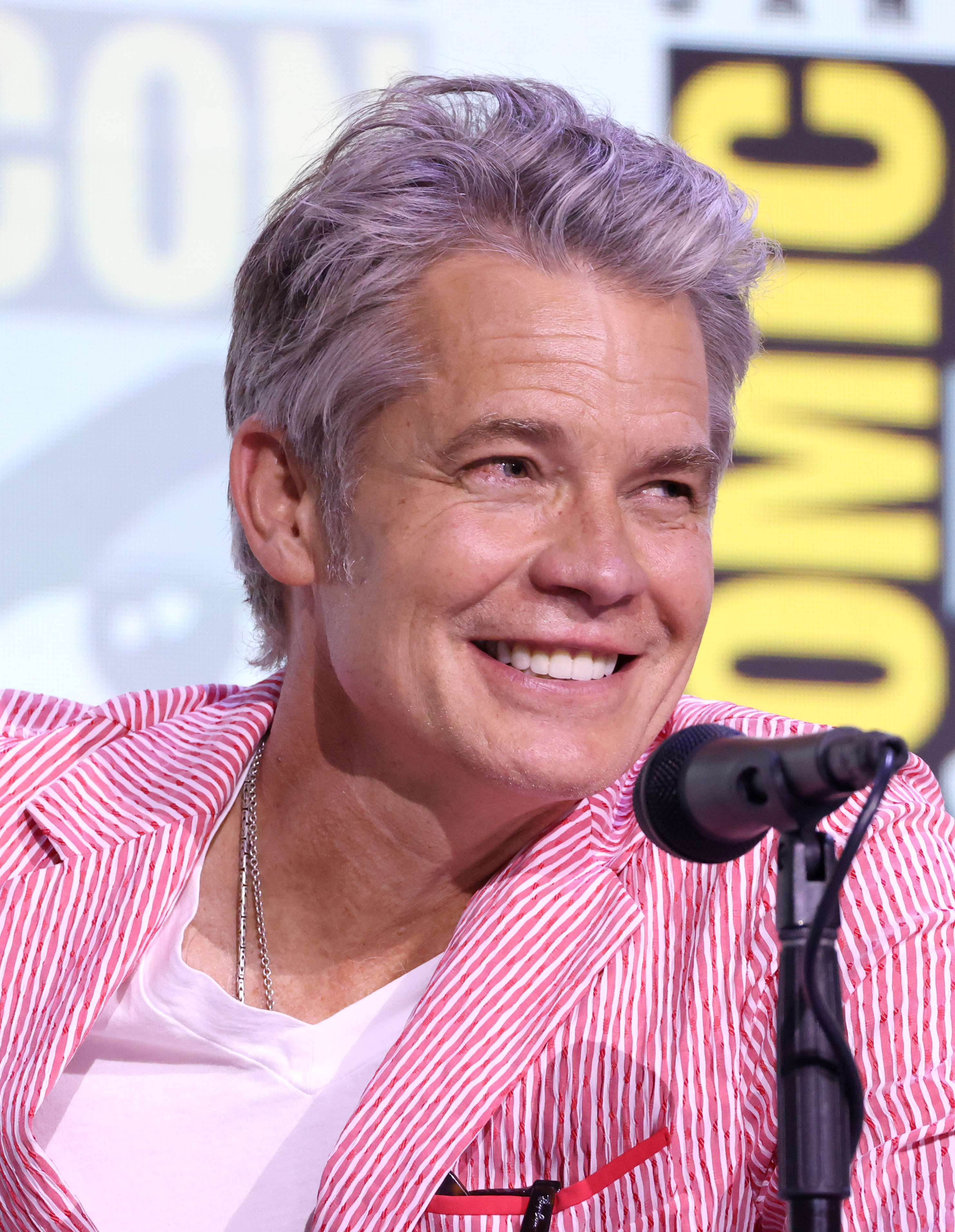

Tim Johnson

About Tim Johnson

Tim Johnson, age 59, is the founder, Chief Executive Officer, and a director of Health In Tech, Inc. (HIT), serving on the board since the company’s founding in 2014; he holds a Master of Business Analytics from Missouri Western State College (1988) and has 30+ years of entrepreneurial experience in stop-loss insurance and self-funded benefits . Under his tenure, FY 2024 revenues were $19.49 million and net income was $0.67 million, with quarterly momentum in 2025 (Q1–Q3) showing revenues of $8.01–$9.31–$8.49 million and net income of $0.50–$0.63–$0.45 million . EBITDA disclosures are not provided in filings, and TSR metrics are not disclosed in the proxy.

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Health In Tech, Inc. | Chief Executive Officer; Director | 2014–present | Founder; deep expertise in stop-loss/self-funded benefits; CEO leadership since inception . |

| Roscommon and Roscommon Captive Management LLC | Owner | –May 2023 | Provided self-insurance services to HIT clients; ~$940,915 in service fees through May 31, 2023; sold to unrelated party end of May 2023 . |

External Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| None disclosed | — | — | — |

Fixed Compensation

| Year | Base Salary ($) | Bonus Paid ($) | Stock Awards ($) | Option Awards ($) | All Other ($) | Total ($) |

|---|---|---|---|---|---|---|

| 2024 | 420,000 | 46,500 | — | — | — | 466,500 |

| 2023 | 420,000 | 150,000 | 108,290 | 519,193 | — | 1,197,483 |

Key terms of employment agreement (dated July 27, 2023):

- Eligible for discretionary annual cash bonus based on individual and company performance; equity plan participation at board/comp committee discretion; standard benefits and expense reimbursement .

- Restrictive covenants include invention assignment, confidentiality, non-compete and non-solicit during employment and for two years post-termination .

Performance Compensation

Tim Johnson’s annual cash bonus is discretionary and tied to individual and company performance per the employment agreement; specific metric weightings, targets, and outcomes are not disclosed in the proxy .

| Incentive Type | Metric | Weighting | Target | Actual | Payout | Vesting |

|---|---|---|---|---|---|---|

| Annual Cash Bonus (2024) | Discretionary (individual/company) | Not disclosed | Not disclosed | Not disclosed | 46,500 | N/A |

| Annual Cash Bonus (2023) | Discretionary (individual/company) | Not disclosed | Not disclosed | Not disclosed | 150,000 | N/A |

| Equity Awards (2024 plan) | Plan permits RSU/PSU/options/SAR | N/A | N/A | N/A | N/A | As granted; service/performance conditions as applicable |

Notes:

- The 2024 Equity Incentive Plan allows performance shares/units and other awards, but CEO-specific performance metrics and weightings were not disclosed for 2023–2024 .

Equity Ownership & Alignment

Total beneficial ownership and voting power:

| Security | Shares | % of Class | % of Total Voting Power |

|---|---|---|---|

| Class A Common Stock | 23,133,568 | 49.74% | — |

| Class B Common Stock | 9,000,000 | 76.92% | — |

| Aggregate Voting Power | — | — | 69.19% |

Breakdown (as-of Sep 8, 2025):

- Includes 62,193 restricted shares and 663,827 options; excludes 70,880 options vesting after 60 days from the proxy date .

- Insider trading policy prohibits margining (using company stock as collateral), short sales, and derivatives for directors, officers, employees, and >10% holders .

- Clawback policy enables recovery of erroneously awarded incentive compensation following restatements, consistent with Exchange Act Section 10D/Nasdaq .

Outstanding equity awards (FY-end 2024):

| Grant Date | Options Exercisable (#) | Options Unexercisable (#) | Strike ($/share) | Expiration | Restricted Stock Not Vested (#) | Market Value ($) |

|---|---|---|---|---|---|---|

| 7/1/2023 | 126,297 | 608,410 | 0.71 | 7/1/2028 | 120,090 | 84,864 |

Vesting characteristics:

- Options and restricted stock awards require service-based vesting following HIT’s IPO; options expire in 2028; RS awards granted at fair value with service conditions .

Pledging/Hedging:

- Policy prohibits margining (pledging for purchases), short sales, and derivatives; no pledging by Johnson is disclosed in the proxy .

Stock ownership guidelines:

- Not disclosed.

Employment Terms

| Provision | Detail |

|---|---|

| Agreement date | July 27, 2023 |

| Term | At-will employment |

| Base salary | $420,000 annually |

| Bonus eligibility | Discretionary, based on individual and company performance |

| Equity eligibility | Participation in company equity plan at board/committee discretion |

| Benefits | Health, life, disability; standard expense reimbursement |

| Non-compete | 2 years post-employment |

| Non-solicit | 2 years post-employment |

| Severance/CoC | Individual severance multiples not disclosed; plan-level change-in-control permits acceleration/cancellation/assumption/cash-out at committee discretion |

Board Governance

- Role: CEO and director; non-independent due to management role .

- Board composition: six members; independence determination—only Johnson and CFO Julia Qian are non-independent .

- Committees: Audit (Hayes, chair), Compensation (Umemezia, chair), Nominating & Governance (Howard, chair); Johnson is not on these committees .

- Meetings: No board meetings held in 2024 due to IPO timing in late December 2024 .

- Insider trading policy, hedging/margining prohibitions, and code of conduct in place .

- Dual-class equity governance: Proposal to allow executive officers (including CEO) to receive Class B shares (10 votes/share; convertible 1:1 to Class A), increasing executive voting concentration if granted; as of Sept 8, 2025, 2.0 million Class B shares reserved for executive awards under the amended plan .

Director compensation (for non-employee directors):

- Annual retainer: $120,000 ($40,000 cash; $80,000 restricted stock vesting after one year) .

- Committee chair fees: Audit $20,000; Compensation $10,000; Nominating/Governance $10,000 .

- Equity grants at annual meeting; proration for new directors .

Compensation Structure Analysis

- Mix shift year-over-year: 2023 included sizable equity (options $519,193; stock $108,290) while 2024 compensation was largely cash with modest bonus and no new equity awards; suggests pre-IPO equity heavy year followed by post-IPO cash-oriented year .

- Guaranteed vs at-risk: Base salary steady at $420,000; bonuses discretionary without disclosed targets; lack of disclosed performance metrics reduces pay-for-performance visibility .

- Equity plan modification: 2024 Plan amendment expands share pool and allows Class B grants to executive officers, raising potential dilution and governance concentration via high-vote shares .

Related Party Transactions

- Roscommon and Roscommon Captive Management LLC (previously owned by Johnson) provided ~$940,915 in services fees to HIT clients through May 31, 2023; entity sold to an unrelated party end of May 2023; related party policies adopted subsequently, with audit committee oversight for future transactions .

Risk Indicators & Red Flags

- Voting control: Johnson beneficially controls 69.19% of total voting power via Class A and Class B shares, concentrating control and potentially reducing minority shareholder influence .

- Dual-role: CEO and director; board determined non-independence for Johnson and CFO; independent committees exist, but executive control and potential Class B grants heighten governance risk .

- Limited performance metric disclosure: Discretionary bonus structure without specific targets reduces transparency on pay-for-performance alignment .

- Related-party history: Material services from an entity previously owned by CEO; policy now in place for future oversight .

- Hedging/pledging: Policy prohibits margining, short sales, and derivatives, which is shareholder-friendly for alignment .

- Clawback: Adopted clawback policy consistent with Nasdaq/Section 10D .

Performance & Track Record

Quarterly performance (oldest → newest):

| Metric | Q4 2023 | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|---|---|---|---|

| Revenues ($) | 5,216,283* | 5,124,931* | 5,002,490 | 4,458,921* | 4,904,564 | 8,014,984 | 9,313,849 | 8,490,093 |

| Net Income ($) | 1,002,300* | 100,536* | 338,007* | 376,086* | -144,152* | 498,592 | 630,631 | 452,176 |

Annual performance:

| Metric | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|

| Revenues ($) | 5,769,781* | 19,151,502* | 19,490,906 |

| Net Income ($) | 79,742* | 2,476,660* | 670,477 |

Values marked with an asterisk were retrieved from S&P Global.

Board Service History and Dual-Role Implications

- Service: Johnson has served as CEO and director since 2014; nominated for re-election at the 2025 annual meeting .

- Committee roles: Johnson is not a member of the audit, compensation, or nominating and governance committees; those are wholly independent with designated chairs .

- Independence: Board determined Johnson is not independent; majority of directors are independent; executive sessions frequency not disclosed .

- Dual-role implications: Significant voting control and potential receipt of Class B high-vote equity grants could heighten entrenchment risk and reduce perceived board independence; independent committees and clawback/hedging policies mitigate but do not eliminate governance concerns .

Director Compensation

| Component | Amount |

|---|---|

| Annual retainer (non-employee directors) | $120,000 ($40,000 cash; $80,000 restricted stock vesting after one year) |

| Committee chair fees | Audit $20,000; Compensation $10,000; Nominating/Governance $10,000 |

| Meeting fees | Not disclosed |

| Equity grants | Granted at annual meeting; prorated for new directors |

Expertise & Qualifications

- Education: Master of Business Analytics, Missouri Western State College, 1988 .

- Industry experience: Stop-loss insurance and self-funded benefits; founder-operator background and prior ownership in self-insurance services entities .

- Board qualifications: Founder with sector expertise; not designated as audit financial expert (Hayes is the audit committee financial expert) .

Say-on-Pay & Shareholder Feedback

- Say-on-pay outcomes: Not disclosed in 2025 proxy .

- Shareholder engagement proposals: Not disclosed beyond standard voting procedures .

Compensation Committee Analysis

- Composition and independence: Four independent directors; chaired by Chike Umemezia; charter authorizes use of independent compensation consultants with independence factors considered .

- Responsibilities: CEO goal-setting and performance evaluation; oversight of executive compensation policies and equity plans; production of compensation report for proxy .

Investment Implications

- Alignment: Johnson’s substantial equity/voting stake (69.19% voting power) tightly aligns him with equity outcomes but raises entrenchment and minority rights concerns, particularly given plan authorization for executive-only high-vote Class B grants .

- Pay-for-performance visibility: Discretionary bonuses without disclosed metrics and limited performance award detail reduce transparency; however, clawback and hedging restrictions are positive governance features .

- Selling pressure/vesting cadence: Significant option balances with service-based vesting and 2028 expiry, plus restricted stock vesting post-IPO, could create periodic selling windows; monitoring 10b5-1 plans and Form 4 filings is warranted (policy permits 10b5-1 usage) .

- Related-party history: Prior services from a CEO-owned entity have ceased; formal related-party policy now in place, lowering future conflict risk .

- Fundamentals trend: FY 2024 revenues were flat to slightly higher year-over-year while net income declined; 2025 quarters show improved net income vs 2024 lows, supporting execution improvement during 2025 under Johnson’s leadership .