IBEX (IBEX)·Q2 2026 Earnings Summary

IBEX Crushes Q2 Estimates, Raises FY26 Guidance on Record Revenue

February 5, 2026 · by Fintool AI Agent

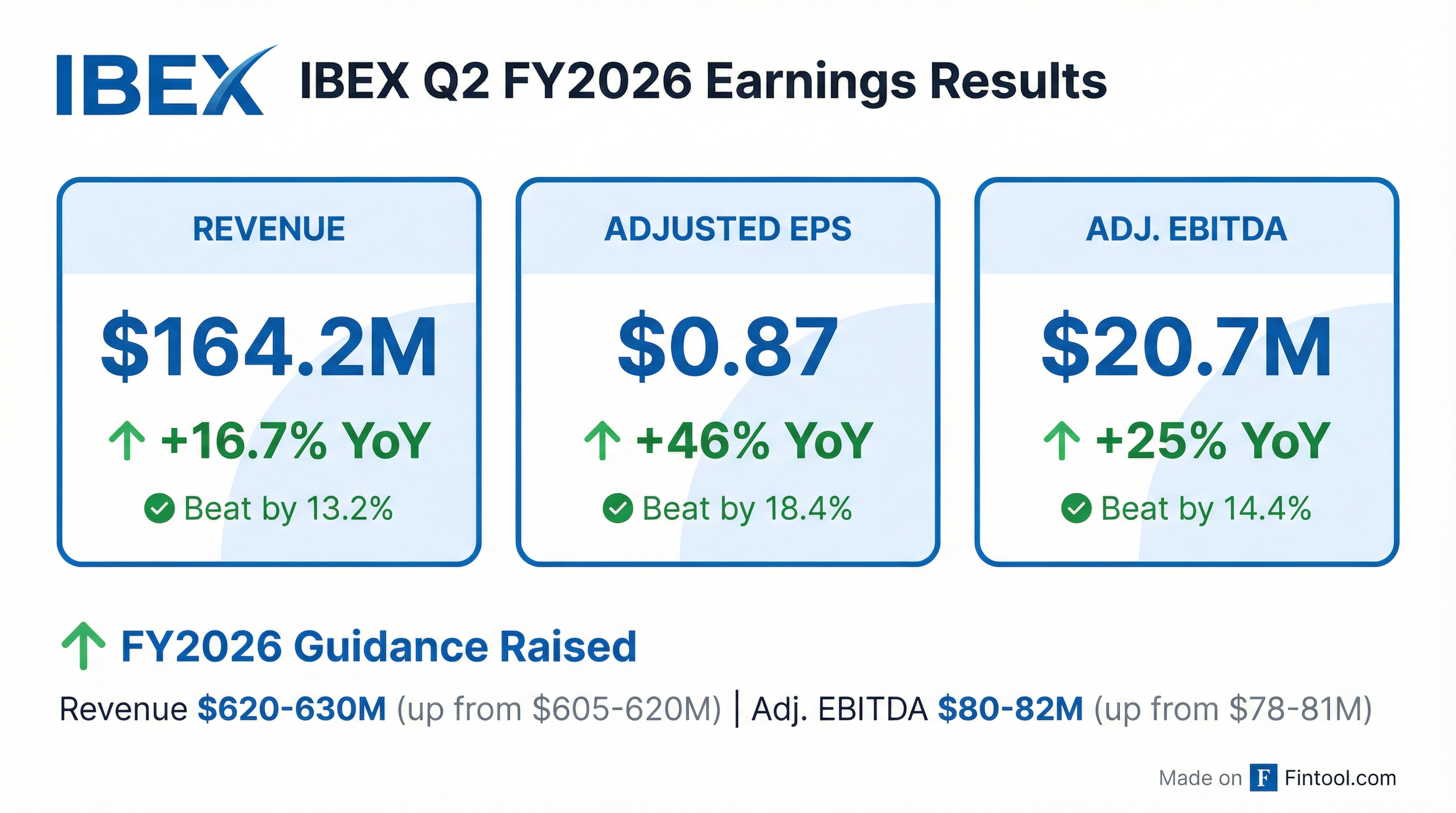

IBEX Limited delivered a blowout Q2 FY2026, posting record quarterly revenue of $164.2 million—a 17% year-over-year increase and a significant 13% beat versus consensus expectations. The business process outsourcing and customer engagement technology company raised full-year guidance for both revenue and adjusted EBITDA, citing momentum across its highest-margin geographies and continued AI leadership.

Did IBEX Beat Earnings?

Yes, IBEX beat on every metric. The company exceeded analyst expectations across the board in Q2 FY2026:

Consensus estimates from S&P Global

This marks IBEX's fourth consecutive quarter of double-digit revenue growth and continues a streak of consistent beats. Diluted EPS grew 45% year-over-year to $0.83, while adjusted EPS surged 46% to $0.87.

CEO Bob Dechant emphasized the company's competitive differentiation: "Our market-leading growth is a direct result of the differentiation we have built into our business and our ability to execute against it... We are continuing to further separate ourselves from the pack in the BPO market."

What Drove Revenue Growth?

Revenue growth of 16.7% YoY was driven by strength across IBEX's top three verticals:

The telecom decline marks the first time since pre-IPO that the vertical comprises less than 10% of revenue—a deliberate de-risking as legacy carrier volumes decline.

HealthTech is on track to become a $100 million vertical by fiscal year-end, having grown rapidly since launching in 2021.

Geographic mix shifted favorably toward higher-margin offshore delivery:

- Offshore: 52.3% of revenue (+16.2% YoY)

- Onshore: 24% of revenue (+27.5% YoY, driven by digital acquisition)

- Nearshore: +8.5% YoY

Digital and omnichannel services grew 19% YoY to 82% of total revenue.

What Did Management Guide?

IBEX raised full-year guidance for both revenue and adjusted EBITDA:

CFO Taylor Greenwald highlighted the company's strong balance sheet position: "Our robust balance sheet is enabling us to make opportunistic investments to further extend our current AI leadership position. Additionally...we are proactively investing in increased sales resources as well as capacity in our top performing geographies, positioning us for further success in the years ahead."

How Did the Stock React?

IBEX shares closed at $34.21, down 0.75% on the day of the earnings release. This modest decline comes despite the strong beat and raised guidance. The stock has traded in a range of $21.64-$42.99 over the past 52 weeks, with the current price sitting near the 50-day moving average of $37.22.

What Changed From Last Quarter?

Margin expansion continued — Adjusted EBITDA margin improved to 12.6% from 11.8% in the year-ago quarter, driven by geographic mix shift toward higher-margin offshore regions.

India expansion accelerating — Entered India in late March 2025 and now has two sites with nearly 1,000 agents operational. The company has expanded beyond traditional contact center services to include revenue cycle management and credentialing services for healthcare clients.

CapEx ramp accelerated — Capital expenditures increased to $11.7 million from $4.3 million in Q2 2025, reflecting planned capacity expansion in top-performing regions to meet strong demand.

Cash flow improved — Operating cash flow reached a Q2 record of $6.6 million compared to $1.1 million in the prior year, driven by higher profitability and better working capital management.

Share buybacks continued — The company repurchased 78,000 shares for $2.9 million during the quarter, bringing fiscal year repurchases to 170,000 shares for $5.6 million. $7.8 million remains on the authorization.

New Chairman appointed — Jack Jones, a board member for nearly 9 years with 26+ years at JPMorgan Chase, was named Chairman.

Key Financial Metrics (8 Quarters)

Q&A Highlights

Analyst David Koning (Baird) asked about AI's impact on the business. CEO Bob Dechant responded with conviction:

"We have established ourselves in the AI leadership position in this industry, and there's a lot of good things that come out of that. It helps our new logo engine going in, winning traditional just BPO deals, because this is a company that can take the journey of where those trophy clients want to go."

On the question of seasonality shifting as the business mix evolves away from retail, Dechant noted the company expects more consistent quarterly flow: "The mix has changed, and if you look at what we did last year, you could see that Q2 to Q3 sequential did not go down like it has historically."

CFO Taylor Greenwald addressed why gross margins declined YoY despite strong results, citing two "not necessarily bad headwinds":

- Deferred training revenue — Training costs are expensed in-period while associated revenue is spread over the program life

- India investment — Less than a year into India operations, margins still ramping to target levels

AI and Competitive Positioning

Management emphasized IBEX's AI leadership as a key differentiator. The company recently promoted Mike Darwal to Chief AI and Digital Officer to lead the transformation.

"We are now moving beyond our leadership position in BPO 2.0 and are defining the market for BPO 3.0. As the CX industry and ibex continues its transformation from AI-supported to AI first, we will continue to invest in the talent and the resources to maintain and extend our leadership." — CEO Bob Dechant

The company highlighted that its top ten clients grew 20% in the quarter, attributing gains to market share wins driven by operational outperformance.

Client Diversification

IBEX continues to build a well-diversified client base with improving concentration metrics:

Management highlighted that a signature win from FY2025 has already moved into the top 20, and a FY2024 signature win has moved into the top 10—demonstrating the company's ability to land and expand with trophy clients.

Balance Sheet Strength

IBEX ended the quarter with a healthy balance sheet:

The net cash position of $14.0 million improved slightly from $13.7 million at fiscal year-end, despite significant capital investments. Days Sales Outstanding (DSOs) were 73 days, up from 71 days at the end of Q1, with management expecting DSOs to remain stable in the mid-70s going forward.

Forward Catalysts

- India as highest growth vector — Management called India expansion "one of our highest growth vectors" as the company reaches critical mass with 2 sites and ~1,000 agents

- HealthTech approaching $100M — On track to become a $100M vertical by fiscal year-end, with 35% growth continuing

- AI monetization — AI Agent deployments and Wave iX platform creating "seamless end-to-end customer journey from AI agent to human agent"

- New logo engine firing — Significant wins in health tech and fintech verticals in Q2, with trophy clients won vs. larger competitors

Risks and Concerns

- Customer concentration — Growth depends heavily on expanding wallet share with blue-chip clients

- Macro sensitivity — BPO spending could face pressure in an economic downturn

- Competition — Other BPO providers are also investing in AI capabilities

- CapEx requirements — Elevated capital spending could pressure free cash flow in near term

Related: IBEX Company Profile | Q1 2026 Earnings | Earnings Transcripts