Hercules Capital (HTGC)·Q4 2025 Earnings Summary

Hercules Capital Q4 2025: In-Line NII, Non-Accruals Plunge to Record Low

February 3, 2026 · by Fintool AI Agent

Hercules Capital (NYSE: HTGC), the largest specialty finance company focused on venture lending, reported preliminary Q4 2025 results that came in essentially in-line with analyst expectations. Net investment income of $0.47-$0.49 per share compares to the $0.48 consensus estimate, while net asset value increased modestly. The standout metric was a dramatic improvement in credit quality, with non-accruals dropping to below 0.5% of the portfolio.

Did Hercules Capital Beat Earnings?

The preliminary Q4 2025 results show NII in-line with expectations:

*Values retrieved from S&P Global

At the midpoint ($0.48), NII would be flat with consensus. The NII range of $0.47-$0.49 compares to $0.49 in Q3 2025 and represents a sequential decline, consistent with the rate environment as interest rates have come down.

Historical NII Trend

What Changed From Last Quarter?

Credit Quality: Major Improvement

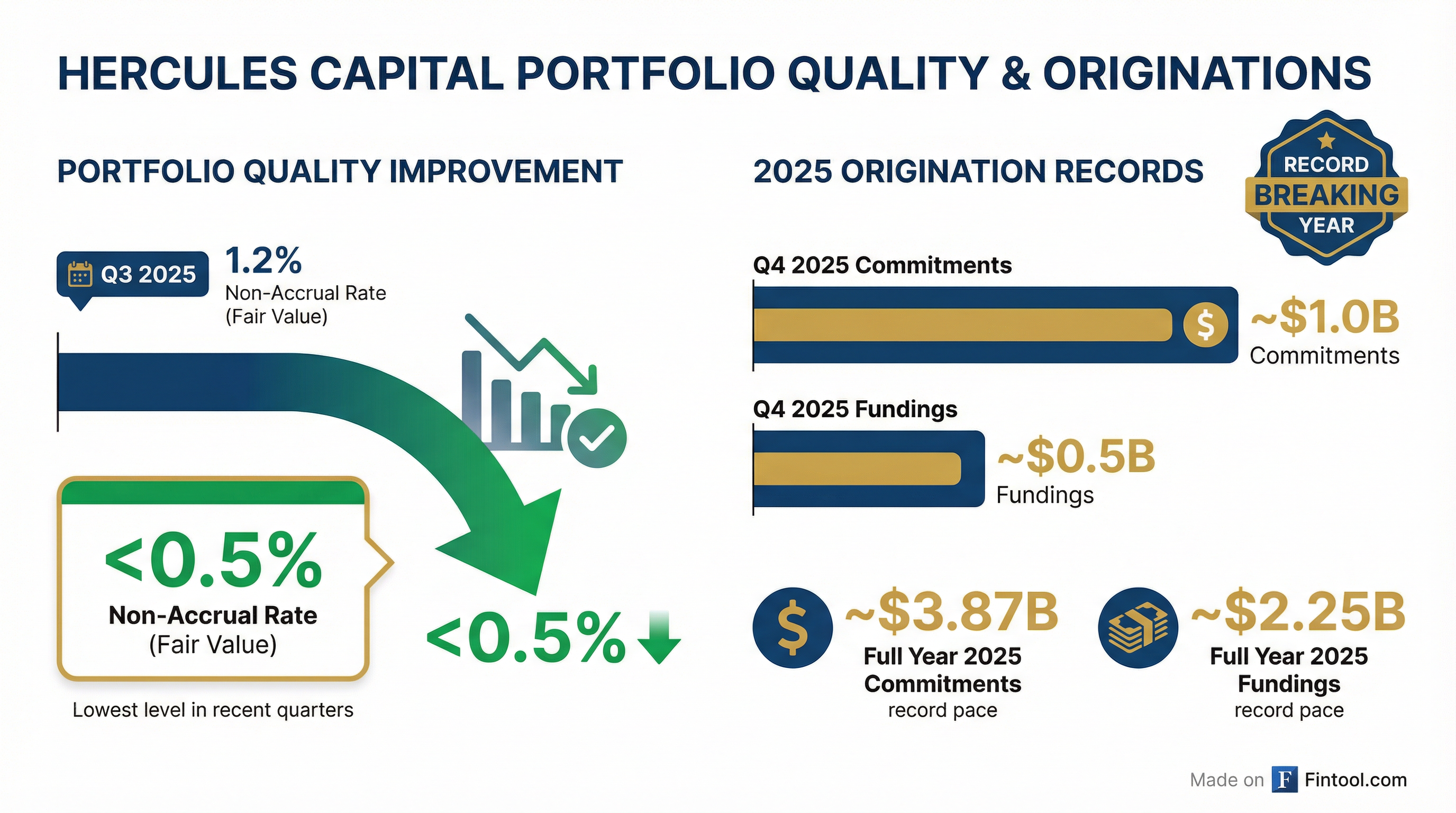

The most notable development was a significant improvement in credit quality. Non-accruals dropped from 1.2% of the investment portfolio at cost in Q3 2025 to below 0.5% at both fair value and cost in Q4 2025.

This is a meaningful improvement and suggests the portfolio cleanup that management has been working through is largely complete.

Origination Activity Remains Strong

Q4 2025 preliminary origination metrics:

Through Q3 2025, Hercules achieved record year-to-date commitments of $2.87 billion and record fundings of $1.75 billion. Adding Q4's ~$1.0B commitments and ~$0.5B fundings would bring 2025 full-year totals to approximately $3.87B in commitments and $2.25B in fundings — extending the company's record-breaking pace.

NAV Growth

NAV per share increased to $12.10-$12.16 from $12.05 in Q3 2025, a gain of $0.05-$0.11 or 0.4%-0.9%. This continues the steady NAV appreciation trend:

How Did the Stock React?

HTGC closed the regular session at $18.30, down 1.2% on the day. In after-hours trading following the preliminary results release, the stock traded at $18.18, down an additional 0.7%. The muted reaction suggests the in-line results were largely expected by the market.

Key Stock Metrics

The stock trades at approximately 1.50x-1.51x NAV (based on preliminary Q4 NAV of $12.10-$12.16), a premium valuation reflecting Hercules' position as the largest and most established venture lending BDC.

Q3 2025 Context: What Management Said

In the Q3 2025 earnings release, CEO Scott Bluestein emphasized the company's strong positioning in a rate reduction environment:

"We continue to be very well positioned for dividend coverage in a rate reduction environment. Our net investment income of $0.49 per share provided 122% coverage of our base distribution in Q3. With the strong growth in our debt investment portfolio through the first three quarters of 2025, we believe the core earnings power of our portfolio is set to provide ample coverage of our base distribution for the foreseeable future."

The preliminary Q4 results support this view — despite continued rate headwinds, the NII range of $0.47-$0.49 still provides 118%-123% coverage of the $0.40 base distribution.

Key Portfolio Metrics

Based on Q3 2025 reported data (Q4 2025 portfolio details not yet released):

The portfolio remains conservatively positioned with over 90% in first lien senior secured debt and nearly all floating rate with floors to protect in a declining rate environment.

What to Watch

-

Full Q4 Results: Today's 8-K contains preliminary estimates only. Full results with detailed portfolio breakdown and management commentary will come with the official earnings release.

-

Dividend Declaration: Q4 distribution details were not included. HTGC has maintained a $0.40 base quarterly distribution plus supplemental distributions (total $0.47 in Q3 2025).

-

Rate Sensitivity: With 97.8% of the portfolio floating rate, NII will continue to be impacted by Fed rate cuts. Management's commentary on rate sensitivity will be key.

-

Credit Quality Sustainability: The dramatic improvement in non-accruals to <0.5% is positive, but investors will want to understand whether this is sustainable or if specific workouts drove the improvement.

-

Origination Pipeline: Q4 commitments of ~$1.0B exceeded Q3's $846M. Management's outlook on venture lending demand and deal pipeline will be important.

Bottom Line

Hercules Capital's preliminary Q4 2025 results show a company navigating the interest rate transition well. While NII came in roughly in-line with expectations (rather than beating), the dramatic improvement in credit quality — with non-accruals dropping from 1.2% to below 0.5% — is the real story. Combined with record-breaking origination activity and continued NAV growth, the quarter reinforces HTGC's position as the premier venture lending BDC. The stock's muted after-hours reaction suggests investors were expecting roughly these results.

This analysis is based on preliminary estimates released in Hercules Capital's Form 8-K dated February 3, 2026. Final results may differ materially.