H&R BLOCK (HRB)·Q2 2026 Earnings Summary

H&R Block Posts 11% Revenue Growth Under New CEO, Reaffirms FY26 Outlook as Stock Slips 4%

February 3, 2026 · by Fintool AI Agent

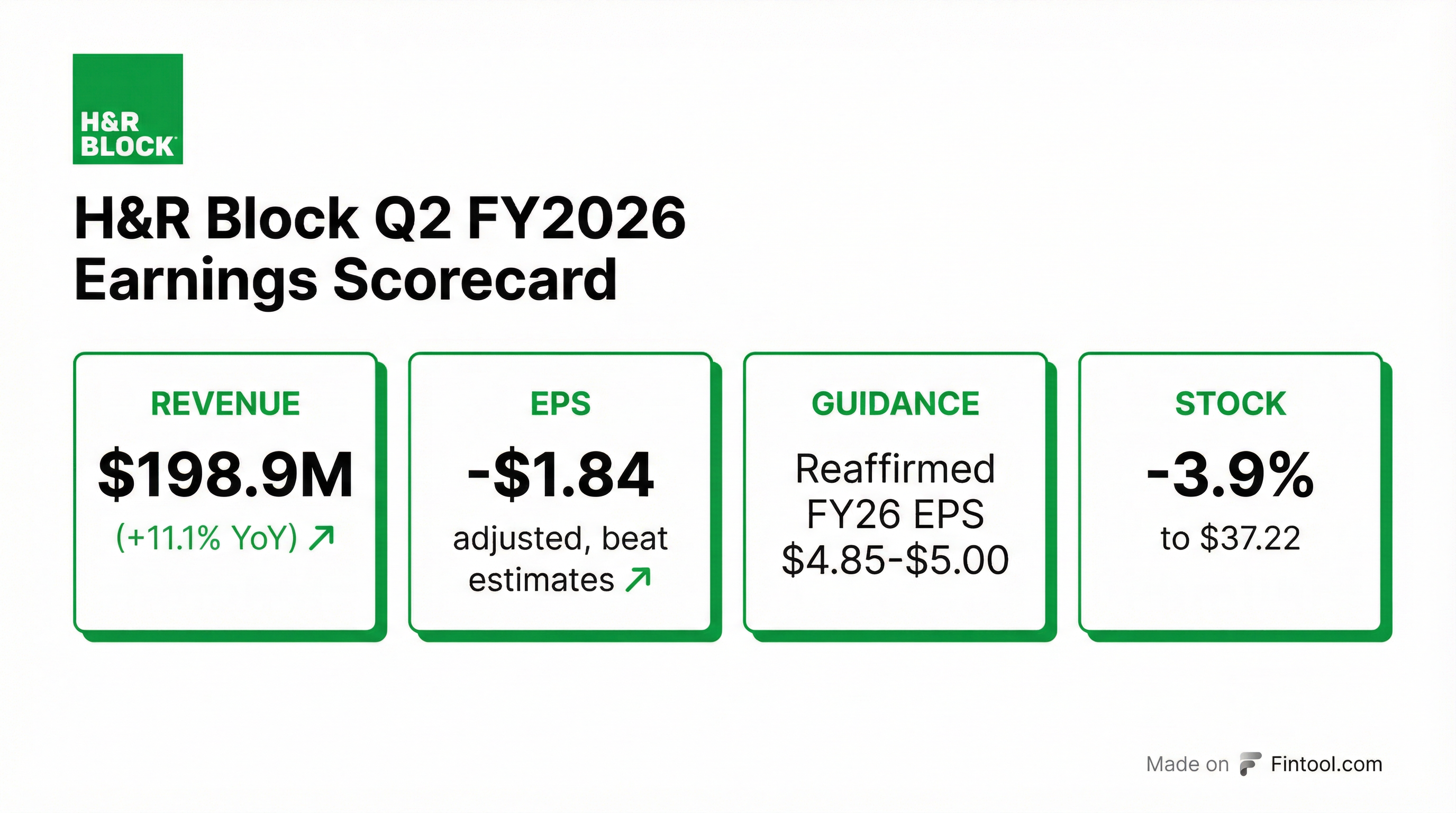

H&R Block reported Q2 FY2026 results that topped analyst expectations on both the top and bottom line, with revenue up 11% year-over-year to $199 million and a narrower-than-expected adjusted loss per share of $1.84. Despite the beat, shares fell 3.9% to $37.22 as management merely reaffirmed—rather than raised—full-year guidance ahead of the critical tax season.

The call marked the first earnings presentation for new CEO Curtis Campbell, who stepped into the role in January 2026. Campbell outlined a multi-year client-centered strategy focused on AI-enabled tax professional tools, scaling the Second Look service, and positioning H&R Block for the complexity created by the One Big Beautiful Bill Act.

Did H&R Block Beat Earnings?

Yes, H&R Block beat on both revenue and EPS in Q2 FY2026.

CFO Tiffany Mason noted that the higher loss per share (despite improved profitability) reflects fewer shares outstanding due to aggressive buybacks—the company has returned $508 million to shareholders in H1 FY2026 through dividends and repurchases.

Important context: Q2 is H&R Block's seasonally weakest quarter, historically contributing approximately 5% of annual revenue and typically resulting in a net loss. Tax preparation is concentrated in Q3 (January-April) and Q4 of the fiscal year.

What Drove Revenue Growth?

The 11% revenue increase was driven by strength across multiple areas :

- Higher assisted tax prep volume and NAC (net average charge): Strong demand through the extension season with improved conversion year-over-year

- Double-digit Wave growth: Strong results in high-margin subscription product Pro Tier and increased payments volume

- Higher DIY software sales: Early season momentum in digital products

- Emerald Advance: Loan applications exceeded expectations with average loan amounts above prior year, resulting in favorable loan volume

Wave will be fully integrated into H&R Block's small business solution by year-end.

What Did Management Guide?

H&R Block reaffirmed its FY2026 outlook :

Key guidance assumptions :

- Industry growth in line with historical norms (~1%)

- Continued emphasis on volume, price, and mix balance

- Strategic prioritization of assisted and paid DIY

- Expanding contribution from small business

- Continued franchise acquisitions at attractive EBITDA multiples

CFO Mason clarified that the high end of guidance assumes H&R Block holds share in the assisted category.

How Did the Stock React?

HRB fell 3.9% on earnings day, closing at $37.22 versus a previous close of $38.72. After-hours trading showed a modest recovery to $38.00.

The stock is now trading near its 52-week low, down substantially from its peak of $64.62. The muted reaction reflects investor disappointment that guidance was reaffirmed rather than raised despite the strong Q2 beat.

What Is the One Big Beautiful Bill Act?

New CEO Curtis Campbell highlighted the One Big Beautiful Bill Act as a significant factor for this tax season. The legislation brings meaningful tax law changes that increase complexity for filers :

- Standard deduction up $750

- TIPS income deduction - new

- Overtime pay deduction - new

- New senior deduction

- Increased SALT deduction

"The net effect is greater complexity, more questions, and a heightened desire for confidence as clients navigate new deductions, exemptions, and eligibility rules. These shifts reinforce the essential role our tax pros play."

Management expects this complexity to drive clients toward assisted tax preparation, noting that historically, significant tax complexity shifts ~20 basis points from DIY to assisted.

What Did the New CEO Say About Strategy?

Curtis Campbell, who joined as President and CEO in January 2026, outlined a fundamental shift in how H&R Block will operate :

Multi-year client-centered strategy:

- Shifting from a short-term seasonal lens to a long-term view of ideal client and tax pro experiences

- Testing and learning continuously rather than season-to-season

- Operating with "significantly higher velocity"

- Embedding disciplined experimentation into operating rhythm

"Historically, our season-to-season approach limited experimentation, speed, and long-term thinking. We've developed a multi-year client-centered strategy focused on delivering confidence, convenience, and transformative experiences."

Key strategic initiatives:

- Second Look scaling - Transformed from a niche offering into a core component of the new client experience, leveraging technology to scale

- AI-enabled tax pro assistant - Nationally launched, provides real-time guidance during client interactions

- Tax pro review for DIY clients - Free for new early-season filers, creating a bridge to professional expertise

- Automation pilots - Extracting data from documents, pre-populating returns, automating back-office tasks

How Is H&R Block Using AI?

Campbell emphasized AI as a critical enabler, not a threat :

"We don't think about AI as a disruptor. We absolutely think about it as an opportunity."

Current AI applications:

- AI-enabled tax pro assistant: Embedded in tax pro tools, provides real-time guidance during client interactions

- Second Look automation: Historically very manual, now leveraging AI to scale to bulk of clients

- Data extraction: Piloting capabilities to reduce manual data collection and entry

- AI Tax Assist for DIY: Real-time guidance for online customers

Marketing evolution:

- Evolving from SEO to "AI engine optimization" for content visibility

- Adapting to changing consumer search behaviors

When asked if AI tools making DIY easier could threaten the assisted business, Campbell said the company envisions "blended experiences" where DIY clients can connect with tax pros when facing uncertainty.

Q&A Highlights

On tax season early indicators (IRS e-file opened January 27):

"We don't see any material impact from the government shutdown... Block has been in business for 70 years, so we are not unfamiliar with government shutdowns."

On pricing: Management expects low single-digit price increases across both assisted and DIY channels.

On refund sizes:

"Depending on who you are as a taxpayer, you could see a slightly higher refund" due to the One Big Beautiful Bill changes, though it's too early to confirm with data.

On assisted market share: CFO Mason noted they've been "chipping away at the assisted share loss over the last couple of tax seasons" and are making progress. The high end of guidance assumes holding share in assisted.

On why share hasn't grown:

"A large portion of the reason why we've had some challenges is a significant amount of manual processes that are dependent on our tax pros to operate consistently at a high level. We're focused on leveraging technology to reduce that manual, non-value-added work."

On consulting costs: The Strategic Sourcing and Cost Optimization Initiative was completed in H1 and will create sustainable savings to self-fund growth investments. All contemplated in the outlook.

Capital Allocation

H&R Block continues its shareholder-friendly capital allocation strategy :

The company has approximately $700 million remaining on its share repurchase authorization.

What Changed From Last Quarter?

Key observations:

- New CEO Curtis Campbell took over in January 2026

- Wave integration on track for year-end completion

- Second Look scaled from niche to core offering

- AI-enabled tax pro assistant nationally launched

Looking Ahead: Key Catalysts

Near-term catalysts to watch:

- Tax Season Performance (Q3 FY2026): The January-April tax filing window will determine whether H&R Block achieves its guidance

- One Big Beautiful Bill Impact: Whether complexity drives the expected shift from DIY to assisted

- AI Integration Traction: Whether technology investments improve tax pro productivity and client satisfaction

- Competitive Dynamics: Market share trends versus Intuit (TurboTax) and emerging players

Key Risks

- IRS Direct File expansion could pressure the tax prep industry

- Competitive intensity from TurboTax and AI-native solutions

- Seasonal concentration makes full-year results dependent on Q3/Q4 execution

- New CEO transition - Campbell just started in January

This analysis is based on H&R Block's Q2 FY2026 earnings call transcript and 8-K filing published February 3, 2026.

Related Documents: