Hess Midstream (HESM)·Q4 2025 Earnings Summary

Hess Midstream Q4 2025: Compression Buildout Complete, EPS Up 6% YoY Despite Winter Weather Headwinds

February 2, 2026 · by Fintool AI Agent

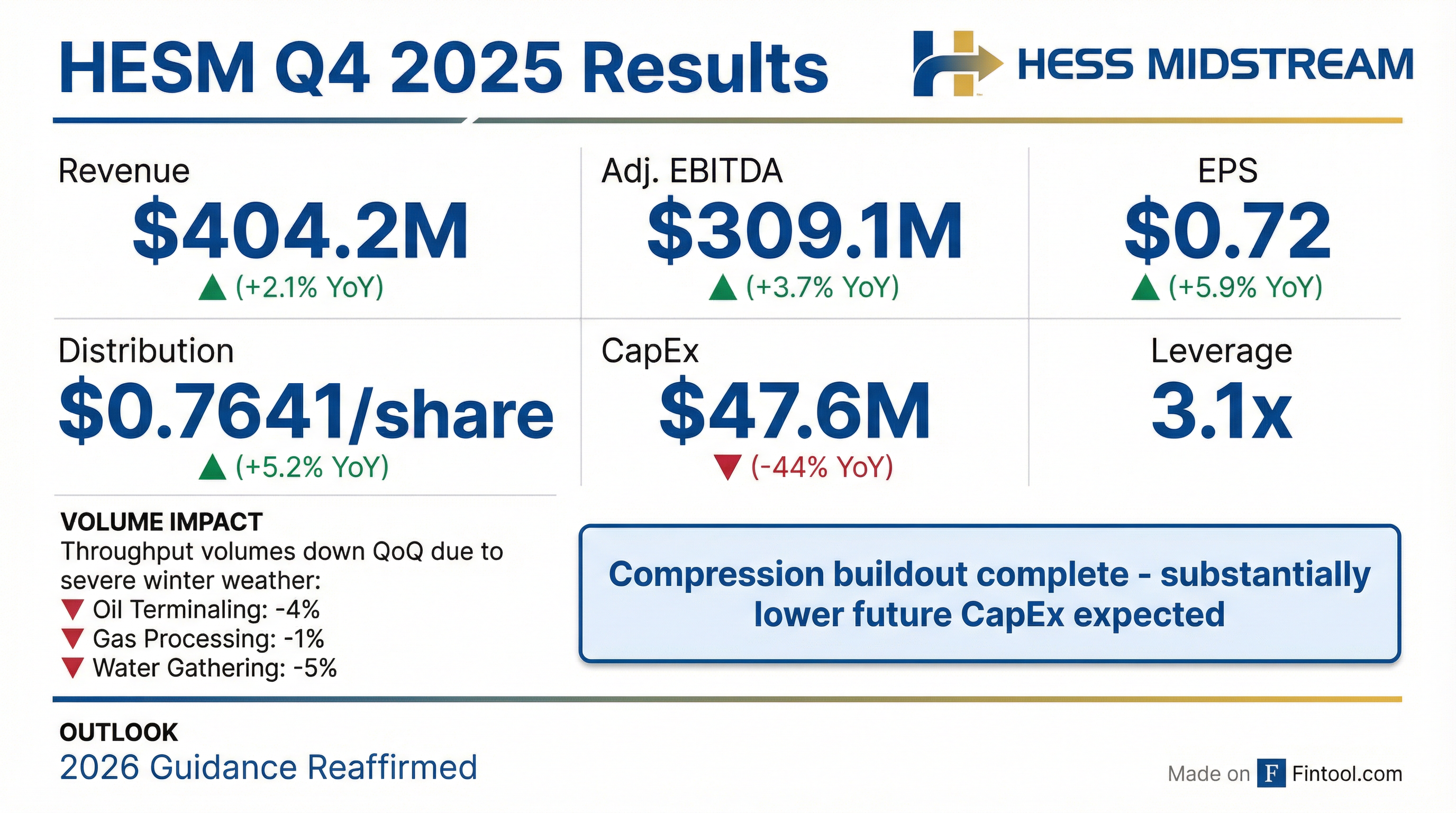

Hess Midstream (NYSE: HESM) reported Q4 2025 results with EPS of $0.72, up 6% year-over-year, despite throughput volumes declining due to severe winter weather in the Bakken. The headline story: the multi-year compression buildout is complete, positioning the company for substantially lower CapEx and growing free cash flow.

CEO Jonathan Stein struck an optimistic tone: "In 2025, we successfully completed our planned multiyear infrastructure project buildout. We remain focused on reliable operating performance and expect substantially lower future capital spending, supporting growing Adjusted Free Cash Flow that positions us well for incremental shareholder returns and debt repayment."

The stock traded down ~2.3% in aftermarket to $34.67, reflecting the weaker throughput volumes despite the positive long-term capital efficiency story.

Did Hess Midstream Beat Earnings?

Analyst consensus estimates for Q4 2025 were not available at the time of publication. However, the year-over-year comparison shows solid improvement across key profitability metrics despite volume headwinds.

Key drivers of YoY revenue growth:

- Higher tariff rates

- Increased third-party services

- Higher pass-through costs ($29.7M vs $26.7M prior year)

EPS increased despite lower net income due to share count dynamics following GIP's exit in May 2025, which changed the noncontrolling interest allocation.

What Happened to Throughput Volumes?

Severe winter weather in the Bakken significantly impacted Q4 2025 volumes:

The volume declines were primarily attributed to lower production caused by severe winter weather rather than structural demand issues. Full year 2025 volumes were actually up across all metrics versus 2024, demonstrating the underlying growth trajectory.

Weather Context: CEO Stein emphasized this is different from prior years when power lines were down across the state for the first half of the year. The current impact is from "significantly extreme cold weather, some snow, but really the cold." Severe weather continued through January and into early February, with management building contingencies into Q1 2026 guidance.

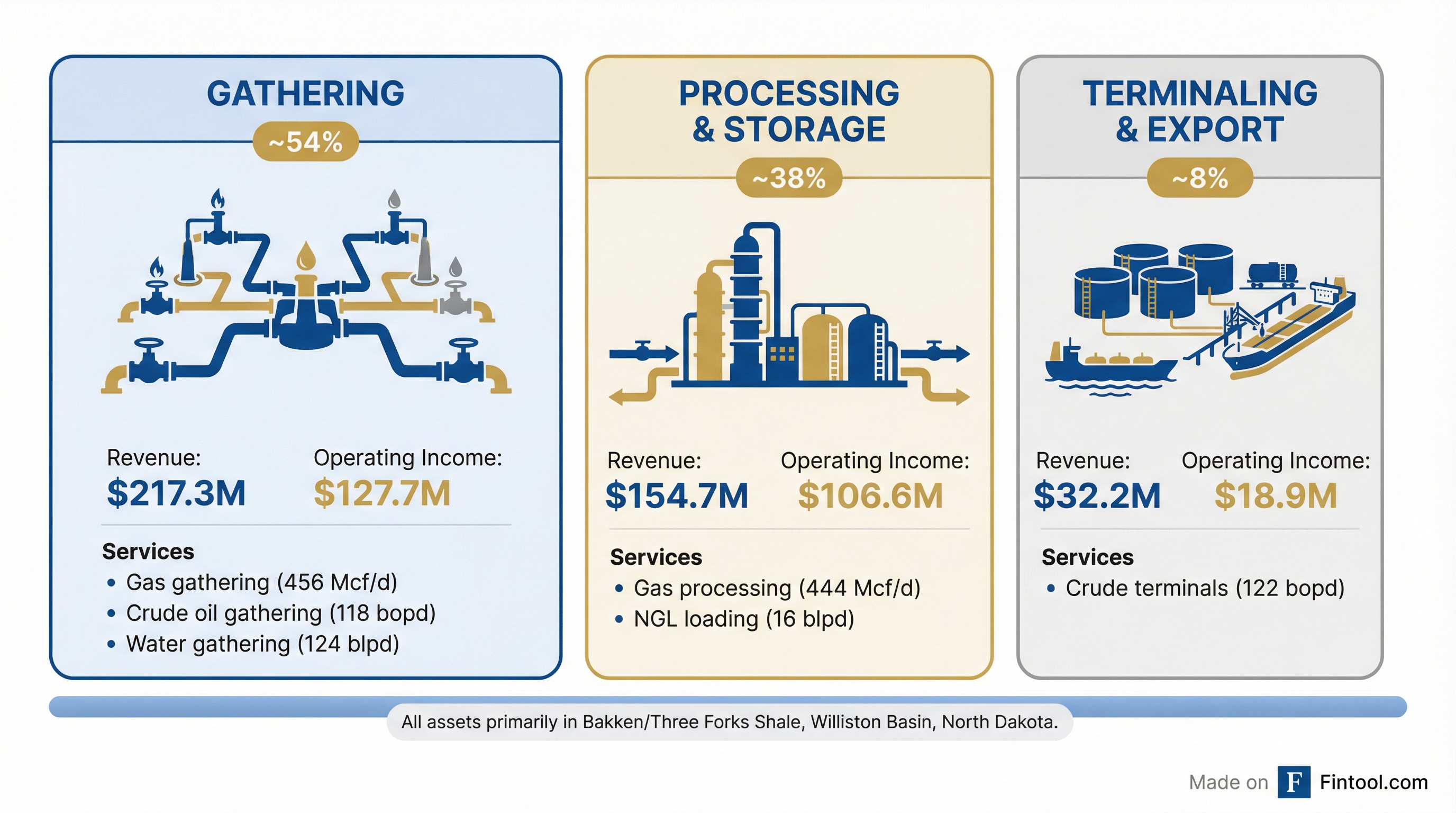

How Did Segments Perform?

Gathering drove the majority of operating income growth, benefiting from higher tariff rates despite lower volumes. Processing & Storage was essentially flat as volume declines offset pricing improvements. Terminaling & Export showed resilience with 6% operating income growth.

What's the CapEx Story?

This is the most important takeaway from the quarter:

The 44% quarterly decline signals the completion of Hess Midstream's compression capacity expansion. In January 2026, the company placed in service a new compressor station providing ~50 MMcf/d of installed capacity with potential to expand an additional 20 MMcf/d.

Why this matters: Lower CapEx directly flows to higher Adjusted Free Cash Flow, supporting the distribution growth strategy and debt reduction. Adjusted FCF jumped 26.5% YoY to $207.8M in Q4 2025.

What Did Management Guide?

Hess Midstream reaffirmed its full year 2026 and long-term guidance issued on December 9, 2025.

Q1 2026 Guidance

CFO Mike Chadwick noted Q1 will be impacted by "severe winter weather that continued through January and the potential for additional winter weather events through the quarter."

Full Year 2026 Guidance

Multi-Year Outlook (Through 2028)

Key growth drivers through 2028:

- Gas volume growth (gas represents 75% of revenues)

- Contracted annual inflation tariff rate adjustments

- Lower operating and capital spend

CEO Jonathan Stein emphasized: "We expect significant Adjusted free cash flow generation in 2026 of $850-$900 million, reflecting 12% growth over 2025 at the midpoint, followed by annualized growth of approximately 10% through 2028."

Management expects to generate approximately $1 billion of financial flexibility through 2028 to continue return of capital to shareholders and pay down debt.

What Changed With Ownership?

Two major ownership changes occurred in 2025:

-

Chevron-Hess Merger Completed (July 18, 2025): Chevron is now the direct parent of Hess and indirectly owns ~37.9% of Hess Midstream on a consolidated basis.

-

GIP Exit (May 30, 2025): Global Infrastructure Partners (part of BlackRock) sold all of its limited partner interests in the Partnership and no longer holds any ownership.

These changes simplified the ownership structure, with Chevron now the sole sponsor alongside public Class A shareholders.

How Did the Stock React?

The stock declined ~2.3% in aftermarket trading, likely reflecting the weaker-than-expected throughput volumes due to winter weather. The longer-term capital efficiency story (completed buildout, lower CapEx) may take time to be reflected in the stock.

Balance Sheet and Leverage

Interest expense increased to $56.7M from $52.2M in Q4 2024, primarily due to higher borrowings under the revolving credit facility.

Leverage Strategy: When asked about the 3x leverage target, CFO Chadwick explained the company expects to "naturally delever below 3x" over the next few years as EBITDA grows while absolute debt levels stay flat or decline. The company is funding incremental shareholder returns from free cash flow after distributions rather than leveraged buybacks — a more conservative approach aligned with Chevron's 200,000 BOE/day plateau production target for the Bakken.

Full Year 2025 Summary

Q&A Highlights

On Balance Sheet Strategy (Citi): Management confirmed they plan to use a portion of free cash flow after distributions to pay down debt, consistent with Chevron's 200,000 BOE/day plateau production target. They expect to naturally delever below 3x leverage over the next few years without a specific target.

On Third-Party Volume Outlook (Citi): "Really no change to our outlook there. Still expecting 10% on average across oil and gas," CEO Stein said. Third-party volumes can vary quarter-to-quarter but the long-term average expectation remains unchanged.

On Growth Drivers Through 2028 (JP Morgan): Growth is driven by inflation escalators, modest gas volume growth, and significantly lower capital spending. CEO Stein emphasized the "unique combination" of elements: significant FCF generation, 5% distribution growth, and balance sheet strength.

On CapEx Floor (JP Morgan): CFO Chadwick confirmed CapEx is expected to decline from $150M in 2026 to ~$75M or less in 2027-2028. Of the $150M in 2026, $25M is for completing the compression/gathering buildout with the remaining $125M for well connects and maintenance.

On Weather Impact (Goldman Sachs): CEO Stein clarified this is not like the power outage situation from prior years: "We're really just seeing significantly extreme cold weather, some snow, but really the cold." Once temperatures improve, production should recover normally. Management built contingencies into Q1 guidance for potential additional winter weather events.

On Chevron's Bakken Plans: CEO Stein noted Chevron just reiterated its 200,000 BOE/day target on their call last Friday (January 30), with continued optimization program. HESM's guidance through 2028 is fully consistent with this plan.

Key Takeaways

Positives:

- EPS up 6% YoY despite volume headwinds

- Compression buildout complete — CapEx drops 40% to $150M in 2026, then <$75M in 2027-2028

- Adjusted FCF up 27% YoY to $207.8M; guiding to $850-900M FCF in 2026 (+12% YoY)

- Distribution increased for another quarter (+5% YoY), targeting 5% growth through 2028

- 95% MVC revenue protection in 2026, 90% in 2027, provides downside floor

- ~$1 billion financial flexibility through 2028 for shareholder returns and debt paydown

- Chevron reiterated 200,000 BOE/day Bakken target just last Friday

Concerns:

- Throughput volumes down 1-5% across all segments due to weather

- Q1 2026 EBITDA guidance of $295-305M is 5% below Q4 due to continued weather impact

- Interest expense rising (+9% YoY) as borrowings increase

- Single-basin concentration (Bakken) creates weather exposure risk

- Dependence on Chevron for ~96% of revenue

Upcoming Catalysts

- February 13, 2026: Q4 2025 distribution payment date

- Q1 2026 Earnings: Watch for weather normalization — management expects volumes to recover in Q2-Q3 following seasonal patterns

- Chevron Development Updates: Track Bakken rig activity (currently 3 rigs) and progress toward 200,000 BOE/day target

- Incremental Shareholder Returns: Management committed to using excess FCF after distributions for debt paydown and potential additional buybacks

View HESM Company Profile | Read Q4 2025 Transcript | Prior Quarter: Q3 2025