Gold.com (GOLD)·Q2 2026 Earnings Summary

Gold.com Lands $150M Tether Investment, EPS Surges 70% as Stock Rallies

February 6, 2026 · by Fintool AI Agent

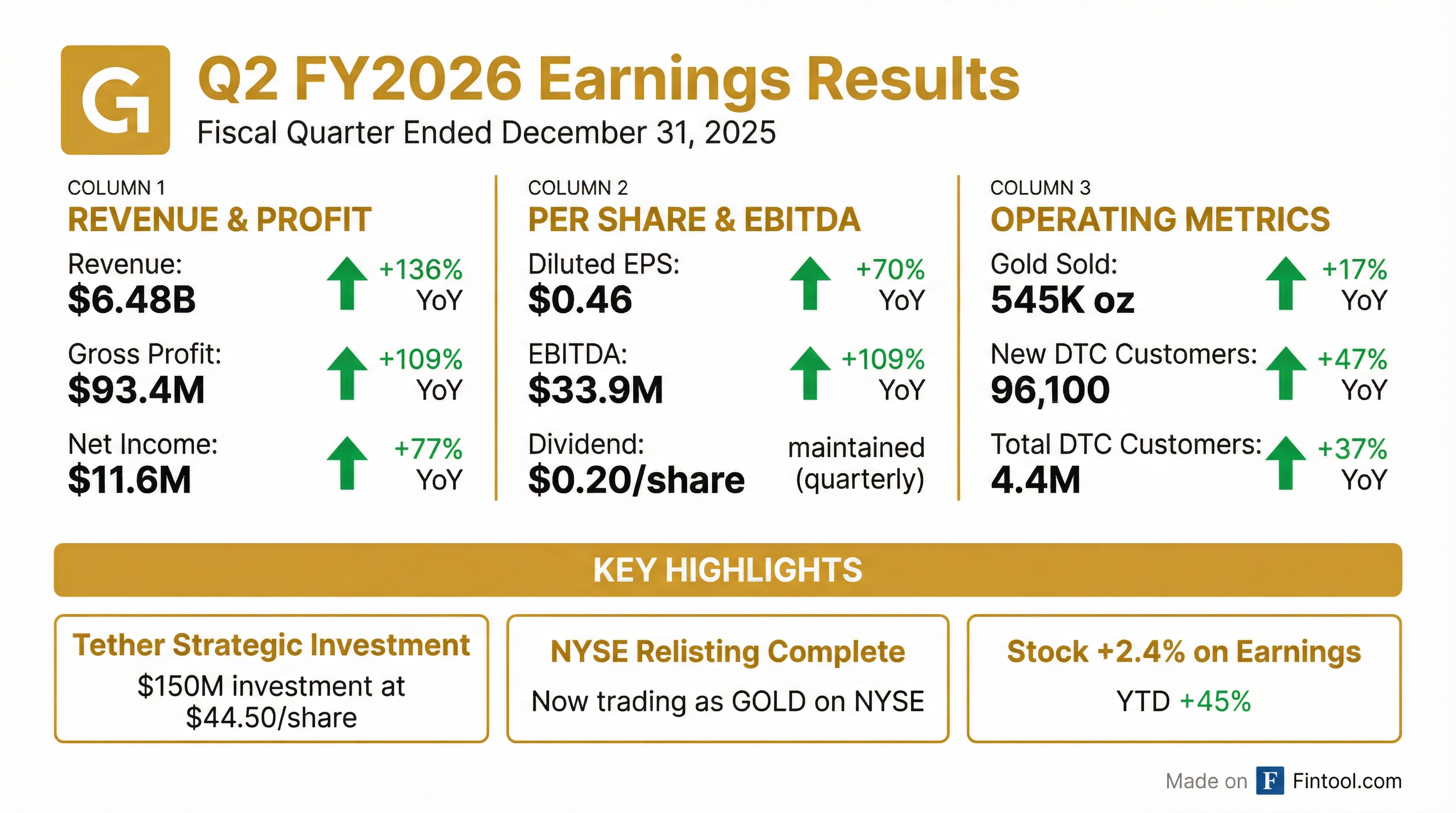

Gold.com (NYSE: GOLD), formerly A-Mark Precious Metals, delivered a powerful earnings rebound in Q2 FY2026, with revenue surging 136% year-over-year to $6.48 billion and EPS of $0.46 representing a 70% increase from the prior year. The quarter marked the company's first earnings report under its new Gold.com identity following a successful rebrand and NYSE relisting in December 2025.

Most notably, the company announced a transformative strategic investment from Tether Investments—one of the largest owners of gold globally—totaling approximately $150 million at $44.50 per share.

Did Gold.com Beat Earnings?

Limited analyst coverage prevents a formal beat/miss assessment. Gold.com (formerly A-Mark) has limited sell-side analyst coverage, making consensus estimates unavailable for comparison.

However, the sequential improvement was dramatic:

The company swung from a net loss of $0.9 million in Q1 FY2026 to net income of $11.6 million in Q2—a 1,339% sequential improvement.

What's the Tether Strategic Investment?

The headline announcement was a $150 million strategic investment from Tether Investments, one of the largest owners of physical gold globally and sponsor of the largest dollar-backed stablecoin (USDT) and gold-backed stablecoin (XAUT).

Key Terms:

- Initial Investment: ~$125 million at $44.50 per share

- Additional Investment: ~$25 million more pending regulatory clearance

- Gold Leasing Facility: Minimum $100 million from Tether

- Board Seat: Tether entitled to nominate a board member

- Storage Services: Gold.com to provide storage for Tether's gold holdings

- Stablecoin Integration: Gold.com to offer Tether stablecoins through DTC channels

- Counter-Investment: Gold.com to invest $20 million in Tether's XAUT stablecoin

CEO Greg Roberts emphasized the immediate financial benefits: "If you just throw everything else out and you just take the interest expense benefits we're gonna see from this transaction, it's a significant amount of money." The fresh capital will enable Gold.com to reduce expensive dollar borrowings (at 6-7% rates) and utilize lower-cost gold leases for liquidity.

Thomas Forte of Maxim Group called it "the most significant announcement in the history of the company."

How Did the Stock React?

Gold.com stock rose 2.4% on earnings day (February 5, 2026), closing at $50.35.

The stock has been on a tear, more than doubling from its 52-week low of $19.73 as precious metals demand surged and the company executed on its rebrand and acquisition strategy.

What Changed From Last Quarter?

The Q1 to Q2 turnaround was driven by several factors:

1. Consumer Demand Surged

"We experienced an increase in consumer demand across our platforms" — CEO Greg Roberts

2. Vegas Facility Operating at Peak Capacity

The AMGL fulfillment facility shipped 120,000+ packages in January alone—testing its operational ceiling. CEO Roberts noted: "The fact that we were able to scale up and get the packages we did out in January is a real testament to everything Thor and Brian have been doing there."

3. Silver Demand Returned

Silver volumes jumped 79% sequentially as the market shifted back toward silver. Roberts explained: "What we've seen in the last 8 weeks is a shift back to silver... silver could be either side of 50% right now as it relates to total volume."

What's the Outlook for Q3?

Management was unusually bullish. When asked about profitability in the current quarter, CEO Roberts stated:

"You should probably think about that we're gonna have a really good quarter this quarter."

Several factors support the optimism:

-

Premium Spreads Expanding: "Premiums are significantly higher for one-ounce silver products than they were three months ago"

-

Backwardation Easing: The silver market is moving back toward contango, which is positive for trading profits. The backwardation in Q2 caused an estimated $10-12 million swing in trading results year-over-year.

-

Mint Capacity Ramping: SilverTowne Mint production is ramping from 200,000 oz/week to 800,000+ oz/week to meet demand.

-

Monex Acquisition Closed: The Monex Deposit Company acquisition closed in January 2026, adding a large customer base and $630M in assets under custody.

Segment Performance

Direct-to-Consumer (DTC)

The DTC segment—including JM Bullion, Stack's Bowers Galleries, GovMint, and Goldline—contributed 77% of consolidated gross profit in Q2, up from 56% in the year-ago quarter.

- Total DTC Customers: 4.36 million (+37% YoY)

- JM Bullion AOV: $2,637 (+29% YoY)

- CyberMetals AUM: $18.9 million (+130% YoY)

Wholesale Sales & Ancillary Services

The wholesale segment benefited from higher gold/silver prices and acquisition contributions from SGI, Pinehurst, and AMS (acquired Feb-Apr 2025).

International Expansion

- LPM Hong Kong: Strong retail showroom and wholesale volumes

- Atkinsons UK: Increased equity stake to 49.5%

- Singapore: New location showing positive momentum

Margin Pressure & Trading Headwinds

Despite strong revenue growth, gross margin compressed to 1.44% from 1.63% in the year-ago quarter.

Key margin headwinds:

- Tight Premium Spreads: Spreads remained tight through year-end

- Silver Backwardation: Created trading losses and higher interest expense

- Higher Interest Expense: Up 57% YoY to $16.3 million due to product financing and metals leases

However, management noted these headwinds are easing as the market moves back toward contango and premiums expand.

Capital Allocation

Dividend Maintained: The Board declared a quarterly dividend of $0.20 per share, payable March 4, 2026 to shareholders of record February 20, 2026.

Balance Sheet Strengthening:

The Tether investment will add $150 million in fresh equity capital plus a $100 million gold leasing facility, significantly improving liquidity and reducing interest expense.

Q&A Highlights

On supply constraints: "We're taking market share right now, and I do believe we're better than everybody else." — CEO Greg Roberts on competitors facing inventory challenges

On silver volatility: "Silver at $100 and gold at $5,000... it causes us a significant increase in the amount of dollars we need to manage those positions." — CEO on managing commodity exposure with higher prices

On Tether opportunities: "There's things they can help us with. There's things we can help them with... I'm very excited about this relationship." — CEO on broader commercial opportunities

On capacity: "We should be easily able to ship 150,000 packages a month, which would be a phenomenal number." — CEO on Las Vegas facility capacity

Key Risks & Concerns

- Commodity Volatility: Gold and silver price swings directly impact inventory values and trading positions

- Margin Sensitivity: Tight premium spreads can quickly compress profitability

- Interest Rate Exposure: Higher rates increase product financing costs

- Integration Risks: Multiple recent acquisitions (SGI, Pinehurst, AMS, Monex) require integration

- Customer Concentration: Reliance on retail demand during bull markets

Forward Catalysts

Gold.com's Q2 FY2026 marked a significant inflection point—not just in financial performance, but in strategic positioning. The Tether investment validates the company's vision as a vertically integrated leader in physical bullion and opens doors to cryptocurrency integration. With premiums expanding, backwardation easing, and management unusually bullish on Q3, the stock's 45% YTD rally may have further to run.

Related Documents: