JACK HENRY & ASSOCIATES (JKHY)·Q2 2026 Earnings Summary

Jack Henry Beats on EPS (+21%) as Margins Surge — 22 Core Wins Signal Competitive Strength

February 4, 2026 · by Fintool AI Agent

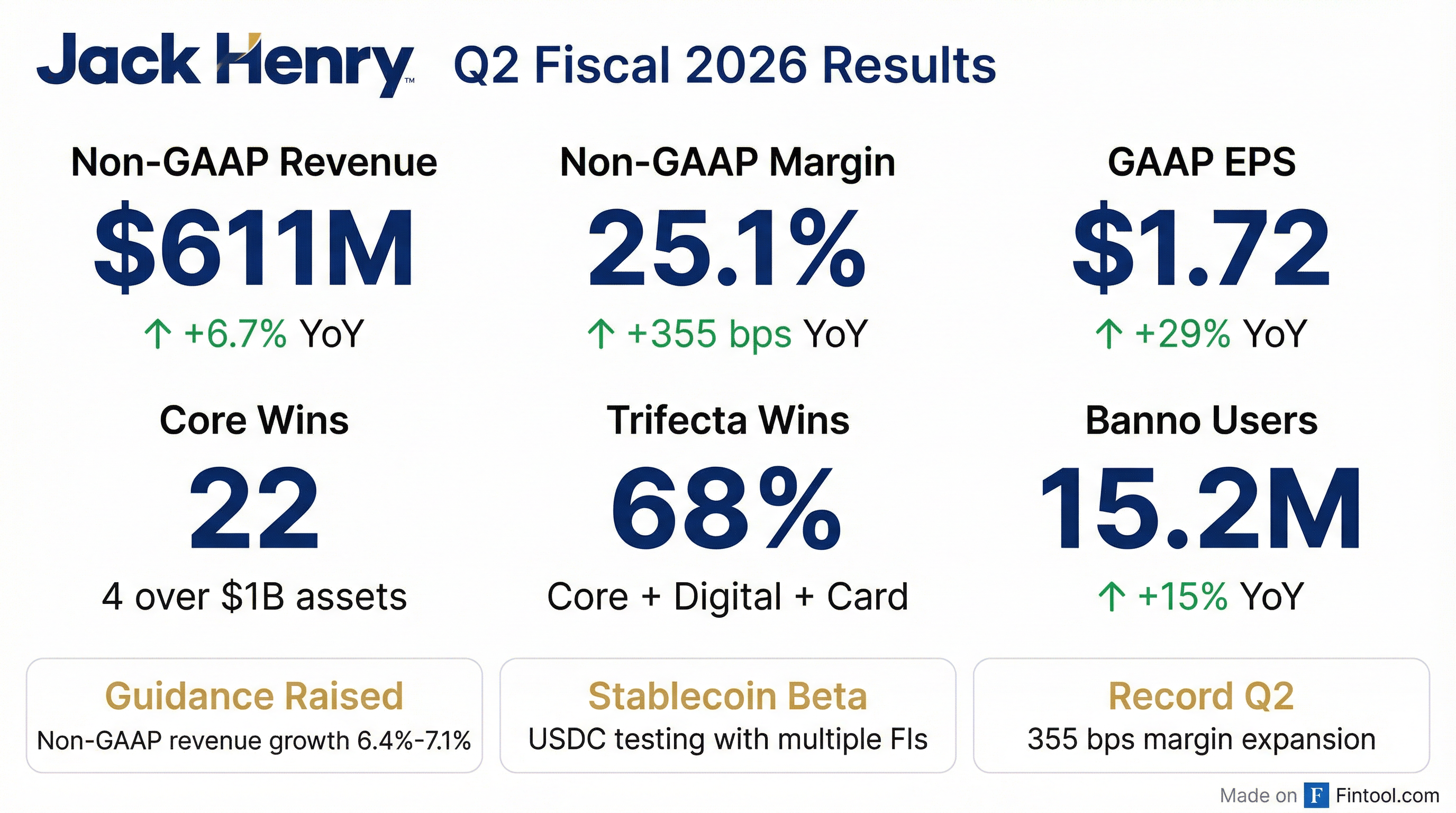

Jack Henry & Associates (NASDAQ: JKHY) delivered a record Q2 FY2026 with significant beats on both revenue and EPS. The standout: 22 competitive core wins — the best quarter in recent memory — as competitor core consolidation news accelerates the pipeline. Management also disclosed stablecoin beta testing and raised full-year guidance.

Key Results:

- Non-GAAP Revenue: $611M (+6.7% YoY) — record Q2

- Non-GAAP Operating Margin: 25.1% (+355 bps YoY)

- Competitive Core Wins: 22 (vs. 11 in Q2 FY25) — 4 with >$1B assets

- Trifecta Wins: 68% included core + digital + card (up from 45%)

- Guidance Raised: Non-GAAP revenue growth to 6.4%-7.1%, margin expansion to 50-75 bps

Did Jack Henry Beat Earnings?

Yes — Jack Henry beat on both revenue and earnings, extending its streak of EPS beats to 7 of the last 8 quarters.

*Values retrieved from S&P Global

The outperformance was driven by disciplined cost management and lower-than-normal medical claims on the company's self-insured healthcare plan, which CFO Mimi Carsley flagged as a temporary benefit .

Beat/Miss Track Record (Last 8 Quarters)

*Values retrieved from S&P Global

How Did the Stock React?

Despite beating estimates on both lines, JKHY fell 7.3% to close at $166.16 — its largest post-earnings drop in recent quarters.

Why Did the Stock Drop?

Management's forward commentary tempered enthusiasm:

-

Slower H2 Growth: "We expect the year-over-year revenue growth rates to slow slightly as we face overall tougher prior year comparables from the second half of fiscal 2025."

-

Margin Normalization: "We expect some contraction in margins in the second half of fiscal 2026 compared to the first half where we experienced lower than normal expense for medical claims under our self-insured employee healthcare plan."

-

Valuation: At ~22x forward earnings pre-print, the stock may have priced in outperformance.

What New Products Are Gaining Traction?

Management highlighted strong momentum across several innovative solutions:

Tap2Local — Merchant Acquiring for SMBs

Jack Henry's cloud-native merchant acquiring solution is rolling out to all Banno clients :

- 400+ clients live — 300 in Nov/Dec, 100 added last week

- Rollout pace: 100-150 clients per month

- Differentiators vs. Stripe/Square:

- ~75% instant account approvals (vs. 2-3 day industry standard)

- Tap-to-pay on both iOS and Android (rare in US market)

- Patent-pending account reconciliation with QuickBooks, Xero, and other accounting platforms

"Stripe and Square are taking deposits away from our institutions... Tap2Local gives the FI a powerful way to win back deposits from small and medium-sized businesses."

Rapid Transfers — External Account Transfers

- 75 clients live, 180 in onboarding

- First provider to bring this capability to community banks and credit unions

- Enables SMBs and consumers to move funds between external accounts, cards, and digital wallets

Stablecoin Strategy

- Beta testing live with multiple financial institutions for USDC send/receive

- Proof of concept completed in just 2 weeks using Jack Henry platform

- Evaluating 20+ stablecoin infrastructure and compliance fintechs for partnerships

Banno Digital Platform

- 1,037 retail clients, 435 live with Banno Business

- 15.2 million registered users — up 15% YoY

- 84 new Banno clients signed in Q2, including several large competitive takeaways

Faster Payments Momentum

What Did Segments Deliver?

All four segments grew revenue year-over-year, with Complementary leading at +9.6% GAAP growth:

Key Drivers by Segment:

- Core: 22 competitive core deals won in Q2 — strong pipeline with growing demand environment

- Payments: Card revenue +6.1%, Faster Payments +52.1% YoY

- Complementary: Digital and transaction revenue +14.8%

What Changed From Last Quarter?

Notable Changes:

- Core Sales Acceleration: 22 competitive core wins in Q2 vs. 4 in Q1 — management remains on track for 50+ wins in FY26

- Lower Deconversion Revenue: Q2 saw $6.2M vs $8.6M in Q1, though full-year guidance was raised to $28M

- SG&A Timing: Lower SG&A (-12.9% YoY) due to timing of Connect conference and gain on sale of assets

What Did Management Guide?

Jack Henry raised guidance for the second consecutive quarter:

H2 Expectations:

- Lower non-GAAP revenue growth vs. H1 due to tougher prior-year comps

- Card revenue expected to slow in back half

- Medical costs returning to normalized levels will pressure margins

- "Margins are projected to contract in the back half of the year"

Segment Outlook:

- Payments: "A little bit more challenging relative to the first half" due to seasonality and grow-over comps

- Complementary: Continued strength expected in Financial Crimes Defender, treasury management, and digital products

- Core: Convert-merge benefits and one-times drove Q2 strength; don't expect same pace in H2

What Did Management Say About Competitive Dynamics?

CEO Greg Adelson on competitor core consolidation:

"The recent announcement of core consolidation by one of our competitors has positively impacted our core payment and complementary solution sales pipelines. We expect our historical success rates within this base of clients to continue and most likely accelerate based on what we know today."

"The pipeline is growing, not just in core opportunities, but across all of our complementary and payment products as well... We're seeing some nice uptick there with some larger opportunities as well."

On market share gains (8-year track record):

"We have outpaced our competitors for many years in core market share growth, even as the overall number of financial institutions has declined... We have relationships with more than 80% of the financial institutions in the U.S."

On AI's impact on the industry (responding to DeepSeek concerns):

"From a standpoint of affecting companies, not just Jack Henry, but others in our space, I think it's really a misinformation. Because when you think about what AI does in the development of technology... it's not just as simple as doing things faster. It's way more complicated than that."

"As you know, we don't do seat licenses here, so we don't have that challenge... From our standpoint, and I think honestly from an industry standpoint, it's a much different perspective than what is being kind of played out there in the space."

On service differentiation:

"We have a 50-year head start on how we've been handling service at this company... We're actually at all-time highs right now, as far as how our survey results are. It's hard to move a big ship when you don't have that mindset built in, as we do at this company."

What Did Management Say About Financial Performance?

CFO Mimi Carsley on margin expansion:

"Q2 delivered 355 basis point increase in non-GAAP margin to 25%. This contributed to year-to-date non-GAAP margin improvement of 291 basis points."

"Non-GAAP margin benefited in the quarter from inherent leverage in our business model, strategic cost management, leveraging existing workforce as we continue to focus on enterprise process improvement and AI utilization, and further aided by lower self-insured medical costs, which we anticipate to be non-sustainable."

Balance Sheet & Cash Flow

Jack Henry continues to strengthen its balance sheet with significant debt reduction:

Cash Flow Highlights (YTD FY26):

- Net Cash from Operations: $273.3M (+32% YoY)

- Free Cash Flow: $172.3M (up from $87.7M prior year)

- Share Repurchases: $125.2M

- Dividends Paid: $84.0M

Return Metrics:

- Return on Avg Shareholders' Equity: 24.3% (vs 21.9% prior year)

- NOPAT ROIC: 22.7% (vs 19.1% prior year)

Q&A Highlights

On pricing environment (Rayna Kumar, Oppenheimer):

"Pretty consistent to what it's been over the last couple of years... And the fact that we won 22 of them in the quarter is pretty good indication because we're never the lowest cost provider."

On bank M&A being neutral-to-positive (Vasu Govil, KBW):

"We've already seen it... even in one very large one that was announced a year ago, we're having opportunities for other products within that set. And in some cases, these other products can be even more valuable than the core itself."

On technology spending trends (Kartik Mehta, Northcoast): According to Cornerstone's annual survey, 84% of banks and 83% of credit unions expect to increase technology spending in 2026 — up from 73% and 79% respectively a year ago .

On private cloud migration (key revenue driver):

- 78% of core clients now operating in private cloud

- ~2x more revenue from private cloud clients vs. on-premise

- 10 new on-premise to private cloud contracts in Q2, 5 with >$1B assets

On SMB strategy roadmap:

"We have a very long roadmap for SMB. This is not just a one-hit wonder with Tap2Local and Rapid Transfers. We have a lot of things we're going to be rolling out over the next 18 months, and some of them are already done."

On capital allocation:

- $125M share repurchases YTD at average price of $157

- "We said we'd feel comfortable if that went to $200 million or more this year"

- Expect to exit year debt-free, barring acquisitions

Key Risks & Concerns

-

H2 Margin Compression: Medical claims expense expected to normalize, reducing the benefit seen in H1

-

Tougher Comps: H2 FY25 had strong results, making YoY comparisons more difficult

-

Industry Consolidation: Elevated deconversion revenue ($28M full-year guidance) reflects continued M&A among community financial institutions

-

Acquisition Integration: Victor Technologies acquisition closed Sep 30, 2025 — still in early integration phase

Forward Catalysts

The Bottom Line

Jack Henry delivered a record Q2 FY2026 with 355 bps of non-GAAP margin expansion and 22 competitive core wins — its best sales quarter in recent memory. The "trifecta" wins (core + digital + card) jumped to 68% of deals, up from 45% a year ago, validating the integrated solution strategy.

What's working:

- Competitor consolidation accelerating pipeline across core, payments, and complementary

- Market share gains: +17% bank, +40% credit union over 8 years

- Private cloud migration: 78% of clients, 2x revenue uplift

- Innovation momentum: stablecoin beta, Tap2Local rollout, Rapid Transfers adoption

What to watch:

- H2 margin normalization as medical claims return to normal levels

- Tougher revenue comps in back half of fiscal year

- Victor Technologies integration progress

Management raised guidance for the second consecutive quarter, signaling confidence despite H2 headwinds. For long-term investors, the fundamental story is strengthening: dominant market share, 50-year service culture, and first-mover positioning in stablecoins for community financial institutions.

Upcoming Investor Engagement: Management participating in 8 investor events over the next 2 months .

Links: