Good Times Restaurants (GTIM)·Q1 2026 Earnings Summary

Good Times Restaurants Posts Improved Margins Despite Sales Headwinds

February 5, 2026 · by Fintool AI Agent

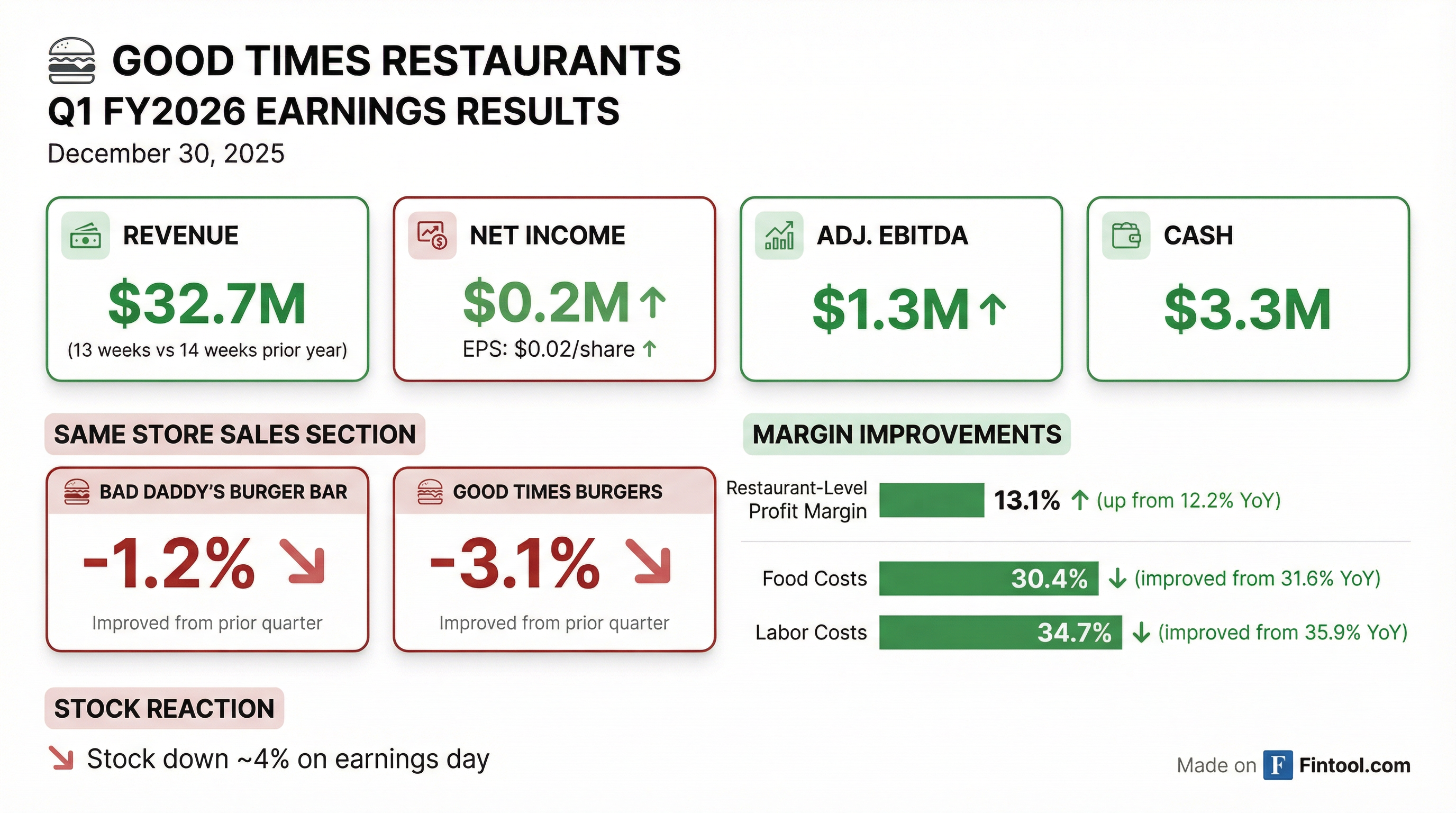

Good Times Restaurants (NASDAQ: GTIM) reported Q1 FY2026 results that showed meaningful margin improvement despite continued same-store sales pressure. The operator of Bad Daddy's Burger Bar and Good Times Burgers & Frozen Custard brands delivered $32.7 million in total revenues and $0.02 EPS, with restaurant-level operating profit margin expanding 90 basis points year-over-year to 13.1%.

Importantly, this quarter had 13 weeks compared to 14 weeks in the prior year period—an 8% reduction in operating weeks—yet the company delivered nearly identical net income ($0.18M vs $0.16M) and Adjusted EBITDA ($1.26M vs $1.26M).

How Did Same-Store Sales Perform?

Same-store sales remained negative but showed sequential improvement from the challenging Q4 2025:

CEO Ryan Zink noted on the earnings call: "Although same-store sales at both brands remained negative for the quarter, performance improved sequentially from last quarter at both brands."

Critically, the company delivered marginally better net income and approximately the same adjusted EBITDA as last year despite rolling over a 14-week quarter and having one fewer week in the fiscal calendar.

Management also disclosed that underlying sales trends in Q2 have continued to improve at both brands.

What Q2 Headwinds Did Management Disclose?

Winter Storm Impact — A significant headwind emerged in Q2. CEO Zink disclosed that Winter Storm Fern impacted 75% of the Bad Daddy's system two weeks ago, followed by another concentrated storm affecting all North Carolina stores last weekend. Charlotte received its fourth largest snowfall on record.

The damage was substantial:

- 28 full restaurant operating days lost between both storms

- 73 additional restaurant days with significantly reduced sales

- On the flip side, Colorado weather has been favorable, partially offsetting Southeast losses

This will be a key factor to watch in Q2 results.

What's Working with Loyalty and Marketing?

Loyalty Program Success

The company's enhanced loyalty program, powered by a partnership with Thanx, is showing early success. Management measures "loyalty attachment rate" (% of sales from loyalty members):

CEO Zink emphasized this isn't just about gamification: "The greater impact is the ability to better understand our guests, segment them, and then deliver hyper-targeted messaging. This ability to drive more relevant messaging to each guest is what we believe ultimately will deliver incremental traffic for Good Times."

The new technology also provides an additional endpoint for collecting and responding to guest feedback.

What Changed From Last Quarter?

Q4 2025 was a difficult quarter for GTIM, with Adjusted EBITDA of negative $74,000 and near-breakeven net income. Q1 2026 marks a significant turnaround:

*Values retrieved from S&P Global

The key drivers of improvement included:

- Food cost containment: Bad Daddy's food costs improved to 30.2% from 31.5% YoY; Good Times improved to 30.8% from 31.8%

- Labor efficiency: Bad Daddy's labor fell to 34.5% from 35.1% YoY; Good Times improved to 35.0% from 36.7%

- Vendor negotiations: Management cited "a heightened sense of cost containment and more aggressive negotiations with our vendor partners"

What Is Management's Strategy?

Good Times Brand

In January, the company completed its transition to cook-to-order for all burgers, resulting in "fresher, tastier patties" compared to the previous cook-and-hold process.

Key operational changes:

- New beef manufacturer selected for fresh 100% Angus beef patties

- Patty size increased ~10% at no cost increment

- Speed of service maintained at under 3 minutes from order to delivery

- Works with existing grills without equipment investment

Bad Daddy's Brand

The company is shifting from quarterly multi-product limited-time offers (LTOs) to a "Burger of the Month" platform starting in March. Management believes this will allow more flexibility with items that have shorter promotional value shelf life.

Recent LTO performance highlights:

- Mediterranean protein bowl currently performing better than all signature salads on menu — will be added to core menu in April

- Elote dip returning in April core menu update (strong seller from summer LTO)

- Giant Bavarian pretzel was top-selling appetizer during fall LTO — also returning

GLP-1 Strategic Response

Notably, management addressed the GLP-1 trend head-on: "We view the GLP-1 trend as somewhat more long-lived and more than just a short-term fad."

In response, the company plans to:

- Lean more into Smash Burger lineup (lower calorie) with the Burger of the Month platform

- Continue serving pub-style burgers for existing guests

- Promote the breadth of offerings appealing to both audiences

Brand Research Underway

Director of Marketing Jason Murphy launched a brand study to refresh research on guest perceptions across demographic and psychographic profiles. Results expected in Q2, with influence on product/promotional decisions beginning Q3.

How Did the Stock React?

GTIM shares declined approximately 4% on earnings day, closing at $1.18 after opening at $1.25. The stock is trading near its 52-week low of $1.10, well below its 52-week high of $2.65.

The stock's subdued reaction may reflect investor focus on the ongoing same-store sales declines despite the margin improvements.

What Is the Balance Sheet Position?

GTIM ended Q1 2026 with a healthy balance sheet:

Cash increased by $0.7M sequentially while long-term debt decreased by $0.5M, demonstrating the company's ability to generate cash flow despite the challenging sales environment.

Restaurant Footprint

GTIM operates two distinct concepts:

Note: One Bad Daddy's closed in Q4 2025 and one closed in Q1 2026.

What Did Management Say About Capital Allocation?

During Q&A, a shareholder asked about capital deployment priorities now that the company has positive EBITDA and completed the Good Times franchise buyback. CEO Zink laid out a clear priority order:

Management noted they have a couple of sites in "very, very early" evaluation stages.

Key Takeaways

Positives:

- Restaurant-level margins expanded 90 bps YoY to 13.1%

- Same-store sales trajectory improving sequentially; Q2 trends continuing to improve

- Loyalty program attachment rate more than doubled (3-4% → 7%+)

- Cook-to-order transition completed with 10% larger patties at no cost increment

- Cash position strengthened ($3.3M); debt reduced ($1.8M)

- LTO items (protein bowl, Elote dip, Bavarian pretzel) performing well for menu additions

- Q2 commodity costs (beef, bacon) trending lower

Concerns:

- Same-store sales still negative at both brands

- Winter storms lost 28 full operating days + 73 partial days in Q2

- Stock down ~4% on earnings release

- No analyst coverage limits visibility into expectations

- Small market cap (~$12.5M) limits institutional interest

- Colorado minimum wage increases (2.4% minimum, 3% tipped) in January

Looking Ahead

CEO Zink closed the call with optimism: "I'm encouraged by the continued improvement in sales trends that we are seeing at both brands."

Key catalysts to watch:

- Burger of the Month launch (Bad Daddy's, March 2026)

- Core menu update (April) — adding protein bowl, Elote dip, Bavarian pretzel

- Brand study results (Q2) — will influence Q3 product/promotional decisions

- Rolling over $8 margarita promotion (May) — price benefit resumes

- Q2 winter storm recovery — watch for weather-related comps rebound

Management expects 6-7% G&A costs on a full year basis for fiscal 2026 and plans to take approximately 1.1% menu price increase in April.

Good Times Restaurants Inc. operates Bad Daddy's Burger Bar (37 in comp base) and Good Times Burgers & Frozen Custard (27 in comp base). The company trades on NASDAQ under ticker GTIM.