INTERNATIONAL BUSINESS MACHINES (IBM)·Q4 2025 Earnings Summary

IBM Surges 7.5% on Double-Digit Software Growth, $23.6B ARR, $12.5B GenAI Momentum

January 28, 2026 · by Fintool AI Agent

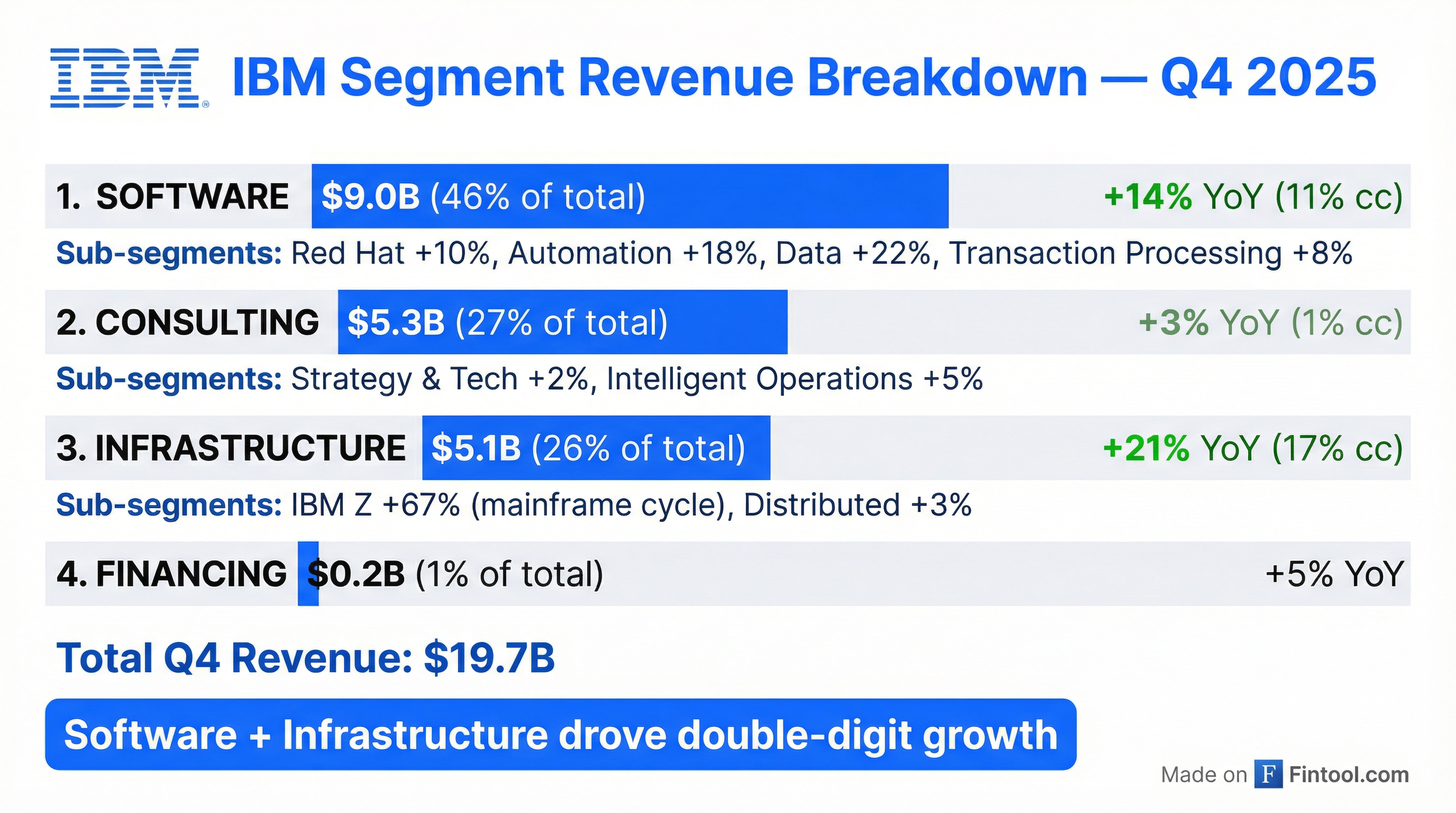

IBM delivered a strong fourth quarter, beating both revenue and earnings estimates while guiding above consensus for 2026. The company reported revenue of $19.7 billion (+12% YoY, +9% at constant currency) versus $19.2 billion expected, and operating EPS of $4.52 versus $4.32 expected. Software and Infrastructure both posted double-digit growth, while the generative AI book of business crossed $12.5 billion and Software ARR reached $23.6 billion. Shares jumped 7.5% in after-hours trading to $316.

Did IBM Beat Earnings?

Yes — both revenue and EPS exceeded expectations:

IBM has now beaten EPS estimates for 8 consecutive quarters.

The GAAP EPS of $5.86 includes a significant benefit from income taxes primarily driven by the resolution of certain tax audit matters. Excluding this, operating performance was the key driver.

What Drove the Beat?

Software: The Star (+14% YoY)

Software revenue of $9.0 billion grew 14% as-reported (11% at constant currency), accounting for 46% of total revenue. The segment delivered $23.6 billion in ARR, up more than $2 billion from year-end 2024, and exceeded the Rule of 40.

Red Hat Detail: Revenue roughly doubled since acquisition ($3.2B → ~$7.5-8B run rate). OpenShift is now a $1.9B ARR business growing 30%+. Virtualization momentum continues with $500M+ in contracts signed over the past two years.

Segment profit: $3.4B (+10% YoY), margin 37.7%. GenAI book of business in Software now exceeds $2 billion inception-to-date.

Infrastructure: Mainframe Cycle Delivers (+21% YoY)

Infrastructure revenue of $5.1 billion surged 21% (17% cc), driven by the robust adoption of the z17 mainframe platform's AI-led innovation. This was a record revenue quarter for IBM Z.

Segment profit: $1.6B (+51% YoY), margin 31.2% (+6.2pp). FY25 segment profit margin expanded 450bps, demonstrating the mainframe cycle's contribution to IBM's profit and free cash flow.

Consulting: Steady but Modest (+3% YoY)

Consulting revenue of $5.3 billion grew 3% (1% cc), showing signs of stabilization after a challenging environment. The segment delivered the largest GenAI bookings quarter to date, exceeding $2 billion, bringing the ITD total to over $10.5 billion.

- Strategy & Technology: +2% (flat cc)

- Intelligent Operations: +5% (+3% cc)

Backlog: $32 billion, up 2% at actual rates, with record-low erosion. GenAI now represents >33% of bookings, >25% of backlog ($8B+), and >15% of revenue—a $3.6B ARR GenAI revenue run rate. Segment profit margin reached a 3-year high at 11.7% for FY25.

What Did Management Guide?

IBM issued 2026 guidance that exceeded Street expectations:

Management also highlighted $4.5 billion in productivity savings at 2025 exit run rate (up from a $2B goal set in 2023), with an incremental $1 billion target for 2026 to reach $5.5 billion annual run rate.

Confluent Acquisition Context: IBM expects ~$600 million of dilution from Confluent in 2026, driven primarily by stock-based compensation and interest expense. The deal is expected to close mid-2026. Confluent should be Adjusted EBITDA accretive within year one and free cash flow accretive in year two. IBM expects ~$500M of operational spend run rate synergies by end of 2027.

CEO Arvind Krishna: "We are excited about the progress we made in 2025, delivering 6% revenue growth, our highest level of revenue growth in many years, and $14.7 billion of free cash flow, our highest level of cash generation in over a decade."

CFO James Kavanaugh: "We finished 2025 with one of the highest growths we've ever had in software overall, but it's pervasive, with three of our four software categories growing double digits. You dial back only about three years ago, we only had one growth factor, and that was Red Hat."

Q&A Highlights: What Analysts Asked

On Software Growth Drivers (Brent Thill, Jefferies): Arvind Krishna broke down the software acceleration: Automation is seeing "secular demand increase" as enterprises need tools to manage growing AI and compute infrastructure. Data benefits from watsonx and partnerships. Red Hat has doubled from $3.2B at acquisition to ~$7.5-8B run rate, with OpenShift at $1.9B ARR growing 30%+.

On Free Cash Flow Outperformance (Amit Daryanani, Evercore): CFO Jim Kavanaugh explained the $14.7B FCF (vs. $13.5B guide) came entirely from business fundamentals—17% adjusted EBITDA growth vs. the original double-digit target. "Over the last 3 years, we've grown free cash flow $5.5 billion... highest free cash flow margin on record of a 114-year history."

On Red Hat Trajectory (Ben Reitzes, Melius): Management acknowledged single-digit ACV bookings in Q4 due to the U.S. federal government shutdown disruption. Kavanaugh: "We're being prudent on Red Hat's guidance right now, because we only need that at double-digit to get software over the line... Upside will deliver upside to software overall."

On Consulting Outlook (Jim Schneider, Goldman Sachs): Consulting backlog of $32B shows GenAI now represents >33% of bookings, >25% of backlog, and >15% of revenue on an exit run rate—a $3.6B ARR GenAI revenue run rate. Over 400 new clients added in 2025.

On Mainframe Sustainability (Eric Woodring, Morgan Stanley): Krishna highlighted three secular drivers: (1) demand for on-premise control and sovereignty, (2) Gen AI tools removing the "hard platform" stigma via Watson Code Assistant for Z, and (3) new in-line AI inferencing capabilities with Spyre cards that shipped in Q4 2025. "A very large number of our clients actually told us they're interested, and they kept space in the machines to put in those cards."

On Enterprise AI Workload Placement (Matt Swanson, RBC): Krishna shared his 3-5 year view: "50% of the enterprise usage of AI is going to be in either a private cloud or is going to be in their own data centers, and the other 50% is going to be usage of public models." Concerns around model learning, sovereignty, and privacy will drive hybrid adoption.

What Changed From Last Quarter?

The acceleration was driven by:

- Mainframe cycle maturation — IBM Z revenue surged 67% as enterprise clients upgraded to z17

- Software strength across all sub-segments — Data (+22%) and Automation (+18%) led

- AI monetization scaling — GenAI book of business more than doubled from Q3

- Adjusted EBITDA growth — 17% YoY for FY25 with ~230bps margin expansion

How Is IBM's AI Strategy Progressing?

IBM's generative AI book of business reached $12.5 billion+ inception-to-date:

- Software: >$2B ITD with strong performance across AI offerings

- Consulting: >$10.5B ITD, with the largest GenAI bookings quarter to date (>$2B in Q4)

The metric represents committed business rather than recognized revenue, providing forward visibility into AI-related growth. This will be the last quarter IBM reports GenAI book of business separately—management noted AI is now "embedded across our business" and a standalone metric no longer captures full AI impact.

IBM has been building this pipeline through:

- watsonx platform — Enterprise AI studio for training and deploying models

- AI-enhanced consulting — Partnering with clients to design and scale AI solutions

- Productivity gains — Using AI to improve delivery efficiency within client contracts

- Project Bob — IBM's next-gen AI-based software development system, used by 20,000+ IBMers with 45% average productivity gains. Orchestrates frontier models (Anthropic Claude, Mistral) with IBM Granite and custom models optimized for cost/performance.

Full-Year 2025 Performance

IBM exceeded its own expectations for revenue, profit, and free cash flow in 2025, delivering the highest revenue growth in many years and the highest annual Software growth in history.

How Did the Stock React?

IBM shares closed at $294.16 (+0.1%) during regular trading, then surged 7.5% after hours to $316.30 following the earnings release.

Key drivers of the move:

- Revenue beat (+2.4%) with acceleration from Q3

- EPS beat (+4.6%) extending the win streak

- Software ARR reaching $23.6B (+$2B YoY)

- 2026 revenue guidance above consensus (>5% vs 4.1%)

- Software guidance accelerating to 10% growth

- GenAI book of business momentum ($12.5B+)

- Strong free cash flow trajectory (+16% YoY)

Capital Allocation

IBM returned $6.3 billion to shareholders in 2025 through dividends and has now paid consecutive quarterly dividends every year since 1916.

The board approved a quarterly dividend of $1.68 per share (record date: February 10, 2026; payment date: March 10, 2026).

Balance Sheet Highlights (Dec 31, 2025):

IBM ended Q4 with $14.5 billion in cash, down $0.3 billion from year-end 2024. Debt increased $6.3 billion, reflecting acquisition activity (~$8.3 billion in acquisitions during FY25, including HashiCorp).

What Are the Key Risks?

- Mainframe cycle normalization — IBM Z growth of 67% will moderate; management guides Infrastructure down low single digits in 2026 (~0.5pt drag to IBM)

- Federal government uncertainty — U.S. government shutdown disrupted Red Hat federal bookings in Q4; management is "being prudent" on Red Hat guidance until clarity improves

- Memory pricing pressure — DRAM spot prices up ~6x YoY as capacity shifts to HBM for AI servers; Arvind expects this dynamic to persist "at least a couple of years"

- Consulting pricing environment — Management noted they are "operating in a very aggressive pricing environment" and will continue monitoring

- Confluent integration execution — $600M dilution in 2026 requires successful realization of ~$500M operational synergies by end of 2027

- Debt levels — $61.3B in total debt requires ongoing cash flow discipline

IBM's forward-looking statements note risks including economic downturns, innovation execution, acquisition integration, and cybersecurity.

Forward Catalysts

Bottom Line

IBM delivered a decisive beat on all metrics that matter: revenue (+2.4%), EPS (+4.6%), and above-consensus guidance for 2026. The combination of a mainframe refresh cycle (z17 delivering record IBM Z revenue), accelerating Software growth (particularly Data +22% and Automation +18%), Software ARR of $23.6B, and a $12.5B GenAI book of business demonstrates that IBM's hybrid cloud and AI transformation is gaining traction.

The 7.5% after-hours move suggests the Street wasn't positioned for this level of strength. With guidance for >5% constant currency growth (vs. 4.1% consensus), Software accelerating to 10%, operating margin expansion of ~1 point, and another $1 billion in incremental free cash flow, IBM enters 2026 with the momentum Arvind Krishna promised.

Key numbers to remember:

- Revenue: $19.7B (+12% YoY, +9% cc)

- Operating EPS: $4.52 (+15% YoY)

- Software ARR: $23.6B (+$2B YoY)

- Adjusted EBITDA: $19.2B for FY25 (+17% YoY)

- Free Cash Flow: $14.7B for FY25 (+16% YoY)

- GenAI Book: $12.5B+ and growing

- Stock: +7.5% after hours to $316.30

View IBM Company Profile | Read Q4 2025 Transcript | Prior Quarter: Q3 2025