&A Strategy

CEO Matt Malone outlined the three-platform approach: "We have a really strong first at Graham Manufacturing, which has been around for 90 years with vacuum and heat transfer. Within Barber-Nichols, we've done some small tuck-in acquisitions... FlackTek offers that third leg of the stool." Future M&A will focus on expanding within these three platforms before considering additional platforms.

FlackTek and Solid Rocket Motor Mixing

The Mega product line is the "world's only production-scale, bladeless dual asymmetric centrifugal mixer, capable of processing multi-hundred kilogram batches in a 55-gallon drum format."

On the Anduril partnership, Malone stated: "This is revolutionizing the mixing process for solid rocket motors, which will push the entire industry forward... we have no restriction in the relationship on providing dual asymmetric mixing machines to others, with the exception of specifically the Mega product line pending some level of purchase of equipment."

Book-to-Bill Guidance

CFO Thome clarified the 1.1x long-term book-to-bill target: "That 1.1 wasn't meant to be guidance for fiscal 2026. Obviously, with the year-to-date book-to-bill ratio of 1.6, we expect to be over that 1.1 long-term target for the year." The 1.1x target supports the company's 8-10% organic growth objectives.

Material Receipts Impact

Regarding margin pressure from material receipts, Thome explained: "The material receipts are very lumpy in nature. They heavily impacted our Q2 results. They were still higher than normal in Q3. For Q4 and going forward, we would expect them to be at a more normalized level."

Energy & Process Macro Headwinds

Malone acknowledged some headwinds: "We are seeing some slowing as it relates to large CapEx purchases, driven by lower oil prices, tariffs, and uncertain macro environment." However, SMR momentum is offsetting some of this weakness.

Facility Investments Coming Online

Graham completed or commissioned several strategic facilities during the quarter:

CFO Thome emphasized: "These investments are what's gonna help us get to our fiscal 2027 guidance and goals... it's gonna be a gradual increase in performance. You're not gonna see a step change overnight."

XDot Acquisition Update

During the quarter, Graham completed the technology purchase of XDot Bearing Technologies, an engineering-led firm with "patented foil-bearing technology and deep expertise in high-speed rotating machinery." The technology delivers "superior performance while reducing development and production costs" and combines with Barber-Nichols turbomachinery capabilities to expand advanced high-speed pump and compressor solutions.

Forward Catalysts

- FlackTek integration: First full quarter contribution expected in Q4 FY2026

- Defense tailwinds: ~85% of backlog in Defense provides stability amid geopolitical uncertainty

- SMR opportunity: New Energy momentum continuing with small modular reactor projects

- Margin expansion path: Management targeting low-to-mid-teen Adjusted EBITDA margins by FY2027 (currently 10.7%)

- XDot contribution: Foil-bearing technology integration supporting Space and industrial markets

- Testing facilities: New Arvada and Jupiter testing capabilities enabling higher-rate production

Historical Financial Performance

Values retrieved from S&P Global

This analysis is for informational purposes only and does not constitute investment advice. Data sourced from company filings and S&P Global.