HEXCEL CORP /DE/ (HXL)·Q4 2025 Earnings Summary

Hexcel Surges 5% as Q4 Beats and Strong 2026 Guidance Signals Aerospace Recovery

January 29, 2026 · by Fintool AI Agent

Hexcel Corporation (NYSE: HXL) delivered a Q4 2025 beat on both revenue and EPS, with shares surging 4.9% to $84.17 as investors reacted to 2026 guidance significantly above Street consensus. CEO Tom Gentile signaled that the commercial aerospace recovery is "gaining traction" as OEM destocking headwinds subside and production rates ramp across all major programs.

Did Hexcel Beat Earnings?

Q4 2025 exceeded estimates with revenue up 3.7% YoY and adjusted operating margin expanding 120 basis points:

*Values retrieved from S&P Global

FY2025 was impacted by A350 schedule changes and channel destocking, but Q4 showed the inflection point:

CEO Tom Gentile emphasized: "We believe the commercial recovery is gaining traction as OEMs take steps toward higher production rates across all our key programs."

What Did Management Guide?

The headline story is 2026 guidance that came in well above Street consensus, driving the stock's 5% surge:

*Values retrieved from S&P Global

Long-Term Targets Affirmed

Management outlined significant long-term value creation potential:

- $500M incremental annual revenue when Boeing and Airbus achieve peak production rates

- $200M+ additional revenue from defense, space, business jets, and regional jets

- Path to 18% operating margins before end of decade

- >$1 billion cumulative free cash flow from 2026-2029

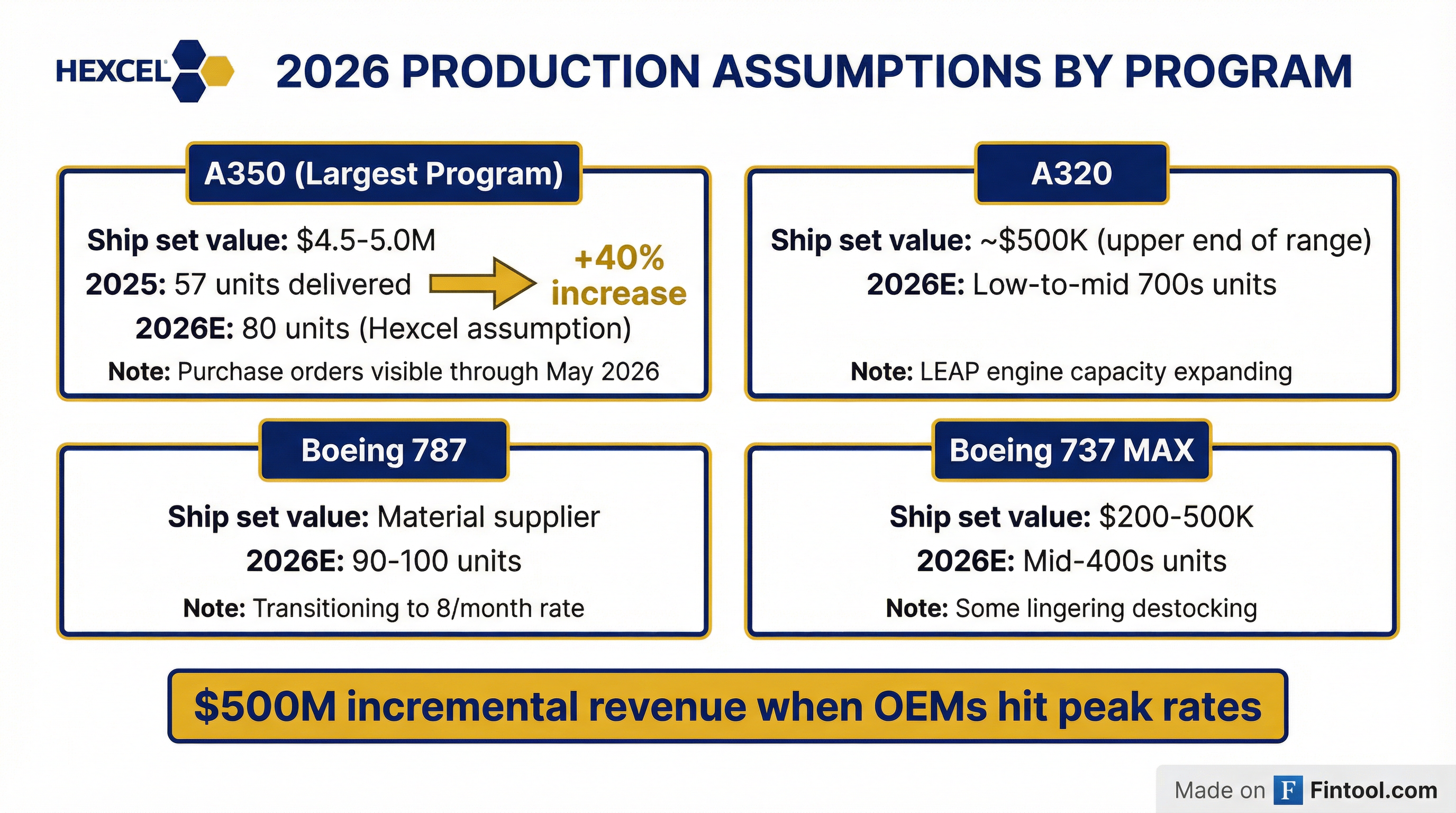

What Are the Production Assumptions?

CEO Gentile provided granular detail on 2026 production assumptions for each major program, noting Hexcel ships material 4-6 months ahead of OEM deliveries:

A350 (Largest Program - $4.5-5.0M ship set)

- 2025 actual: 57 units delivered to Airbus

- 2026 assumption: ~80 units (+40% increase)

- Visibility: Firm purchase orders through May 2026

- Confidence driver: Bottom-up demand polling of all 35 Airbus plants

- Action taken: Brought mothballed carbon fiber line online early to protect upside

A320neo ($200K-500K ship set, toward upper end)

- 2026 assumption: Low-to-mid 700s units

- Catalysts: Safran expanding LEAP engine capacity with new Morocco assembly line; record Q4 2025 LEAP shipments exceeded 2019 pre-pandemic peak

Boeing 787 (Material supplier)

- 2026 assumption: 90-100 units

- Catalyst: Boeing transitioning to 8 aircraft/month rate; inventory normalized

Boeing 737 MAX ($200K-500K ship set)

- 2026 assumption: Mid-400s units

- Caution: Some lingering destocking remains a watch item

How Did the Stock React?

Hexcel shares surged +4.9% to $84.17 following the earnings call, approaching the new 52-week high of $88 touched intraday. The stock has nearly doubled from its 52-week low of $45.28.

The strong reaction reflects investor confidence in management's 2026 outlook and the improving commercial aerospace fundamentals.

What Did Management Say About Incremental Margins?

Management guided to mid-30s% incremental margins for 2026, driven by operating leverage as volumes ramp:

"We've been so under capacity the last six years, really since the pandemic began, that we're not able to basically allocate all of the fixed costs and depreciation from the assets that we put in place to go up in rate. As we start being able to absorb all of that depreciation, because the volume's going up, it's going to lead to operating leverage, which will drive margins faster than revenue growth."

Key margin drivers:

- Headcount management: Finished 2025 with 330 fewer positions vs. 2024 through attrition

- Selective hiring: A350-related hiring starting now; general hiring mid-2026

- Cost discipline: SG&A as % of sales improved from 10.1% to 8.5% in Q4

- Incentive comp true-up: Lower-than-target 2025 payout contributed to Q4 margin strength

Composite Materials Segment Standout

The Composite Materials segment delivered 20.5% adjusted operating margin in Q4, significantly above historical levels:

"There was nothing specifically unique... we had very solid cost control here at the end of the quarter."

What's the Next-Generation Aircraft Opportunity?

Management discussed significant content growth potential on next-generation narrow-body aircraft:

CEO Gentile: "If you put a wing on the next narrow body, that'll take the 15% to 30%... double the $500,000 to $1 million per ship set at 75 per month, it's a lot of carbon fiber."

Production Technology Investments

Hexcel is actively working with OEMs on manufacturing improvements:

- Layup speed: Targeting 80-160 kg/hour vs. current 20 kg/hour

- Cure time: Reducing from 12 hours to under 2 hours

- Out-of-autoclave processing: Active development

- Resin infusion at point of manufacture

What's the Defense Opportunity?

Defense & Space represented 35% of FY2025 revenue and is a key growth vector:

Strong demand drivers:

- Military rotorcraft programs (Black Hawk, CH-53K)

- European fighter programs

- Launchers and satellites

- Emerging opportunity: Missiles and unmanned systems

CEO Gentile on drones and missiles: "Lightweight is so critical because range is important, and durability is also important... This new defense is a big opportunity for us, and that's why we're strengthening the team so that we can do that."

Capital Allocation Update

$350M Accelerated Share Repurchase: Initial delivery of ~3.95M shares in Q4; final settlement expected Q1 2026. Management emphasized this decision reflected confidence in Hexcel's long-term value.

Dividend Increased 6%: Quarterly dividend raised to $0.18/share from $0.17, payable February 17, 2026.

Deleveraging Priority: Net debt/EBITDA at 2.7x, above target range of 1.5-2.0x. Management expects to repay $350M revolver borrowing "as soon as possible in 2026." Interest expense should decline through the year as cash is generated.

Remaining Authorization: $384M available for future repurchases after current ASR completes.

Q&A Highlights

On A350 visibility and destocking: "The purchase orders are very strong this year, in contrast to last year. We've got good visibility on the purchase orders, firm purchase orders, all the way out through May... We actually brought one [carbon fiber line] online earlier than expected, just so that we're prepared for the increase."

On Boeing assumptions being conservative: "On the MAX, we did see a lot of destocking last year... our numbers really show them what they were pulling from us, still a little bit lower than that. So yes, we are being probably a little bit more conservative on Boeing."

On FX headwinds: Q4 2025 operating margin was negatively impacted by ~110 bps from FX, which included some short-term non-USD balance settlements. This level is "not anticipated to be an ongoing trend."

On operational focus: "The number one priority for us right now in the immediate future is to focus exclusively on making sure we can ramp up on these production rates. That's gonna generate so much operating leverage."

Risks and Watch Items

- Customer concentration: Heavy exposure to Boeing and Airbus schedules

- 737 MAX destocking: "This remains a watch item... we will continue to monitor it throughout 2026"

- FX headwinds: Dollar weakness vs. euro is a margin headwind, though hedged over 10 quarters

- Execution risk: 2026 guidance depends on OEM rate ramps materializing

- Leverage elevated: 2.7x net debt/EBITDA until ASR repayment

Key Takeaways

- Q4 beat: Revenue +2.0% and EPS +5.2% vs. consensus; commercial aerospace +7.6% YoY

- 2026 guidance crushes Street: Revenue and EPS guidance 9% and 27% above consensus respectively

- A350 inflection: Purchase order visibility through May 2026; carbon fiber line reactivated early

- Mid-30s incremental margins: Operating leverage to drive margin expansion as volumes grow

- Long-term path clear: $500M incremental revenue at peak rates, 18% margins before decade end

- Stock reacts positively: +4.9% to new 52-week highs on earnings call

View Hexcel company page | View Q4 2025 transcript | Prior earnings: Q3 2025